Credit Spread Chart

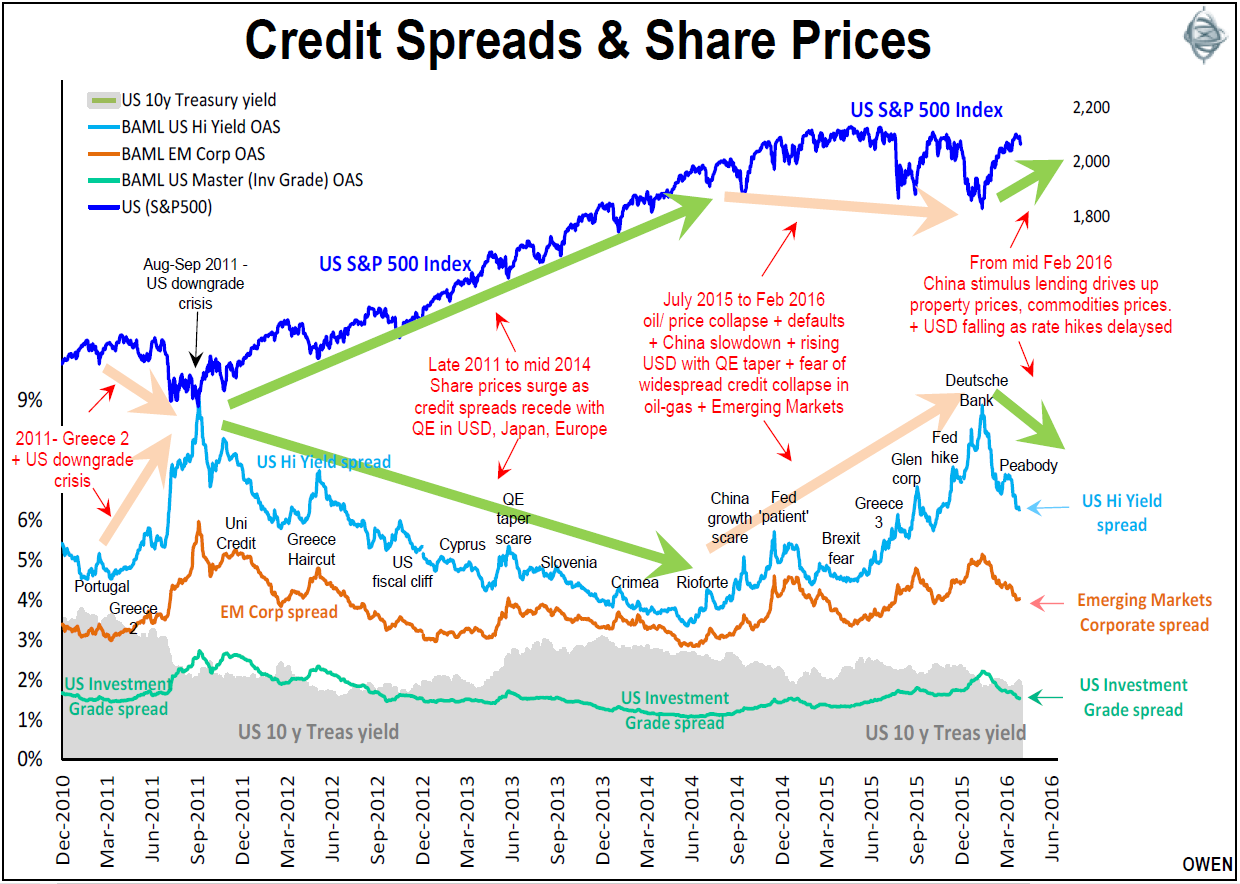

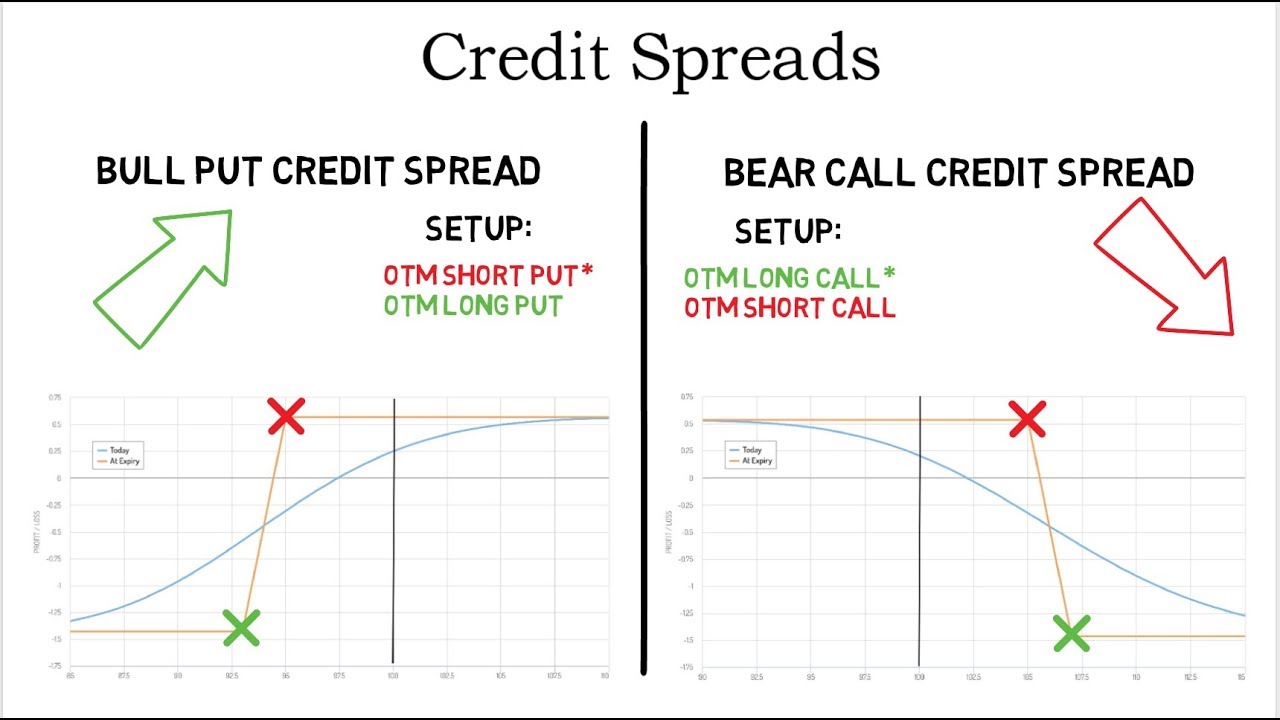

Credit Spread Chart - Web these charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. Bank of america merrill lynch. 396 economic data series with tag: Web als credit spread bezeichnet man die differenz zwischen der rendite einer risikobehafteten anleihe und der rendite einer quasi risikolosen benchmark bei sonst identischen konditionen (insbesondere laufzeit). Web in bond trading, a credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. Us treasury and corporate snapshot. Web credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. Web as an example, the us ccc credit spread is calculated as follows: Bank of america merrill lynch. Web net percentage of large domestic banks increasing spreads of interest rates over banks' cost of funds on credit card loans. In other words, the spread is the difference in returns due to different credit qualities. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Web as an example, the us ccc credit spread is calculated as follows: Download, graph, and track economic data. Die zahlungsfähigkeit ist dabei ein wichtiges kriterium, da es sich. In other words, the spread is the difference in returns due to different credit qualities. Web credit spread index historical chart. Web credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. Web in bond trading, a credit spread, also known as a yield spread, is the difference. Download, graph, and track economic data. Using a bull put strategy, you sell a put option, and buy the same number of lower striking put options. 396 economic data series with tag: In practice, the credit spread is expressed in terms of basis points (or “bps”), in which 1.0% equals 100 basis points. Web net percentage of large domestic banks. Web als credit spread bezeichnet man die differenz zwischen der rendite einer risikobehafteten anleihe und der rendite einer quasi risikolosen benchmark bei sonst identischen konditionen (insbesondere laufzeit). Download, graph, and track economic data. The best bull put strategy is one where you think the price of the underlying stock will go up. Bank of america merrill lynch. This is lower. Web net percentage of large domestic banks increasing spreads of interest rates over banks' cost of funds on credit card loans. The best bull put strategy is one where you think the price of the underlying stock will go up. Download, graph, and track economic data. Die zahlungsfähigkeit ist dabei ein wichtiges kriterium, da es sich. Us treasury and corporate. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. Web credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. In practice, the credit spread is expressed in terms of basis points (or “bps”), in which 1.0% equals 100 basis points.. In other words, the spread is the difference in returns due to different credit qualities. Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note with a similar maturity date (the 'benchmark treasury'). Web credit spread index historical chart. Web credit. Us treasury and corporate snapshot. The best bull put strategy is one where you think the price of the underlying stock will go up. Download, graph, and track economic data. Web as an example, the us ccc credit spread is calculated as follows: In other words, the spread is the difference in returns due to different credit qualities. Interest rate spreads, 36 economic data series, fred: Web as an example, the us ccc credit spread is calculated as follows: Bank of america merrill lynch. The best bull put strategy is one where you think the price of the underlying stock will go up. Bank of america merrill lynch. All bonds in this comparison have long durations, making the main differentiator the underlying credit risk. 396 economic data series with tag: Web credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. Us treasury and corporate snapshot. Web net percentage of large domestic banks increasing spreads of. An oas index is constructed using each constituent bond's oas, weighted by. Web credit spread index historical chart. Web credit spread is the difference between the yield (return) of two different debt instruments with the same maturity but different credit ratings. Download, graph, and track economic data. In other words, the spread is the difference in returns due to different credit qualities. Bank of america merrill lynch. Finding profits using a bull put credit spread: Web als credit spread bezeichnet man die differenz zwischen der rendite einer risikobehafteten anleihe und der rendite einer quasi risikolosen benchmark bei sonst identischen konditionen (insbesondere laufzeit). Bank of america merrill lynch. Web in bond trading, a credit spread, also known as a yield spread, is the difference in yield between two debt securities of the same maturity but different credit quality. Web this download contains the latest credit spread fed data for the credit spread regression process. Web these charts display the yield spreads between corporate bonds, treasury bonds, and mortgages. This is lower than the long term average of 1.95%. The best bull put strategy is one where you think the price of the underlying stock will go up. An oas index is constructed using each constituent bond's oas, weighted by. Download, graph, and track economic data.

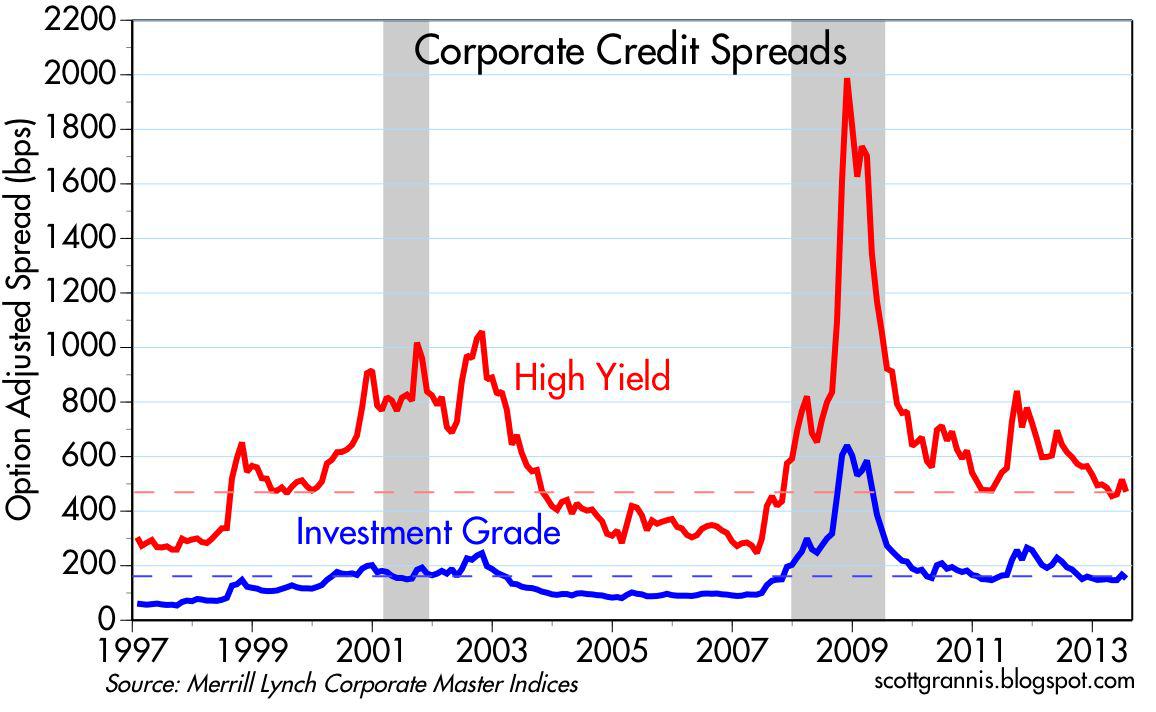

LongTerm Credit Spread Chart September 12, 2016

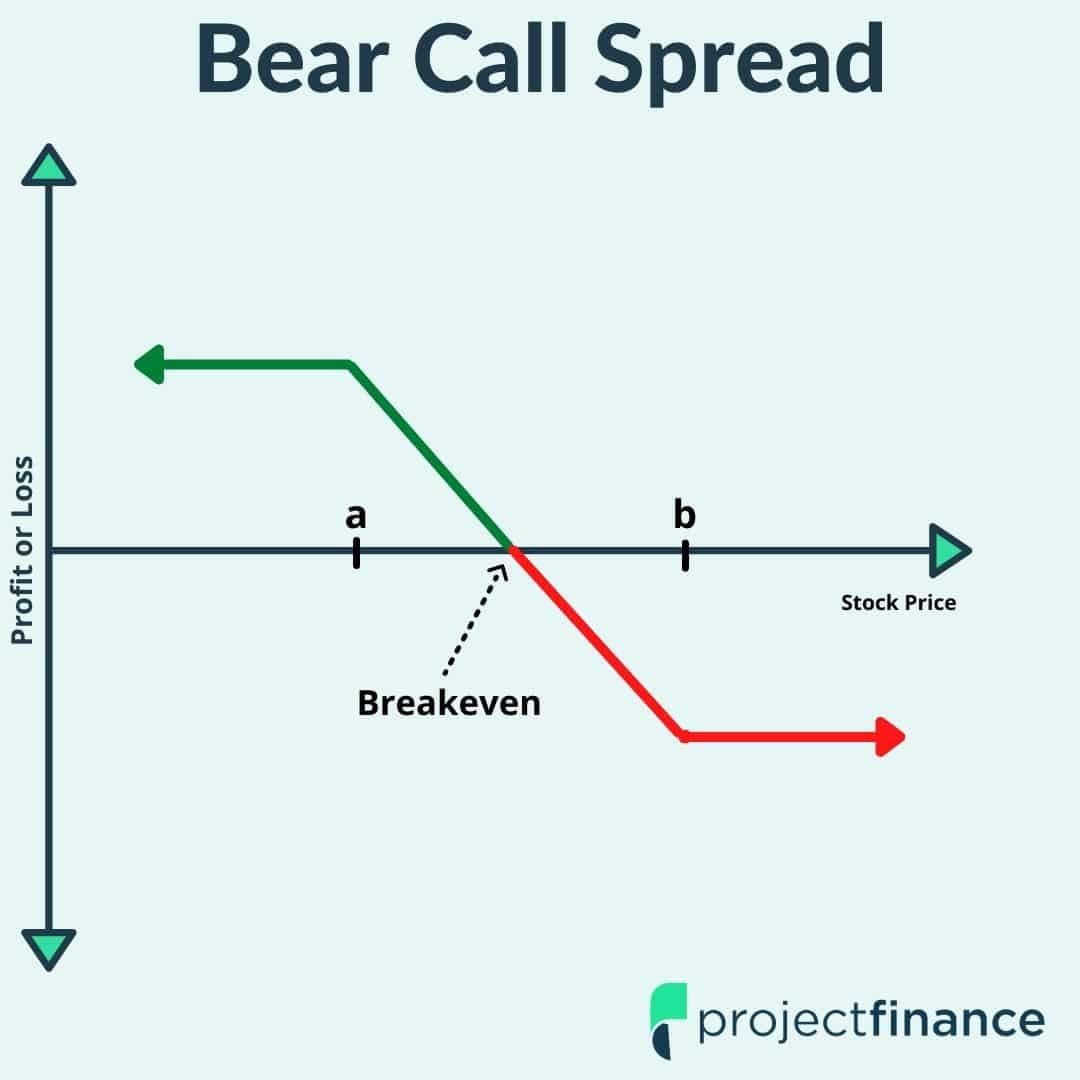

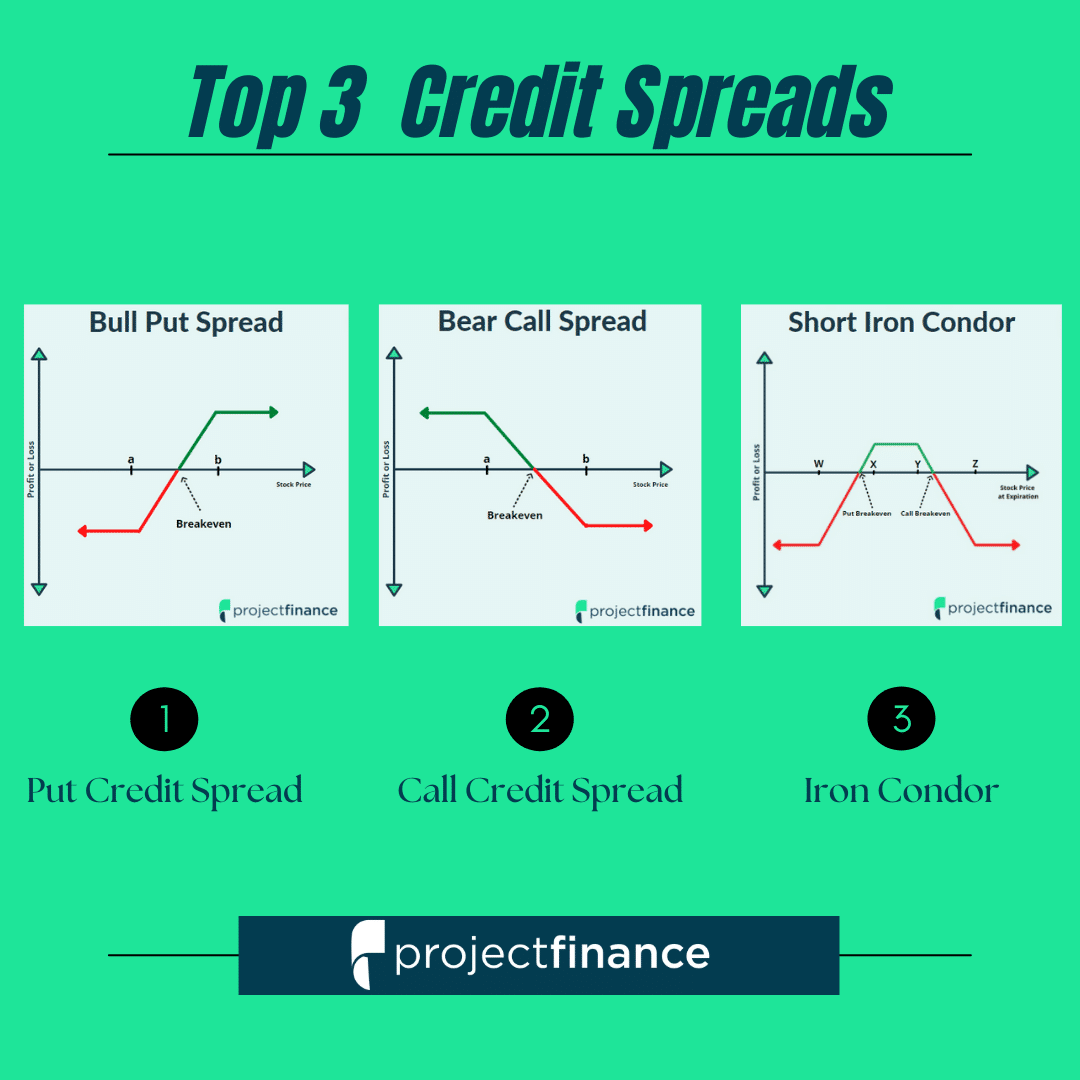

Credit Spread Options Strategies (Visuals and Examples) projectfinance

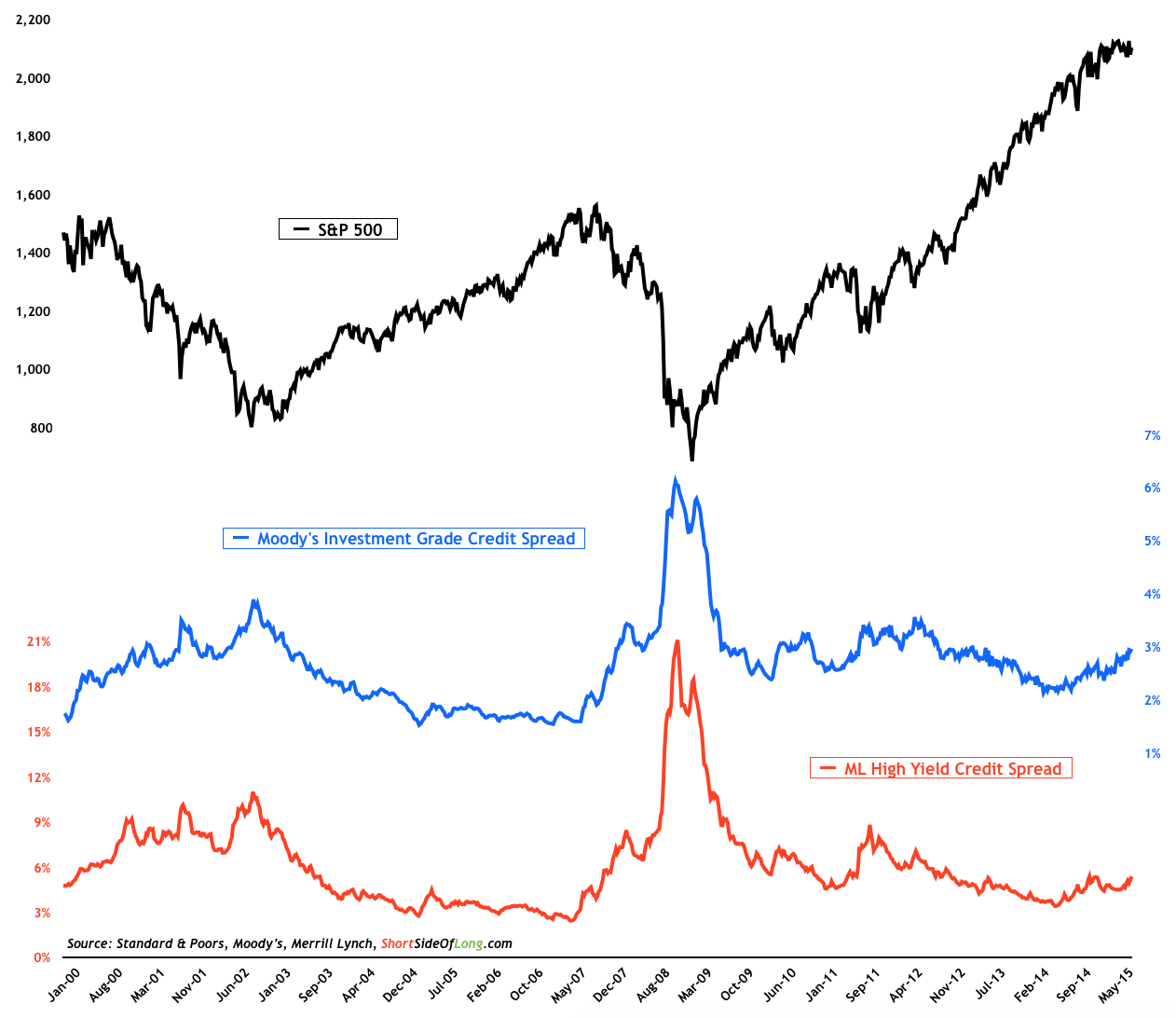

What credit spreads reveal about share markets

Options Series 1 Credit Spreads Knowmadic View

Credit Spread Update Still Looking Good Seeking Alpha

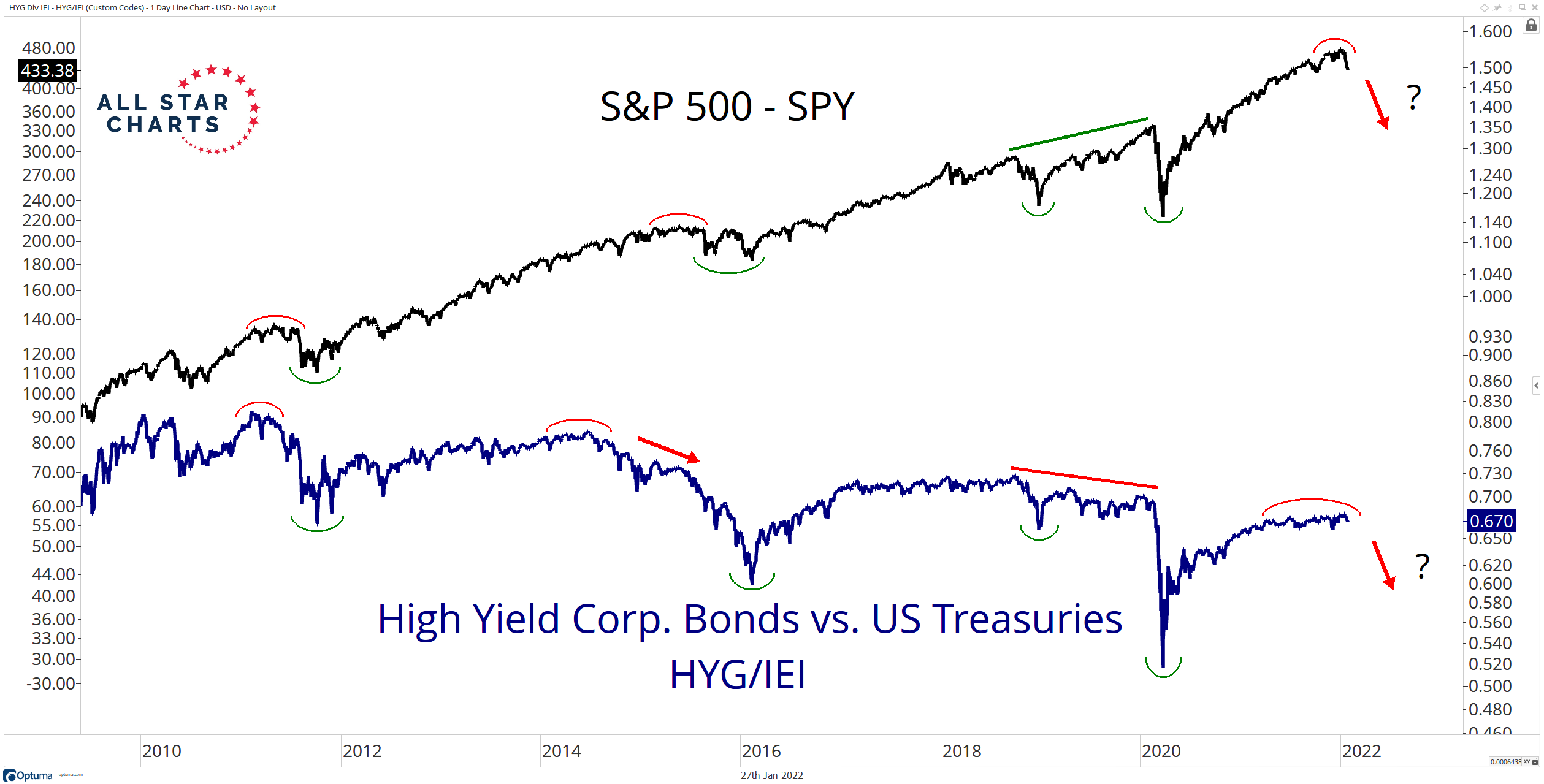

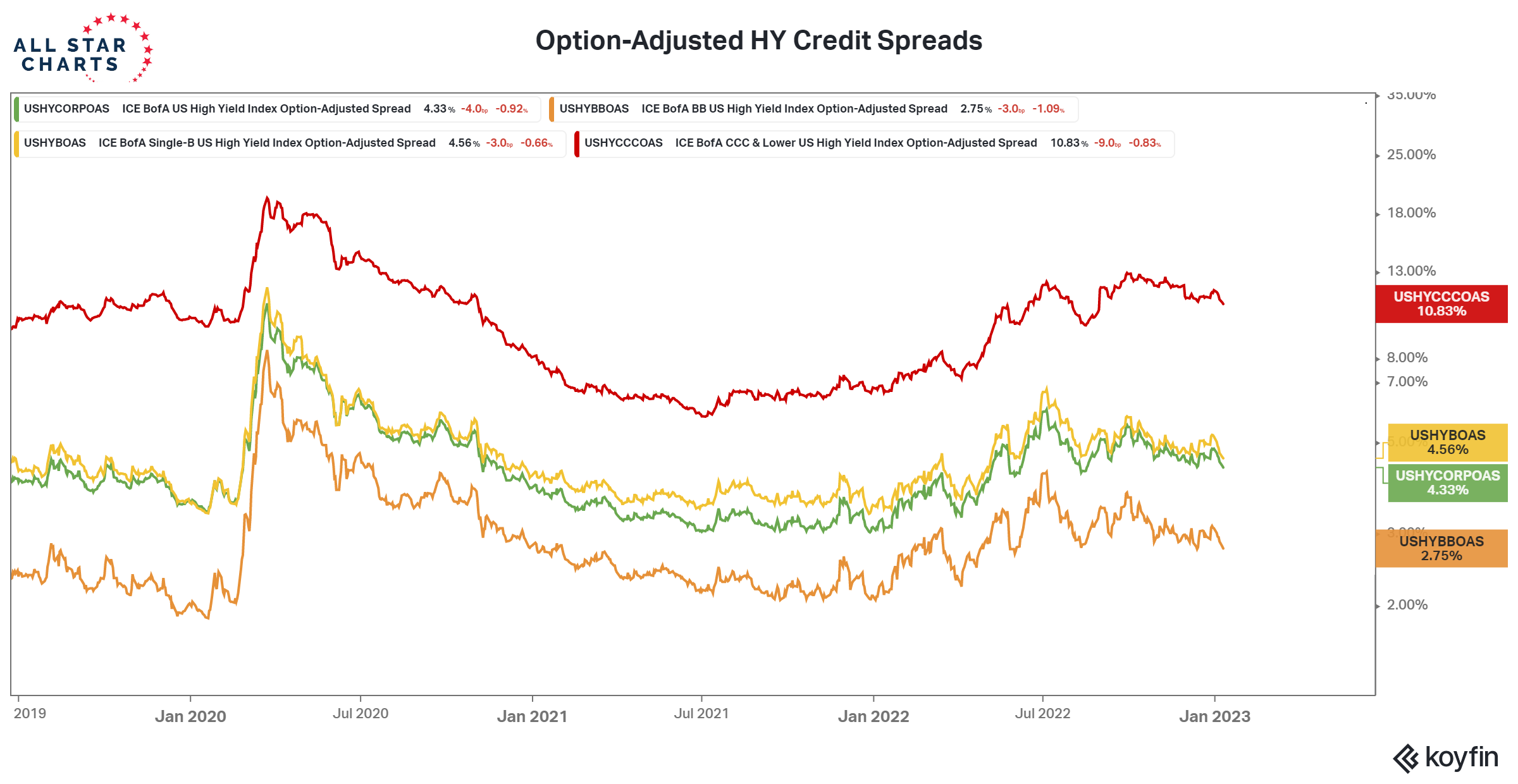

Breaking Down Credit Spreads All Star Charts

Credit Spreads Continue To Rise Seeking Alpha

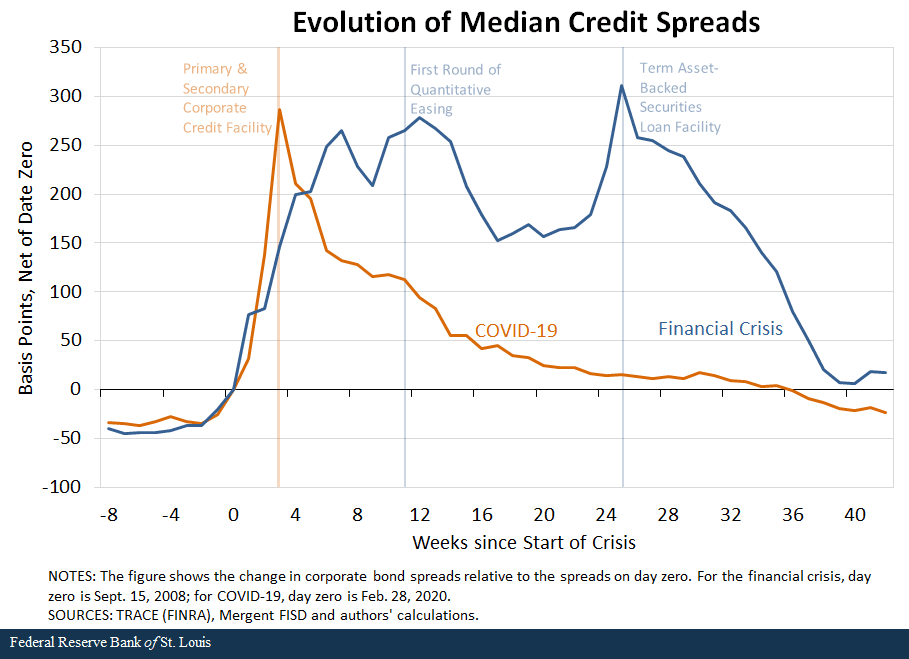

Credit Spreads, Financial Crisis and COVID19 St. Louis Fed

3 Best Credit Spread for Options Strategies projectfinance

Credit Spreads Contract All Star Charts

Web Net Percentage Of Large Domestic Banks Increasing Spreads Of Interest Rates Over Banks' Cost Of Funds On Credit Card Loans.

Die Zahlungsfähigkeit Ist Dabei Ein Wichtiges Kriterium, Da Es Sich.

Frequency (Freq) A = Annual, Sa = Semiannual, Q = Quarterly, M = Monthly, Bw = Biweekly, W = Weekly, D = Daily, Na = Not Applicable.

396 Economic Data Series With Tag:

Related Post: