Bearish Chart Pattern

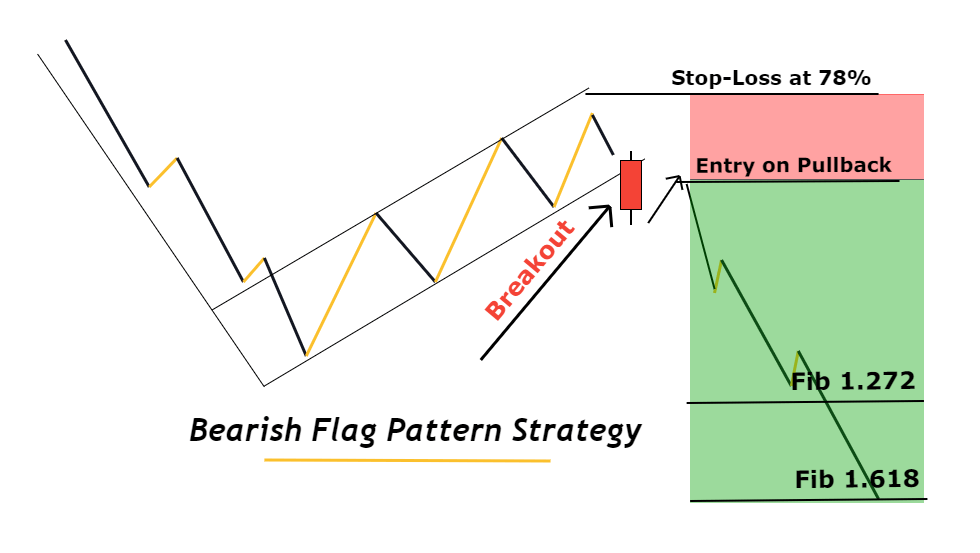

Bearish Chart Pattern - A bearish channel is formed by two parallel bearish lines. Web bearish candlestick patterns can be a great tool for reading charts. And whether you are a beginner or advanced trader, you clearly want to have a pdf to get a view of. Include a diagram showing the components of a bearish pin bar: Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. Web bearish chart patterns. Web many people think of chart patterns as bullish or bearish but there are really three main types of chart pattern groups: Gold, silver, and bitcoin all experience summer doldrums. How reliable are bearish chart patterns in predicting market trends. Web the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. How can i identify bearish chart patterns? Come learn about 8 popular patterns that can help with your day trading. Web the bearish engulfing pattern is a technical chart pattern that can help identify reversals in an uptrend.. Web bearish chart patterns: Web a bearish channel is a continuation chart pattern (of a trend). The upper line is called the resistance line; “bearish prices” is a decrease in prices relative to the market's upper point by approximately 20%. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Gold, silver, and bitcoin all experience summer doldrums. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Web what is a bearish pattern? Chart patterns refer to recognizable formations that emerge from security price data over time. So, based on this expectation, should this. And whether you are a beginner or advanced trader, you clearly want to have a pdf to get a view of. High, low, open, close, nose, body, and tail. The upper line is called the resistance line; Which type of stock bearish pattern should a trader focus on? The price progresses between these two parallel lines; Web the bearish rectangle is a continuation pattern that occurs when a price pauses during a strong downtrend and temporarily bounces between two parallel levels before the trend continues. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. How reliable are bearish chart patterns in predicting market trends. Web the bearish. Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. The upper line is called the resistance line; Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. Web in trading, a bearish pattern is a technical chart pattern that indicates a potential trend. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Reversal chart patterns, continuation chart patterns, and bilateral chart patterns. They provide technical traders with valuable insights into market psychology and supply/demand dynamics. Usd/jpy drops below ichimoku cloud top at 155.95, hinting at potential further declines. Hanging man is a. Web bearish pin bars bearish pin bars occur when buyers are in control initially, but a rejection at a price level allows sellers to take over, pushing the price close to or at the session low by the close. They provide technical traders with valuable insights into market psychology and supply/demand dynamics. Web a pattern is identified by a line. 📍bear flag 🔸 a small rectangular pattern that slopes against the preceding trend 🔸 forms. A bearish channel is formed by two parallel bearish lines. Web the aspects of a candlestick pattern. Breaking out of patterns like a rising wedge, bearish quasimodo, or descending triangle can confirm the move lower. Setting stop loss and taking profit. It is characterized by a narrowing range of price with higher highs and higher lows, both. Web bearish chart patterns. Include a diagram showing the components of a bearish pin bar: So, based on this expectation, should this. Web faraday future may be stuck in the ‘falling three methods’ pattern. These are some of the most common bearish chart patterns you will see in the market. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Technical analysts and chartists seek to identify patterns. Web the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. A smaller bullish candle followed by a larger bearish. Web what are bearish chart patterns? We will focus on five bullish candlestick patterns that give the strongest reversal signal. A bearish channel is formed by two parallel bearish lines. 📍bear flag 🔸 a small rectangular pattern that slopes against the preceding trend 🔸 forms. So, based on this expectation, should this. In this lesson, we will show you how to identify the bearish rectangle and use it as a possible selling opportunity. Web for example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. How to identify the bearish rectangle. However, there are some disputes on whether. Web a bearish harami is a two bar japanese candlestick pattern that suggests prices may soon reverse to the downside. Web ein bearish pattern ist ein chartmuster, das einen voraussichtlichen kursrückgang eines wertpapiers signalisiert.

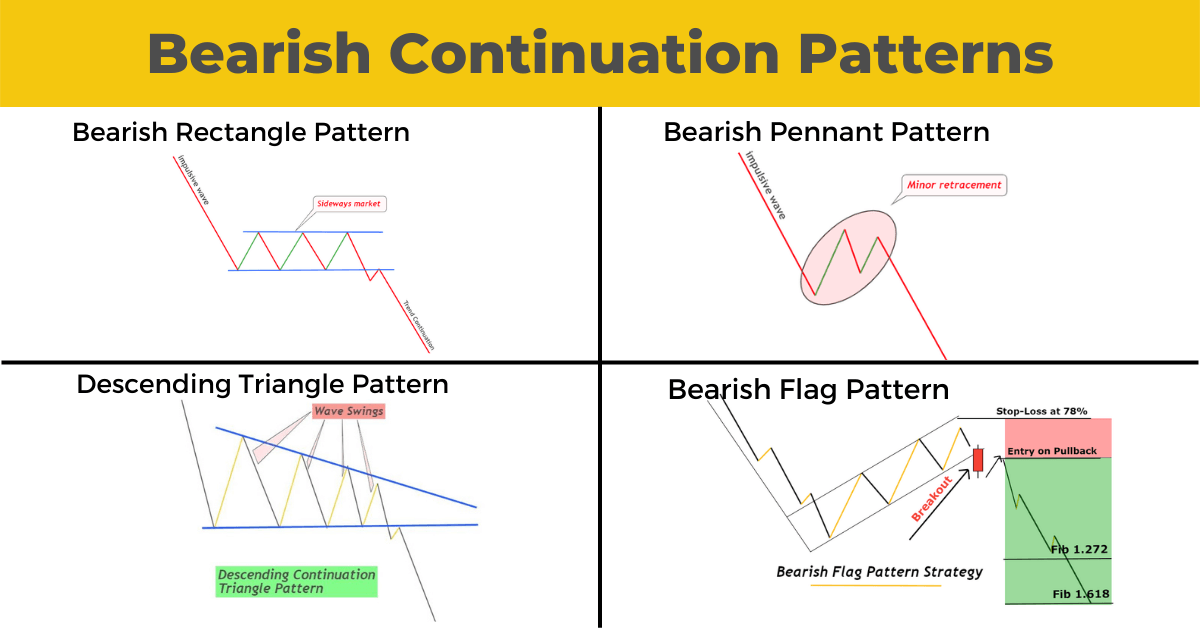

Bearish Continuation Patterns Full Guide ForexBee

Chart Patterns

bearishreversalcandlestickpatternsforexsignals Forex trading training

Bearish Reversal Candlestick Patterns The Forex Geek

Bearish Flag — Chart Patterns — Education — TradingView vlr.eng.br

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

.png)

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

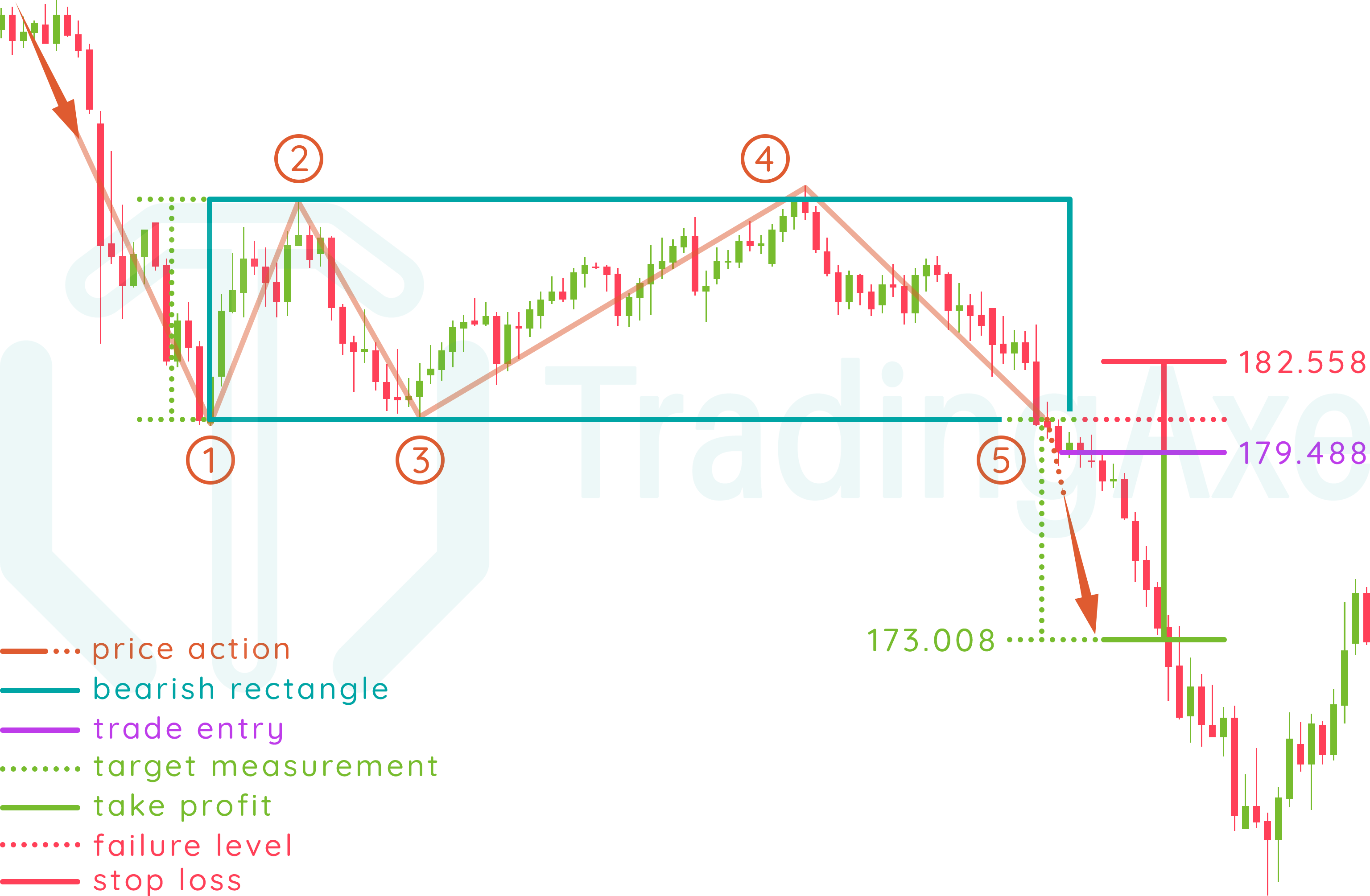

How To Trade Bearish Rectangle Chart Pattern TradingAxe

Top 3 Bearish Chart Patterns New Traders Should Understand Warrior

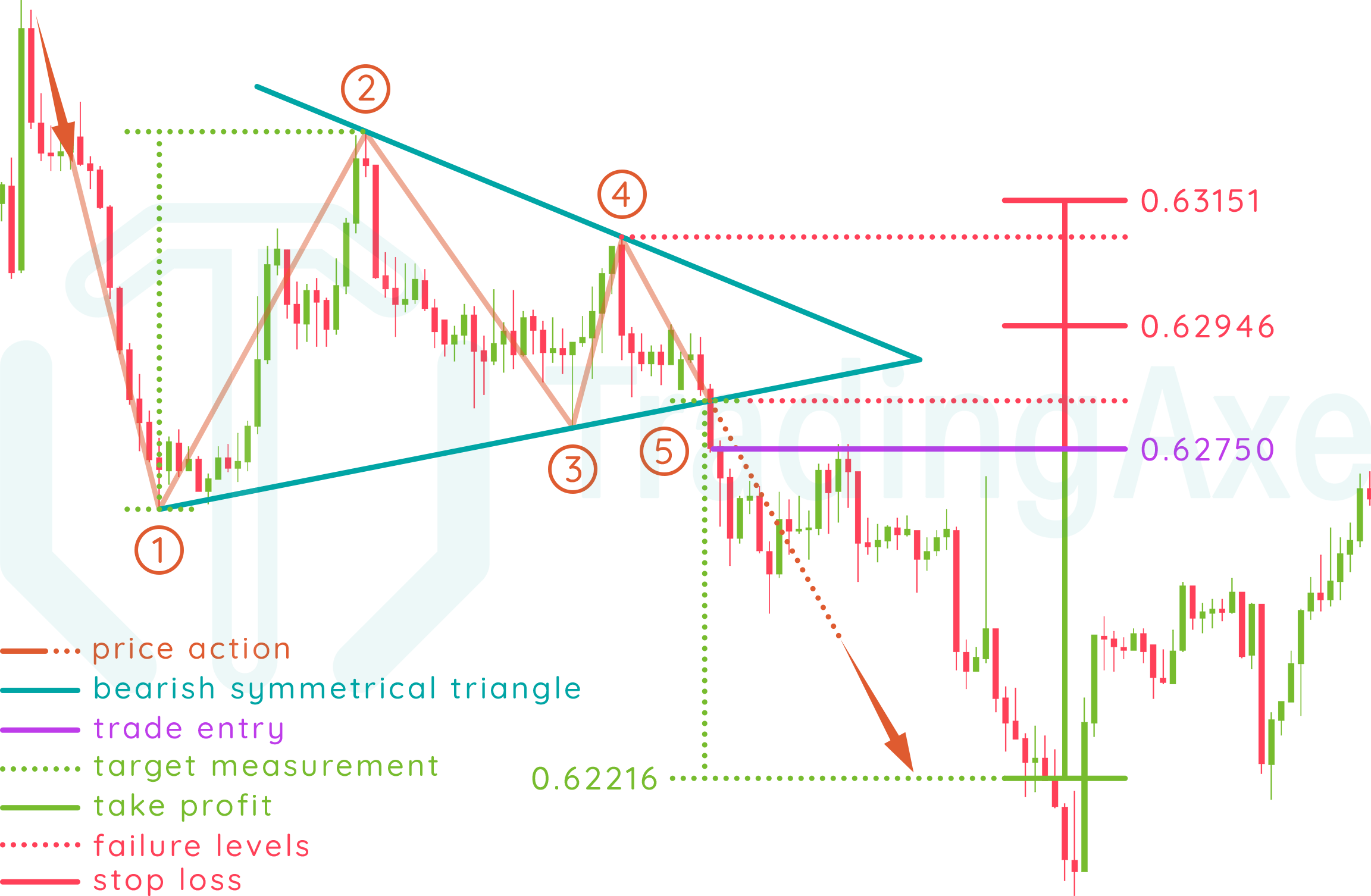

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

“Bearish Prices” Is A Decrease In Prices Relative To The Market's Upper Point By Approximately 20%.

The Pattern Consists Of A Long White Candle Followed By A Small Black Candle.

Which Type Of Stock Bearish Pattern Should A Trader Focus On?

Chart Patterns Refer To Recognizable Formations That Emerge From Security Price Data Over Time.

Related Post: