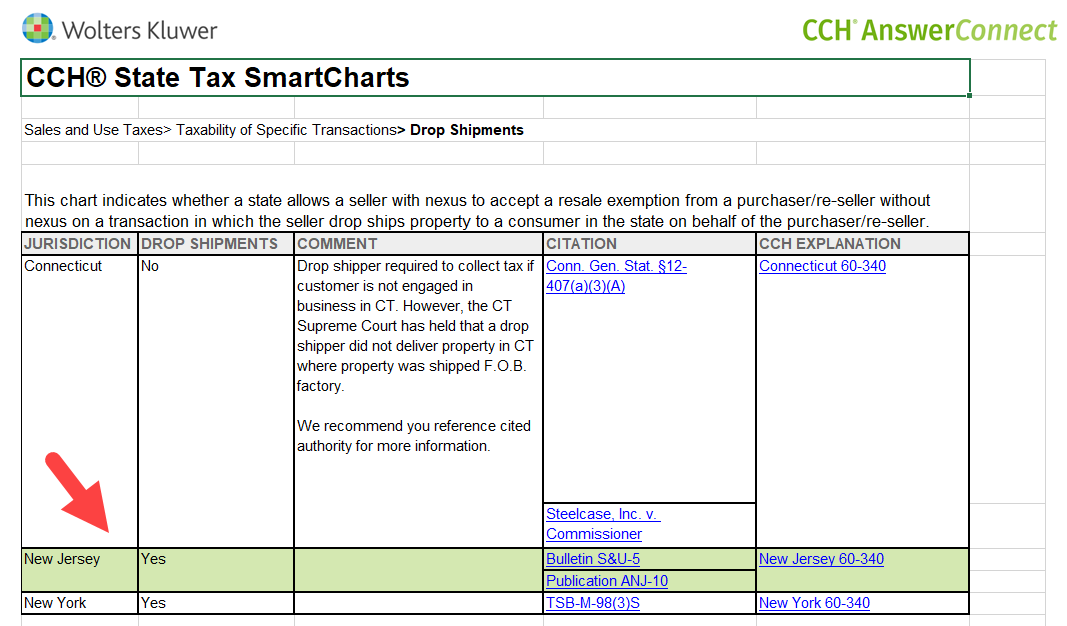

Cch State Tax Smart Charts

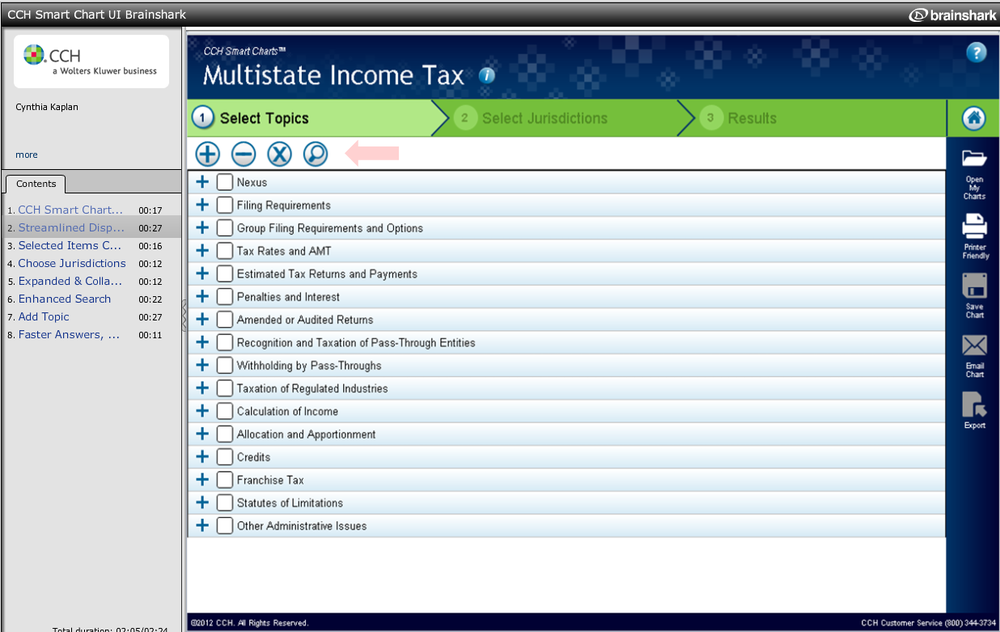

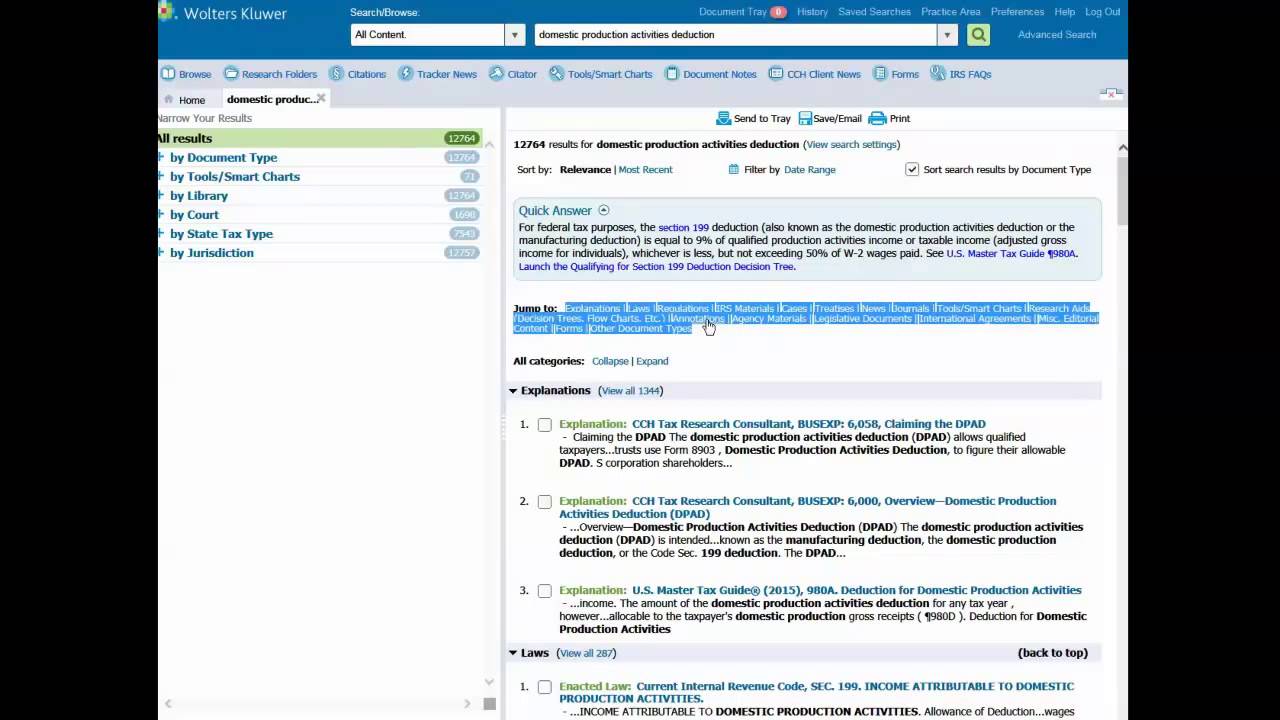

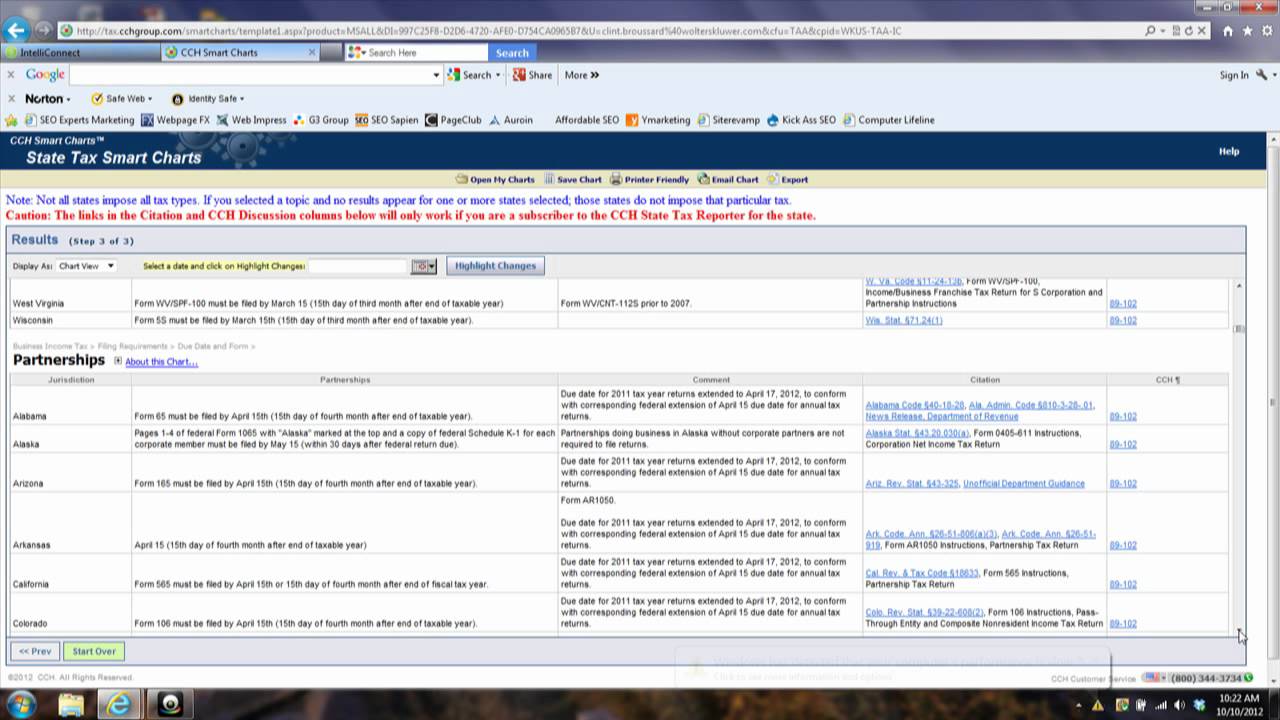

Cch State Tax Smart Charts - Special apportionment rules that apply to specific industries, such as manufacturers, financial institutions, insurance The deduction for the pte tax is then passed through in the distributive share of the pte owners’ income. Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on income taxes (personal and corporate), sales and. Web this chart shows the standard apportionment formulas used in each state for the 2023 tax year. Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on income taxes (personal and corporate), sales and use taxes and tax administration. Web she is a contributor to cch’s intelliconnect, which includes cch’s state tax review, a weekly newsletter that reports on tax news at the state level, as well as cch’s state tax reporters, the multistate corporate income tax guide. Cch tax prep partner series™. Instantly create charts that provide a snapshot of tax treatment across all. Web an automatic tax thesaurus helps to achieve useful results by matching various terms commonly used in state tax materials. Links to state regulations and supporting laws in state smart charts that are relevant to the active state field or state form. Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on income taxes (personal and corporate), sales and. Select help > state smart charts. Web cch answerconnect state tax research with smartcharts. Web in the wolters kluwer's state tax handbook (2021), readers. 395 views 1 year ago. Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on income taxes (personal and corporate), sales and use taxes and tax administration. Cch tax prep partner series™. Special apportionment rules that apply to specific industries, such. Wolters kluwer tax & accounting us. Instantly create charts that provide a snapshot of tax treatment across all. Select the tax topic or topics to research; Web cch answerconnect state tax research with smartcharts. 395 views 1 year ago. Now those changes are also visible in. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on. The cch state tax smart charts save you time by placi. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web finding all the information for a specific tax topic in all 50 states can be extremely time consuming. Choose the tax jurisdictions to research. Choose the tax jurisdictions to research or compare; Web finding all the information for a specific tax topic in all 50 states can be extremely time consuming. Web this chart shows whether each state and the district of columbia allow a corporation income tax deduction for income taxes paid to states or localities. Web an automatic tax thesaurus helps to. Cch tax prep partner series™. Select the tax topic or topics to research; Web an automatic tax thesaurus helps to achieve useful results by matching various terms commonly used in state tax materials. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web cch answerconnect. Now those changes are also visible in. Select help > state smart charts. Select the tax topic or topics to research; Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on income taxes (personal and corporate), sales and. Web this chart. Web this handy and affordable reference provides readers with an overview of the taxation scheme of each state and the district of columbia, as well as multistate charts on income taxes (personal and corporate), sales and use taxes and tax administration. Special apportionment rules that apply to specific industries, such as manufacturers, financial institutions, insurance Web in the wolters kluwer's. Web in the wolters kluwer's state tax handbook (2021), readers have access to multistate charts on income taxes (personal and corporate), sales and use taxes and tax administration for each state’s taxation scheme, including the district of columbia. Open a state interview form. 395 views 1 year ago. Web finding all the information for a specific tax topic in all. Cch tax prep partner series™. Web it streamlines the time and effort to manually research various state sales tax rates. Web this chart shows the standard apportionment formulas used in each state for the 2023 tax year. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Open a state interview form. Instantly create charts that provide a snapshot of tax treatment across all. The deduction for the pte tax is then passed through in the distributive share of the pte owners’ income. Select the tax topic or topics to research; Select help > state smart charts. Most states generally recognize the federal s corporation election, but some states require compliance with additional filing requirements and conditions. Special apportionment rules that apply to specific industries, such as manufacturers, financial institutions, insurance State smart charts can be accessed from the help tab while working in a state form. The cch state tax smart charts save you time by placi. Web in the wolters kluwer's state tax handbook (2021), readers have access to multistate charts on income taxes (personal and corporate), sales and use taxes and tax administration for each state’s taxation scheme, including the district of columbia. Web view state smart chart changes in both print & downloaded files when you take advantage of our unique smart chart highlights feature, you easily see what’s changed as of a certain date. Web cch answerconnect state tax research with smartcharts.

The Best Tax Software 2019 The CPA Journal

Cch State Tax Smart Charts

CCH® SmartCharts YouTube

CCH State Tax Rates and Tables Free Download and Review

CCH AnswerConnect New Features February 2022

Tax Software in the Ongoing Pandemic Environment The CPA Journal

Cch Smart Charts

New design for CCH Smart Charts CPA Practice Advisor

State Tax Smart Charts A Visual Reference of Charts Chart Master

CCH State Tax Smart Charts Demo on Intelliconnect YouTube

Web This Chart Shows Whether Each State And The District Of Columbia Allow A Corporation Income Tax Deduction For Income Taxes Paid To States Or Localities.

Web Finding All The Information For A Specific Tax Topic In All 50 States Can Be Extremely Time Consuming.

Wolters Kluwer Tax & Accounting Us.

Web This Handy And Affordable Reference Provides Readers With An Overview Of The Taxation Scheme Of Each State And The District Of Columbia, As Well As Multistate Charts On Income Taxes (Personal And Corporate), Sales And Use Taxes And Tax Administration.

Related Post: