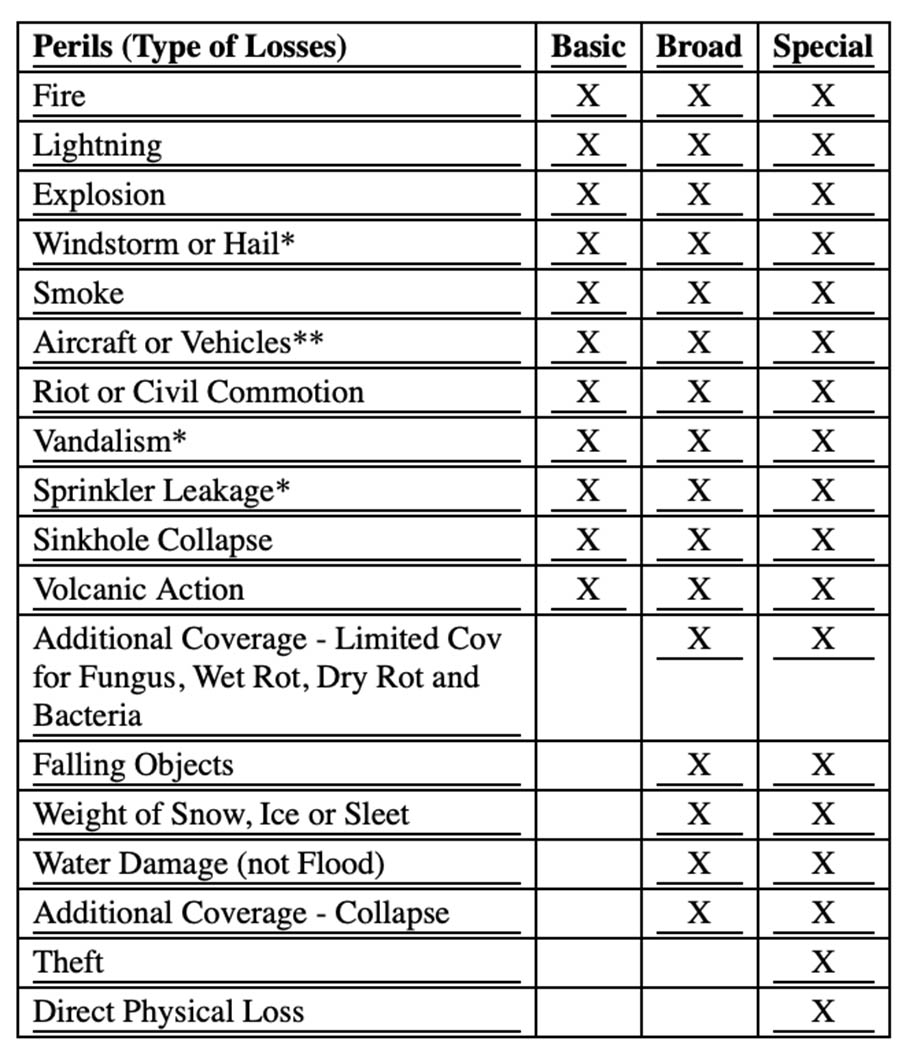

Basic Broad And Special Perils Chart

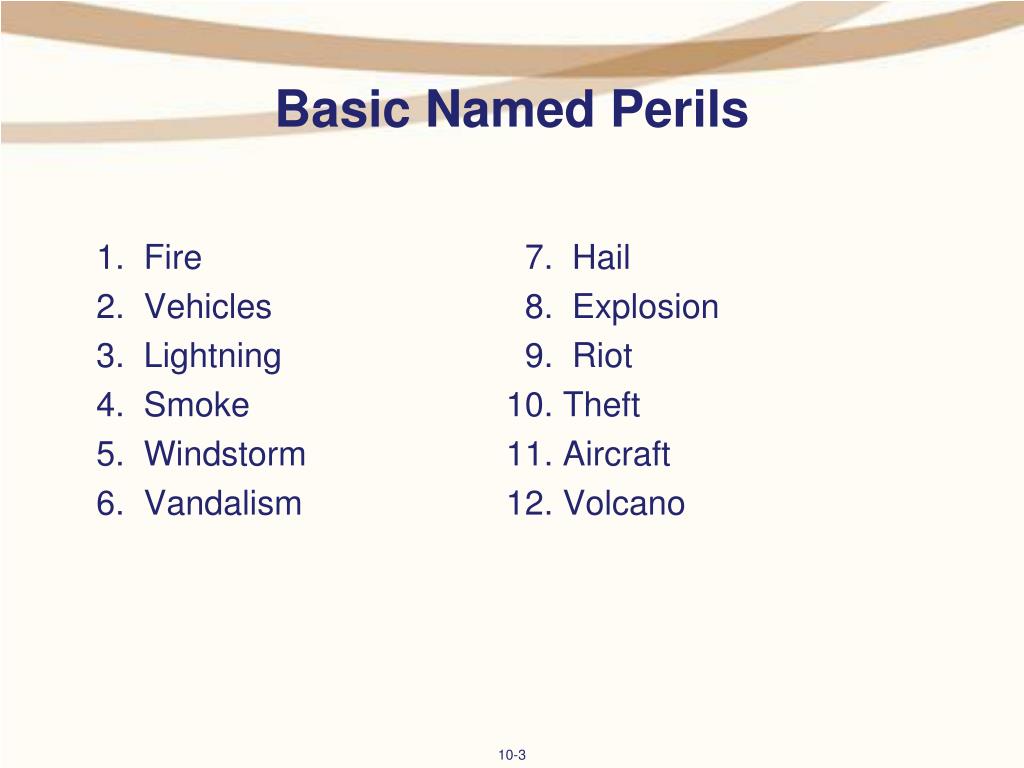

Basic Broad And Special Perils Chart - As the general trend of. It is the silver package of the three forms and gives you the bare minimum for the most. Damage from vehicles or aircrafts. This type of policy only covers perils that are specifically listed. Web learn the difference between basic and special forms. The basic, broad, and special causes of loss forms. Web today, this research is primarily driven by user interview studies of data scientists or coarse metrics about tool use. Web the broad form is built to cover everything the basic form, and the most common perils expected. In the most common broad form insurance policy, you will also. See the list of perils covered by each form and how they vary in. When looking at your homeowners, renters, condo, or other property insurance policy it is important to. Damage from vehicles or aircrafts. Web learn the differences between basic, broad, and special form coverage for property insurance. The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. Web the princeton. Web when property insurance is written on a broad form, you receive coverage for the 11 causes of loss mentioned in the description of the basic form, with the addition of. Ho 00 04 contents broad form. Ho 00 05 comprehensive form. Ho 00 02 broad form. Web the annual and seasonal rainfall graphs show that the maximum rainfall was. Web along with the 10 named perils above, broad form homeowners insurance also covers: Web the princeton guide to historical research provides students, scholars, and professionals with the skills they need to practice the historian’s craft in the digital age,. As the tumultuous aftermath of. For example, a seminal study by kandel et al. Web welcome to the comprehensive cataclysm. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: When looking at your homeowners, renters, condo, or other property insurance policy it is important to. Web welcome to the comprehensive cataclysm classic gold guide, your ultimate companion on the path to wealth within the revamped world of azeroth. Web the term “coverage. Ho 00 05 comprehensive form. Web welcome to the comprehensive cataclysm classic gold guide, your ultimate companion on the path to wealth within the revamped world of azeroth. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles,. Web it's important to note that both basic and broad form coverage policies only cover a specific set of named perils.. Ho 00 02 broad form. Web when structuring your insurance policy, the coverage form selected plays a significant role in determining which perils are covered for your property should a loss occur. It makes sense that basic has the least amount of coverages and special has the most, so the more coverage you. In the most common broad form insurance. The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. Web covered perils and valuation: It makes sense that basic has the least amount of coverages and special has the most, so the more coverage you. Web the basic causes of loss form (cp 10 10) provides coverage. Web today, this research is primarily driven by user interview studies of data scientists or coarse metrics about tool use. When looking at your homeowners, renters, condo, or other property insurance policy it is important to. Ho 00 02 broad form. The basic and broad causes of loss forms are named perils forms; Broad form coverage is more encompassing than. It is the silver package of the three forms and gives you the bare minimum for the most. Web the broad form is built to cover everything the basic form, and the most common perils expected. The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. For example,. Ho 00 03 special form. Ho 00 05 comprehensive form. Web learn the differences between basic, broad, and special form coverage for property insurance. It is the silver package of the three forms and gives you the bare minimum for the most. See the list of perils covered by each form and how they vary in. Web there are three causes of loss forms: Damage from vehicles or aircrafts. Ho 00 02 broad form. Falling objects (like tree limbs). Ho 00 05 comprehensive form. Ho 00 02 broad form. The broad form is made to cover all perils the basic form covers, along with some additional common perils that could occur. It makes sense that basic has the least amount of coverages and special has the most, so the more coverage you. Web basic is the least inclusive of the three coverage forms because it covers only named perils. See the list of perils covered by each form and how they vary in. For example, a seminal study by kandel et al. Web special form insurance coverage. Web learn the differences between basic, broad, and special form coverage for property insurance. Web the term “coverage form” refers to a policy that outlines the inclusions or exclusions of property coverage provided by an insurance policy. Web the basic form perils include: Web learn the difference between basic and special forms.

The Difference Between Basic, Broad and Special Form Insurance

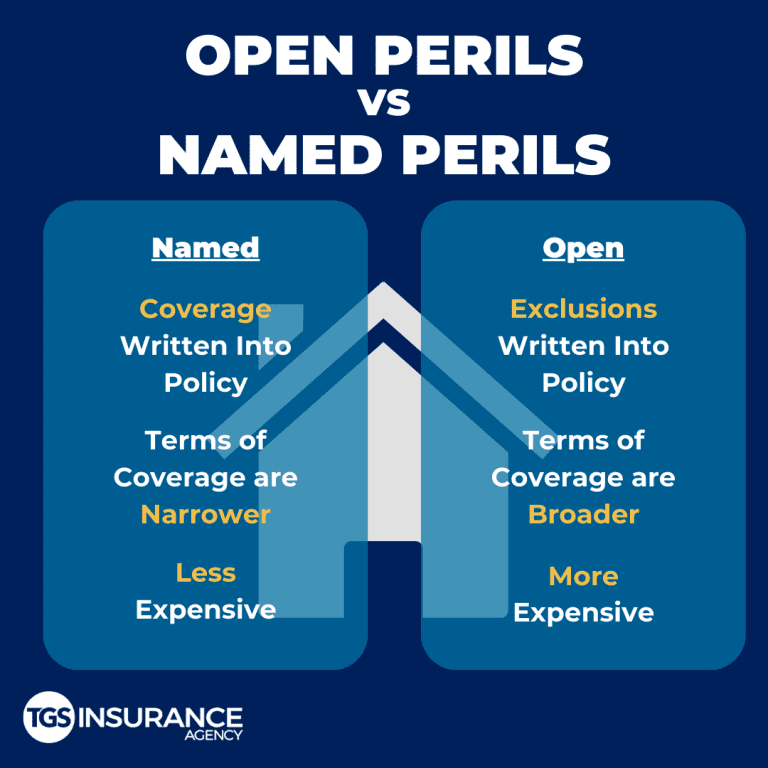

Open Peril Vs Named Peril Coverage TGS Insurance Agency

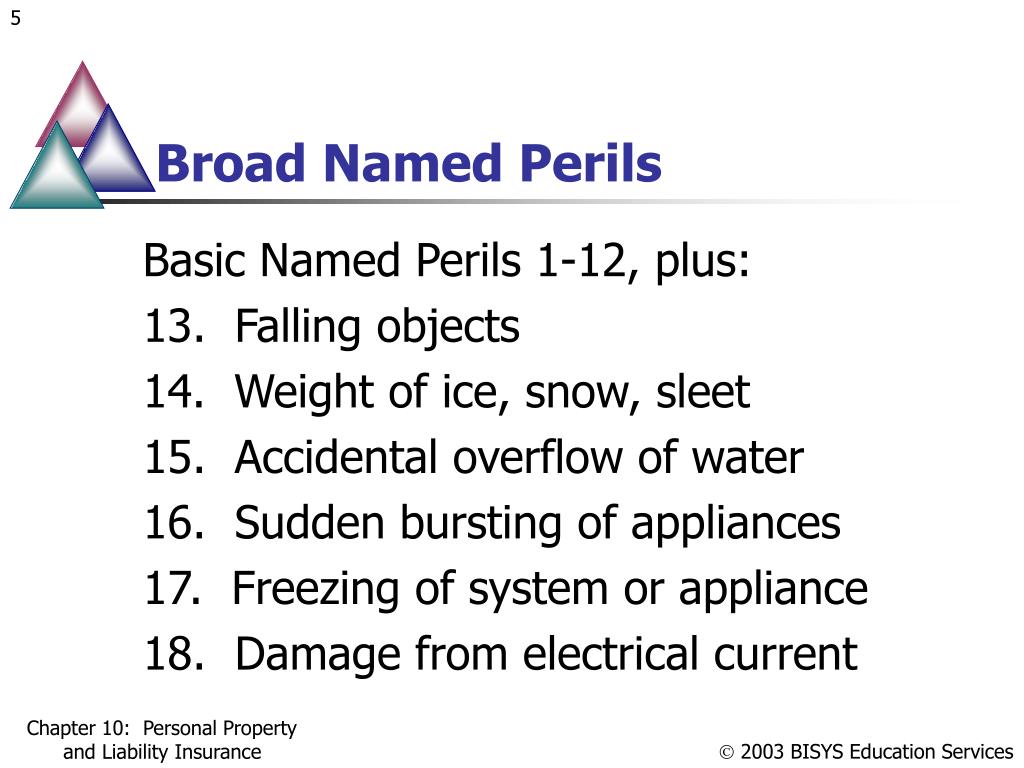

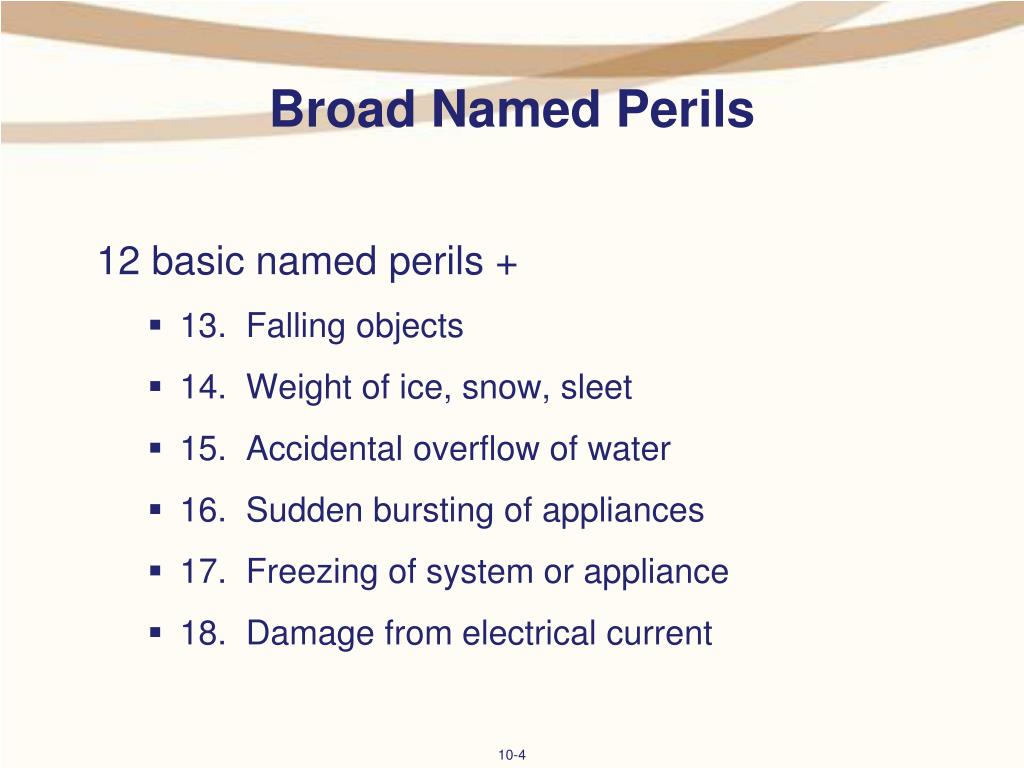

PPT Chapter 10 PowerPoint Presentation, free download ID68509

Is It Covered? Burst Pipes • National Real Estate Insurance Group

Basic Broad And Special Perils Chart

PPT Chapter 10 PowerPoint Presentation, free download ID3201947

PPT Chapter 10 PowerPoint Presentation, free download ID3201947

Basic vs Special Form Coverage Insurance Resources

Open Perils Coverage What Homeowners Need to Know Auto Lending

Commercial Property Different Coverage Forms (Basic vs. Broad vs

Web There Are 3 Different Coverage Forms:

Ho 00 05 Comprehensive Form.

Web The Named Perils Covered In The Basic Form Include The Following:

Depending On How Comprehensive Or Limited Your Homeowners Insurance Policy Is, Your Home Or Belongings.

Related Post: