Cash Drawer Balance

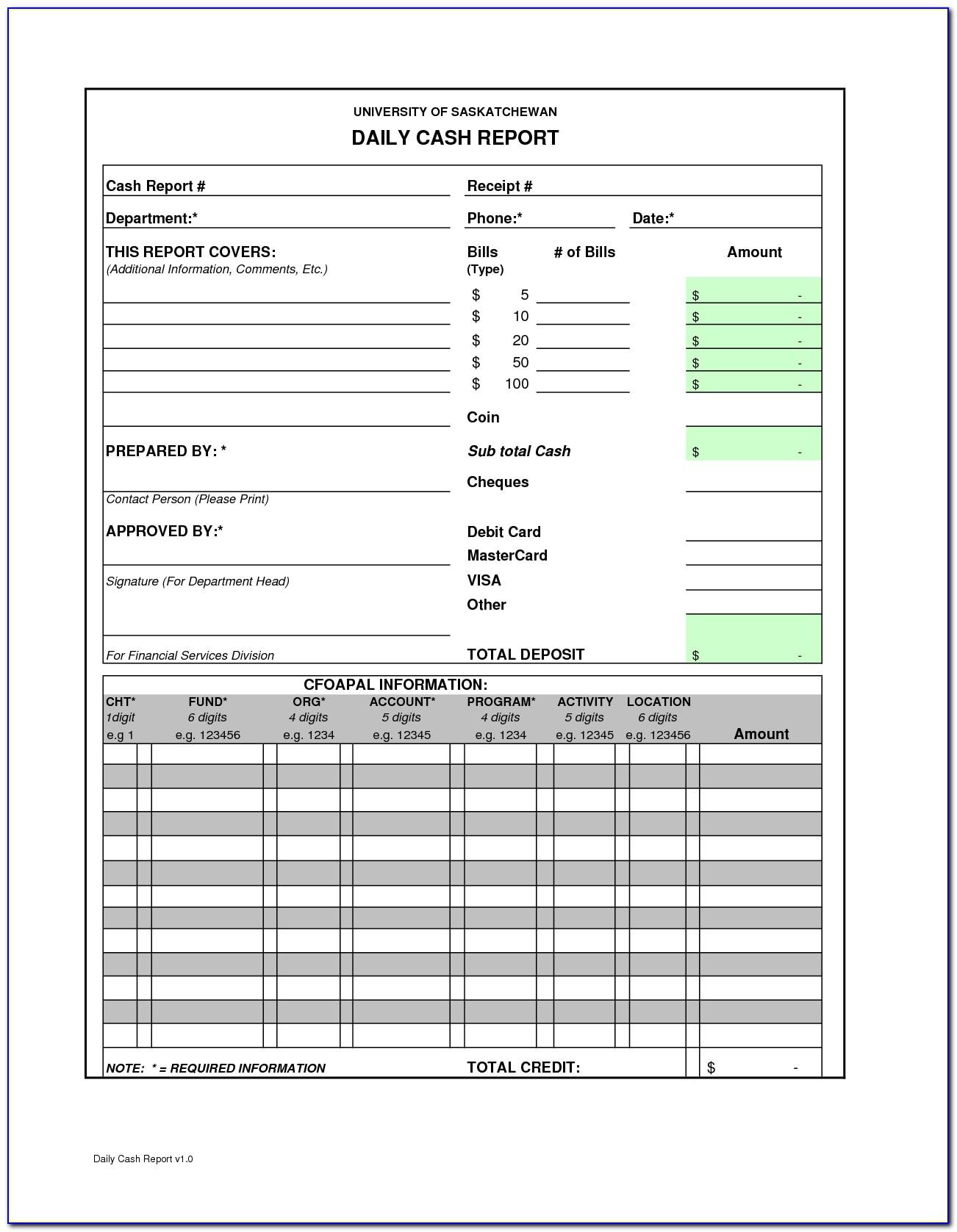

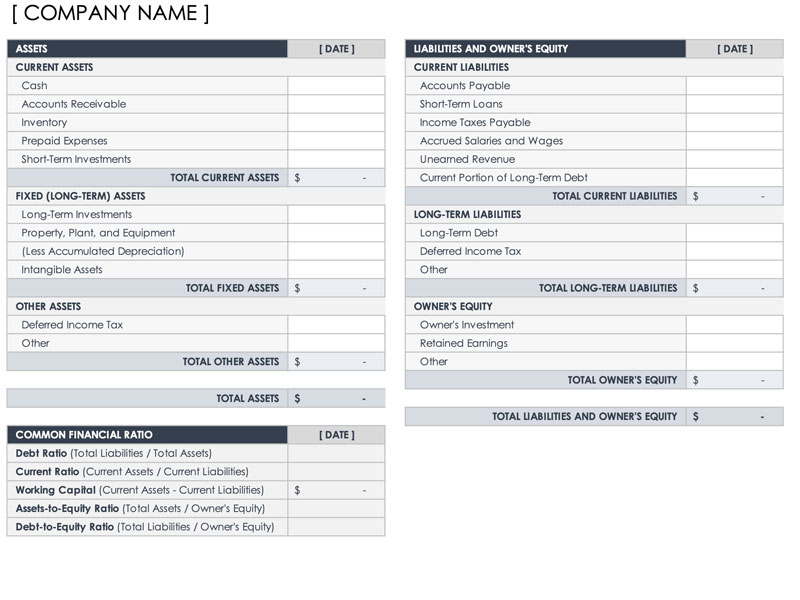

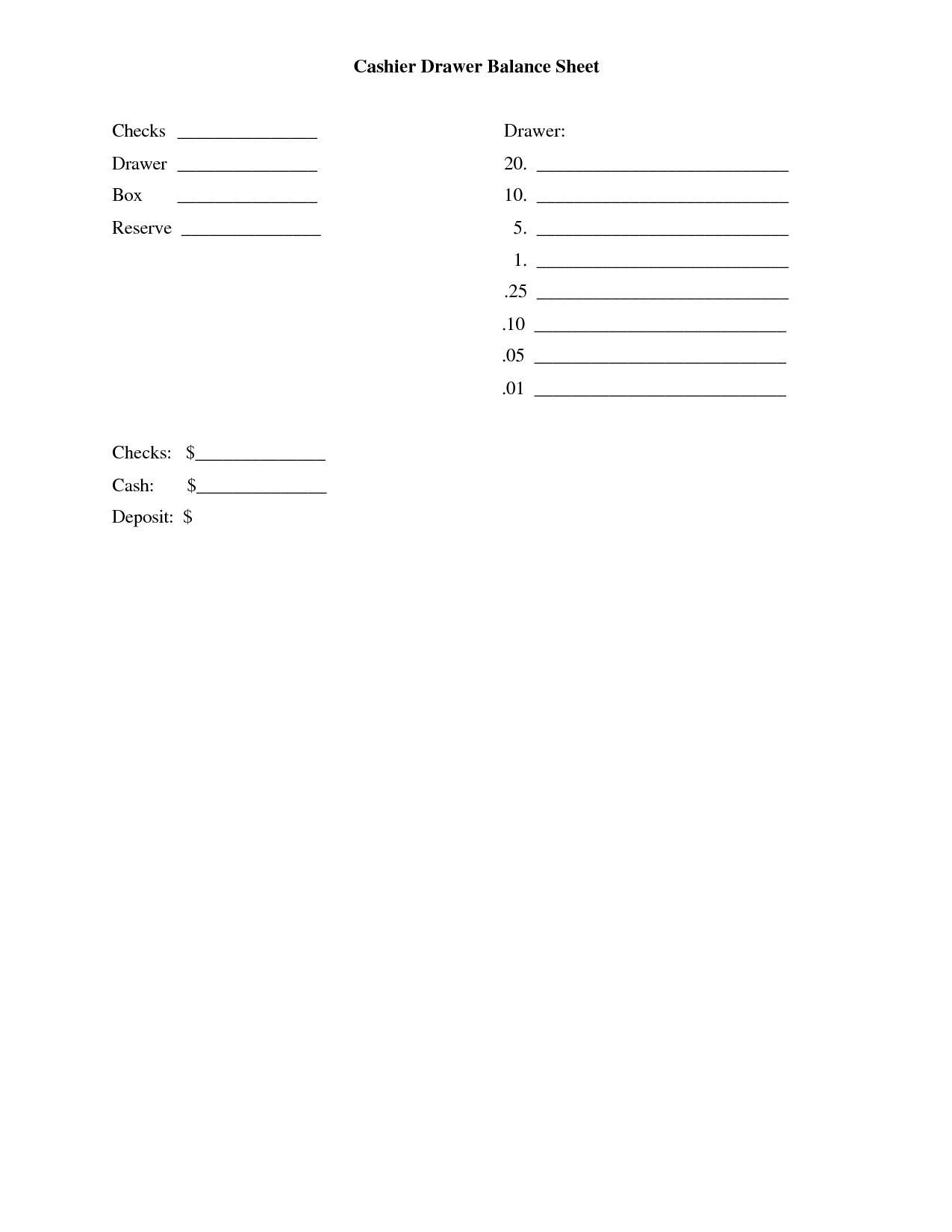

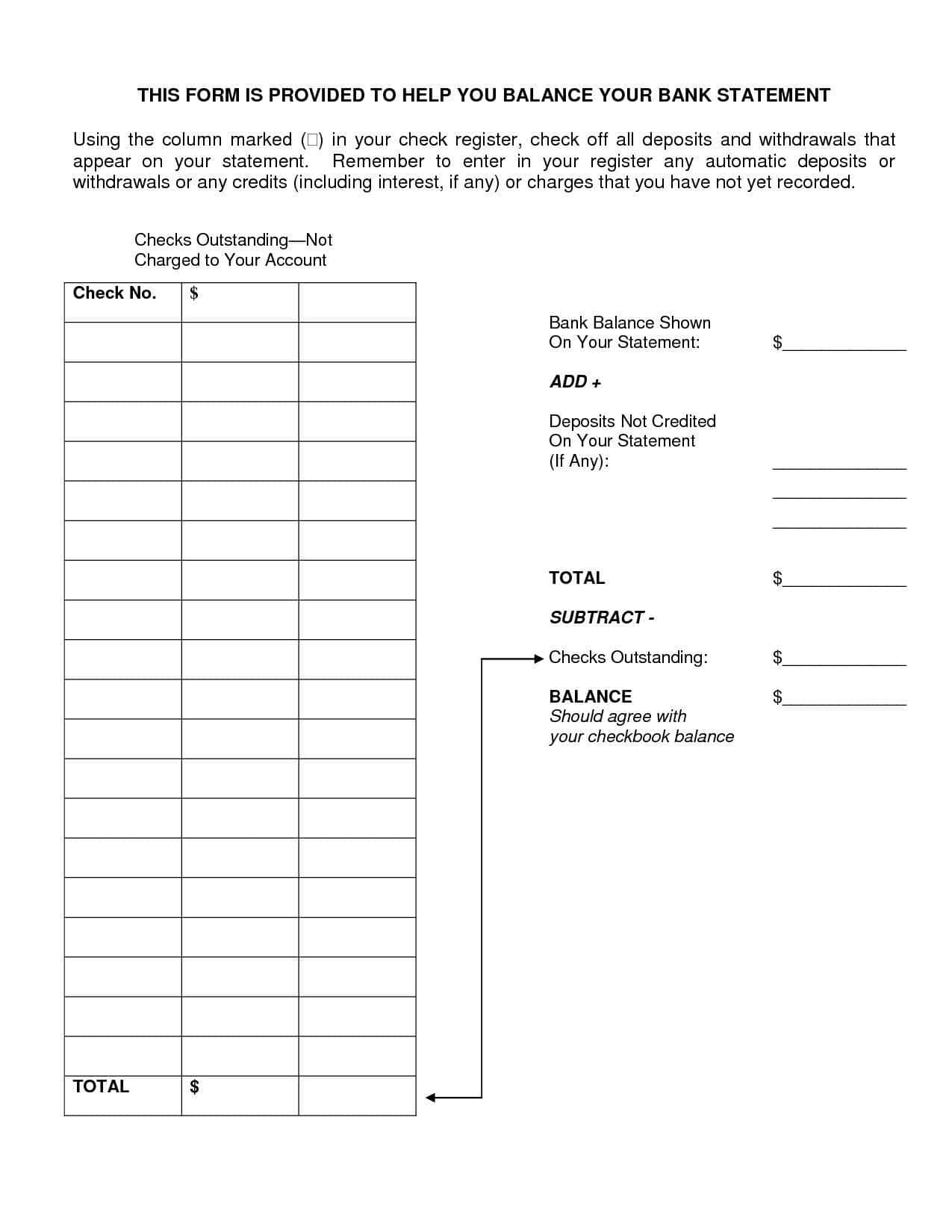

Cash Drawer Balance - Accurate balancing of cash drawers requires a reliable point of reference. Enter the value and then select done. Web add a line to your p&l statements to account for cash discrepancies. When recording your cash register totals, be sure to account for your beginning balance (e.g. It’s the process of verifying that the amount of cash in your cash or pos register matches the recorded sales. Received $48.0 thousand in investment interest disbursed $142.9 thousand in accrued technical assistance grants disbursed $250.0 thousand in. You’ll have an introductory 0% purchase and qualifying balance transfer apr for 15 months from account opening (then 20. Print it out and pull the cash drawer, before retreating to a discrete area. The balance decreased by $343.0 thousand from prior month, primarily due to: If balancing the drawer after closing, be sure the sales floor lights are off and the door is locked. The bank should have a spreadsheet that will allow you to keep track of how much you have in each denomination. You’ll have an introductory 0% purchase and qualifying balance transfer apr for 15 months from account opening (then 20. Add sales report to pos. Sign it in a few clicks. Still, when there are multiple registers, this can create. Enter your default starting cash amount, then tap start drawer > confirm start drawer. The cash drawer and its contents should be taken to an office or another secluded area to prepare the report. For example, count your $100 dollar bills and write the amount on the spreadsheet under $100 denominations. Check out using cash drawers during your shift to. There are several reasons to compose and manage a cash sheet: When recording your cash register totals, be sure to account for your beginning balance (e.g. Web this video shows how to balance a cash drawer at the end of a shift. Web add a line to your p&l statements to account for cash discrepancies. For example, count your $100. Web cash balancing, also known as cashier balancing, sounds like a fancy way of saying counting money. Type text, add images, blackout confidential details, add comments, highlights and more. However, keep the process the same. Plan for an appropriate opening balance for each cash drawer, using best practices as a guide. Enter your default starting cash amount, then tap start. Record all cash drawer transactions. Type text, add images, blackout confidential details, add comments, highlights and more. When recording your cash register totals, be sure to account for your beginning balance (e.g. Enter your default starting cash amount, then tap start drawer > confirm start drawer. Web the active cash provides a longer introductory apr than the new pnc card. This comprehensive record is critical for accounting purposes and addressing unresolved issues. It’s the process of verifying that the amount of cash in your cash or pos register matches the recorded sales. Draw your signature, type it, upload its image, or use your mobile device as a. Sign it in a few clicks. The company's revenue rose 11% year over. $500 cash rewards bonus after spending $5,000 in purchases in the first three months of account opening. You could also pay them out the $50 that you have in the safe (so they can at least tip out the service staff) and write them a. Web follow these steps to balance your cash drawers. At the end of each shift. Web follow these steps to balance your cash drawers. As long as there is money in the drawer, they’re good. This is one of your primary bases for balancing: Many don’t worry about balancing the drawer until year end or until there is an. Count your cash drawer at the start of each workday. But it’s more than that! The company's revenue rose 11% year over year in its first quarter and earnings per share soared 39%. For example, in smaller businesses with only one register, it might not be possible. Delta state university president dan ennis announced on monday he is cutting $3 million from the school's budget to change what he calls. This will pull up a number pad where you can set the new starting balance to the cash drawer. You can lean on cash balancing to ensure accuracy and prevent losses. Type text, add images, blackout confidential details, add comments, highlights and more. The bank should have a spreadsheet that will allow you to keep track of how much you. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Withdrawn cash drawer and x read to hand, begin the physical count. At the end of each shift or business day, pull the pos report for each drawer. Add the amounts and check your register or drawer to make sure the actual cash and its written amount are equal. This is one of your primary bases for balancing: Web the active cash provides a longer introductory apr than the new pnc card. For a small business, $100 to $150 should be more than enough. As long as there is money in the drawer, they’re good. Share your form with others. This report serves as a crucial tool for comparing against the physical count of cash. Type text, add images, blackout confidential details, add comments, highlights and more. Document all transactions, including initial and final balances, payment forms, and any discrepancies. Tally up the sum totals of all coins, notes and pdq. Type text, add images, blackout confidential details, add comments, highlights and more. Add sales report to pos. Web tap settings > cash management > toggle on cash management.

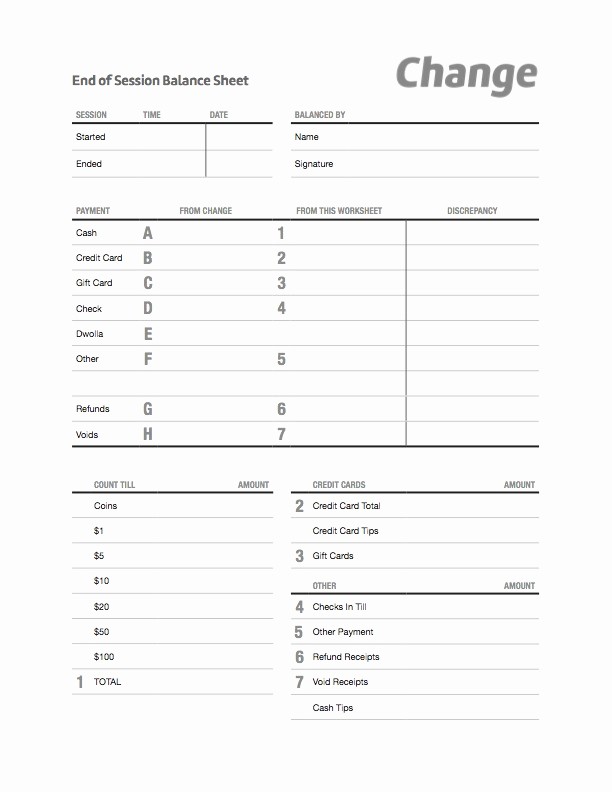

Cash Drawer Balance Sheet Alcohol Workplace Wizards

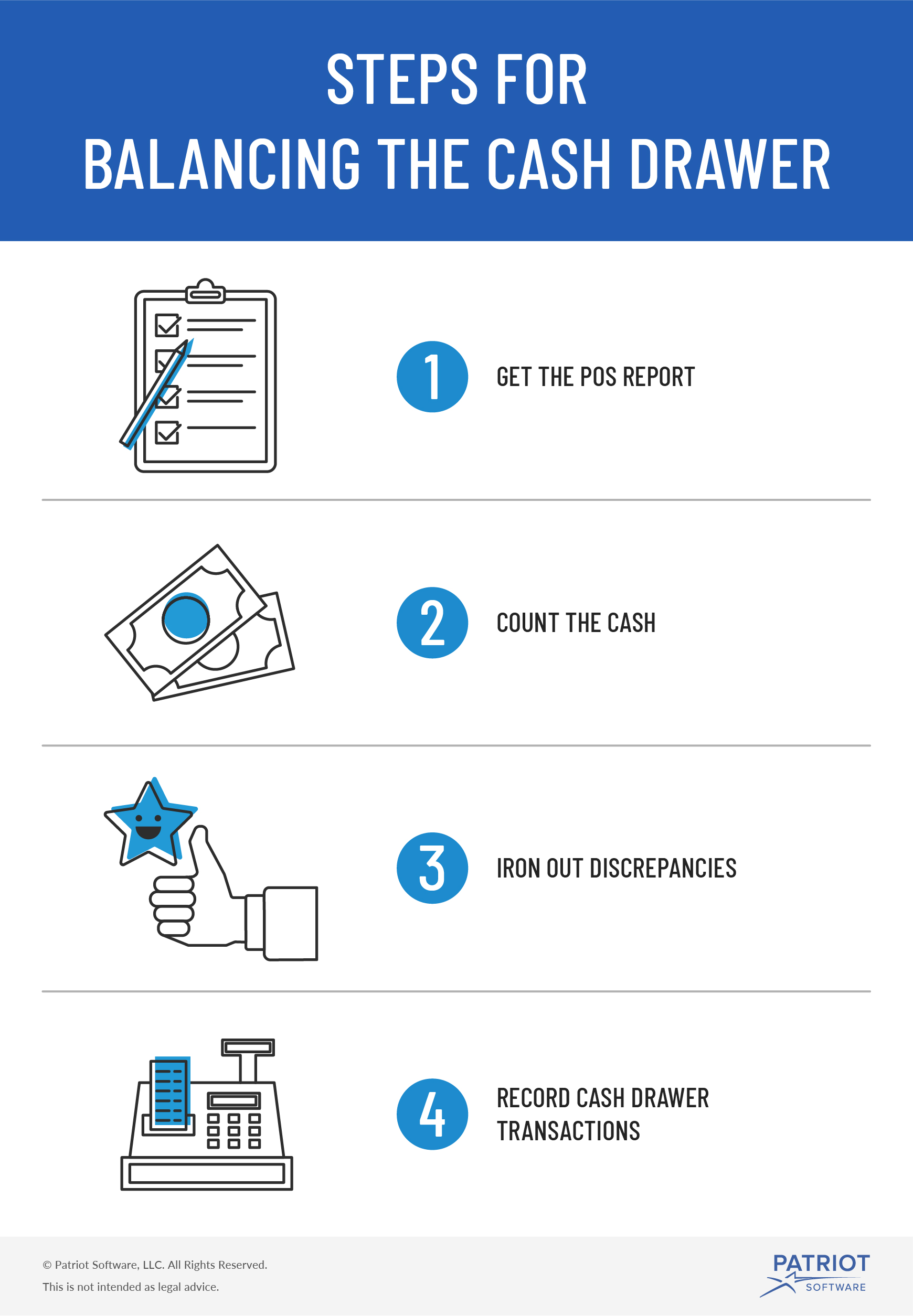

Balancing Your Cash Drawer Steps, Tips, & More

Daily Cash Register Balance Sheet Template Excel Cash Register Count

Cashier Balance Sheet Balance sheet, Balance sheet template, Business

How to Balance Cash Drawers Easily in 5 Seconds

Daily Cash Register Balance Sheet Excel Templates

Cash Drawer Balance Sheet charlotte clergy coalition

Cash Drawer Balance Sheet Template Lovely Free Cashier Balance Sheet

Cash Drawer Balance Sheet charlotte clergy coalition

Cash Drawer Worksheet/drawer Count for Business Etsy

After You Count Your Drawer And Check Out Any Discrepancies, Record Your Cash Drawer Transactions In Your Books.

Depending On The Size Of Your Business, You May Have More Than One Cash Drawer In Use Over The Course Of The Day Or Shift.

Write An Iou For $215 To The Server And Pay Them Out When You Go To The Bank And Get The Safe Back Up To Operating Balances.

This Comprehensive Record Is Critical For Accounting Purposes And Addressing Unresolved Issues.

Related Post: