Chart Patterns Crypto

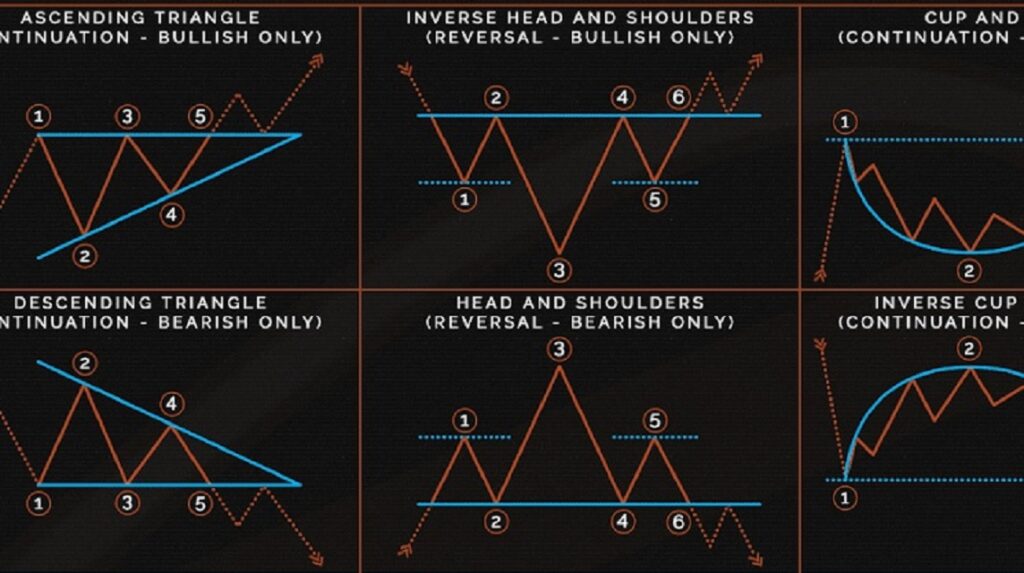

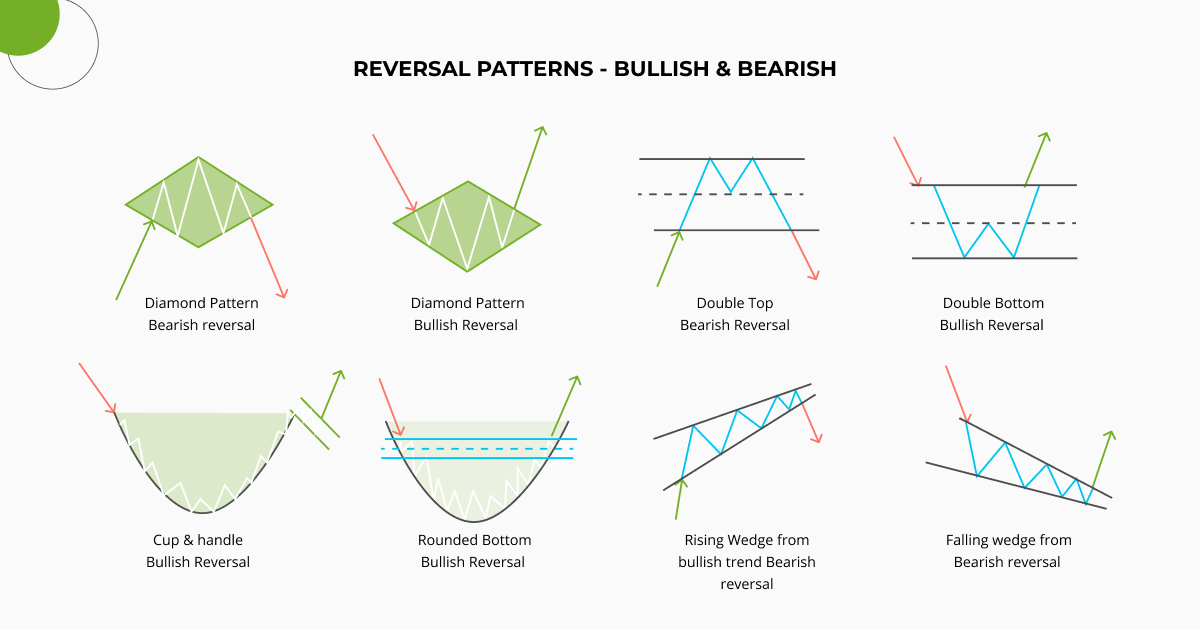

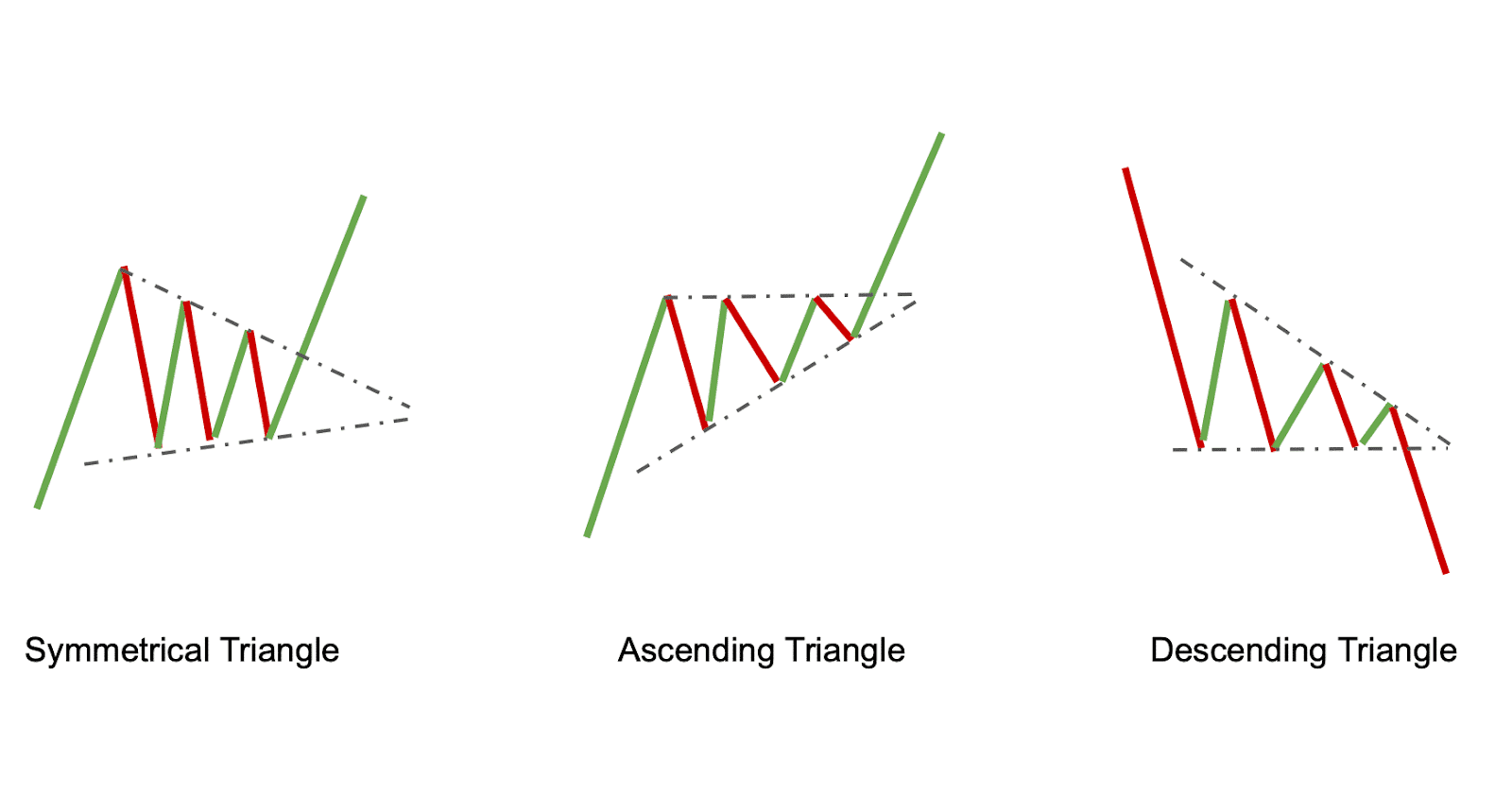

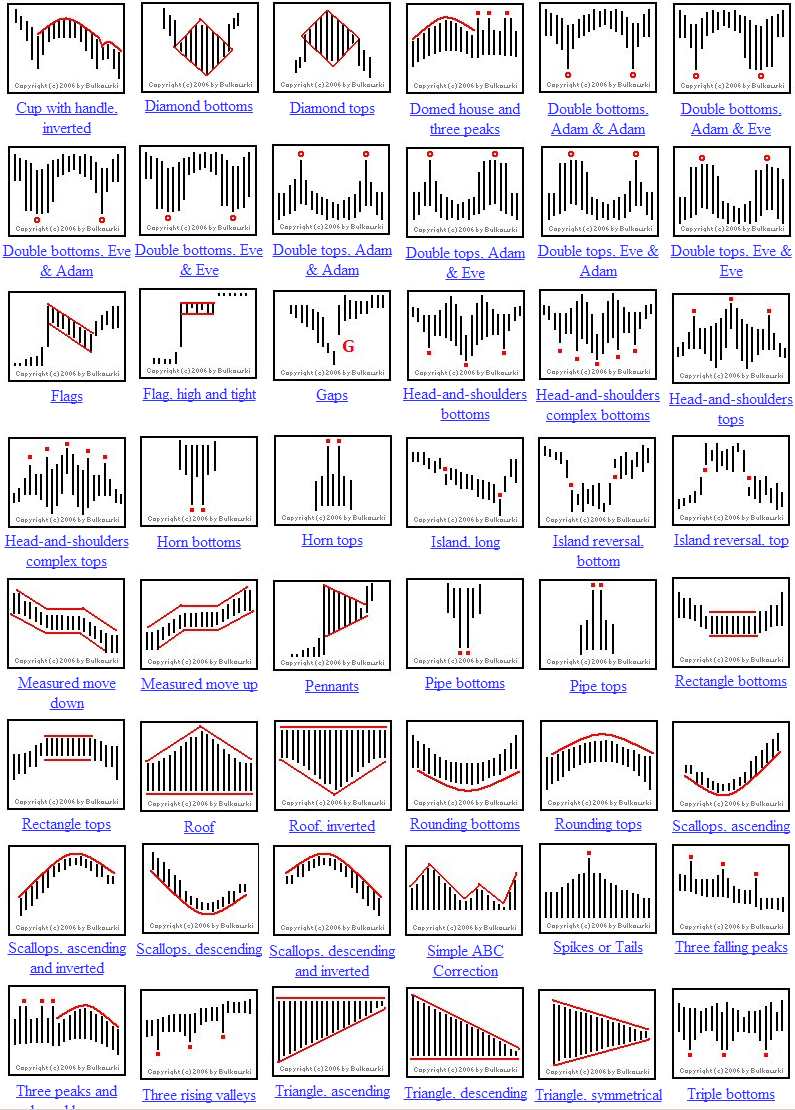

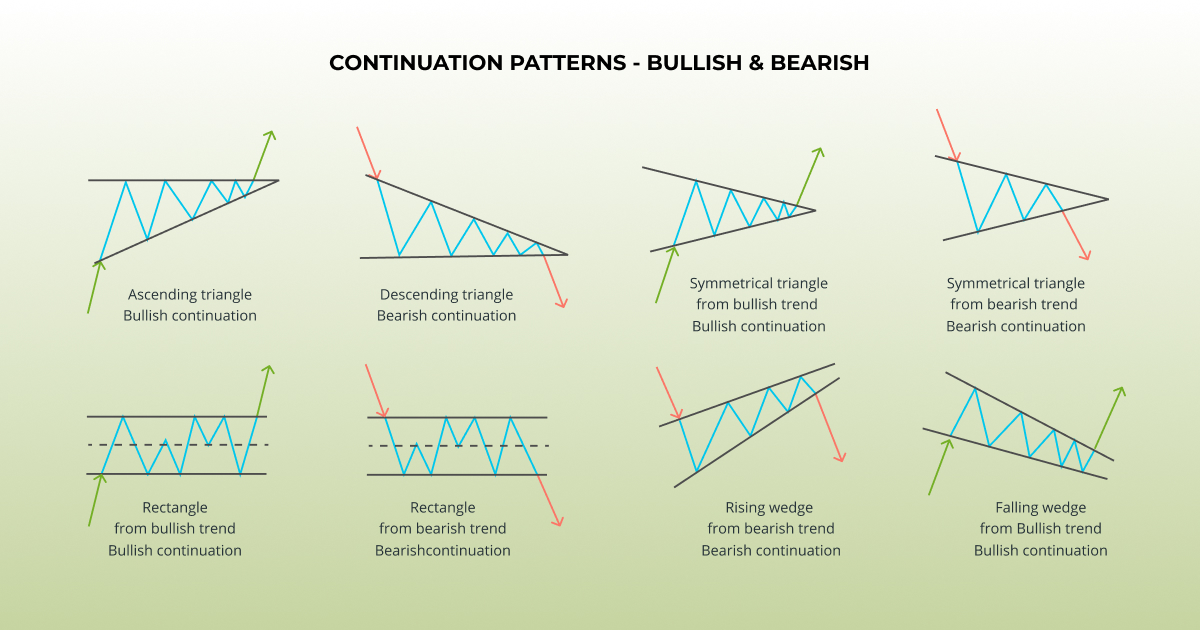

Chart Patterns Crypto - In order to be able to fully utilize candlestick charts to predict upcoming trends, a trader (or investor) must be familiar with different patterns that candlesticks form on charts and what they could potentially signal. Web top 20 trading patterns cheat sheet. Traders should also consider other factors, such as volume, market conditions, and overall trend direction, when making trading decisions. Web a candlestick chart is a type of price chart used to describe the price movements of stocks, derivatives, commodities, cryptocurrencies and other tradeable assets. Head and shoulders (and inverse head and shoulders) 2.2. Web candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. Candlestick charts trace their origins back to japan, most likely in the late 1800s. Let's take a look at 7 popular crypto chart patterns, and how you can use them. Web cryptocurrency jun 1, 2024. Web reading a crypto token chart is one of the most important skills to have when trading crypto. Web crypto chart patterns, frequently combined with candlestick trading, provide a visual story of how prices have behaved in the markets and often indicate a bullish, bearish, or neutral emotion. Web in this guide, we will break down these chart patterns into four categories: Web chart patterns are unique formations within a price chart used by technical analysts in stock. Bitcoin ( btc) continues to cling to the $67,000 mark, with bears and bulls failing to push the maiden cryptocurrency’s price in either direction significantly. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Today, candlestick charts are commonly used, even by traders and investors who are. The analysis on x highlights. Livermore cylinders are so popular on crypto charts rn! Web crypto graph patterns assess a market’s psychology through its price action. Web in the world of crypto trading, recognizing patterns can yield more than insights. Candlestick charts are among the most popular representations of technical analysis data. Web crypto analyst techdev (@techdev_52) recently shared a detailed chart analysis suggesting that. Web what are crypto chart patterns? Web top 20 most common crypto chart patterns, what they mean & downloadable pdf cheat sheet (included). For example, the candlestick patterns included in the cheat sheet can help you identify reversal signals, bullish and bearish candle types and more. This article will provide you with clear steps and important tips on how to. Especially since its social volume dropped slightly over the last few days. For example, the candlestick patterns included in the cheat sheet can help you identify reversal signals, bullish and bearish candle types and more. Web chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. Web crypto analyst techdev. The altcoin’s bearish price action had a negative impact on the token’s social metrics too. Especially since its social volume dropped slightly over the last few days. Price momentum is a trend. Charts are often cluttered with a myriad of lines, patterns, and indicators, making it difficult to decipher meaningful insights. Over time, a bullish market suggests that the price. Web on an adjusted basis per google finance, ffie stock traded hands at $65.30 one year ago. The ability to assess price movements and recognise patterns in the charts is crucial to doing what in finance is called technical analysis. In fact, this skill is what traders use to determine the strength of a current trend during key market. Web. Notably, xrp has continued to consolidate between a high of $0.5703 and a low of $0.4665 over the past. Web cryptocurrency jun 1, 2024. Charts are often cluttered with a myriad of lines, patterns, and indicators, making it difficult to decipher meaningful insights. Crypto trading patterns frequently appear in crypto charts, leading to more predictable markets. What are classical chart. The patterns are identified using a series of trendlines or curves. Especially since its social volume dropped slightly over the last few days. In fact, this skill is what traders use to determine the strength of a current trend during key market. Candlestick charts trace their origins back to japan, most likely in the late 1800s. Crypto chart patterns are. Common types of crypto trading patterns. Web three main principles apply to bitcoin chart principles: Which crypto assets are used for pattern recognition? What are classical chart patterns? Web top 20 most common crypto chart patterns, what they mean & downloadable pdf cheat sheet (included). The altcoin’s bearish price action had a negative impact on the token’s social metrics too. Candlestick charts trace their origins back to japan, most likely in the late 1800s. Crypto chart patterns are simply trends and formations observed on cryptocurrency price charts. Web cryptocurrency jun 1, 2024. Applying these tenets, you can easily draw on several influences, including behavioral and traditional economic principles, to predict market movements. Livermore cylinders are so popular on crypto charts rn! Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). Web a candlestick chart is a type of price chart used to describe the price movements of stocks, derivatives, commodities, cryptocurrencies and other tradeable assets. Web chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. Web our candlestick pattern cheat sheet will help you with your technical analysis. Web crypto chart patterns, frequently combined with candlestick trading, provide a visual story of how prices have behaved in the markets and often indicate a bullish, bearish, or neutral emotion. Web while reading chart patterns may seem daunting for crypto newcomers, they are integral to any good trading strategy. This analysis, backed by historical patterns and technical indicators, points to a potential shift in the market that could lead to unprecedented price levels for bitcoin. What are classical chart patterns? Moonshilla made this assertion in his latest report on xrp’s price movements. Crypto trading patterns frequently appear in crypto charts, leading to more predictable markets.

Get to Know Crypto Patterns for Trading Patterns, Write This Down!

Top Chart Patterns For Crypto Trading

Crypto Chart Pattern Explanation (Downloadable PDF)

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Crypto Chart Pattern Explanation (Downloadable PDF)

Understanding Crypto Chart Patterns A Beginner’s Guide to Trading

Chart Styles in Crypto Trading Crypto Radio

Bitcoin Chart Analysis How to Trade Bitcoin Using Charts Master The

5 Crypto Chart Patterns For Crypto Trading ZenLedger

Chart Patterns for Crypto Trading. Trading Patterns Explained

Web At The Time Of Writing, The Token Was Trading At $0.515 With A Market Capitalization Of Over $28.5 Billion, Making It The 7Th Largest Crypto On The Charts.

Web 10 Steps For How To Trade Crypto Using Crypto Chart Patterns.

Over Time, A Bullish Market Suggests That The Price Trend Will Continue To Rise, Whereas An Adverse Market Indicates The Reverse.

Especially Since Its Social Volume Dropped Slightly Over The Last Few Days.

Related Post: