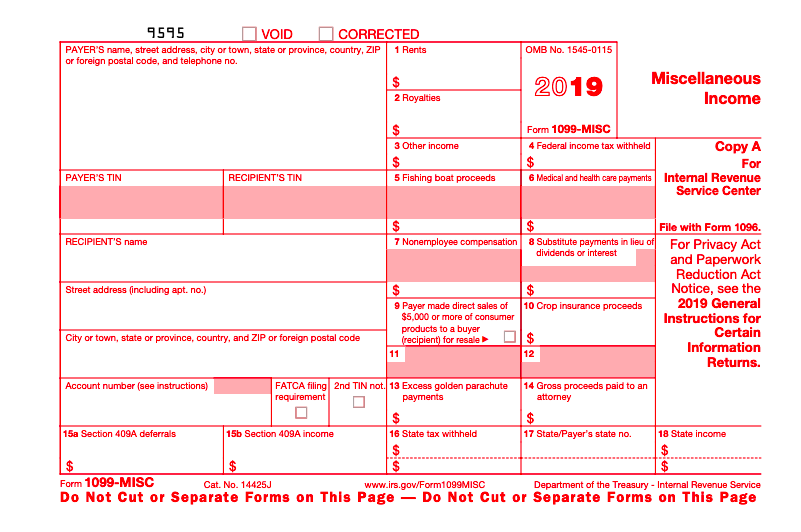

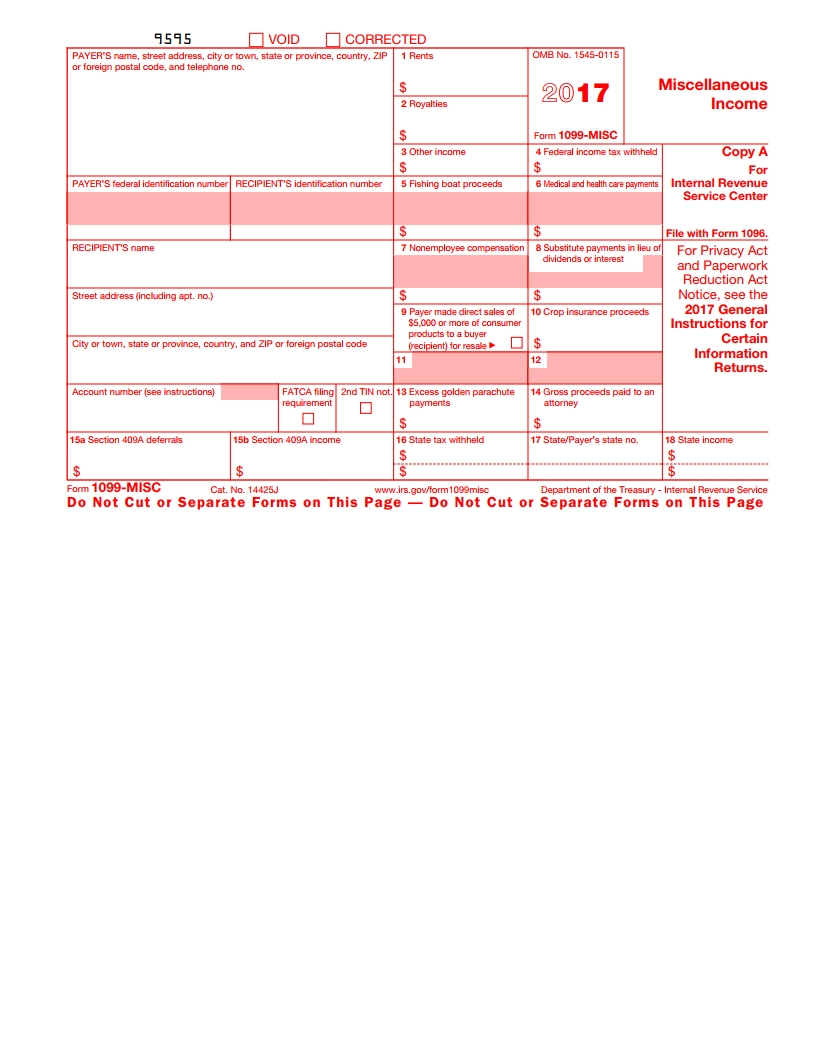

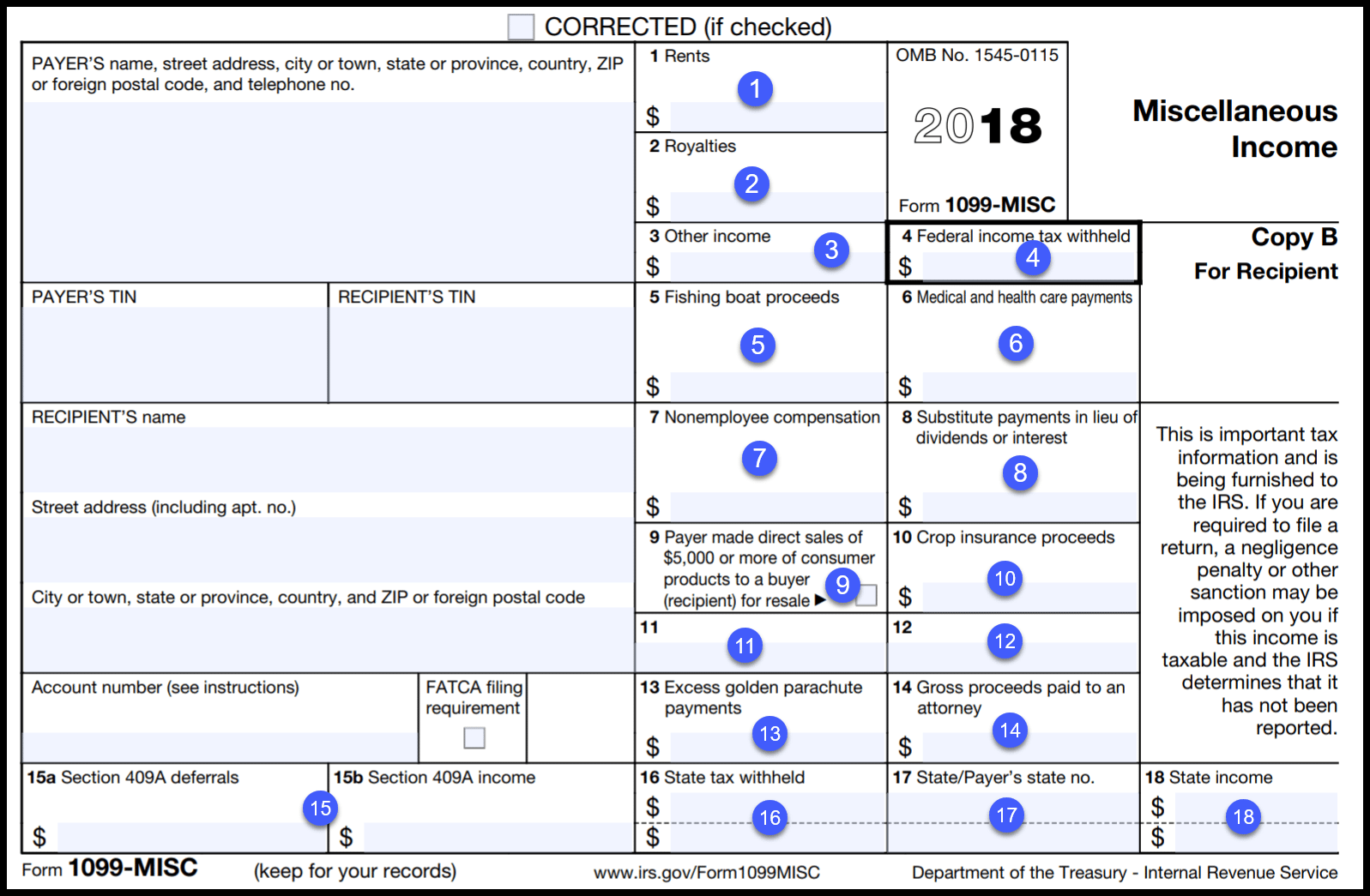

1099 Printable Forms

1099 Printable Forms - Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web written by sara hostelley | reviewed by brooke davis. One copy goes to you and. A 1099 is an irs tax form known as an information return, documenting different types of nonemployee income an individual or business makes. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web updated november 06, 2023. These can include payments to independent contractors, gambling winnings, rents,. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. How it works, who gets one. Cash paid from a notional principal contract made to an individual,. Web updated november 06, 2023. How it works, who gets one. One copy goes to you and. What is a 1099 form? 1099 forms can report different types of incomes. What is a 1099 form? Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Cash paid from a notional principal contract made to an individual,. Web updated november 06, 2023. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of. A 1099 is an irs tax form known as an information return, documenting different types of nonemployee income an individual or business makes. Web written by sara hostelley | reviewed by brooke davis. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. One copy goes to you and. How it. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. What is a 1099 form? 1099 forms can report different types of incomes. Web written by sara hostelley | reviewed by brooke davis. Web updated november 06,. What is a 1099 form? A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. These can include payments to independent contractors,. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. What is a 1099 form? A 1099 is an irs tax form known as an information return, documenting different types of nonemployee income an individual or business makes. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. A 1099 is an irs tax form known as an information return, documenting different types of nonemployee income an individual or business makes. Web updated november 06,. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web updated november 06, 2023. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. What is a. Cash paid from a notional principal contract made to an individual,. How it works, who gets one. Web written by sara hostelley | reviewed by brooke davis. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. What is a 1099 form? How it works, who gets one. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Web updated november 06, 2023. 1099 forms can report different types of incomes. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Cash paid from a notional principal contract made to an individual,. One copy goes to you and. How it works, who gets one. Web updated november 06, 2023. Web written by sara hostelley | reviewed by brooke davis. What is a 1099 form? 1099 forms can report different types of incomes. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form.

1099 Form Template. Create A Free 1099 Form Form.

![]()

Printable 1099 Form Pdf Free Printable Download

1099MISC Form The Ultimate Guide for Business Owners

1099MISC 3Part Continuous 1" Wide Formstax

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Free Printable 1099 Misc Forms Free Printable

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

Irs 1099 Printable Form Printable Forms Free Online

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

1099 Irs Form Printable Printable Forms Free Online

A 1099 Is An Irs Tax Form Known As An Information Return, Documenting Different Types Of Nonemployee Income An Individual Or Business Makes.

A 1099 Form Is A Record That An Entity Or Person (Not Your Employer) Gave Or Paid You Money.

These Can Include Payments To Independent Contractors, Gambling Winnings, Rents,.

Related Post: