American Retirement In 6 Charts

American Retirement In 6 Charts - Web so, if you earn $100,000 a year, ideally you have savings of $550,000 to $1.1 million in your retirement accounts by age 60. Average annual expenditures for americans 65 and older. The share of the u.s. With a full retirement age of 67, someone claiming benefits at 64 would see. A 4% withdrawal rate may contribute to the longevity of retirement funds, and while less common, a 6% rate could be successful in certain. Web find assisted living facilities near you. Web the financial services industry uses the 4% rule as a benchmark for how you can withdraw from your retirement savings over the span of 30 years. Web on average, americans have around $141,542 saved up for retirement, according to the “how america saves 2022” report compiled by vanguard, an. Before we show you the scenario of american retirement in 6 charts, let us. Web here's what retirement looks like in america in six charts | 15 min. Web data from the federal reserve’s most recent survey of consumer finances (2022) indicates the median retirement savings account balance for all u.s. Web april 22, 2024, at 3:44 p.m. Retirement market outlook examines three broad trends the firm suggests continue to shape the retirement outlook for millions of. Web beyond 36 months, the program reduces your benefits by 5/12. The earlier you start saving for retirement, the more time your money. The us retirement scenario in a nutshell. By 2030, more than one in five. The mean (average) is $75,020. From 401 (k)s to healthcare, a look at how americans spend time and money in. Spending that money on car loans instead destroys a. Web here’s what retirement looks like in america in six charts. Retirement assets to show how americans are building their retirement savings,. Web find assisted living facilities near you. The share of the u.s. Retirement market outlook examines three broad trends the firm suggests continue to shape the retirement outlook for millions of. Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age, use the chart below and select your year of birth. Web the most recent data from. Web april 22, 2024, at 3:44 p.m. From 401 (k)s to healthcare, a look at how americans spend time and money in retirement. Before we show you the scenario of american retirement in 6 charts, let us. At that point, the top 10% of all american households had a net. Web beyond 36 months, the program reduces your benefits by. A 4% withdrawal rate may contribute to the longevity of retirement funds, and while less common, a 6% rate could be successful in certain. Web based on a 12% average annual rate of return, he says, one could retire with more than $8.5 million after 40 years. By 2030, more than one in five. The share of the u.s. Veronica. A 4% withdrawal rate may contribute to the longevity of retirement funds, and while less common, a 6% rate could be successful in certain. Web 15 rows normal retirement age; Web the most recent data from the fed's survey of consumer finances comes from the end of 2022. From 401 (k)s to healthcare, a look at how. Before we show. Web here’s what retirement looks like in america in six charts. Web here’s what retirement looks like in america in six charts. The mean (average) is $75,020. Few americans manage to save anywhere near that sum in. Web data from the federal reserve’s most recent survey of consumer finances (2022) indicates the median retirement savings account balance for all u.s. Web beyond 36 months, the program reduces your benefits by 5/12 of 1% each month. Social security life expectancy calculator: The median income for americans 65 and older is $50,290. Web on average, americans have around $141,542 saved up for retirement, according to the “how america saves 2022” report compiled by vanguard, an. Before we show you the scenario of. Retirement assets to show how americans are building their retirement savings,. Web the most recent data from the fed's survey of consumer finances comes from the end of 2022. You should have 7.6 times your. Web to find out how much your benefit will be reduced if you begin receiving benefits from age 62 up to your full retirement age,. The mean (average) is $75,020. Spending that money on car loans instead destroys a. A 4% withdrawal rate may contribute to the longevity of retirement funds, and while less common, a 6% rate could be successful in certain. With a full retirement age of 67, someone claiming benefits at 64 would see. Web data from the federal reserve’s most recent survey of consumer finances (2022) indicates the median retirement savings account balance for all u.s. Web april 22, 2024, at 3:44 p.m. Social security life expectancy calculator: You should have 7.6 times your. Web here’s what retirement looks like in america in six charts. Veronica dagher, anne tergesen, rosie ettenheim. Web this markets in a minute from new york life investments charts the state of u.s. Web beyond 36 months, the program reduces your benefits by 5/12 of 1% each month. At that point, the top 10% of all american households had a net. From 401 (k)s to healthcare, a look at how americans spend time and money in retirement. The share of the u.s. By 2030, more than one in five.

Early Retirement Charted The Simple Chart That Shows You How

Nine Charts about the Future of Retirement Urban Institute

How Much to Save for Retirement REALLY? Retirement Planning

Is it Time to Retire? Find Out with This Saving Money Chart!

![26+ Essential Retirement Statistics [2023] Facts About American](https://www.zippia.com/wp-content/uploads/2021/12/average-retirement-savings-by-age.jpg)

26+ Essential Retirement Statistics [2023] Facts About American

Here's What Retirement Looks Like In America In Six Charts

How do I calculate my FERS retirement? Retirement News Daily

Acht grote die Amerikanen hebben over hun pensioen American

Important ages for retirement savings, benefits and withdrawals 401k

What Retirement Looks Like In America In Six Charts

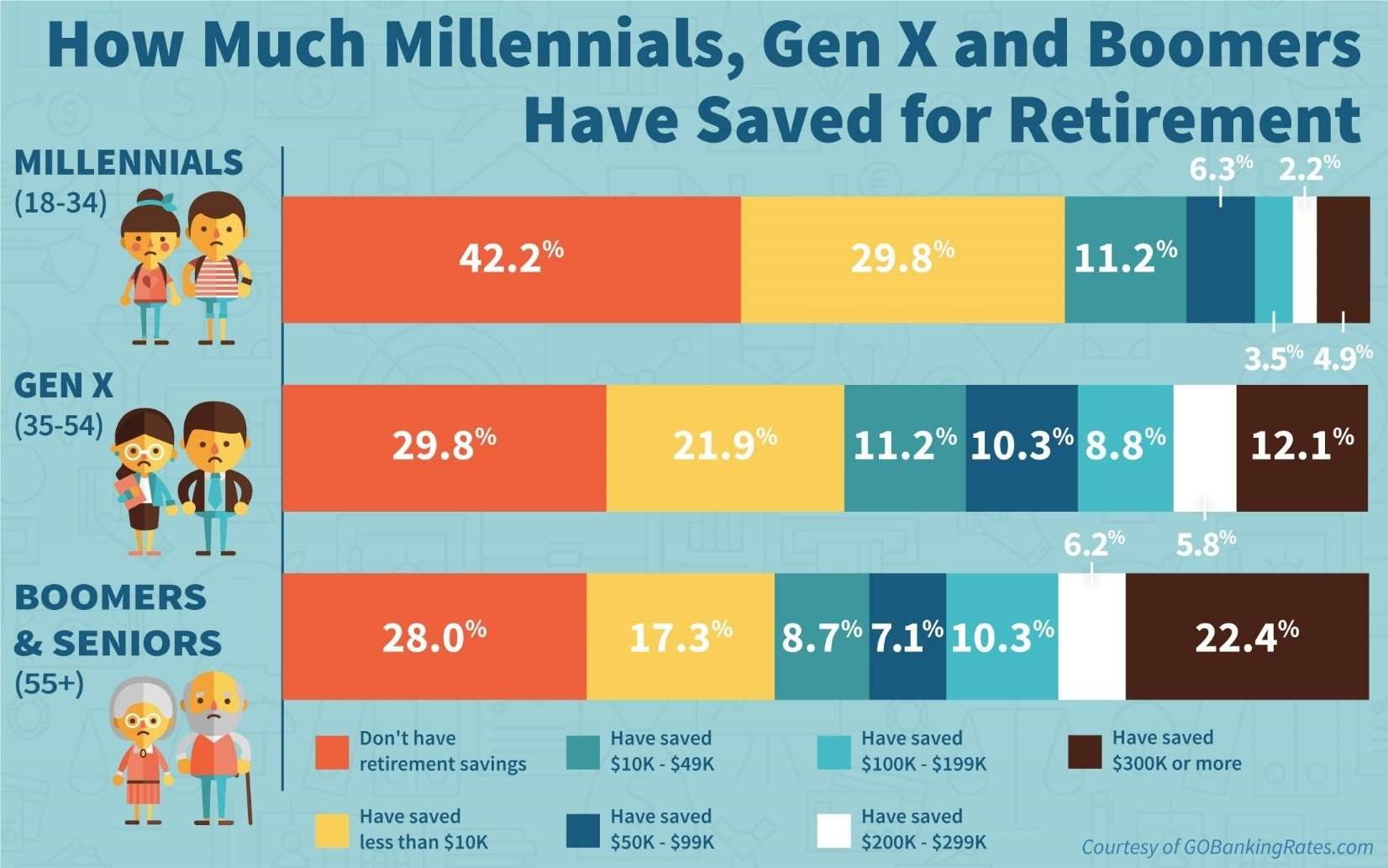

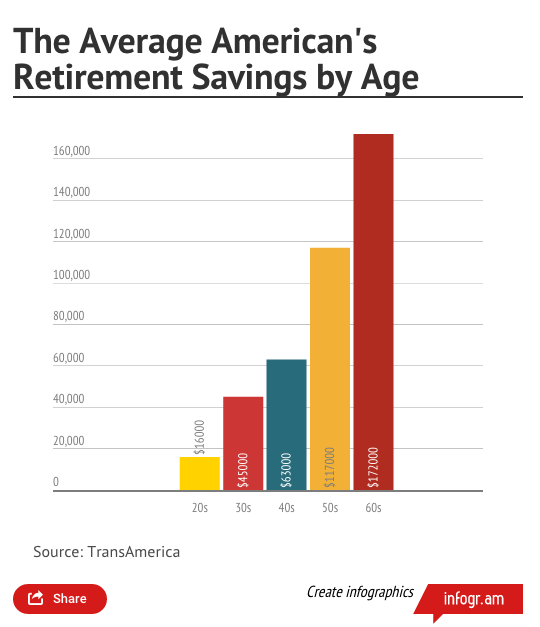

Retirement Savings Are Meant To Grow With Age.

From 401 (K)S To Healthcare, A Look At How Americans Spend Time And Money In Retirement.

Web Here’s What Retirement Looks Like In America In Six Charts.

Population Aged 65 Years And Older Has Continuously Increased Since The 1950S And Is Expected To Continue Rising.

Related Post: