Dave Ramsey Debt Snowball Printable

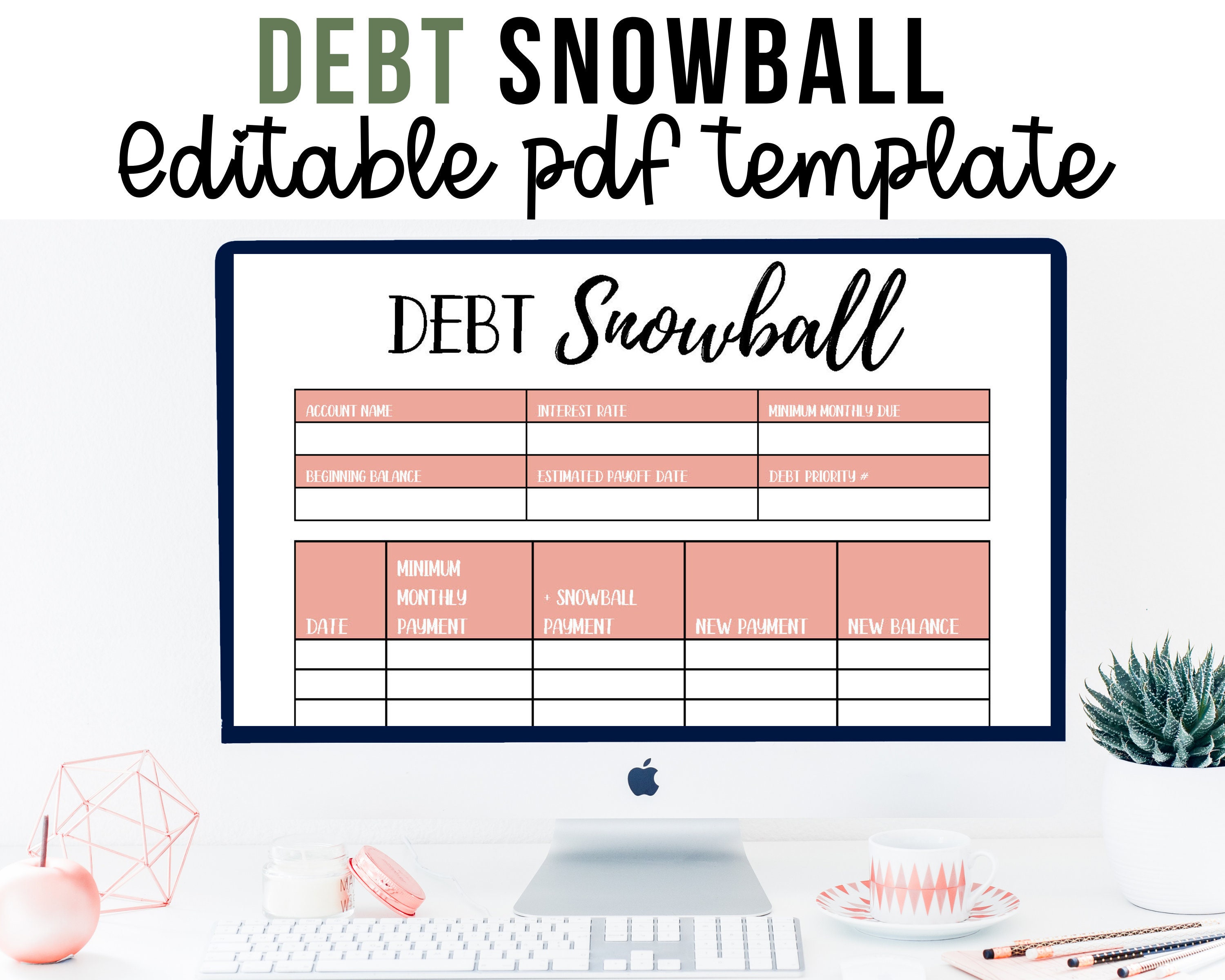

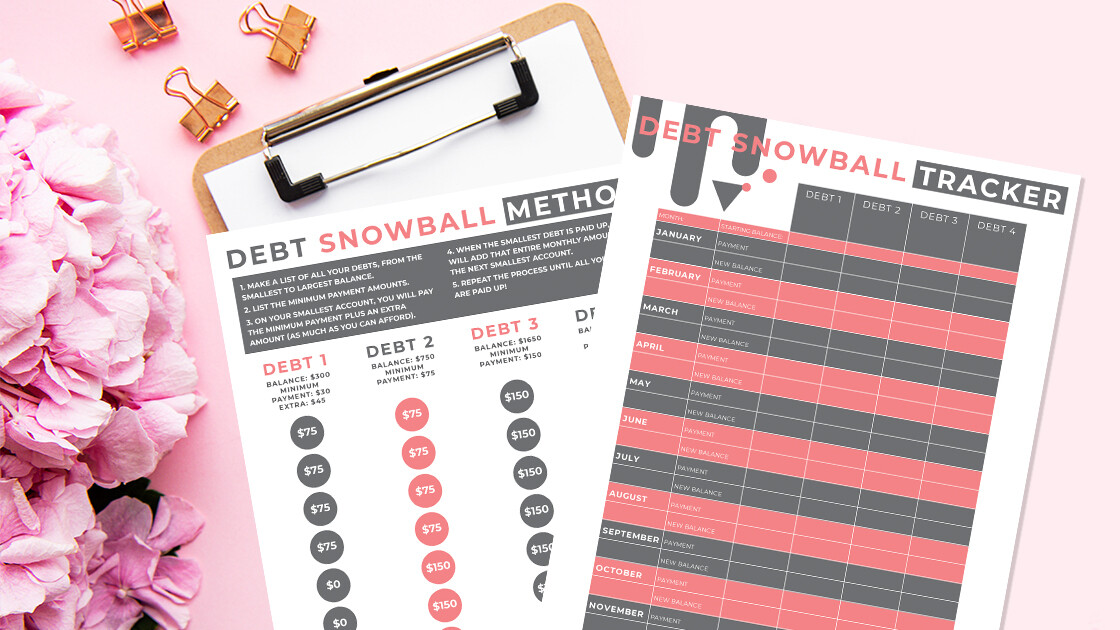

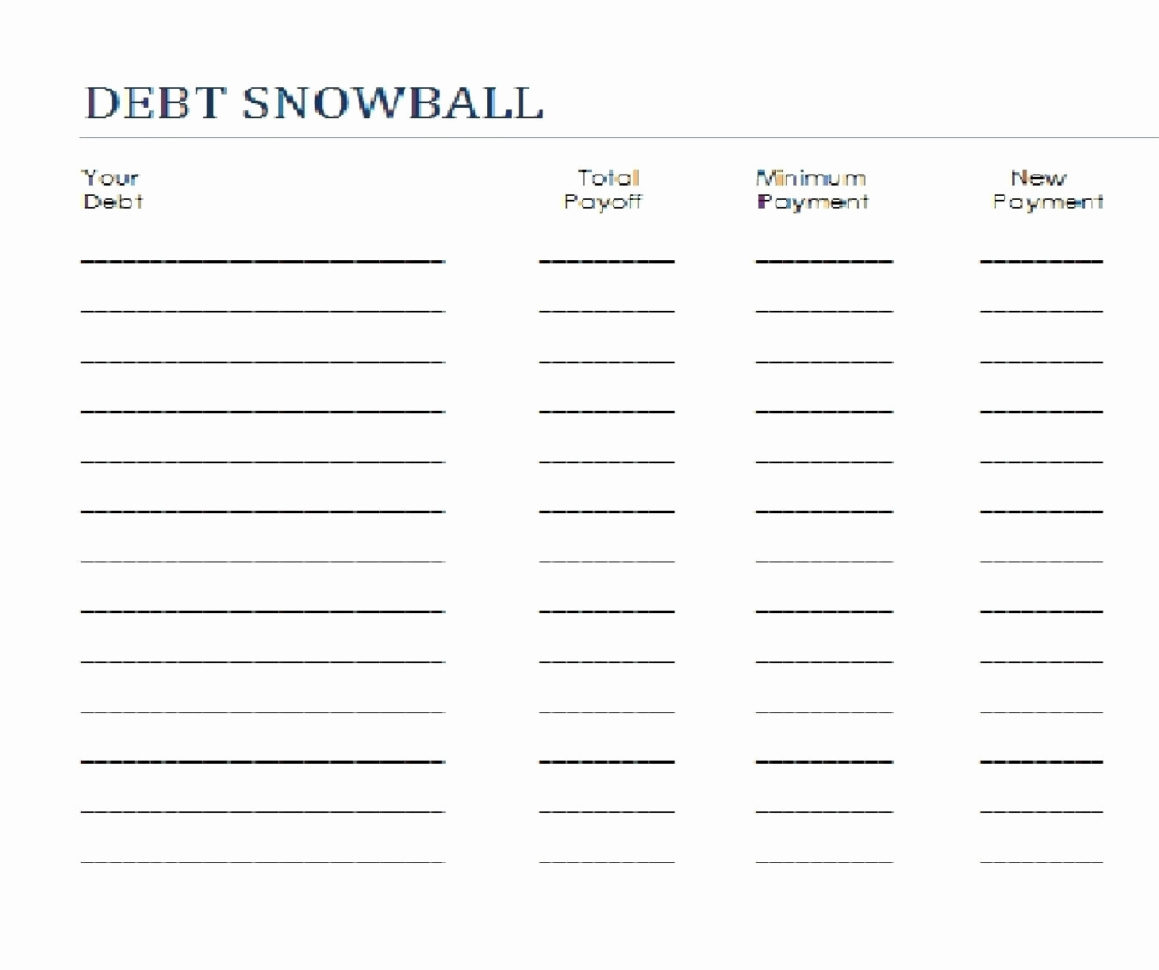

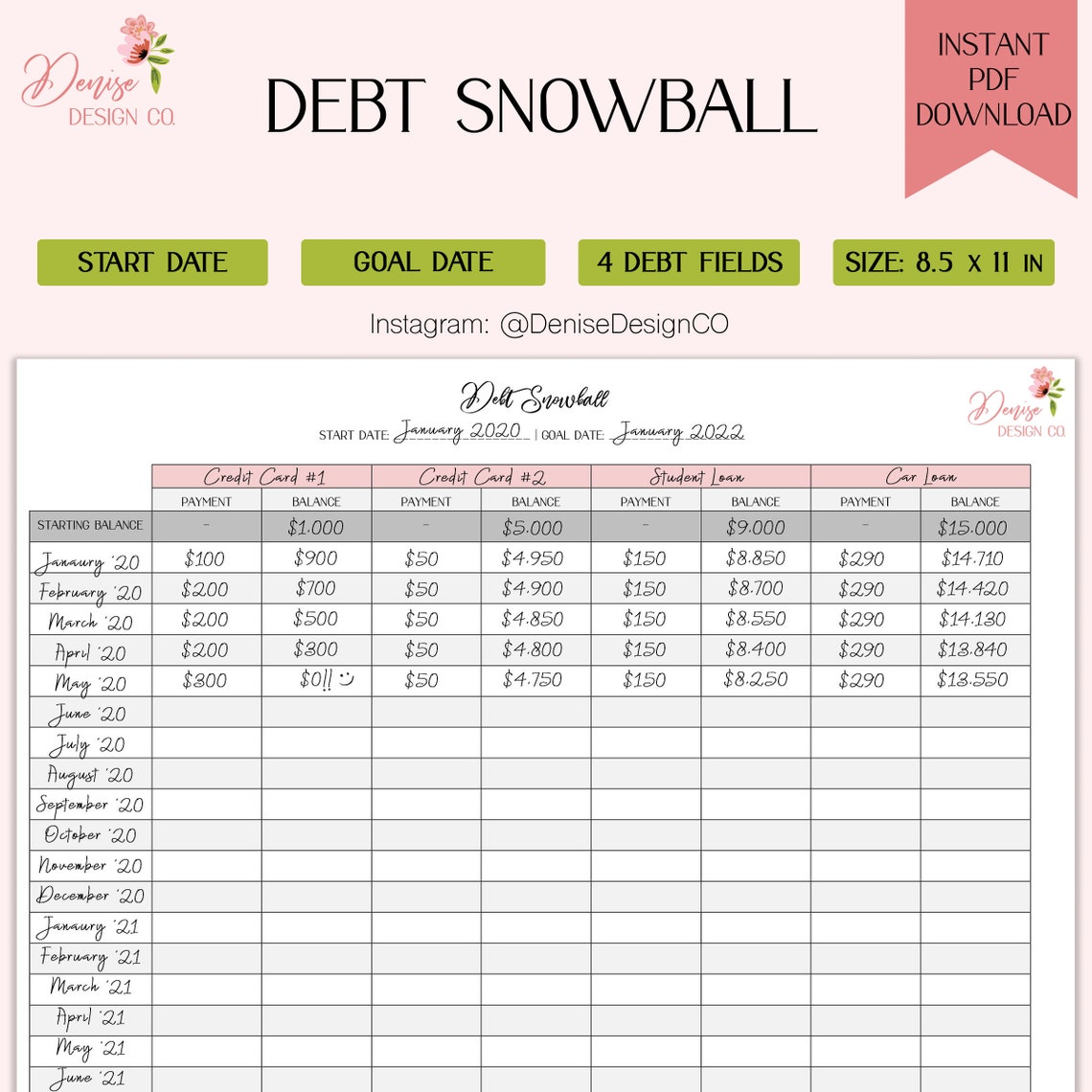

Dave Ramsey Debt Snowball Printable - Do i pause the debt snowball if i have to use my emergency fund? Pay as much as possible on your smallest debt. Attack that one with everything you’ve got, using any extra money you have left after you’ve covered. This is the exact debt snowball form that we used to get out debt in that short period of time. Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. List your debts from smallest to largest. Make minimum payments on all your debts except the smallest. Web the debt snowball method is the best way to get out of debt. Debt snowball this is the fun one! Put them in order by balance from smallest to largest—regardless of interest rate. Dave ramsey rachel cruze ken coleman dr. I have the perfect worksheet to help you with this step. Just make your minimum payments and rebuild your emergency fund as fast as you can. Get your debt snowball rolling. Do i pause the debt snowball if i have to use my emergency fund? Web here is an example of step 1: Start by listing all of your debts except for your mortgage. Pay off all debt (except the house) using the debt snowball. Here you will list all of your debts from smallest to. Next, it’s time to pay off the cars, the credit cards and the student loans. Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Start by listing all of your debts except for your mortgage. Make minimum payments on all your debts except the smallest debt. Here’s how the debt snowball works: There are tons of ways to pay off debt, but i would argue that. Web the debt snowball method is the best way to get out of debt. The first page in the kit is the debt snowball payments page. Web here’s how the debt snowball method works: Web this is based on the principles of dave ramsey’s total money makeover book and financial peace university. Web here is an example of step 1: Attack that one with everything you’ve got, using any extra money you have left after you’ve covered. John delony george kamel jade warshaw. Put them in order by balance from smallest to largest—regardless of interest rate. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum. Pay minimum payments. I have the perfect worksheet to help you with this step. Make minimum payments on all your debts except the smallest debt. All you need to do is download and print the debt snowball tracker worksheets. Dave ramsey rachel cruze ken coleman dr. Make minimum payments on all debts except the smallest—throwing as much money as you can at that. List your debts from smallest to largest regardless of interest rate. Put them in order by balance from smallest to largest—regardless of interest rate. Web here’s how the debt snowball method works: Dave ramsey rachel cruze ken coleman dr. Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Make minimum payments on all your debts except the smallest debt. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum. Pay off all debt (except the house) using the debt snowball. Here’s how the debt snowball works: Web this is based on the principles of dave ramsey’s total. Web this is based on the principles of dave ramsey’s total money makeover book and financial peace university. Here you will list all of your debts from smallest to. Pay as much as possible on your smallest debt. Keep reading and at the end of the post. Web the debt snowball method is the best way to get out of. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum. Web this is based on the principles of dave ramsey’s total money makeover book and financial peace university. Next, it’s time to pay off the cars, the credit cards and the student loans. Web the fine print smart money. There are tons of ways to pay off debt, but i would argue that this method is the most successful. Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Here’s how the debt snowball works: How to use the debt snowball worksheets. Do i pause the debt snowball if i have to use my emergency fund? Start by listing all of your debts except for your mortgage. Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. List your debts from smallest to largest (regardless of interest rate). Web this is based on the principles of dave ramsey’s total money makeover book and financial peace university. Make minimum payments on all your debts except the smallest. Make minimum payments on all your debts except the smallest debt. The first page in the kit is the debt snowball payments page. Attack that one with everything you’ve got, using any extra money you have left after you’ve covered. Here’s how the debt snowball works: Dave ramsey rachel cruze ken coleman dr. Web the fine print smart money happy hour.

Dave Ramsey Snowball Worksheets Debt snowball, Debt snowball

Dave Ramsey Snowball Debt Templates in Printable, Excel and PDF

Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Sheet Debt

![]()

The Debt Snowball Method A Complete Guide With Free Printables Free

Free printable Debt Snowball Tracker (based on Dave Ramsey method)

How to Pay Off Debt Using the Debt Snowball Method — Living that Debt

Dave Ramsey Debt Snowball Spreadsheet And Dave Ramsey Snowball Sheet

Debt Snowball Tracker printable This Dave Ramsey style "snowball

The Dave Ramsey Debt Snowball Simplified My Worthy Penny Dave

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Snowball Sheet

Once That Debt Is Gone, Take Its Payment And Apply It To The Next Smallest Debt (While Continuing To Make Minimum.

Pay Minimum Payments On Everything But The.

This Is The Exact Debt Snowball Form That We Used To Get Out Debt In That Short Period Of Time.

You Should Temporarily Pause The Debt Snowball If You Use Your Emergency Fund.

Related Post: