1035 Exchange Chart

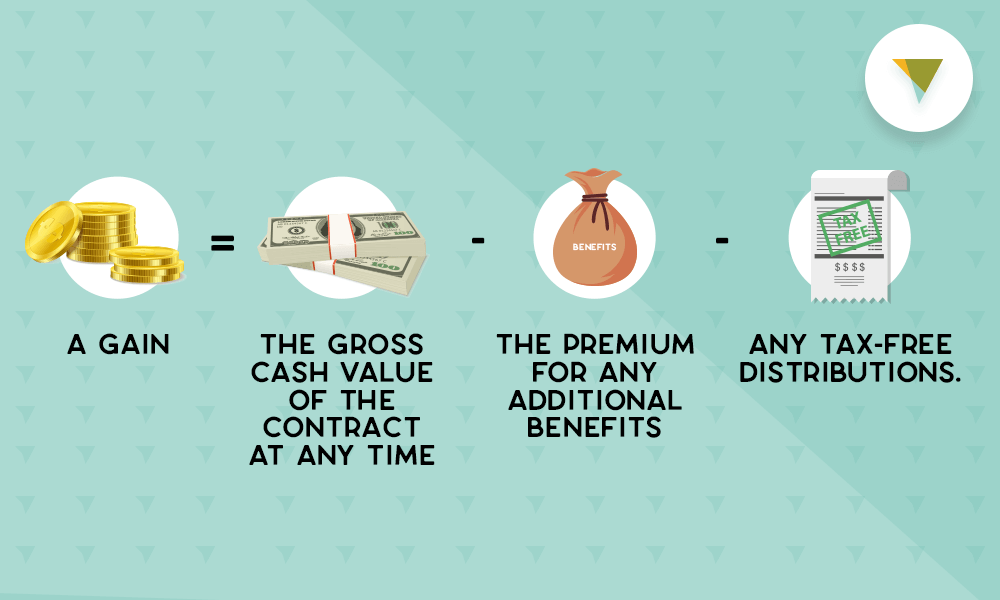

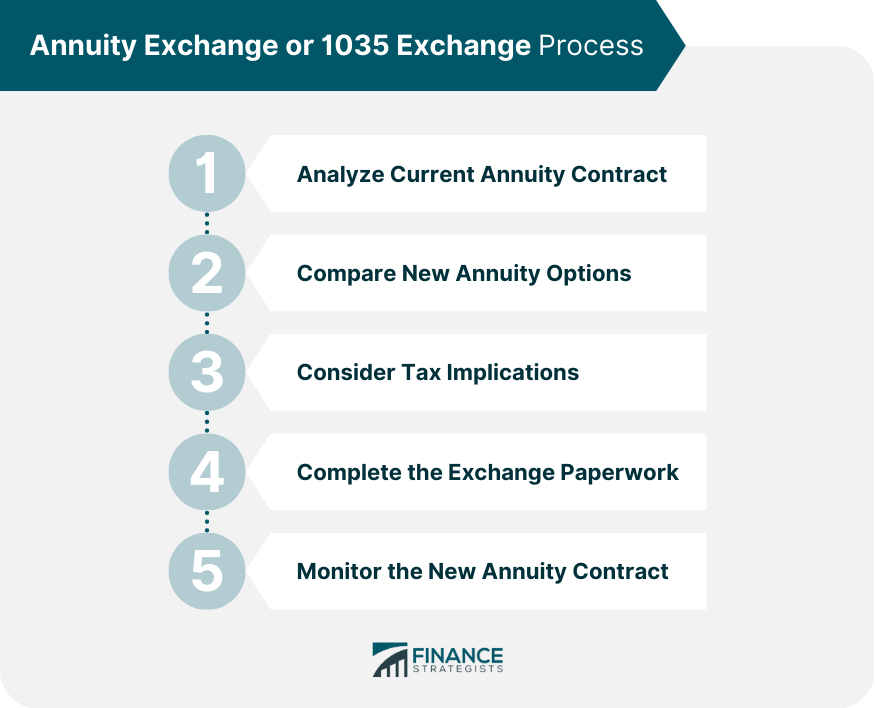

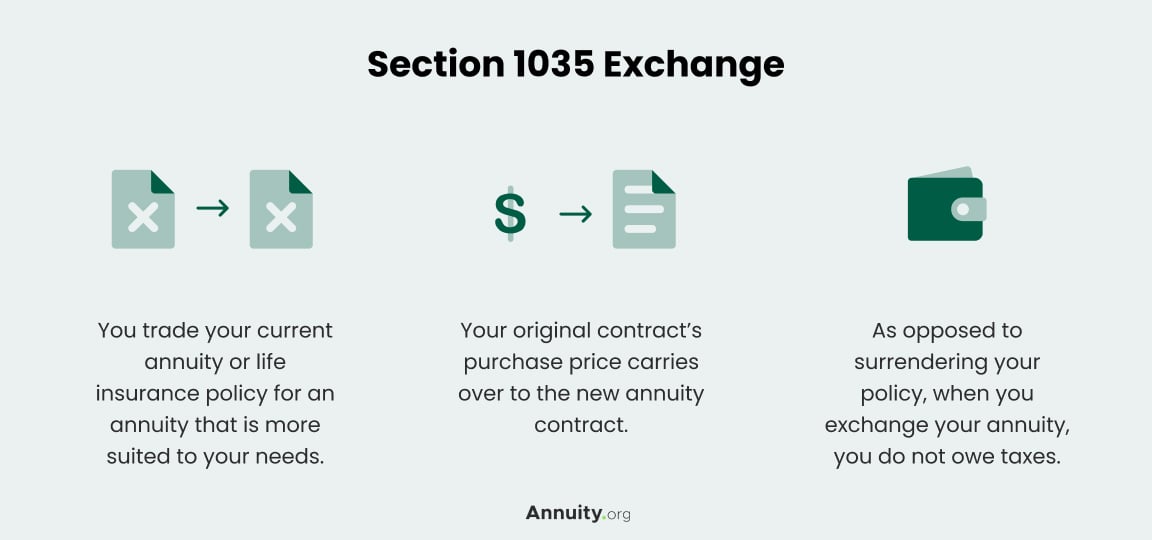

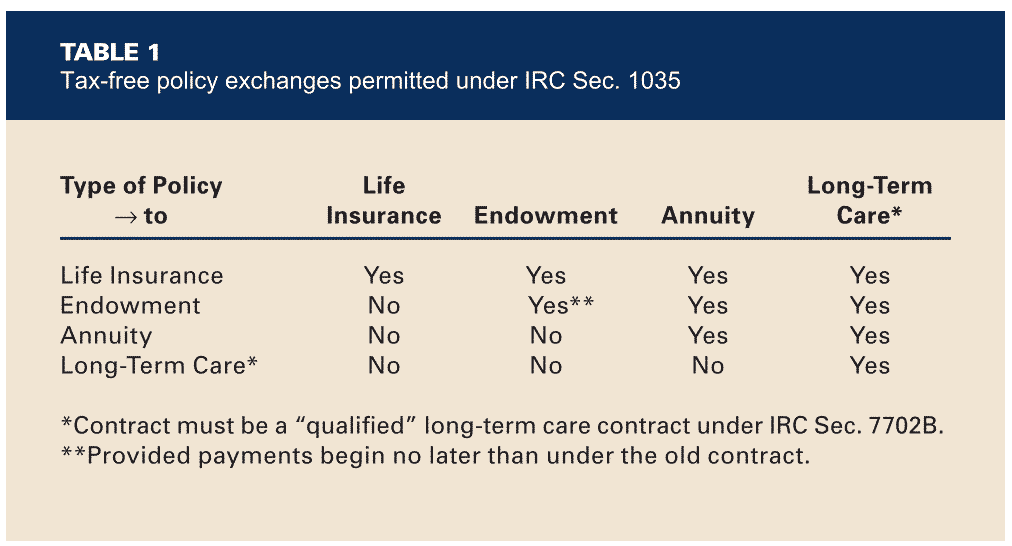

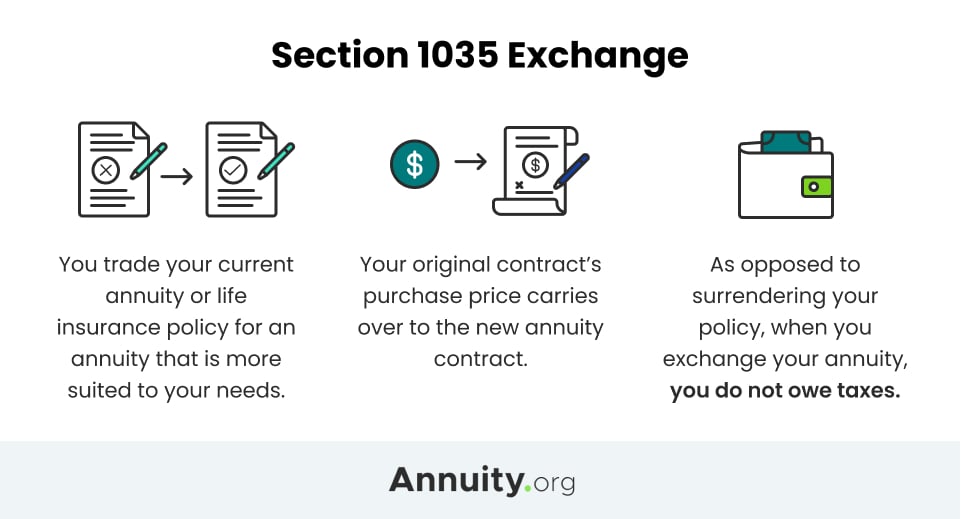

1035 Exchange Chart - Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. The ruling concludes that, pursuant to § 1035, no gain or loss is. Section 1035 says that you can transfer one annuity to another. Web a 1035 exchange provides a means for exchanging an annuity contract or life insurance policy without being treated as if it had been surrendered or sold. Web a second insurance company in exchange for a variable annuity contract issued by the second company. Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or. Web what are annuity exchange (1035 exchange) options? If you are bored take some time and read it. Web a 1035 exchange is from the irs code section1035. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. When you take distributions from the contract, you will pay income taxes only on the gain. Section 1035 says that you can transfer one annuity to another. Web what is a section 1035 exchange? Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or.. If you are bored take some time and read it. Web what are annuity exchange (1035 exchange) options? Web a second insurance company in exchange for a variable annuity contract issued by the second company. Web what is a section 1035 exchange? Web a 1035 exchange provides a means for exchanging an annuity contract or life insurance policy without being. A tax professional should be. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web what is a section 1035 exchange? Web a second insurance company in exchange for a variable annuity contract issued by the second company. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or. The ruling concludes that, pursuant to § 1035, no gain or loss is. A tax professional should be. Web what are annuity exchange (1035 exchange) options? Keep in mind that a. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. If you are bored take some time and read it. Keep in mind that a. When you take distributions from the contract, you will pay income taxes only. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Web a 1035 exchange provides a means for exchanging an annuity contract or life insurance policy without being treated as if it had been surrendered or sold. A tax professional should be. Web what are annuity exchange (1035 exchange) options? Web a second. Web how a 1035 exchange works. The ruling concludes that, pursuant to § 1035, no gain or loss is. If you are bored take some time and read it. Web a 1035 exchange provides a means for exchanging an annuity contract or life insurance policy without being treated as if it had been surrendered or sold. Web a 1035 exchange. Web a 1035 exchange is from the irs code section1035. Section 1035 says that you can transfer one annuity to another. When you take distributions from the contract, you will pay income taxes only on the gain. The ruling concludes that, pursuant to § 1035, no gain or loss is. An annuity exchange refers to the process of transferring an. If you are bored take some time and read it. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. Web what are annuity exchange. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. Web a 1035 exchange is from the irs code section1035. Web a second insurance company in exchange for a variable annuity contract issued by the second company. When. Learn all about 1035 exchanges from aafmaa & get your questions answered today. Web the internal revenue service (irs) allows you to exchange an annuity policy that you own for a new annuity policy without paying tax on the gains earned on the original contract. A tax professional should be. An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy. Web how a 1035 exchange works. Keep in mind that a. Web both the 1031 and 1035 exchanges provide you, the taxpayer, with the opportunity to exchange into investments that might better align with your goals or. Web what is a section 1035 exchange? When you take distributions from the contract, you will pay income taxes only on the gain. The ruling concludes that, pursuant to § 1035, no gain or loss is. If you are bored take some time and read it. Section 1035 says that you can transfer one annuity to another.

Annuity Exchange (1035 Exchange) Options Meaning & Types

1035 Exchange Definition, Qualifications, and What to Consider

1035 Annuity Exchange A TaxFree Way to Change Annuities

Alternatives to Long Term Care Insurance • My Annuity Store

Flah & Company

1035 Exchange Definition, Qualifications, and What to Consider

1035 Exchange Definition, Qualifications, and What to Consider

1035 Annuity Exchange A TaxFree Way to Change Annuities

1035 Exchange Rules An Overview Insurance News Magazine

How Does a 1035 Exchange Work for Annuities and Insurance?

Web A 1035 Exchange Is From The Irs Code Section1035.

Web What Are Annuity Exchange (1035 Exchange) Options?

Web A Second Insurance Company In Exchange For A Variable Annuity Contract Issued By The Second Company.

Web A 1035 Exchange Provides A Means For Exchanging An Annuity Contract Or Life Insurance Policy Without Being Treated As If It Had Been Surrendered Or Sold.

Related Post: