Annuity Due Chart

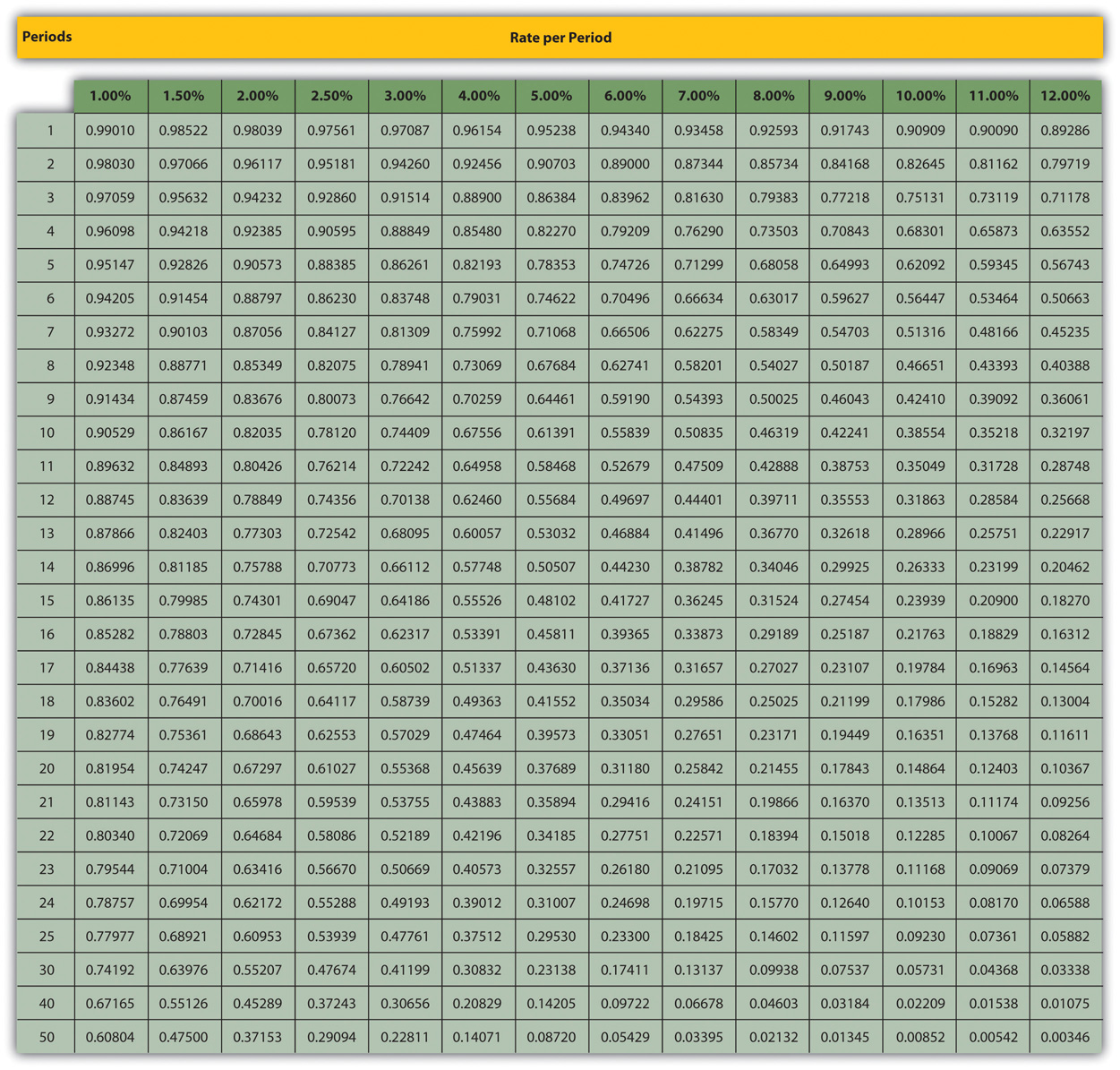

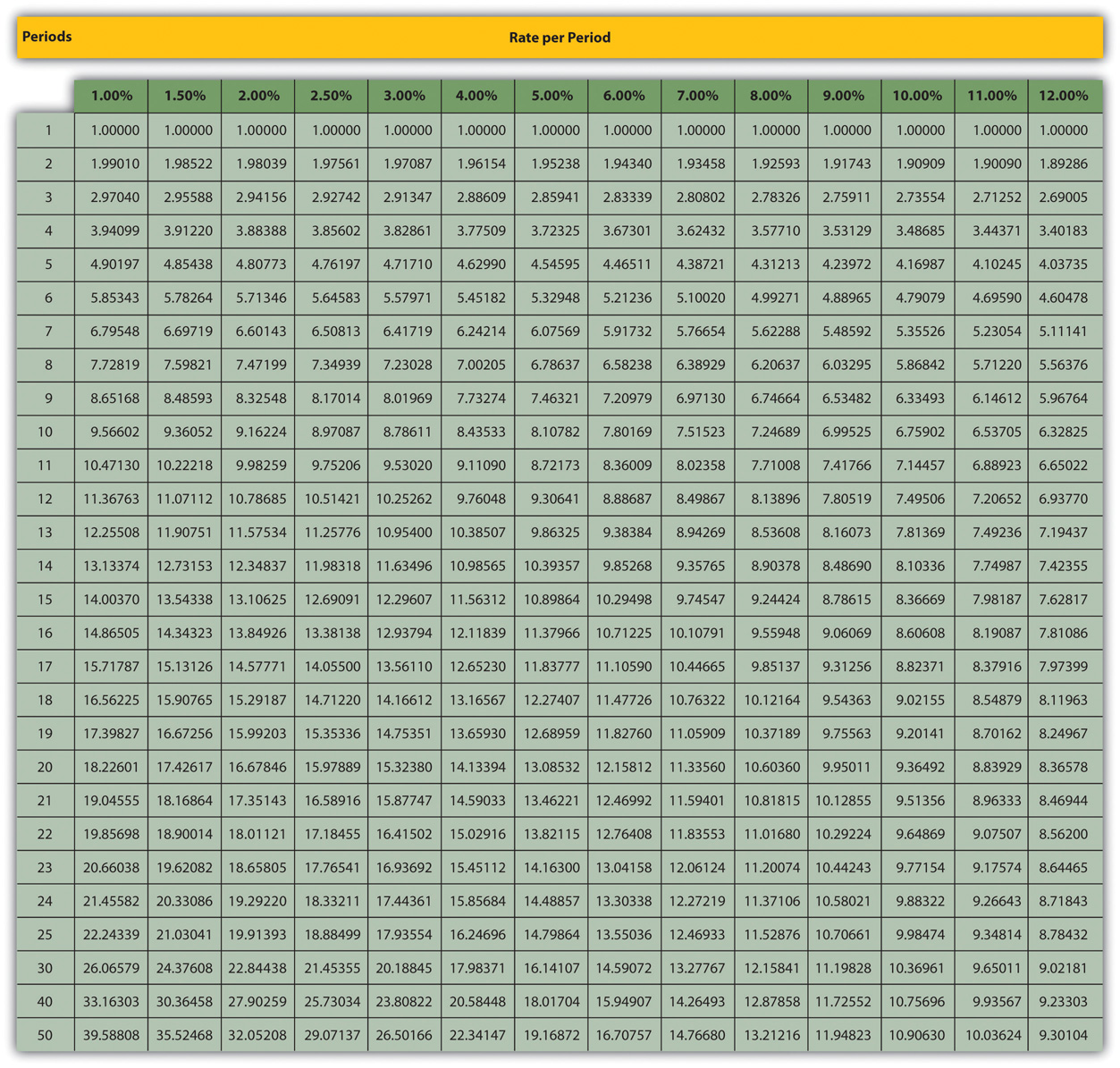

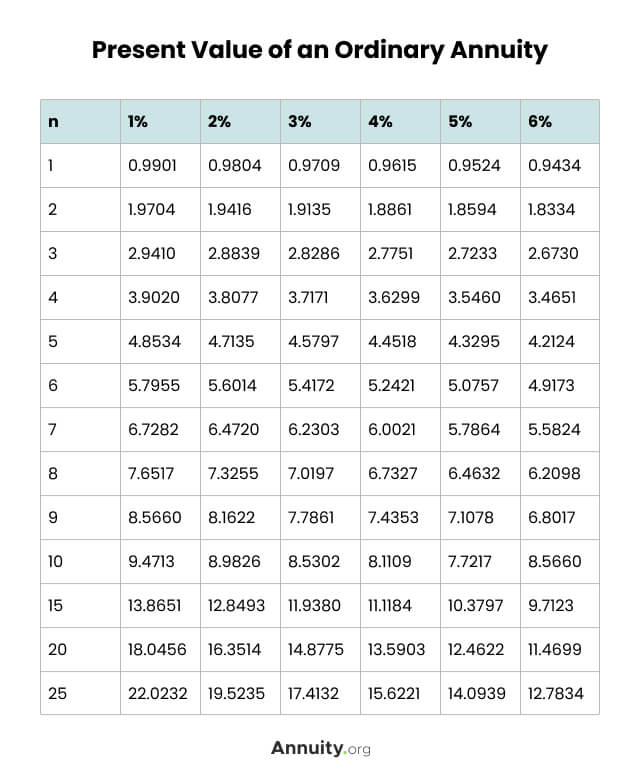

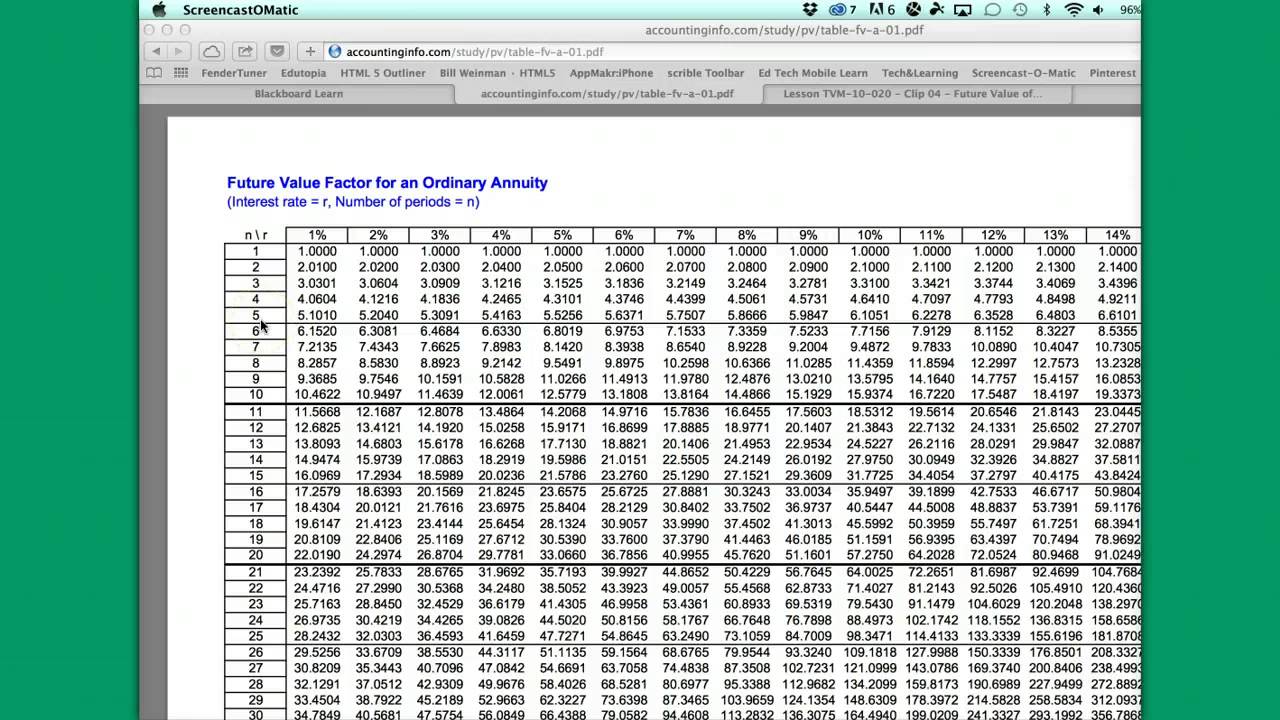

Annuity Due Chart - An annuity due is an annuity whose payment is due immediately at the beginning of each period. Web free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. Payments are due at the beginning of the period. An annuity is an investment that provides a series of payments in exchange for an initial lump sum or contributions over time. N = total number of periods. Web an annuity table tells you the present value of an annuity. A common example of an annuity due payment is rent, as. This seemingly minor difference in timing can impact the future value of an annuity because of. Web the formula used is: Present value (pv) of ordinary annuity: This tool facilitates calculating the. Web annuity due refers to a series of equal payments made at the same interval at the beginning of each period. Web an annuity table tells you the present value of an annuity. Understanding annuity tables can be a useful tool when building your retirement plan. An annuity due is an annuity whose payment is. Web to find the future value of an annuity due, simply multiply the formula above by a factor of (1 + r). A common example of an annuity due payment is rent, as. Web calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment. Web the formula used is:. An annuity due is an annuity whose payment is due immediately at the beginning of each period. Web the formula used is: Web annuity due refers to a series of equal payments made at the same interval at the beginning of each period. Web as you probably already know, annuities have many faces. Web an annuity table tells you the present. The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. This seemingly minor difference in timing can impact the future value of an annuity because of. \begin {aligned} &\text {p} = \text {pmt} \times \frac { \big ( (1 +. Web calculate the present value of an. \begin {aligned} &\text {p} = \text {pmt} \times \frac { \big ( (1 +. Web the present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. Web an annuity table tells you the present value of an annuity. Understanding annuity. Present value (pv) of ordinary annuity: Web annuity due refers to a series of equal payments made at the same interval at the beginning of each period. Understanding annuity tables can be a useful tool when building your retirement plan. \begin {aligned} &\text {p} = \text {pmt} \times \frac { \big ( (1 +. Web calculate the present value of. N = total number of periods. The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. Web an annuity table tells you the present value of an annuity. Web the present value of annuity calculator applies a time value of money formula used for measuring the current. Web to find the future value of an annuity due, simply multiply the formula above by a factor of (1 + r). An annuity is an investment that provides a series of payments in exchange for an initial lump sum or contributions over time. Web free annuity calculator to forecast the growth of an annuity with optional annual or monthly. An annuity due is an annuity whose payment is due immediately at the beginning of each period. Web the annuity table contains a factor specific to the future value of a series of payments, when a certain interest earnings rate is assumed. Web the purpose of the present value annuity tables is to make it possible to carry out annuity calculations. Web the present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. Web to find the future value of an annuity due, simply multiply the formula above by a factor of (1 + r). Web free annuity calculator to forecast. Present value (pv) of ordinary annuity: Web the formula used is: The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. Web calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment. A common example of an annuity due payment is rent, as. R = interest rate per period. This seemingly minor difference in timing can impact the future value of an annuity because of. Web to find the future value of an annuity due, simply multiply the formula above by a factor of (1 + r). An annuity is an investment that provides a series of payments in exchange for an initial lump sum or contributions over time. \begin {aligned} &\text {p} = \text {pmt} \times \frac { \big ( (1 +. Web an annuity table tells you the present value of an annuity. Web the annuity table contains a factor specific to the future value of a series of payments, when a certain interest earnings rate is assumed. This tool facilitates calculating the. Payments are due at the beginning of the period. Web as you probably already know, annuities have many faces. Web the purpose of the present value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator.

Present Value Annuity Due Table slideshare

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present and Future Value of Annuities

Present Value Of Annuity Table change comin

AnnuityF Ordinary Annuity Table

AnnuityF Pv Due Annuity Table

What is an Annuity? Present Value Formula + Calculator

AnnuityF Pv Due Annuity Table

What Is an Annuity Table and How Do You Use One?

Present Value Annuity Due Tables Double Entry Bookkeeping

Present Value Annuity Due Table Pdf Matttroy

Web Free Annuity Calculator To Forecast The Growth Of An Annuity With Optional Annual Or Monthly Additions Using Either Annuity Due Or Immediate Annuity.

Web Annuity Due Refers To A Series Of Equal Payments Made At The Same Interval At The Beginning Of Each Period.

Understanding Annuity Tables Can Be A Useful Tool When Building Your Retirement Plan.

An Annuity Due Is An Annuity Whose Payment Is Due Immediately At The Beginning Of Each Period.

Related Post: