Coverdell Vs 529 Comparison Chart

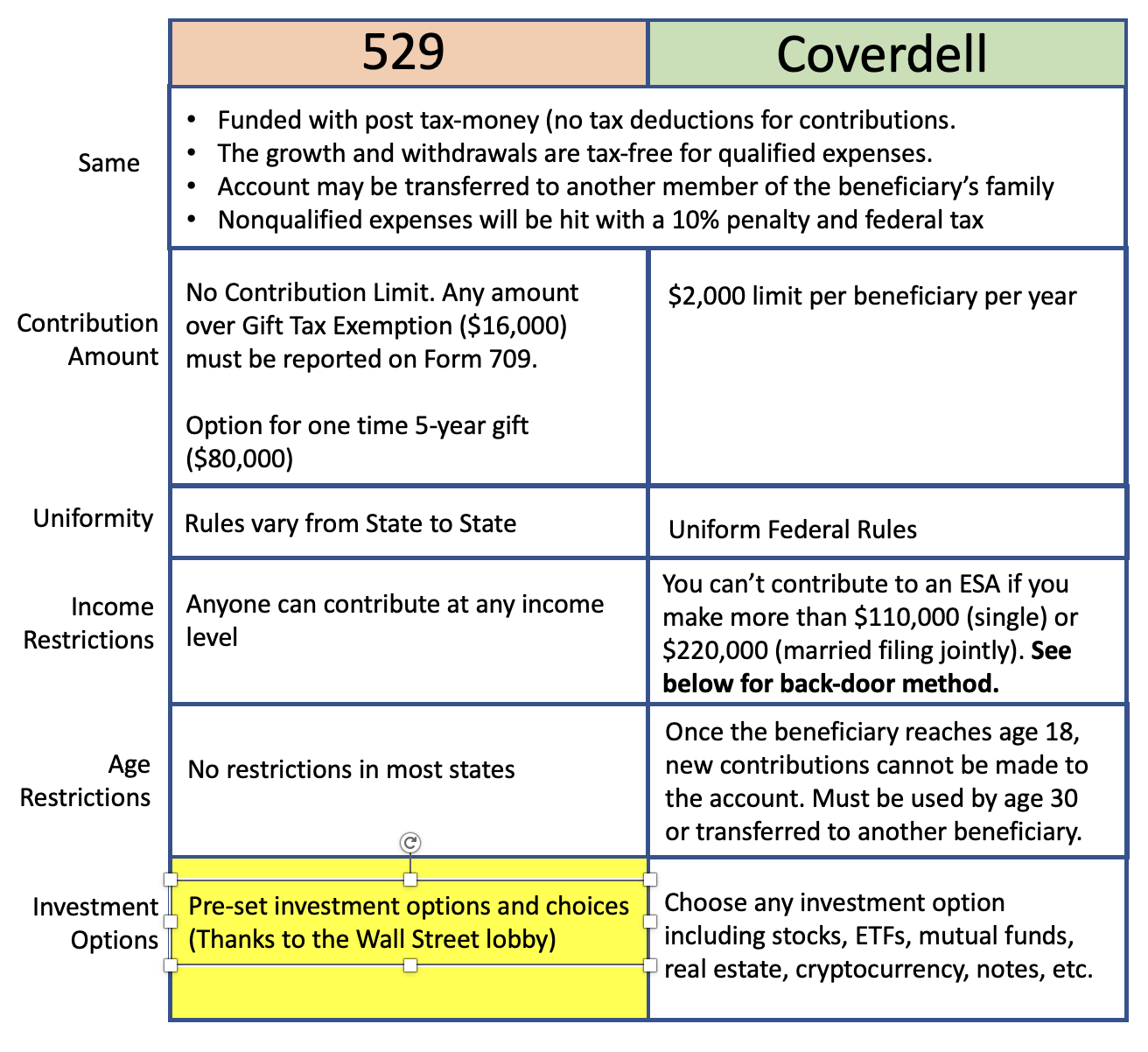

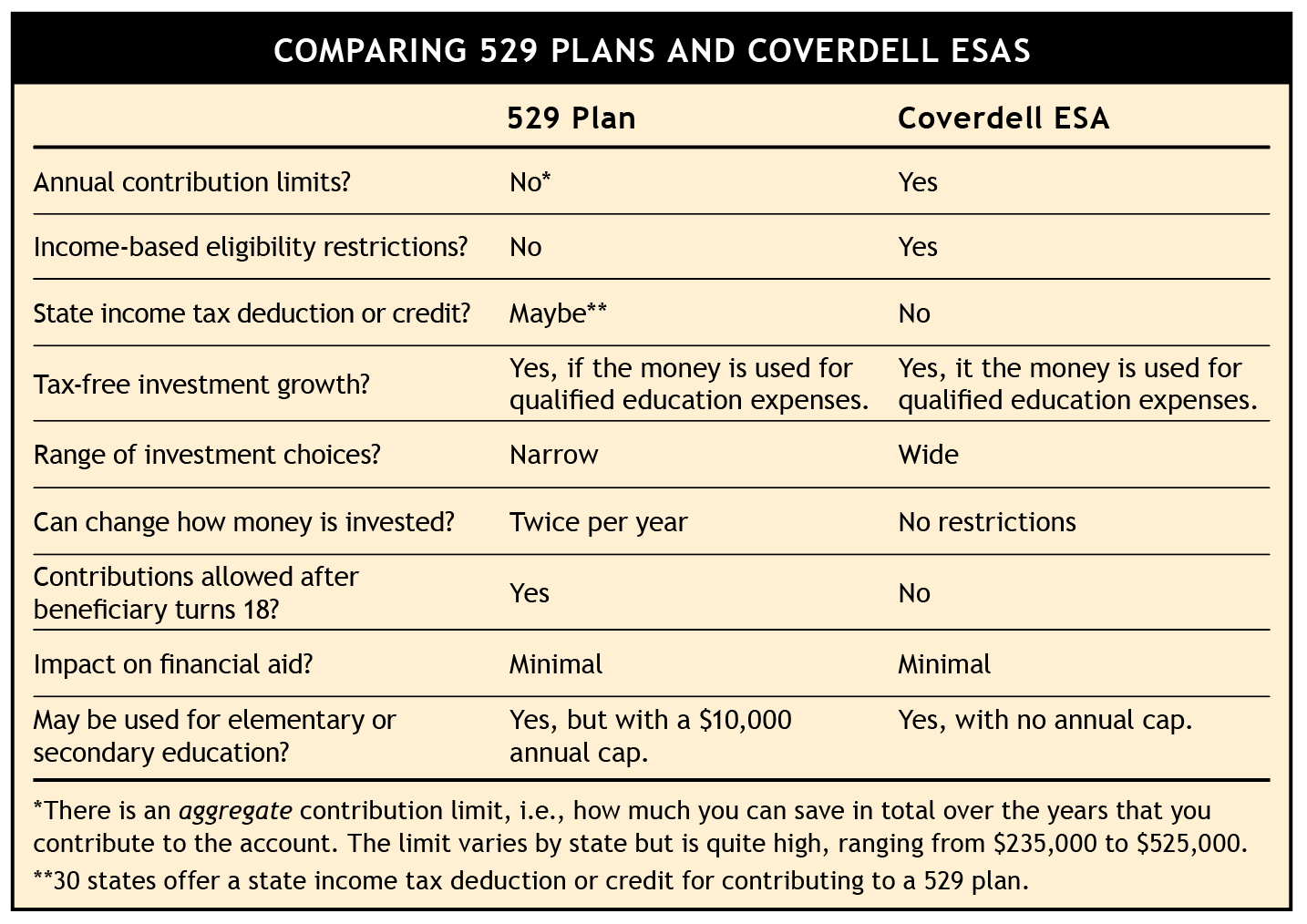

Coverdell Vs 529 Comparison Chart - A 529 plan is a savings plan that’s designed specifically for higher education expenses, unlike an esa. First, let’s take a look at coverdell esas. Web according to a u.s. Download earlybird today and start investing in your child’s tomorrow. Web select up to 3 savings options: Both coverdell esas and 529 plans offer significant benefits for educational savings, including tax advantages and the ability to cover a wide range of. The maximum annual contribution limit for a coverdell esa is $2,000 per beneficiary, while there is no annual contribution limit for 529 college savings plans. Web 529 plans have higher contribution limits, while coverdell plans can be used for more than just college expenses. Web key differences between a coverdell and a 529. Web understanding the key differences. Web we’re going over the main distinctions between coverdell esa vs 529 plans! The cost jumps even higher for students enrolled at private colleges. There are a number of significant differences between the two types of plans. Web while both coverdell esas and 529 plans serve as college savings tools, they differ significantly in contribution limits, investment flexibility, and eligibility. Web key differences between a coverdell and a 529. Web according to a u.s. Let’s start by looking at a coverdell esa, and then we’ll look more closely at 529. Web despite the overall similarities between the two account types, there are a few jarring differences between coverdells and 529 plans. Coverdell esas have income limits while 529 plans do. You have more investment options with coverdell esas compared to 529s. Web family & relationships. Web key differences between a coverdell and a 529. Perhaps the biggest comes down to contribution limits and just who can contribute to each account. Web select up to 3 savings options: Perhaps the biggest comes down to contribution limits and just who can contribute to each account. Web 529 plans have higher contribution limits, while coverdell plans can be used for more than just college expenses. Plus, we’ll discuss a third. Web family & relationships. Web understanding the key differences. Web family & relationships. Web invest early, grow together. Or select up to 3 features important to you: Perhaps the biggest comes down to contribution limits and just who can contribute to each account. The maximum annual contribution limit for a coverdell esa is $2,000 per beneficiary, while there is no annual contribution limit for 529 college savings plans. Web invest early, grow together. You have more investment options with coverdell esas compared to 529s. Web we’re going over the main distinctions between coverdell esa vs 529 plans! Web however, there are some key differences between them: The maximum annual contribution limit for a coverdell esa is $2,000 per beneficiary, while there is no annual contribution limit for 529. Web invest early, grow together. Perhaps the biggest comes down to contribution limits and just who can contribute to each account. Saving early and often can soften. Web while both coverdell esas and 529 plans serve as college savings tools, they differ significantly in contribution limits, investment flexibility, and eligibility criteria. Web family & relationships. Web before we embark on our exploration of these savings options, let's introduce the main players: Or select up to 3 features important to you: Web select up to 3 savings options: Web invest early, grow together. The maximum annual contribution limit for a coverdell esa is $2,000 per beneficiary, while there is no annual contribution limit for 529 college. Web key differences between a coverdell and a 529. Web coverdell esa and 529 college plan comparison. Download earlybird today and start investing in your child’s tomorrow. Plus, we’ll discuss a third. Planning for college education expenses early — as in from birth — lets parents spread out the cost and contribute to a child’s higher education. You’ll learn how each of these plans works — including details like who owns the plan and how you can fund them. Web before we embark on our exploration of these savings options, let's introduce the main players: Web however, there are some key differences between them: Coverdell esas have income limits while 529 plans do not. These are two. The maximum annual contribution limit for a coverdell esa is $2,000 per beneficiary, while there is no annual contribution limit for 529 college savings plans. Download earlybird today and start investing in your child’s tomorrow. Web understanding the key differences. A 529 plan is a savings plan that’s designed specifically for higher education expenses, unlike an esa. Plus, we’ll discuss a third. There are a number of significant differences between the two types of plans. 529 plans and coverdell esas. Web coverdell esa and 529 college plan comparison. We’ll also help you figure out how to choose the best savings option for your child’s future. Web 529 plans have higher contribution limits, while coverdell plans can be used for more than just college expenses. Or select up to 3 features important to you: Web despite the overall similarities between the two account types, there are a few jarring differences between coverdells and 529 plans. Web however, there are some key differences between them: The coverdell used to be known as an “education ira” and still. 529 plans typically offer more generous contribution limits and greater flexibility, whereas. Both coverdell esas and 529 plans offer significant benefits for educational savings, including tax advantages and the ability to cover a wide range of.

The Complete Guide To Starting A College Fund For Kids

Paying for Educational Expenses TAX FREE Comparison of the Coverdell

529 versus ESA The Best for College Savings Mark J. Kohler

Coverdell ESA vs. 529 Plan What’s the Difference?

The Coverdell ESA Still a Good Way to Save for College

ESA vs. 529—Which One Is Better Detailed Comparison & Breakdown

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2024

529 Coverdell Comparison Charts

529 versus ESA The Best for College Savings Mark J. Kohler

Comparing the Coverdell ESA and 529 Plan YouTube

Web We’re Going Over The Main Distinctions Between Coverdell Esa Vs 529 Plans!

Web Before We Embark On Our Exploration Of These Savings Options, Let's Introduce The Main Players:

Planning For College Education Expenses Early — As In From Birth — Lets Parents Spread Out The Cost And Contribute To A Child’s Higher Education.

Saving Early And Often Can Soften.

Related Post: