163 J State Conformity Chart

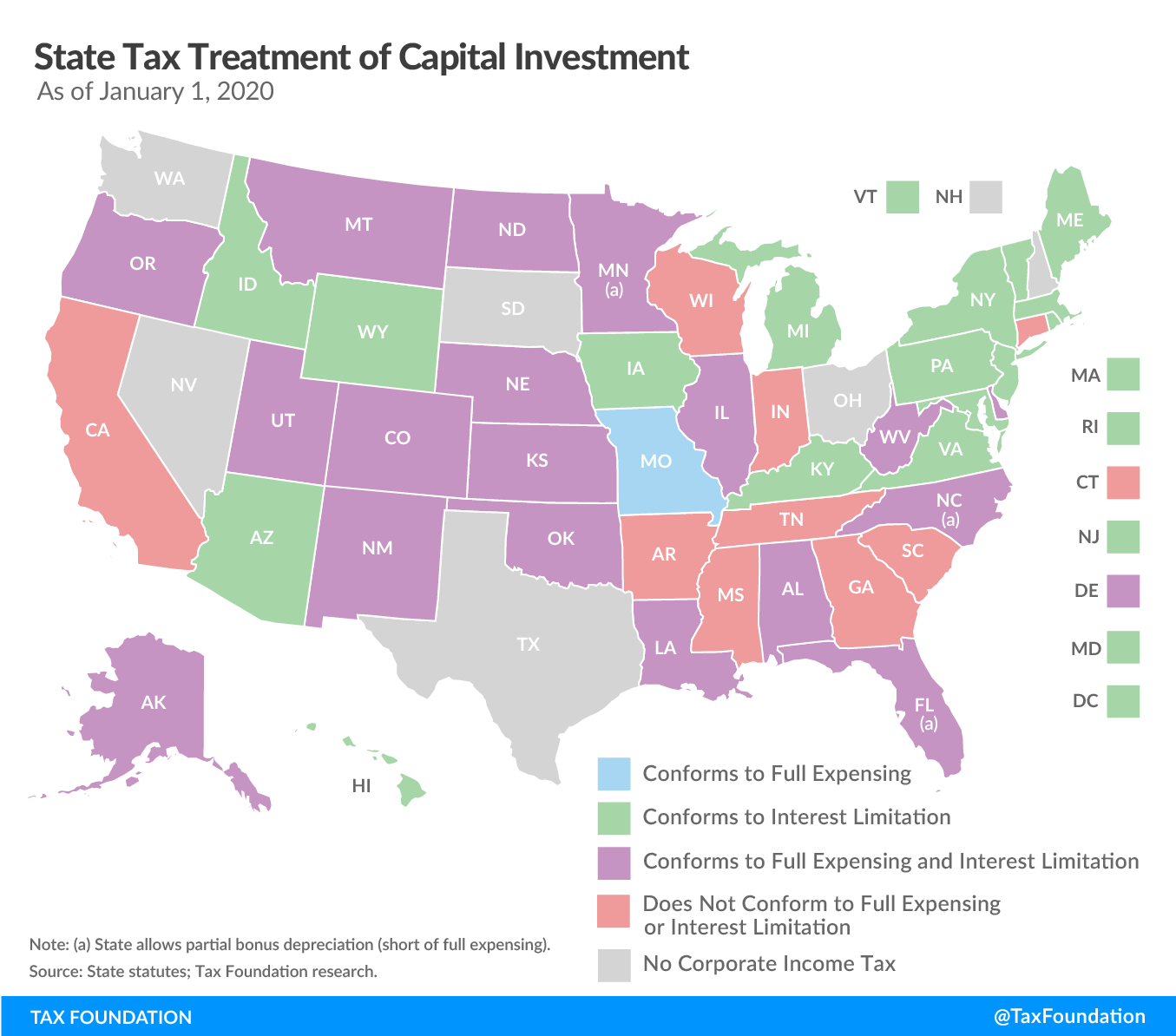

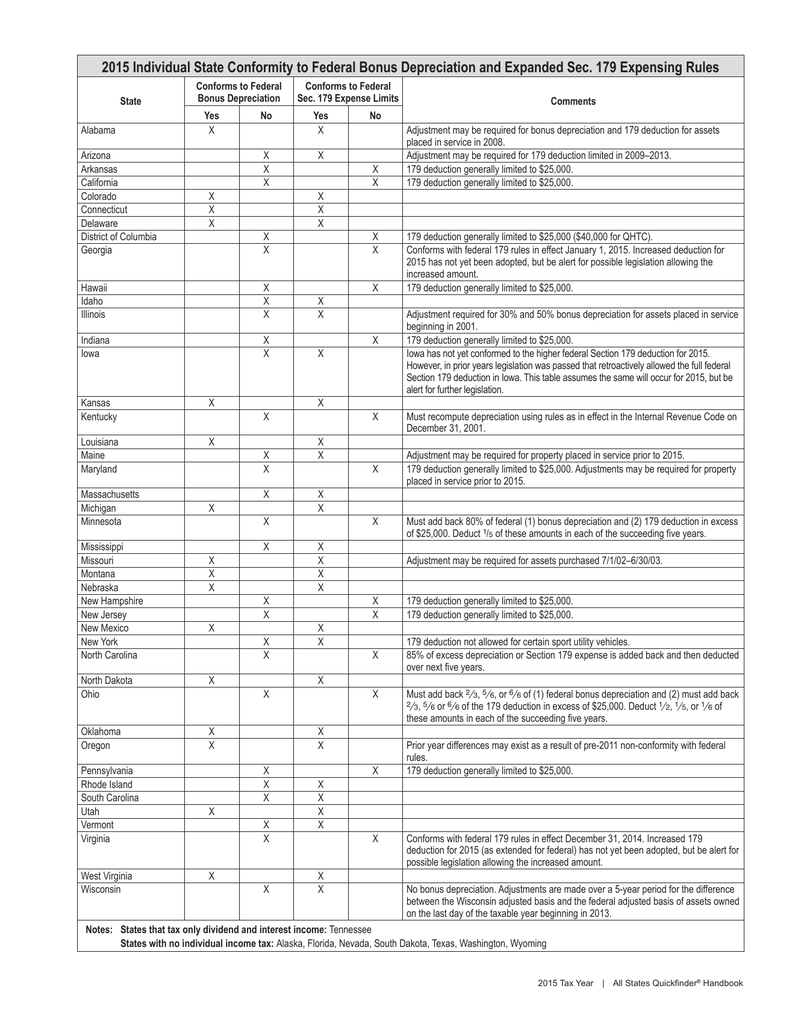

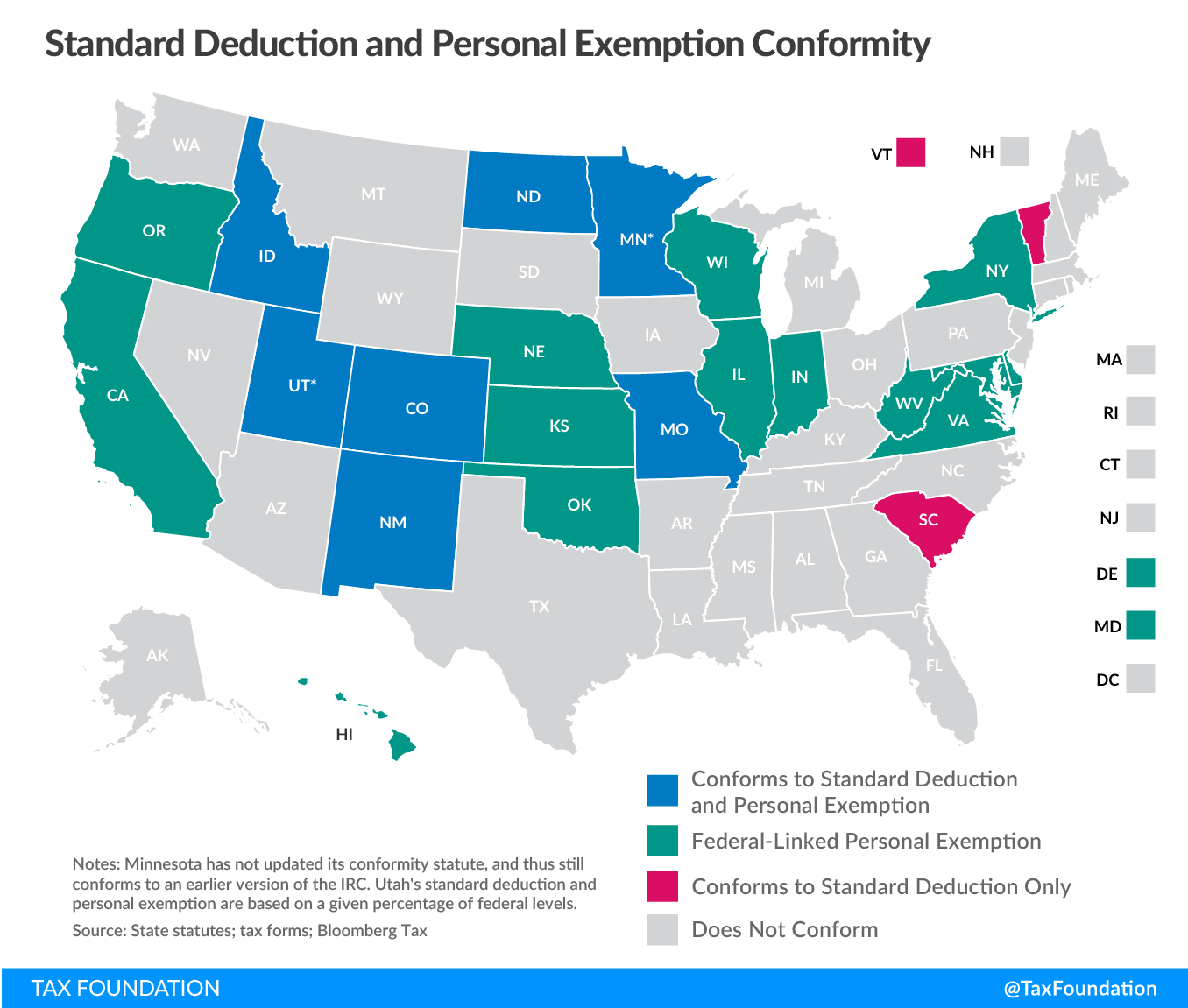

163 J State Conformity Chart - Web download your complimentary copy today. Web chart 1 illustrates the status of state corporate income tax law conformity with the federal interest expense deduction limitation after the cares act.10 eleven states did not adopt or affirmatively decouple from the section 163(j) interest expense limitations in the tcja. 163 (j) limitation resulting from the consolidated group's aggregate amount of bie, bii, and ati, computed without regard. These maps track specific state corporate tax law conformity to the recent federal changes made to irc § 163 (j) interest expense limitation, 80% cap rules, and qualified improvement property asset life, and nol carryback in the cares act and tcja. Web under section 163 (j), a taxpayer's business interest deduction cannot exceed the sum of: • the taxpayer's business interest income for the tax year; These states generally do not impose any limitation on interest expense Web this paper provides a snapshot of how states currently conform to internal revenue code (irc) income tax provisions in general, as well as to the irc’s treatment of nols, business interest expenses, forgiven ppp loans, and uc benefits. One of the most significant tax changes for many businesses in 2022 is a requirement that taxpayers capitalize and amortize their research and experimentation (r&e) expenses paid or incurred after dec. Web tcja/cares act conformity maps. Most of the 22 states with “rolling” business and corporate tax conformity will automatically adopt the cares act tax provisions. Web state conformity to the code: Web download the full state i.r.c. Statistical process control provides several different ways of assessing process capability. Web state conformity with section 163(j) is complicated. Conformity to the irc and associated amendments. Business interest expense limitation under § 163 (j) paycheck protection program income exclusion and expense deduction. Web most states, absent legislative decoupling, generally will conform to section 163 (j), but how they conform will depend upon subtle differences in how each state conforms to that section of the irc and its regulations. Specifically,. Web most states, absent legislative decoupling, generally will conform to section 163 (j), but how they conform will depend upon subtle differences in how each state conforms to that section of the irc and its regulations. 163 (j) limitation resulting from the consolidated group's aggregate amount of bie, bii, and ati, computed without regard. Web chart 1 illustrates the status. Web tcja/cares act conformity maps. That conformity has spawned new state tax laws and state tax administrator interpretations as to how the irc section 163 (j) limitation is computed for state income tax purposes. • 30% of the taxpayer's adjusted taxable income for the year; Web companies also should consider state conformity to, and treatment of, section 280c, the potential. This study evaluates the process capability of crown cap manufacturing through. And (4) net operating losses (nols). That conformity, however, is far from uniform. Business interest expense limitation under § 163 (j) paycheck protection program income exclusion and expense deduction. Web most states, absent legislative decoupling, generally will conform to section 163 (j), but how they conform will depend upon. Web this study aims to highlight the importance of a systematic approach to process capability assessment and the importance of following a sequence of steps. Web the proposed regulations under sec. Most of the 22 states with “rolling” business and corporate tax conformity will automatically adopt the cares act tax provisions. Specifically, the new regulations did not provide further guidance. Conformity chart, which includes each state’s conformity status, key differences between state and federal bonus depreciation rules, state resources, and expert analysis to help simplify your corporate tax planning strategy and reduce risk. That conformity has spawned new state tax laws and state tax administrator interpretations as to how the irc section 163 (j) limitation is computed for state income. 381 and 382, so it is important not only for federal purposes, but also for state purposes, to accurately calculate and track the sec. Statistical process control provides several different ways of assessing process capability. Web four of the most significant state conformity issues resulting from the tcja and cares act relate to the treatment of: 163 (j) carryforwards to. Web download the full state i.r.c. One of the most significant tax changes for many businesses in 2022 is a requirement that taxpayers capitalize and amortize their research and experimentation (r&e) expenses paid or incurred after dec. Web state conformity with section 163(j) is complicated. Web chart 1 illustrates the status of state corporate income tax law conformity with the. Web this study aims to highlight the importance of a systematic approach to process capability assessment and the importance of following a sequence of steps. Web changes to the treatment of section 174 research and experimentation (r&e) expenses: The chart below provides a basic irc conformity overview. • 30% of the taxpayer's adjusted taxable income for the year; 163 (j). • the taxpayer's business interest income for the tax year; Some states, such as new york, have already decoupled from the cares act section 163(j) provision (retaining the 30% limit). Most states have adopted secs. • the taxpayer's floor plan financing interest for. Web as for conformity to the internal revenue code, approximately 35 states currently adopt section 163 (j) for purposes of their corporate income taxes. And (4) net operating losses (nols). Web download your complimentary copy today. Web under section 163 (j), a taxpayer's business interest deduction cannot exceed the sum of: Web companies also should consider state conformity to, and treatment of, section 280c, the potential for state subtraction modification for disallowed federal deductions, and the impact to a taxpayer’s section 163 (j) limitation. Web april 1, 202124 min read by: That conformity, however, is far from uniform. • 30% of the taxpayer's adjusted taxable income for the year; Web state conformity to the code: Web section 163(j) to partnerships, although they reserved on several key issues. Web chart 1 illustrates the status of state corporate income tax law conformity with the federal interest expense deduction limitation after the cares act.10 eleven states did not adopt or affirmatively decouple from the section 163(j) interest expense limitations in the tcja. Statistical process control provides several different ways of assessing process capability.

State Tax Conformity a Year After Federal Tax Reform

Will Arizona Lead the Way on Full Expensing This Year? Upstate Tax

State Conformity to CARES Act, American Rescue Plan Tax Foundation

The State of Federal Conformity Tax Foundation of Hawaii

IRC §163 Interest

State Conformity to CARES Act, American Rescue Plan Tax Foundation

2015 Individual State Conformity to Federal Bonus Depreciation and

State Conformity to Federal PandemicRelated Tax Provisions in CARES

State Tax Conformity a Year After Federal Tax Reform

TCJA Proposed Regulations Weekly Client Update 163(j) Interest

Web State Conformity With Section 163(J) Is Complicated.

Business Interest Expense Limitation Under § 163 (J) Paycheck Protection Program Income Exclusion And Expense Deduction.

That Conformity Has Spawned New State Tax Laws And State Tax Administrator Interpretations As To How The Irc Section 163 (J) Limitation Is Computed For State Income Tax Purposes.

Web This Study Aims To Highlight The Importance Of A Systematic Approach To Process Capability Assessment And The Importance Of Following A Sequence Of Steps.

Related Post: