Divergence Chart Patterns

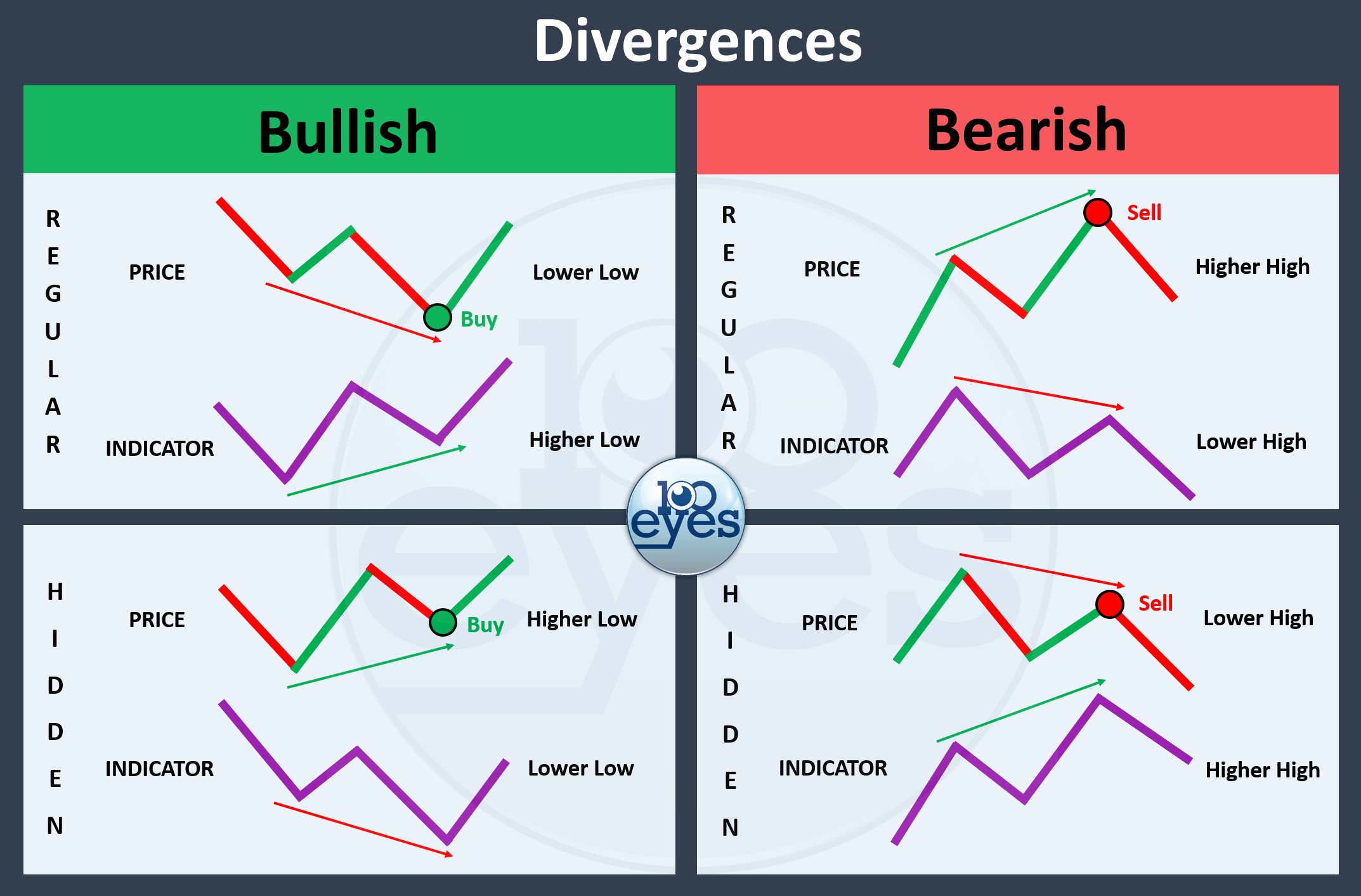

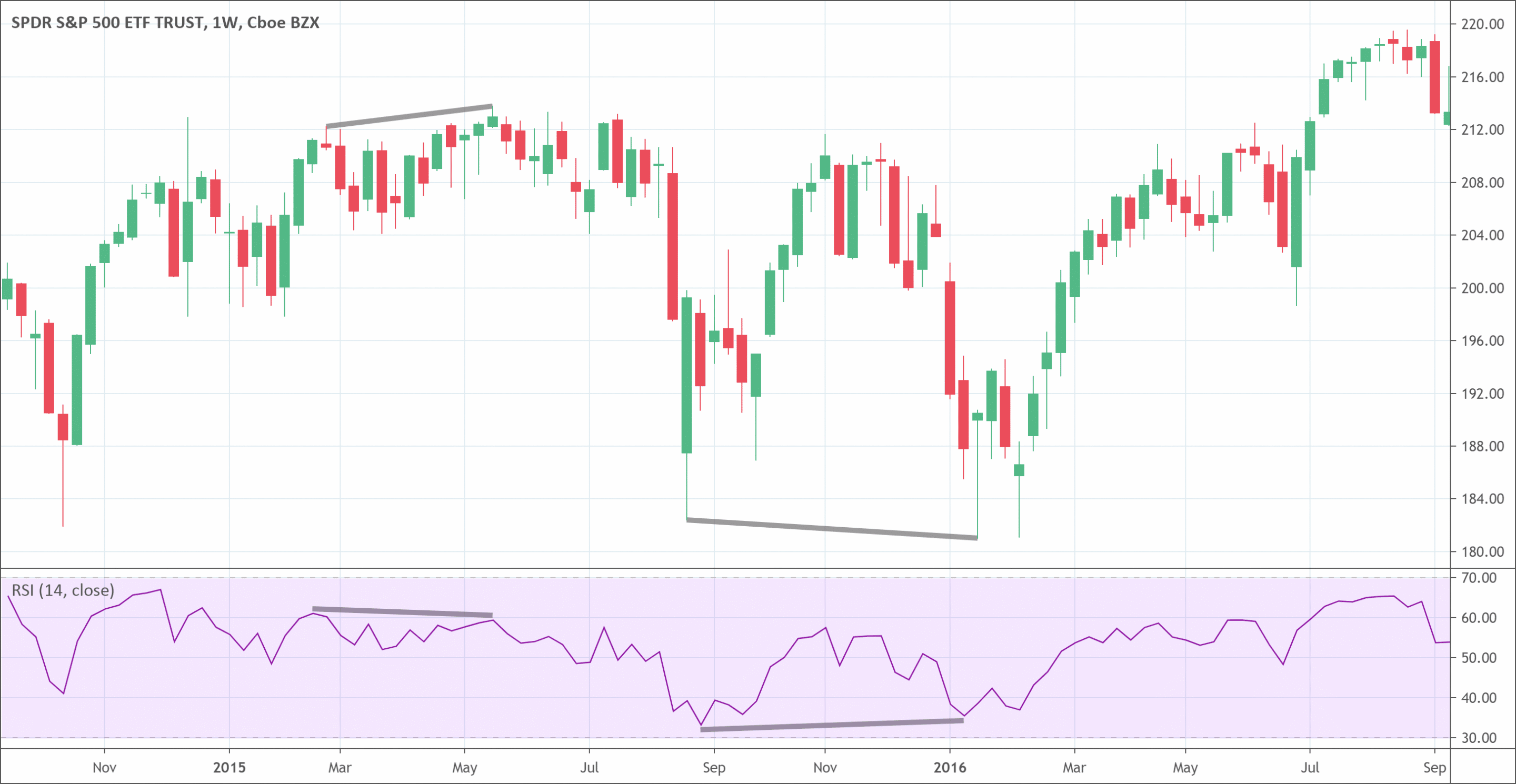

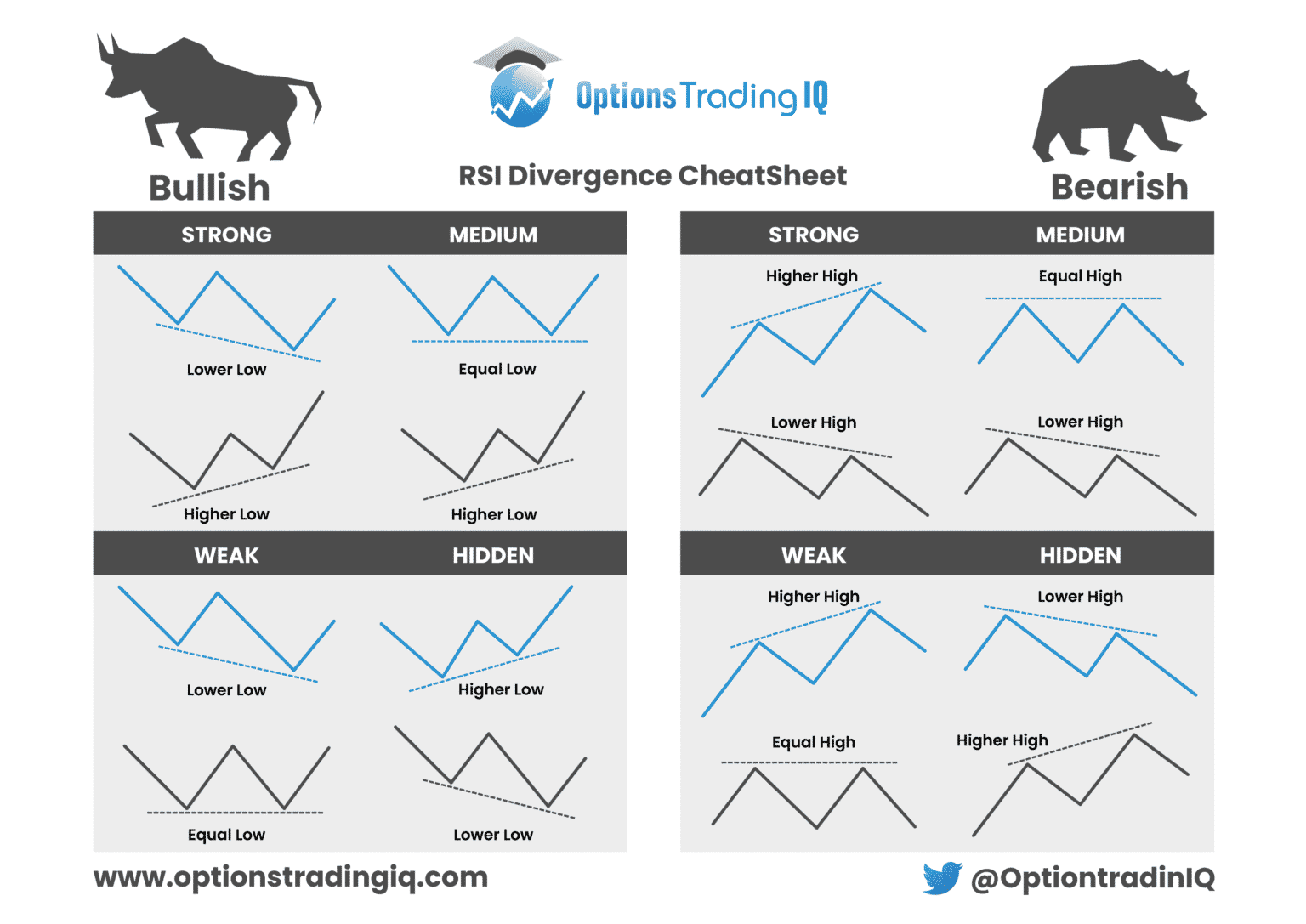

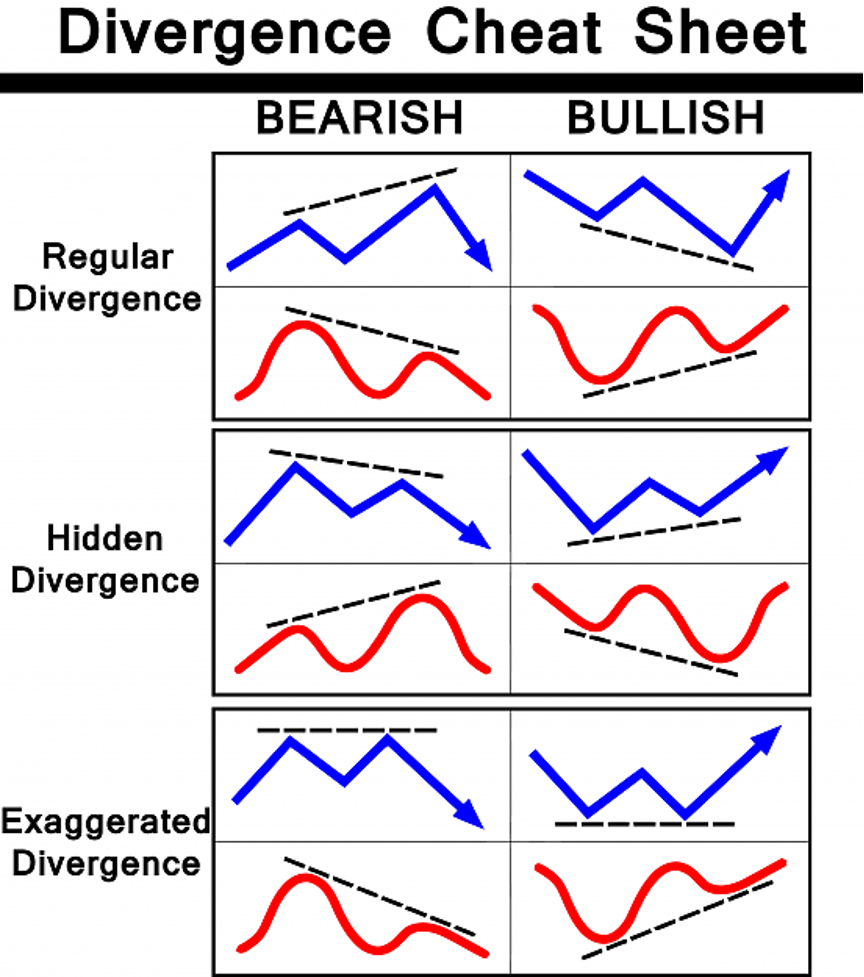

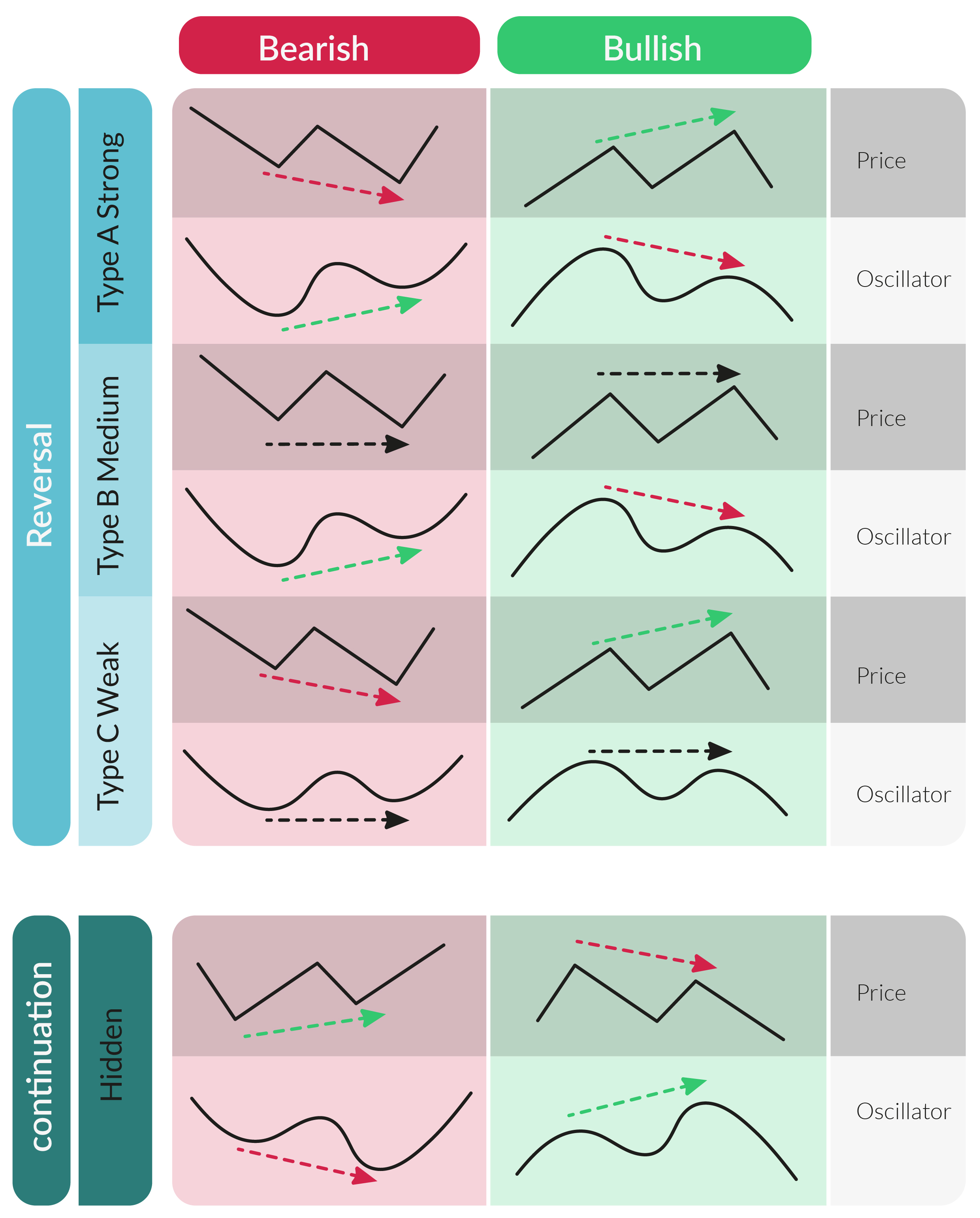

Divergence Chart Patterns - Aha, that’s the tricky part! Web divergences are used by technical traders to read momentum, such as when the market's momentum is about to change direction or the speed at which an investor is approaching a possible momentum. This pattern can provide traders with valuable information about potential price reversals or changes in trends. I've marked out two patterns showing how the recent breakout puts gold in the acceleration phase of the bull market. Web the charts for these safe havens are really bullish and warn of a major us dollar meltdown. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Web oscillator indicator for divergence patterns is weis wave volume, macd, the rsi, cci, or stochastic obv. Web what is the rsi indicator, and why is it so popular? Web we can graph this to show the differences. A bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. Web we can graph this to show the differences. Web here’s what the divergence cheatsheet looks like: There are other configurations that. Rsi divergence occurs when the relative strength index indicator starts reversing before price does. 1) regular or classic divergence. You can get your free divergence cheat sheet pdf below. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Each type of divergence will contain either a bullish bias or a bearish bias. These indicators are designed to provide estimates of an asset's price. Make it your computer wallpaper! Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Cvx) remains a leading player in the oil and gas industry. Web but how does it work and when does it stop working? Web the charts for these safe havens are really bullish and warn of a major us dollar meltdown. Developed in 1978. Bullish divergence a bullish divergence in stock trading is created when the price action is moving lower on the chart, while your indicator of choice is creating higher lows. Divergence is a warning sign that the price trend is weakening, and in some case may result in. Web this chart in figure 6 shows that trends don't reverse quickly or. Each type of divergence will contain either a bullish bias or a bearish bias. This divergence signals the measures of the magnitude of recent price changes to evaluate overbought or. A bearish divergence consists of an overbought rsi reading, followed by lower high on rsi. Web divergence is a very useful tool to help traders spot trend reversals or continuation. Rsi divergence occurs when the relative strength index indicator starts reversing before price does. Make it your computer wallpaper! Web divergence chart patterns are a technical analysis tool used in trading to identify potential price reversals or changes in market trends. Both patterns start at the dow/gold ratio peak (1966 and 1999, respectively). Web divergence is when the price of. For instance, if price forms a higher high while the rsi forms a lower high, it indicates bearish divergence. Make it your computer wallpaper! Divergence occurs when an asset’s price and an indicator, like the relative strength index (rsi), move in opposite directions. This pattern can provide traders with valuable information about potential price reversals or changes in trends. Web. Web but how does it work and when does it stop working? This divergence signals the measures of the magnitude of recent price changes to evaluate overbought or. Web this quick reference guide highlights the various trading divergence patterns that may appear on a chart. For instance, if price forms a higher high while the rsi forms a lower high,. Web divergence is a very useful tool to help traders spot trend reversals or continuation patterns. Price and the rsi, which should typically move in tandem, end up showing contradictory signals. Rsi divergence occurs when the relative strength index indicator starts reversing before price does. Web divergence is a popular concept in technical analysis that describes when the price is. They occur when the price action of an asset and a corresponding trading indicator, such as the relative strength index (rsi) or moving average convergence divergence (macd), move in the opposite. Also, you can use other suitable chart patterns to confirm the trade, especially harmonic chart patterns that are extremely accurate in predicting price movements. You can get your free. Web divergence is when the price of an asset and a technical indicator move in opposite directions. Web the charts for these safe havens are really bullish and warn of a major us dollar meltdown. Web patterns in revenue, volumes, dividend yields, valuation multiples, cash flows, and inventories look potentially bearish. Welles wilder, the relative strength index (rsi) is a momentum oscillator indicator that measures the speed and price changes movements. Divergence trading is an effective method, and allow traders to combine price action and indicator analysis into a trading strategy; This pattern provides valuable insights into potential price reversals or changes in trends. Aha, that’s the tricky part! We make the best profits when we understand trend momentum and use it for the right strategy at the right time. Web we can graph this to show the differences. Web divergence is a popular concept in technical analysis that describes when the price is moving in the opposite direction of a technical indicator. Divergence is a warning sign that the price trend is weakening, and in some case may result in. Web but how does it work and when does it stop working? I've marked out two patterns showing how the recent breakout puts gold in the acceleration phase of the bull market. Web divergences are used by technical traders to read momentum, such as when the market's momentum is about to change direction or the speed at which an investor is approaching a possible momentum. Web oscillator indicator for divergence patterns is weis wave volume, macd, the rsi, cci, or stochastic obv. They occur when the price action of an asset and a corresponding trading indicator, such as the relative strength index (rsi) or moving average convergence divergence (macd), move in the opposite.

Divergence Trading 100eyes Scanner

Divergence Everything Traders Should Know PatternsWizard

Types of Divergence for POLONIEXETHBTC by Yrat — TradingView

Trading strategy with Divergence chart patterns Trading charts, Forex

RSI Divergence Cheat Sheet Options Trading IQ

How To Trade an RSI Divergence Complete Guide Living From Trading

The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

MACD Divergence Forex Trading Strategy The Ultimate Guide To Business

The New Divergence Indicator and Strategy 3rd Dimension

![RSI Divergence Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/rsi-divergence-cheat-sheet-2048x1448.png)

RSI Divergence Cheat Sheet [FREE Download] HowToTrade

Here, A News Source Viewed As More Trustworthy By A Group — Overall, Among Democrats, By Those Ages 65 And Over, Etc.

This Pattern Can Provide Traders With Valuable Information About Potential Price Reversals Or Changes In Trends.

A Bearish Divergence Consists Of An Overbought Rsi Reading, Followed By Lower High On Rsi.

This Divergence Signals The Measures Of The Magnitude Of Recent Price Changes To Evaluate Overbought Or.

Related Post: