Best Stochastic Settings For 1 Minute Chart

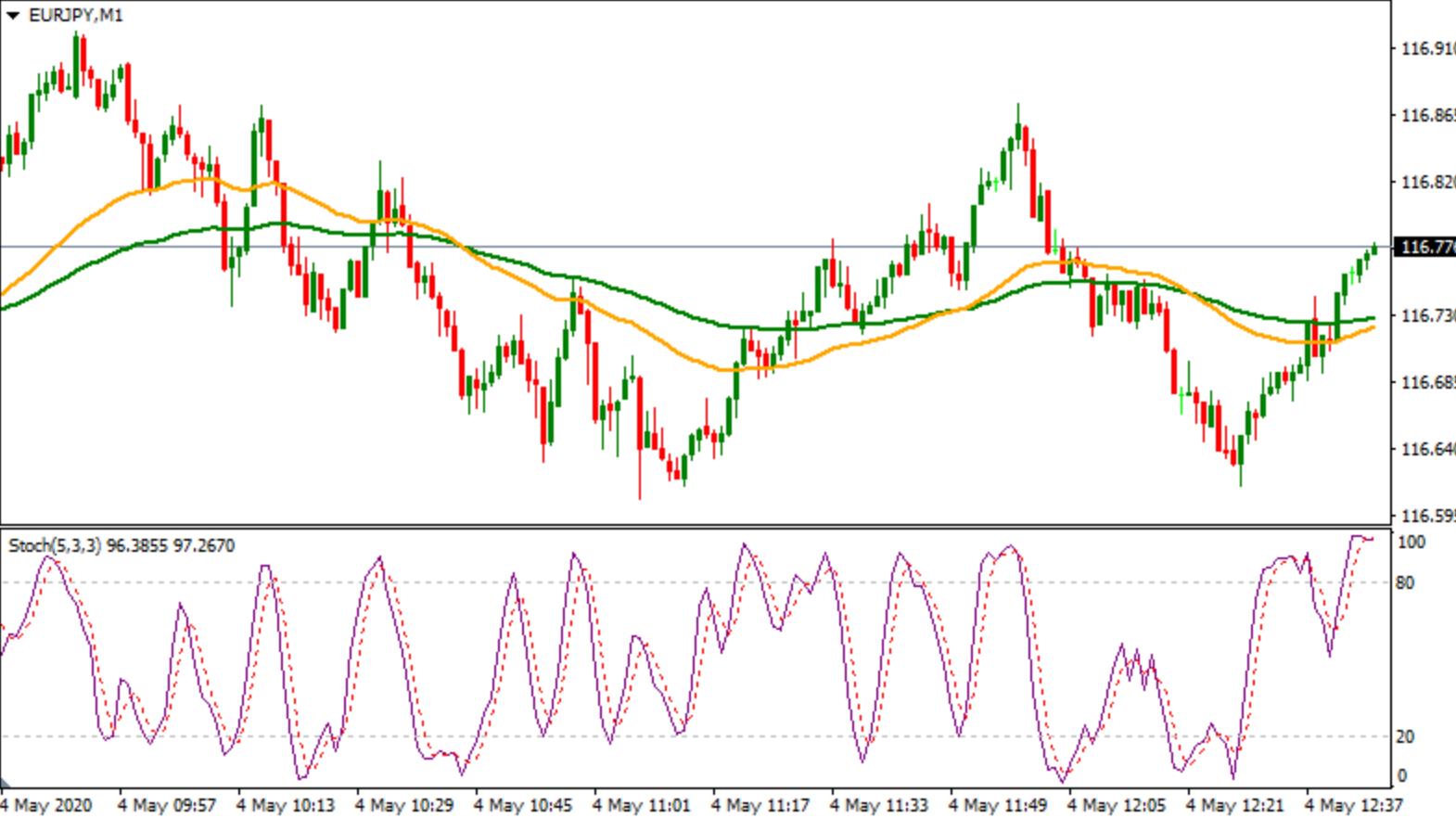

Best Stochastic Settings For 1 Minute Chart - Our 399 years of backtests revealed conclusively that the best settings for stochastic oscillator are using the standard 14,3,14,3 on an hourly ohlc/candlestick chart, which produced a 43% win rate. However, these values can be adjusted based on individual preferences and trading strategies. Understand that whatever you choose, the. The stochastic oscillator offers three versions of settings: Stochastic oscillator with a setting of (5,3,3) strategy overview. Web the best stochastic oscillator settings. This is what the default setting looks like on the metatrader 5 trading platform: How to trade classic divergences with stochastic indicator. Remember, the lower the time frame the less precise the signals are going to be. Web finding the best stochastic settings for 1 minute chart. Web the default settings for the stochastic oscillator’s parameters are often 5, 3, and 3, respectively. Stochastic is a common technical indicator used in trading. The stochastic indicator can help traders stay on the right side of the market and better time entries and exits. Our 399 years of backtests revealed conclusively that the best settings for stochastic oscillator are. Web what are the best indicators for 1 minute trading chart? The %k line is the faster line and the %d line is the slower line. Slowing is usually applied to the indicator's default setting as a period of 3. On one hand, a high sensitivity setting can result in a higher rate of false signals, potentially leading to premature. Web 1 minute scalping with rsi and stochastic is a best trend momentum strategy high profitable, based on reletive strength index, stochastic oscillator and simple moving averages. Our 399 years of backtests revealed conclusively that the best settings for stochastic oscillator are using the standard 14,3,14,3 on an hourly ohlc/candlestick chart, which produced a 43% win rate. How to trade. Web the best stochastic settings for a 1 minute chart are 14,3,3. Setting the %k at 14, while %d and slow %k are set at 3 can generate the most accurate signals for fx traders. Web finding the best stochastic settings for 1 minute chart. How to trade classic divergences with stochastic indicator. Web what are the best indicators for. Trading strategy | how to use stochastic indicator for trading divergences. The stochastic oscillator offers three versions of settings: This means that the %k line will be averaged over 14 periods and the %d line will be averaged over 3 periods. So i’m new to the whole day trading/scalping however i been educating myself on everything i need to know. Slowing is usually applied to the indicator's default setting as a period of 3. Choose the most effective variables for your trading style by deciding how much noise you’re willing to accept with the data. Web use the best stochastic settings: The stochastic indicator can help traders stay on the right side of the market and better time entries and. Web what are the best indicators for 1 minute trading chart? Different versions of the stochastic oscillator. Closing price is the closing price of the security for the existing period. This is what the default setting looks like on the metatrader 5 trading platform: The stochastic oscillator is determined as follows: The optimal settings will depend on your Setting the %k at 14, while %d and slow %k are set at 3 can generate the most accurate signals for fx traders. Mostly focused on paper trading atm. Web i've been using the trade tab with 2 charts: Web finding the best stochastic settings for 1 minute chart. The stochastic indicator can help traders stay on the right side of the market and better time entries and exits. Different versions of the stochastic oscillator. Stochastic is a common technical indicator used in trading. The stochastic oscillator offers three versions of settings: The stochastic indicator is an invaluable momentum and mean reversion tool that helps traders detect overbought and. Mostly focused on paper trading atm. Bearish divergence occurs when price makes a. This is what the default setting looks like on the metatrader 5 trading platform: The stochastic oscillator offers three versions of settings: Slowing is usually applied to the indicator's default setting as a period of 3. With this formula, we get a ratio that tells us where the close is in relation to the range of the defined period. The ticks give you an easier visualization of the 1min movement. The stochastic indicator is an invaluable momentum and mean reversion tool that helps traders detect overbought and oversold levels and confirm technical analysis signals such as breakouts and trends. Closing price is the closing price of the security for the existing period. The stochastic oscillator offers three versions of settings: This means that the %k line will be averaged over 14 periods and the %d line will be averaged over 3 periods. I use a 200 ema on a daily chart and focus on a 9/20 on a minute chart. Web use the best stochastic settings: Remember, the lower the time frame the less precise the signals are going to be. The stochastic indicator can help traders stay on the right side of the market and better time entries and exits. Web the best stochastic settings for a 1 minute chart are 14,3,3. The %k line is the faster line and the %d line is the slower line. Web the stochastic is an indicator that measures momentum in the markets. Understand that whatever you choose, the. Bearish divergence occurs when price makes a. Slowing is usually applied to the indicator's default setting as a period of 3.

Stochastic Oscillator Indicator How to Use in Your Trading

Best Stochastic Settings for 1 minute chart The Forex Geek

Best settings in 5 minutes of Stochastic strategies YouTube

:max_bytes(150000):strip_icc()/dotdash_Final_Pick_The_Right_Settings_On_Your_Stochastic_Oscillator_SPY_AAL_Jun_2020-01-763c8471cbd94fa7bda0e21de6ce792c.jpg)

stochastic settings for scalping

best macd settings for 1 minute chart

Best Stochastic Settings For 1 Minute Chart (MT5 & MT4)

Stochastic Settings for 1 Minute Chart A Trader’s Guide to Precision

Best Stochastic Settings for 1 Minute Chart (MT4 & MT5)

Stochastic 1 Min Forex Scalper

Best Stochastic Setting For Day Trading UnBrick.ID

However, These Values Can Be Adjusted Based On Individual Preferences And Trading Strategies.

Mostly Focused On Paper Trading Atm.

Bullish Divergence Occurs When Price Makes A New Low But The Stochastic Indicator Does Not, Indicating A Likely Reversal.

Our 399 Years Of Backtests Revealed Conclusively That The Best Settings For Stochastic Oscillator Are Using The Standard 14,3,14,3 On An Hourly Ohlc/Candlestick Chart, Which Produced A 43% Win Rate.

Related Post: