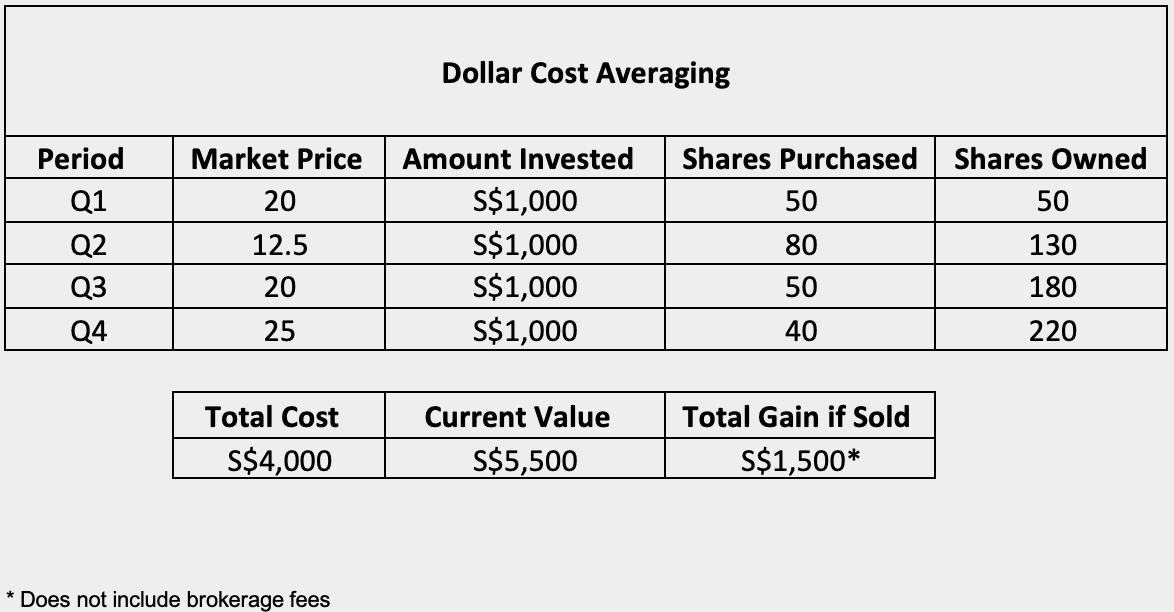

Dollar Cost Averaging Chart

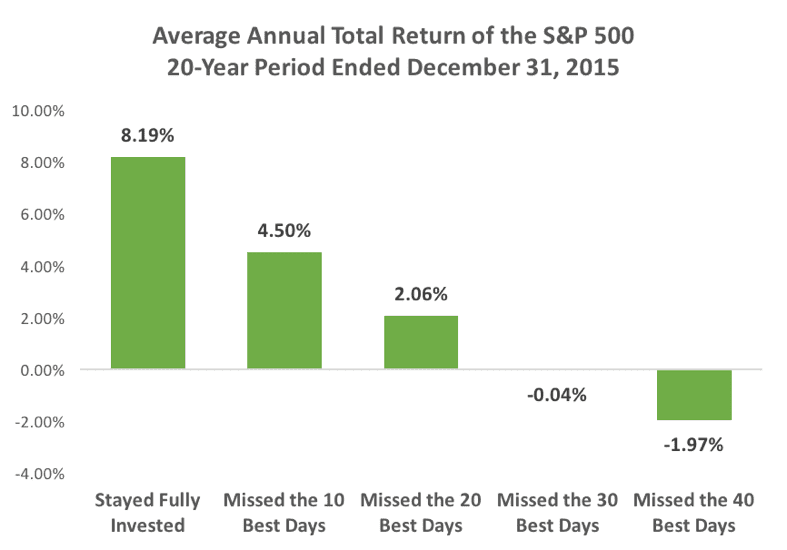

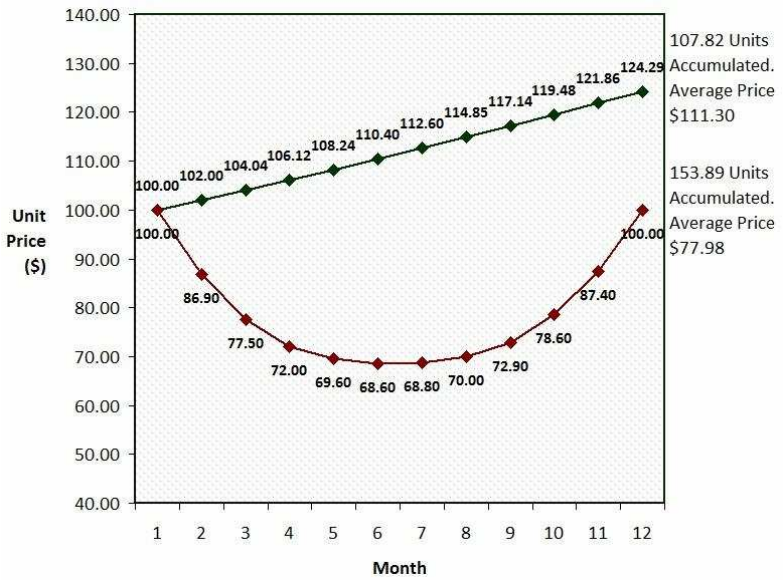

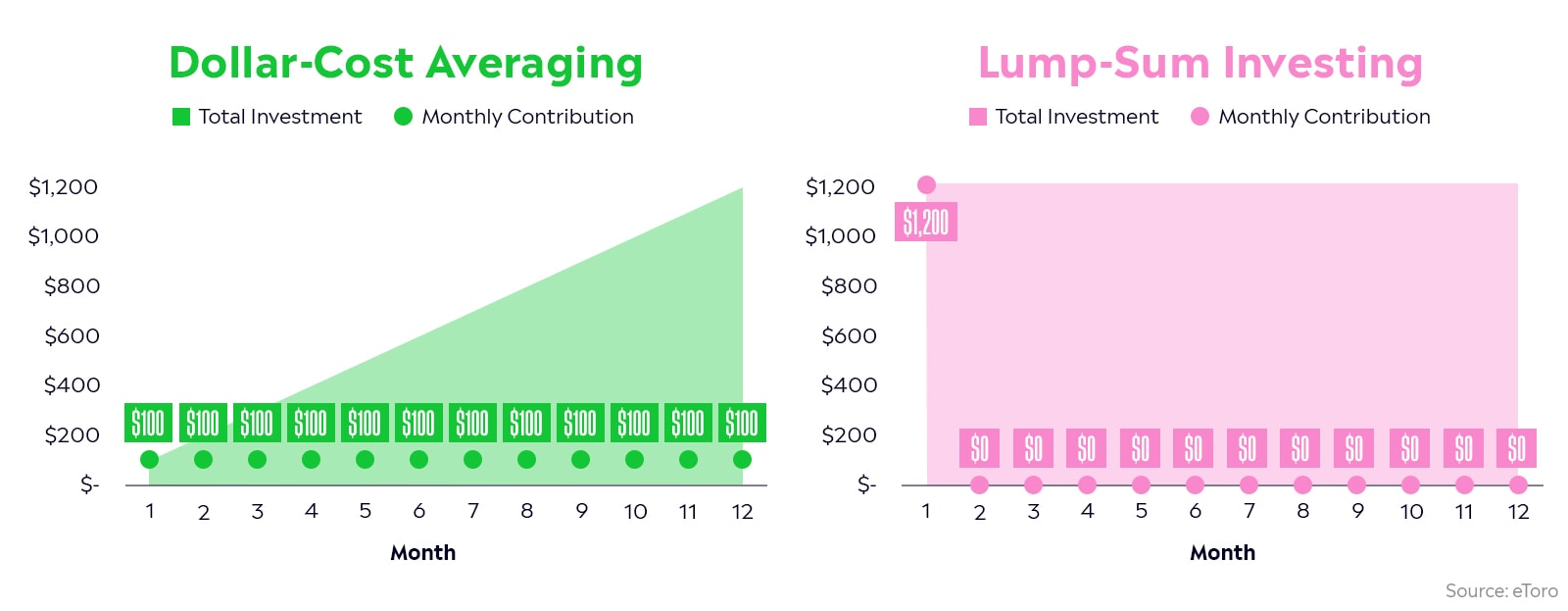

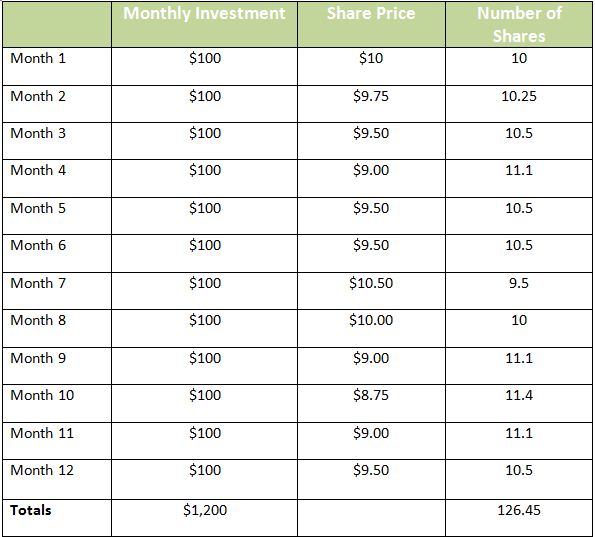

Dollar Cost Averaging Chart - Web if the current price is $12.50 per share, the original position is worth $625 (50 shares times $12.50), which only requires an investment of $375 to reach $1,000. Web dollar cost averaging ( dca) is an investment strategy that aims to apply value investing principles to regular investment. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. If you go with the more conservative 12%. What is dollar cost averaging? It is also called unit cost averaging, incremental averaging, or cost average effect. Dca aims to mitigate the impact of market volatility and potentially lower the average cost per share. This article delves deep into the mechanics, benefits, and practical applications of dollar cost averaging. Web dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. Let's say you invest $100 every month. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. If you have a 401 (k). This strategy aims to reduce the impact of market volatility by buying more shares when prices are low and fewer shares when. No matter what the financial markets are. Web dca provides just that. What is dollar cost averaging? Web dollar cost averaging ( dca) is an investment strategy that aims to apply value investing principles to regular investment. Dca aims to mitigate the impact of market volatility and potentially lower the average cost per share. You can set up a specific. Web dca provides just that. In the uk, it is referred to as pound cost averaging. You'll invest a fixed dollar amount at regular intervals over a long period. Web dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. Web dollar cost averaging ( dca) is an investment strategy that aims to apply value investing principles to regular investment. Web dollar cost average calculator for stocks, etfs & crypto. You'll invest a fixed dollar amount at regular intervals over a long period. Instead of purchasing shares at a single price point, with. The amount of money invested using this. This is done until the end value. This article delves deep into the mechanics, benefits, and practical applications of dollar cost averaging. It's helpful to understand the math. You'll invest a fixed dollar amount at regular intervals over a long period. Web however, if you assume this trend continues, $500 monthly investments would cross the $1 million mark in around. You'll invest a fixed dollar amount at regular intervals over a long period. You can set up a specific. The amount of money invested using this approach is usually smaller than a lump sum would be, but the contributions will build up steadily over time. Web dollar cost averaging is the practice of investing a fixed dollar amount on a. Dca aims to mitigate the impact of market volatility and potentially lower the average cost per share. You'll invest a fixed dollar amount at regular intervals over a long period. Web dollar cost averaging ( dca) is an investment strategy that aims to apply value investing principles to regular investment. The amount of money invested using this approach is usually. Web dollar cost averaging ( dca) is an investment strategy that aims to apply value investing principles to regular investment. It is also called unit cost averaging, incremental averaging, or cost average effect. No matter what the financial markets are. Web dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the. If you have a 401 (k). Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. If you go with the more conservative 12%. In the uk, it is referred to as pound cost averaging. Dca aims to mitigate the impact of market volatility and. Web dca provides just that. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. No matter what the financial markets are. Web dollar cost averaging (or dca investing) is the process of purchasing investments on a regular schedule instead of putting a large sum. Web if the current price is $12.50 per share, the original position is worth $625 (50 shares times $12.50), which only requires an investment of $375 to reach $1,000. This is done until the end value. Dca aims to mitigate the impact of market volatility and potentially lower the average cost per share. If you have a 401 (k). It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs. You can set up a specific. This helps to average out the cost of the acquired asset over time. Web dollar cost averaging (or dca investing) is the process of purchasing investments on a regular schedule instead of putting a large sum of money into the market all at once. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher. This article delves deep into the mechanics, benefits, and practical applications of dollar cost averaging. Instantly analyze dollar cost averaging (dca) for stocks, etfs & crypto over any investment schedule using recent financial data. What is dollar cost averaging? Instead of purchasing shares at a single price point, with. Use the dollar cost averaging (dca) calculator from merrill edge to learn more about dollar cost averaging and find a dca strategy that works for you. If you go with the more conservative 12%. No matter what the financial markets are.

Dollar Cost Averaging Bravias Financial

Dollar Cost Averaging Roy Walker Wealth Management

Dollar Cost Averaging A Passive Stock Investment Strategy YouTube

Exploring Finance The Ultimate Dollar Cost Averaging Strategy

Dollarcost averaging A simpleyeteffective investment strategy eToro

What Exactly is Dollar Cost Averaging? Ms. Independcent

Dollar Cost Average Chart

A Beginners Guide to DollarCost Averaging (DCA) with Examples

How to Use Dollar Cost Averaging to Build LongTerm Wealth Standard

How Dollar Cost Averaging Transforms Your Investment Strategy

It Is Also Called Unit Cost Averaging, Incremental Averaging, Or Cost Average Effect.

The Amount Of Money Invested Using This Approach Is Usually Smaller Than A Lump Sum Would Be, But The Contributions Will Build Up Steadily Over Time.

Web Dollar Cost Averaging ( Dca) Is An Investment Strategy That Aims To Apply Value Investing Principles To Regular Investment.

If You Make Regular Contributions To An Investment Or Retirement Account,.

Related Post: