Bull Trap Chart

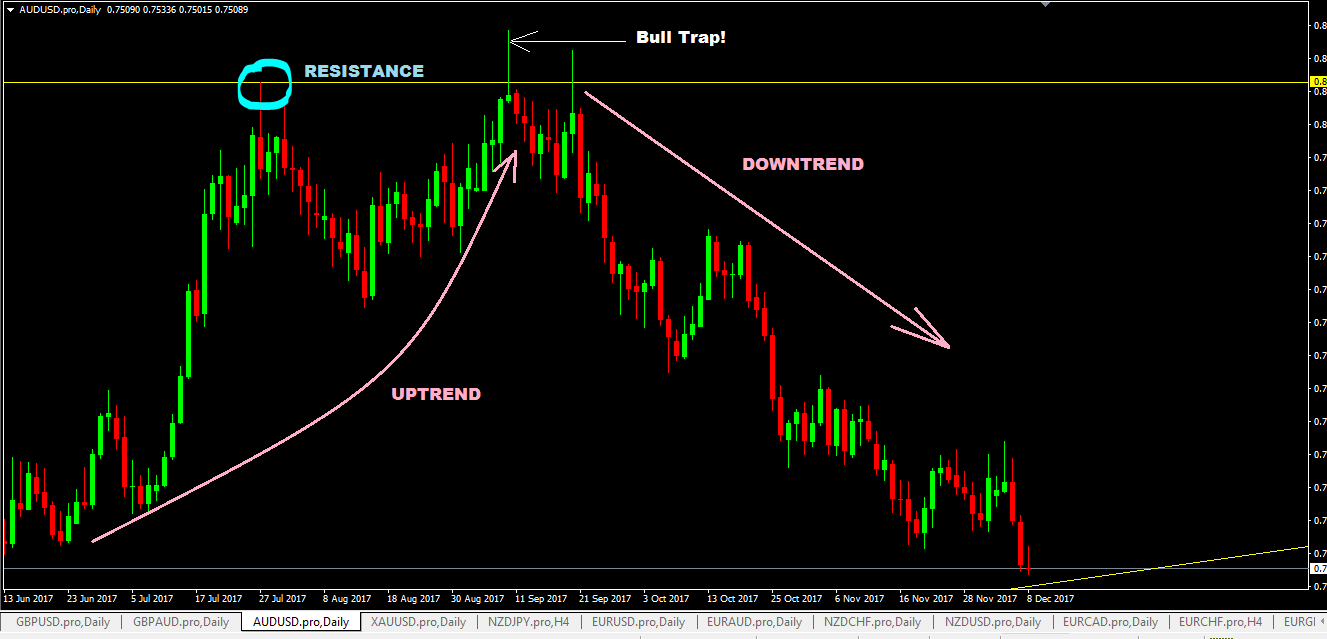

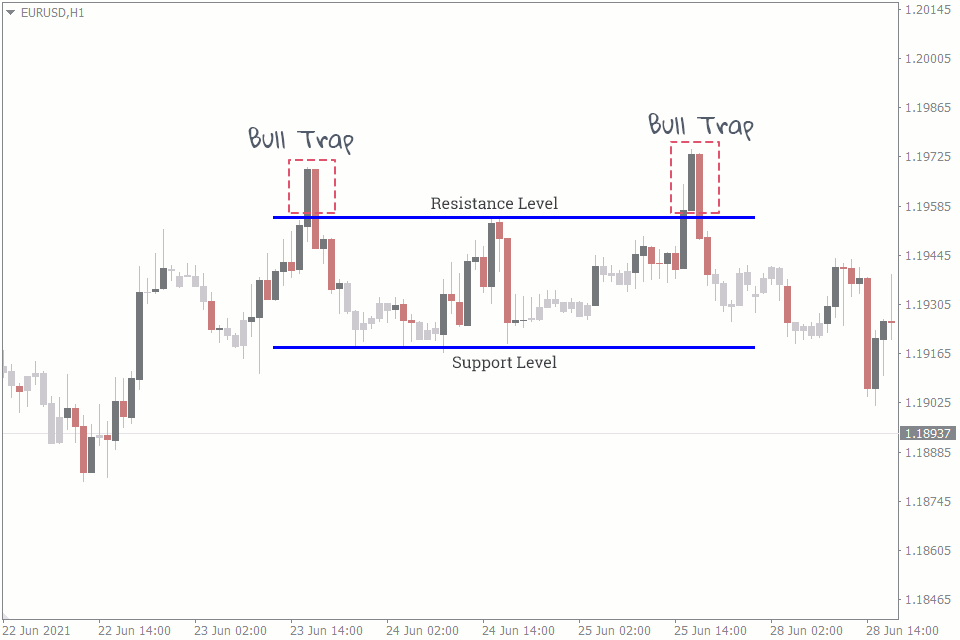

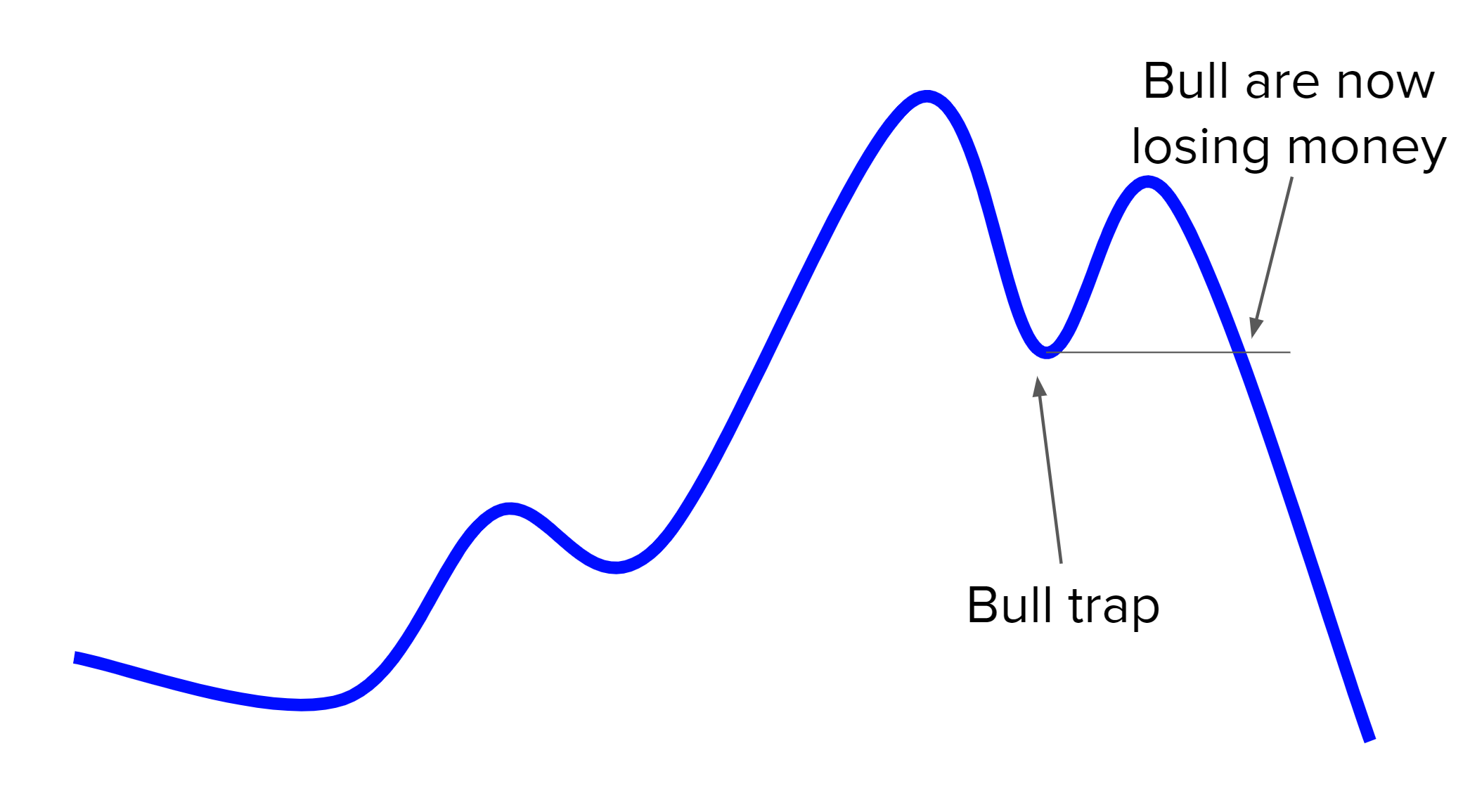

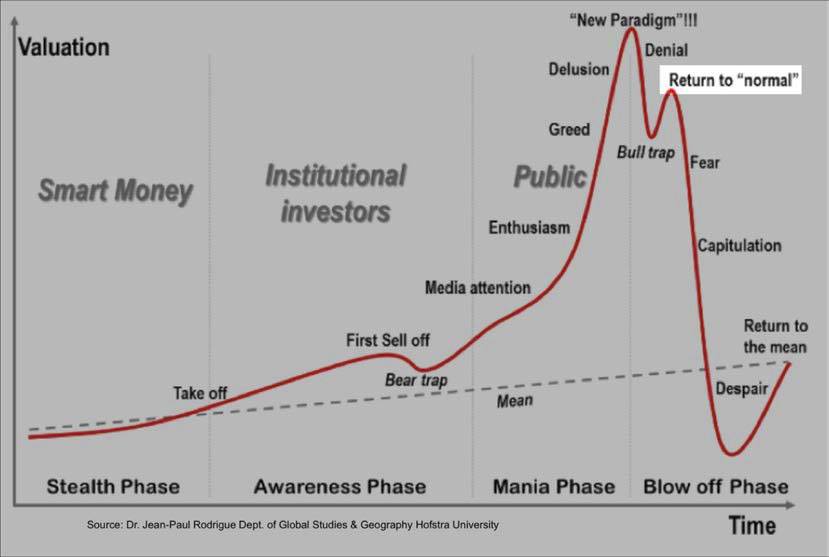

Bull Trap Chart - A bull trap can occur in stocks, or any other asset class, on any chart time frame. Bull traps happen when a security, like a stock, falls in price, but then briefly spikes, tricking investors into buying shares before they lose value again. Web identifying a potential bull trap. Web bull traps are characterised by low trading volume and divergence between the price and momentum indicators, such as macd and rsi. Bull trap trading strategy backtest; This price decline is caused by selling pressure, which is when a large number of investors are selling low their holdings of a security at the same time, causing the price decline. Web it takes practice to trade or avoid bull traps, just like any other chart pattern or trading strategy. Often, bull traps involve an upward bounce off a support level or an upward break through a resistance level. Web a bull trap is an upward price movement that resembles a reversal from a downward trend. In this article, you’ll learn what to watch out for, why bull traps happen, with examples and how to take advantage of them. Below is an example of a bull trap that takes place in the stock honeywell (hon) over a two day period. “the candles are so bullish. In this article, you’ll learn what to watch out for, why bull traps happen, with examples and how to take advantage of them. Why does a bull trap happen? Web bull traps in trading. So, this must have happened in the above chart! You’re tempted “chase” a breakout. Web bull traps in trading is a pattern that is represented by a false impulse breakdown of resistance amid volumes moving on the downward path. Often, bull traps involve an upward bounce off a support level or an upward break through a resistance level. Web in. Why does a bull trap happen? You’re tempted “chase” a breakout. Bull trap trading strategy backtest; A bull trap can occur in stocks, or any other asset class, on any chart time frame. How to trade bull traps? Web bull traps are characterised by low trading volume and divergence between the price and momentum indicators, such as macd and rsi. Web what is a bull trap? In particular, a bull trap is a multiple top breakout that reverses after exceeding the prior highs by one box. How can i recognise a likely bull trap? Web a bull trap. Web in trading, a bull trap is a situation where a trader buys an asset believing its price will continue to rise, only to see it fall sharply after reaching a new high. A bull trap can occur in stocks, or any other asset class, on any chart time frame. You know, bull traders follow an uptrend. We've shown how. Web bull trap charting example. What is a bull trap & how do i avoid it? Is a bull trap bullish or bearish? Web bull traps occur in the forex market when a false signal that a currency pair is about to continue or accelerate its upward trend occurs. As the name states, a bull trap is a chart pattern. This buying activity causes new buyers to chase the stock as they jump in. How often does a bull trap happen? “the candles are so bullish. After the first descent, the price maintains a horizontal direction until it breaks out. You know, bull traders follow an uptrend. As the name states, a bull trap is a chart pattern that traps bull traders. Web bull traps in trading is a pattern that is represented by a false impulse breakdown of resistance amid volumes moving on the downward path. Bull traps happen when a security, like a stock, falls in price, but then briefly spikes, tricking investors into buying. Breakout traders look for a resistance level that the price touched a few times. Bull traps occur when buyers fail. Before entering a trade during what looks like a potential bull rally, it might make sense for traders to use technical tools like volume, momentum indicators, and candlestick charts to look for. Web bull traps are characterised by low trading. But a trend doesn’t last forever. These setups can trick bullish traders into buying a stock on the belief that a sustained upward price movement is just beginning. In this article, you’ll learn what to watch out for, why bull traps happen, with examples and how to take advantage of them. In particular, a bull trap is a multiple top. Best markets to trade a bull trap. Below is an example of a bull trap that takes place in the stock honeywell (hon) over a two day period. A bull trap can occur in stocks, or any other asset class, on any chart time frame. Web bull traps are characterised by low trading volume and divergence between the price and momentum indicators, such as macd and rsi. Web identifying a potential bull trap. The common bull trap patterns examples. Web the chart shows the price action breaking through the resistance and closing slightly above it. Because when the price has exploded higher, there’s no “floor” (like swing low or support) to hold these higher prices. After the first descent, the price maintains a horizontal direction until it breaks out. Before entering a trade during what looks like a potential bull rally, it might make sense for traders to use technical tools like volume, momentum indicators, and candlestick charts to look for. Web a bull trap is a false signal in trading that suggests a declining asset has reversed and is heading upwards when, in fact, the asset will continue to decline. Web what is a bull trap? Web it takes practice to trade or avoid bull traps, just like any other chart pattern or trading strategy. Bull traps happen when a security, like a stock, falls in price, but then briefly spikes, tricking investors into buying shares before they lose value again. Often, bull traps involve an upward bounce off a support level or an upward break through a resistance level. Web chart showing classic bull trap | source:

What is a Bull Trap & How Do I Avoid It? CMC Markets

How to Trade the Bull Trap The Complete Guide Pro Trading School

How to Trade the Bull Trap The Complete Guide Pro Trading School

Bull Trap Pattern Forex Trading Strategy ForexCracked

What are Bull and Bear Traps in the Forex Market? (How to Avoid Them

Bull Trap or One of the Most Useful Trading Patterns I Have Used

Bull trap in crypto and how to recognize it for newbie investors

Bull Trap

Mastering Bull Trap Strategies to Avoid Losses and Gain Profits

Bull Trap Trading Guide How to Identify And Escape

Understand The Common Characteristics Of Bull Traps And Gain Insights Into Strategies For Minimizing Risk And Maximizing Profits.

What Is A Bull Trap & How Do I Avoid It?

Frequently Asked Questions (Faqs) On The Bull Trap Trading Strategy.

“The Candles Are So Bullish.

Related Post: