Bond Stock Correlation Chart

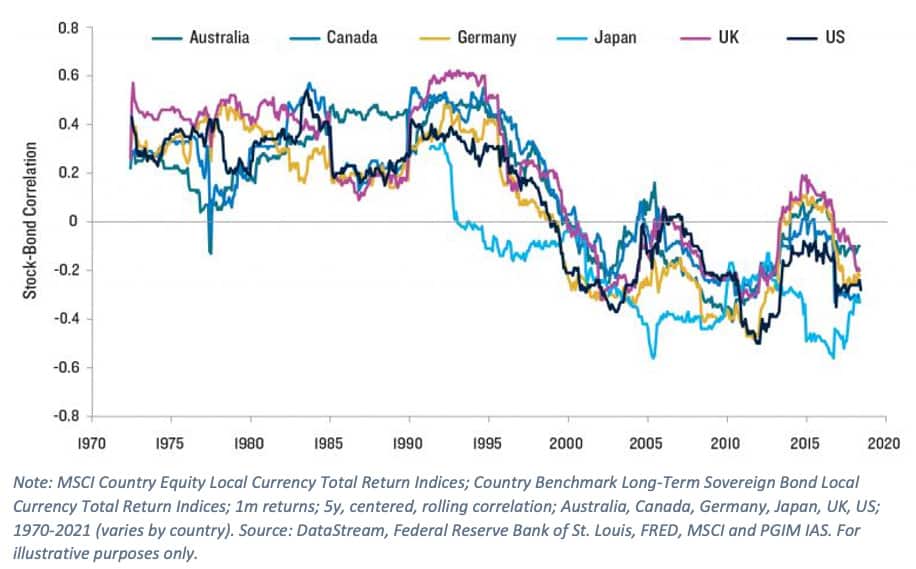

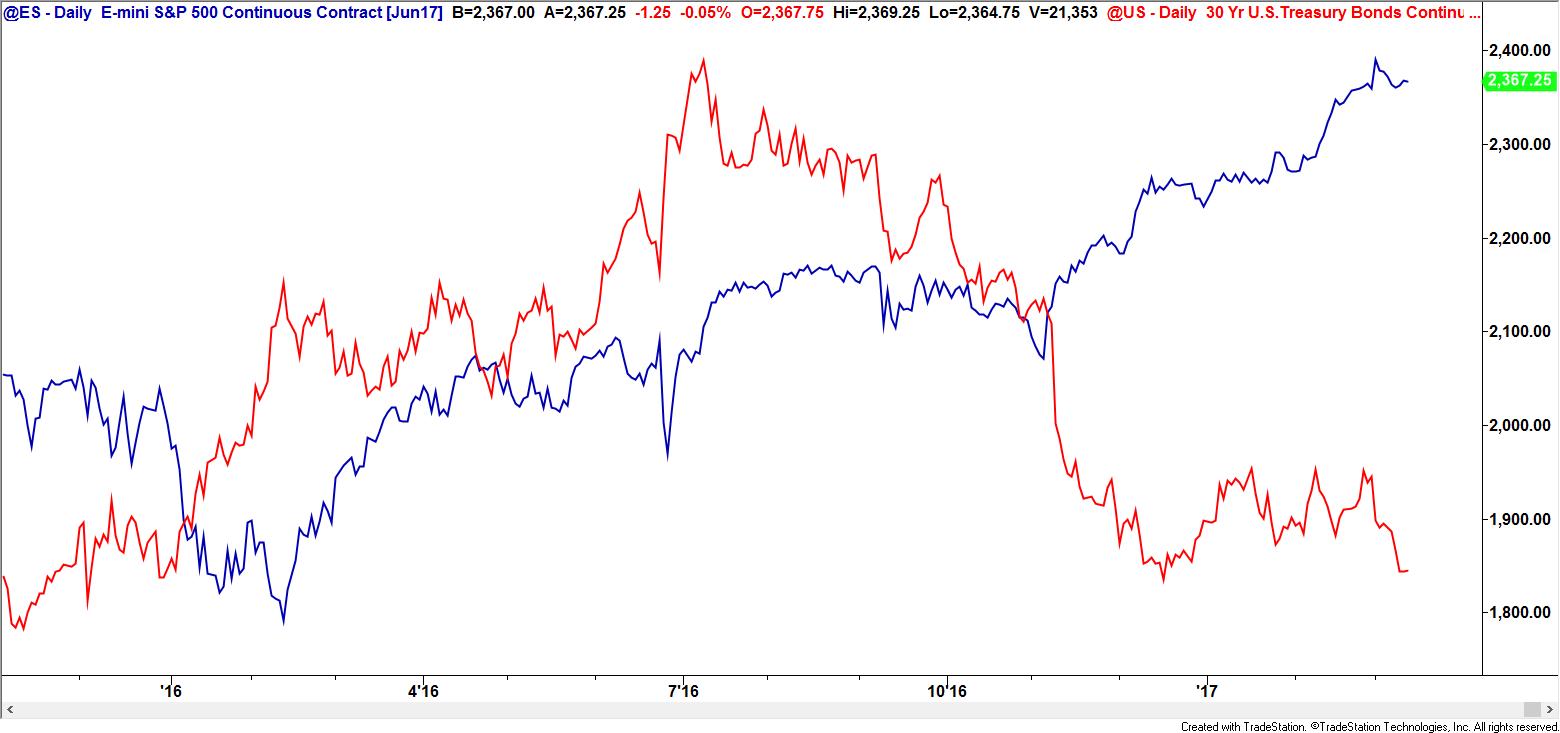

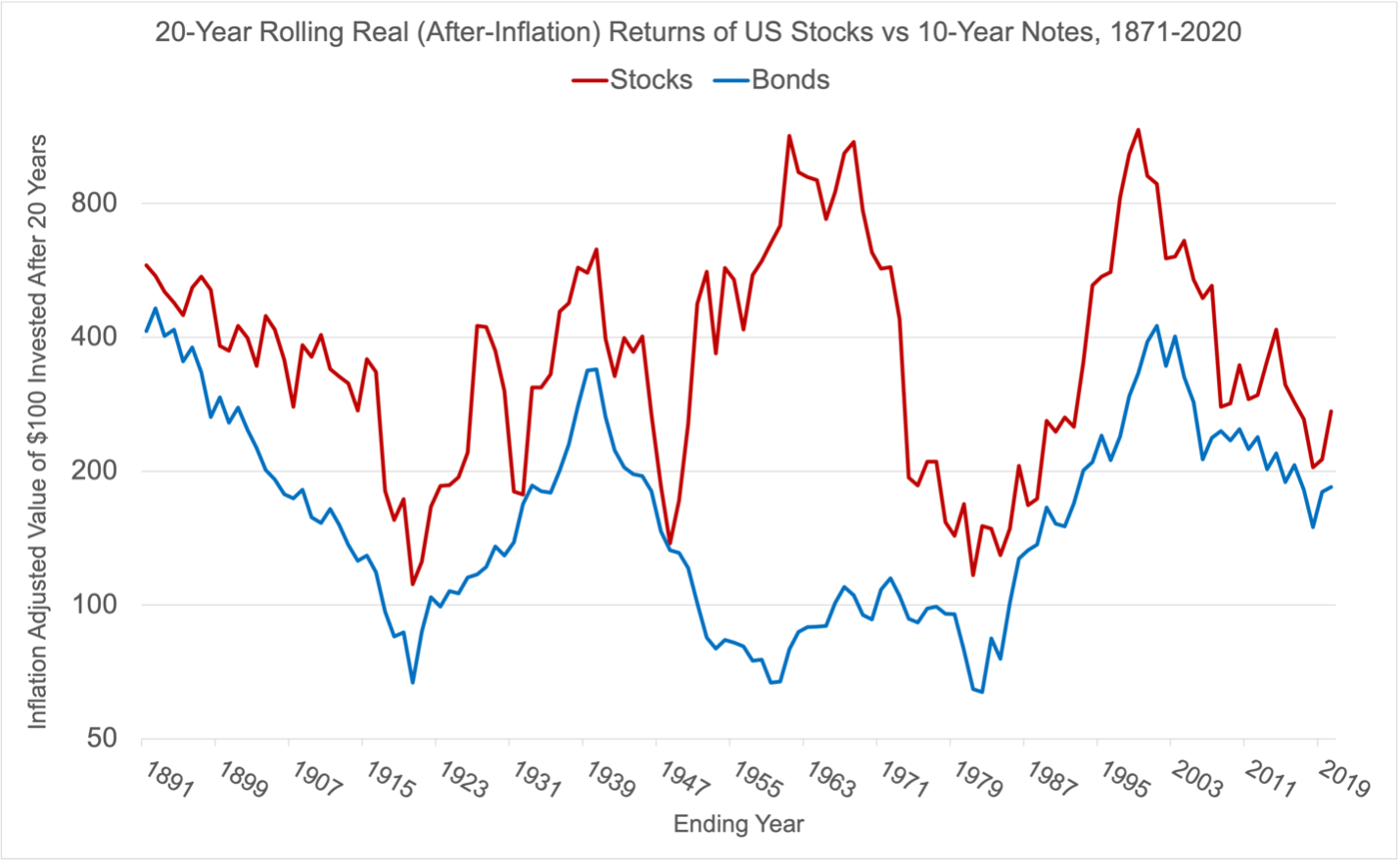

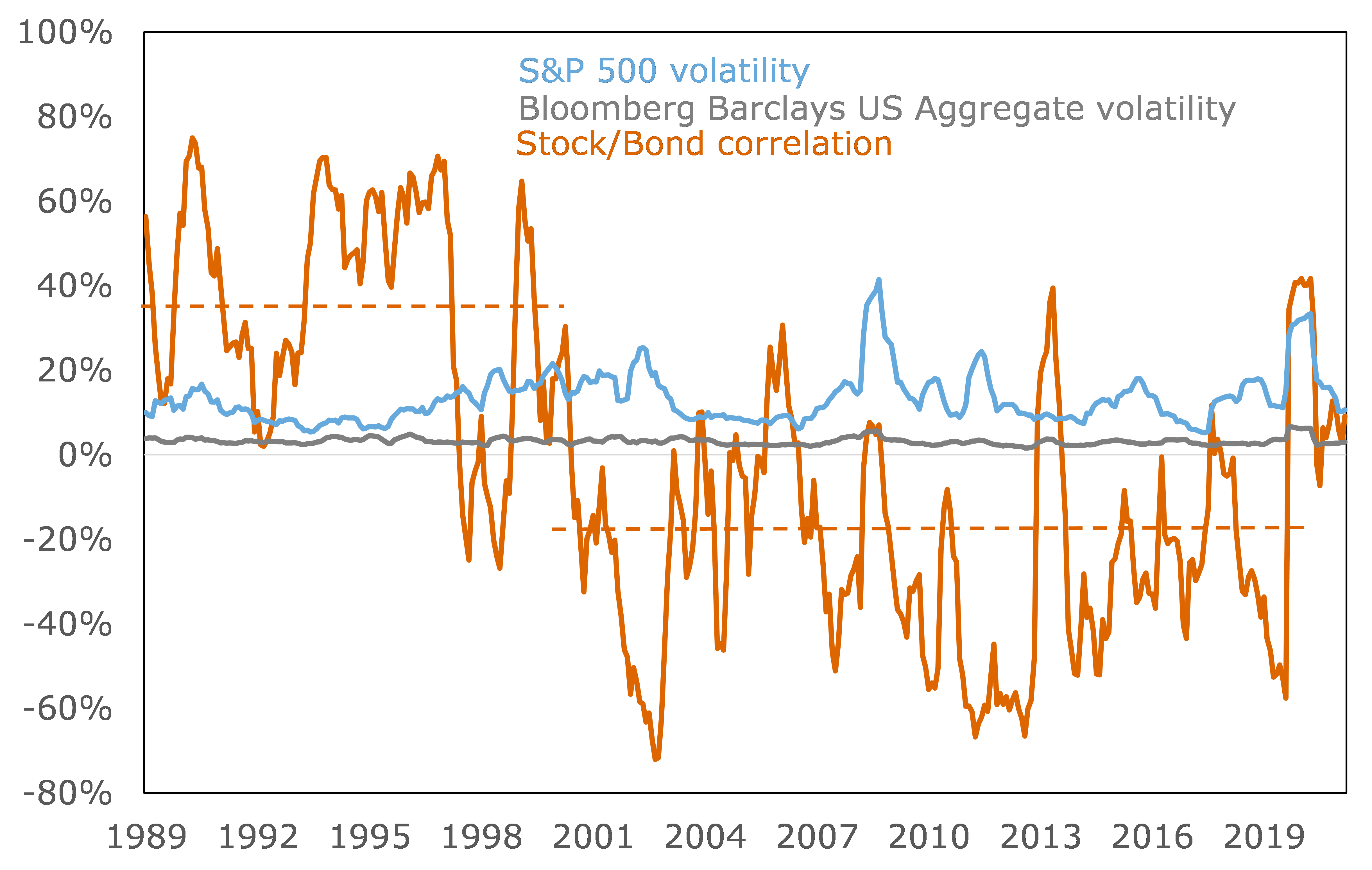

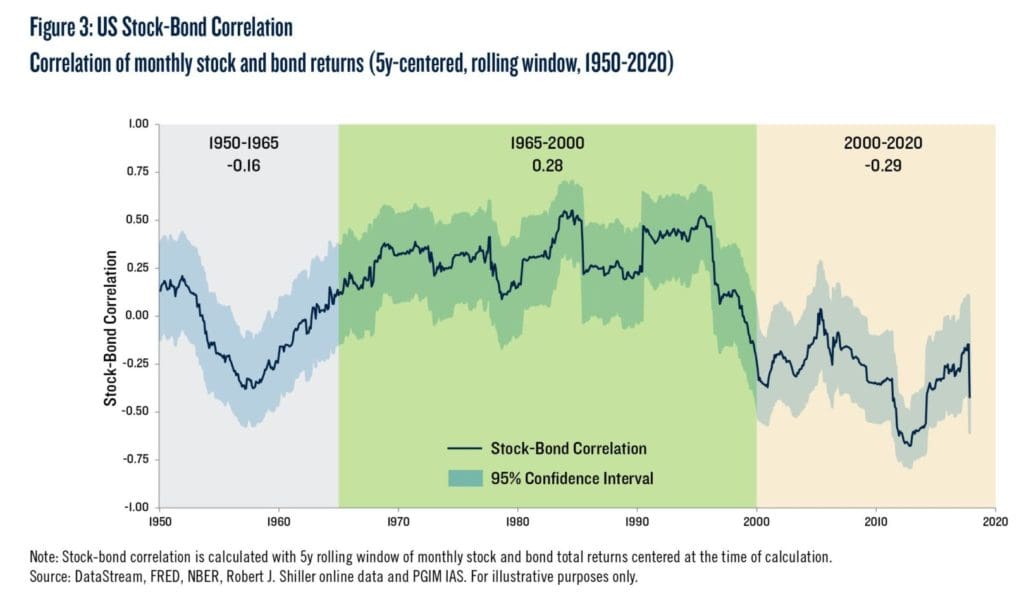

Bond Stock Correlation Chart - August 18, 2023 | 2 minute read. Web inflation will increase stock/bond correlation by raising the discount factor (y t) common to stocks and bonds. Web for each calendar quarter from 1989 through the first three quarters of 2021, the chart below shows (in orange) the correlation of the daily returns on the s&p 500® index and the bloomberg barclays u.s. Bloomberg finance, l.p., as of aug. This week’s chart looks at how it exacerbates the diversification challenge. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. Correlation of stock/bond performance vs. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. Bureau of economic analysis, bloomberg finance, l.p. An increase in uncertainty about the outlook for growth, on the other hand, will decrease the correlation as the equity risk premium increases, depressing stock prices, while the bond term premium declines, increasing bond prices. Morningstar direct, ubs asset management. How can you minimize the impact of a market crash on your portfolio? This week’s chart looks at how it exacerbates the diversification challenge. Bureau of economic analysis, bloomberg finance, l.p. Bloomberg finance, l.p., as of aug. S&p 500 with sbbi long government bonds. This infographic is available as a poster. Bloomberg finance, l.p., as of aug. An increase in uncertainty about the outlook for growth, on the other hand, will decrease the correlation as the equity risk premium increases, depressing stock prices, while the bond term premium declines, increasing bond prices. This week’s chart looks at. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. Bureau of economic analysis, bloomberg finance, l.p. Morningstar direct, ubs asset management. June 17, 2022 | 2 minute read. S&p 500 with sbbi long government bonds. Morningstar direct, ubs asset management. And fs investments, as of april 30, 2022. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that stocks and bonds moved in the same direction during. This infographic is available as a poster. One thing it clearly shows is the volatile nature of equity market returns, which stands in contrast against global. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. How can you minimize the impact of a market crash on your portfolio? Asset class correlation over 25 years. Correlation of stock/bond performance vs. For the last 20y, the correlation between stock and bond returns has been negative, enabling. Bloomberg finance, l.p., as of aug. Data as of 30 september 2019. Core inflation has averaged 4.5% for the past three years and is currently 4.7%. Asset class correlation over 25 years. Morningstar direct, ubs asset management. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. Bonds are an obvious casualty from rising inflation. Web for each calendar quarter from 1989 through the first three quarters of 2021, the chart below shows (in orange) the correlation of the daily returns on the s&p 500® index and the. This week’s chart looks at the trend and how it has exacerbated the diversification challenge. June 17, 2022 | 2 minute read. It also shows (in blue) the annualized volatility of the daily equity returns and (in gray) the daily bond market returns. Correlation of stock/bond performance vs. Web the chart below illustrates that us equities and government fixed income. And fs investments, as of april 30, 2022. Bloomberg finance, l.p., as of aug. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that stocks and bonds moved in the same direction during. Bonds are an obvious casualty from. Web for each calendar quarter from 1989 through the first three quarters of 2021, the chart below shows (in orange) the correlation of the daily returns on the s&p 500® index and the bloomberg barclays u.s. Bureau of economic analysis, bloomberg finance, l.p. Morningstar direct, ubs asset management. One thing it clearly shows is the volatile nature of equity market. An increase in uncertainty about the outlook for growth, on the other hand, will decrease the correlation as the equity risk premium increases, depressing stock prices, while the bond term premium declines, increasing bond prices. Web the chart below illustrates that us equities and government fixed income are diverging ever so slightly in performance. Bloomberg finance, lp, fs investments. Bonds are an obvious casualty from rising inflation. Data as of 30 september 2019. Web as prices spike, this week’s chart looks at rising inflation’s impact on the correlation between stocks and bonds. And fs investments, as of april 30, 2022. An earlier version of this article was published as the q2 2022 alternative thinking. How strong is this relationship when we look at individual months? A recent paper analyzing the correlation between stock and bond returns going back to 1875 suggests the relationship of the past quarter century is shifting in an uncertain inflationary. Morningstar direct, ubs asset management. How can you minimize the impact of a market crash on your portfolio? Core inflation has averaged 4.5% for the past three years and is currently 4.7%. This week’s chart looks at how it exacerbates the diversification challenge. One thing it clearly shows is the volatile nature of equity market returns, which stands in contrast against global bonds, which have historically delivered smoother, more predictable returns. For the last 20y, the correlation between stock and bond returns has been negative, enabling cios to increase stock allocations, with bonds acting as a hedge, while still satisfying a given risk budget.

Stock Bond Correlation A Global Perspective Fixed News Australia

With inflation, stockbond correlation jumps FS Investments

Stock and Bond Correlation Explained

Quick Chart 20Year Rolling Returns of Stocks vs Bonds GFM Asset

Stock & Bond Correlation

A Century of StockBond Correlations Bulletin September 2014 RBA

Is The StockBond Correlation Positive Or Negative Russell Investments

Historical Asset Class Correlations Which Have Been the Best Portfolio

A Century of StockBond Correlations Bulletin September 2014 RBA

StockBond Correlation, an InDepth Look QuantPedia

It Also Shows (In Blue) The Annualized Volatility Of The Daily Equity Returns And (In Gray) The Daily Bond Market Returns.

Bureau Of Economic Analysis, Bloomberg Finance, L.p.

S&P 500 With Sbbi Long Government Bonds.

January 5, 2024 | 3 Minute Read.

Related Post: