Dp1 Dp2 Dp3 Comparison Chart

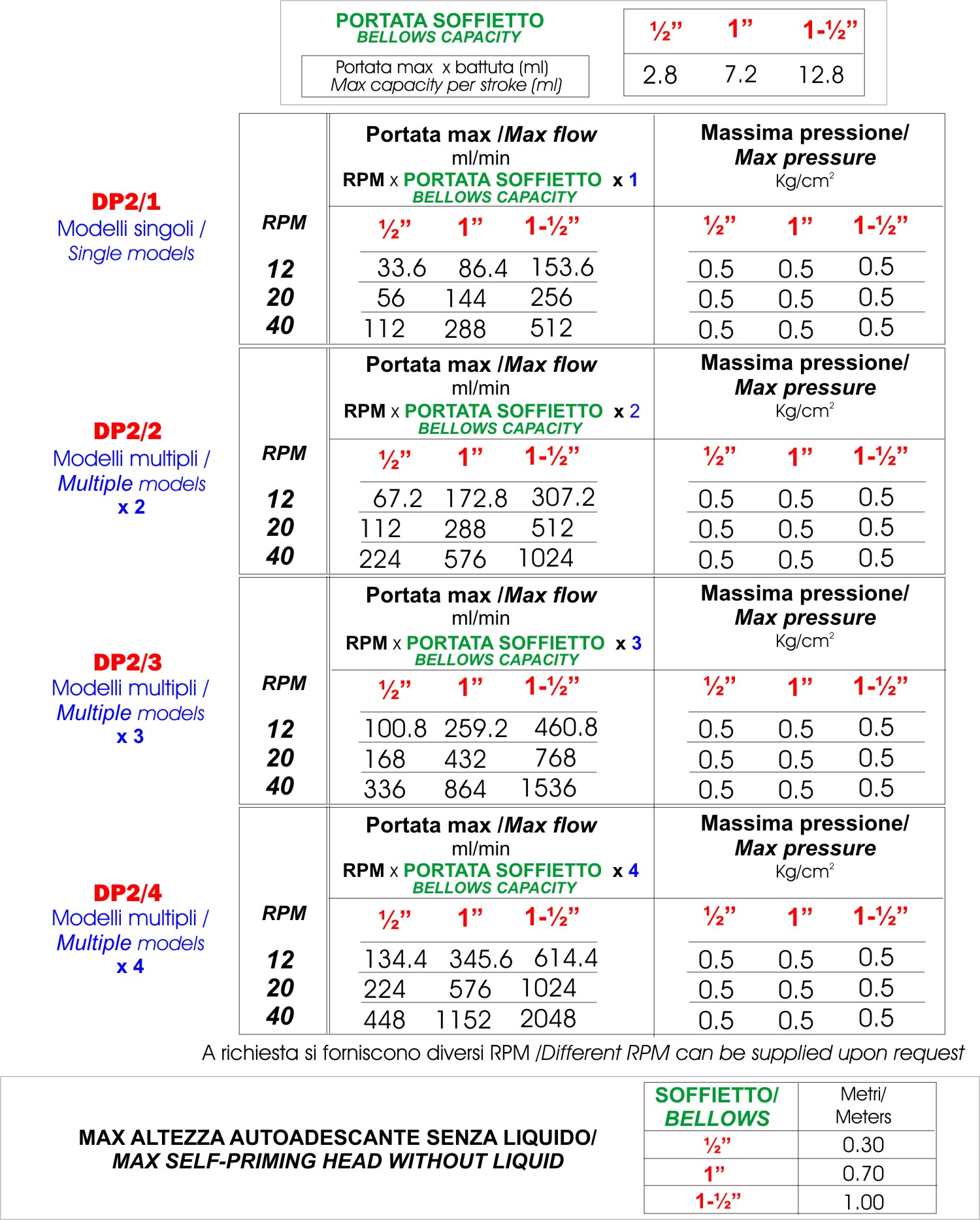

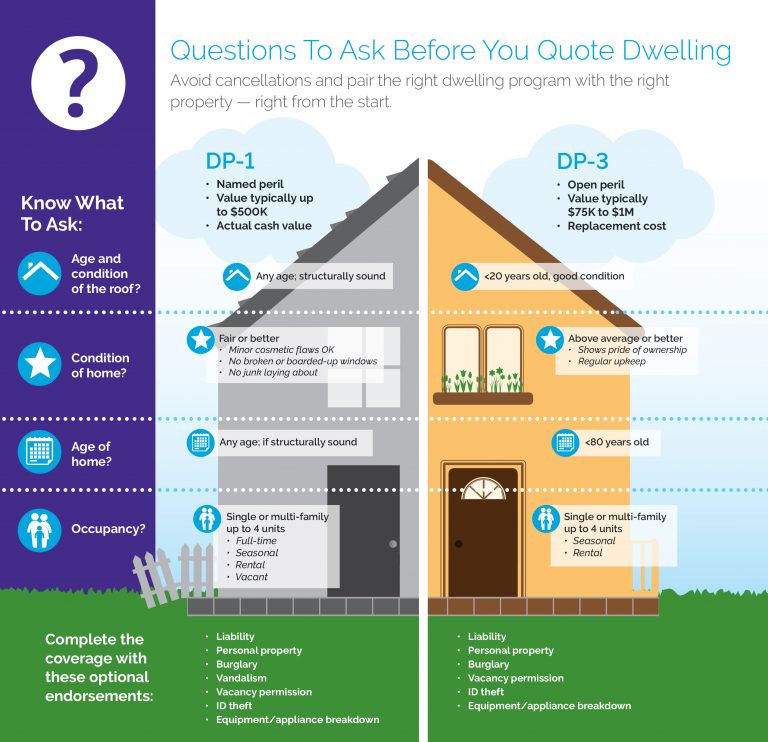

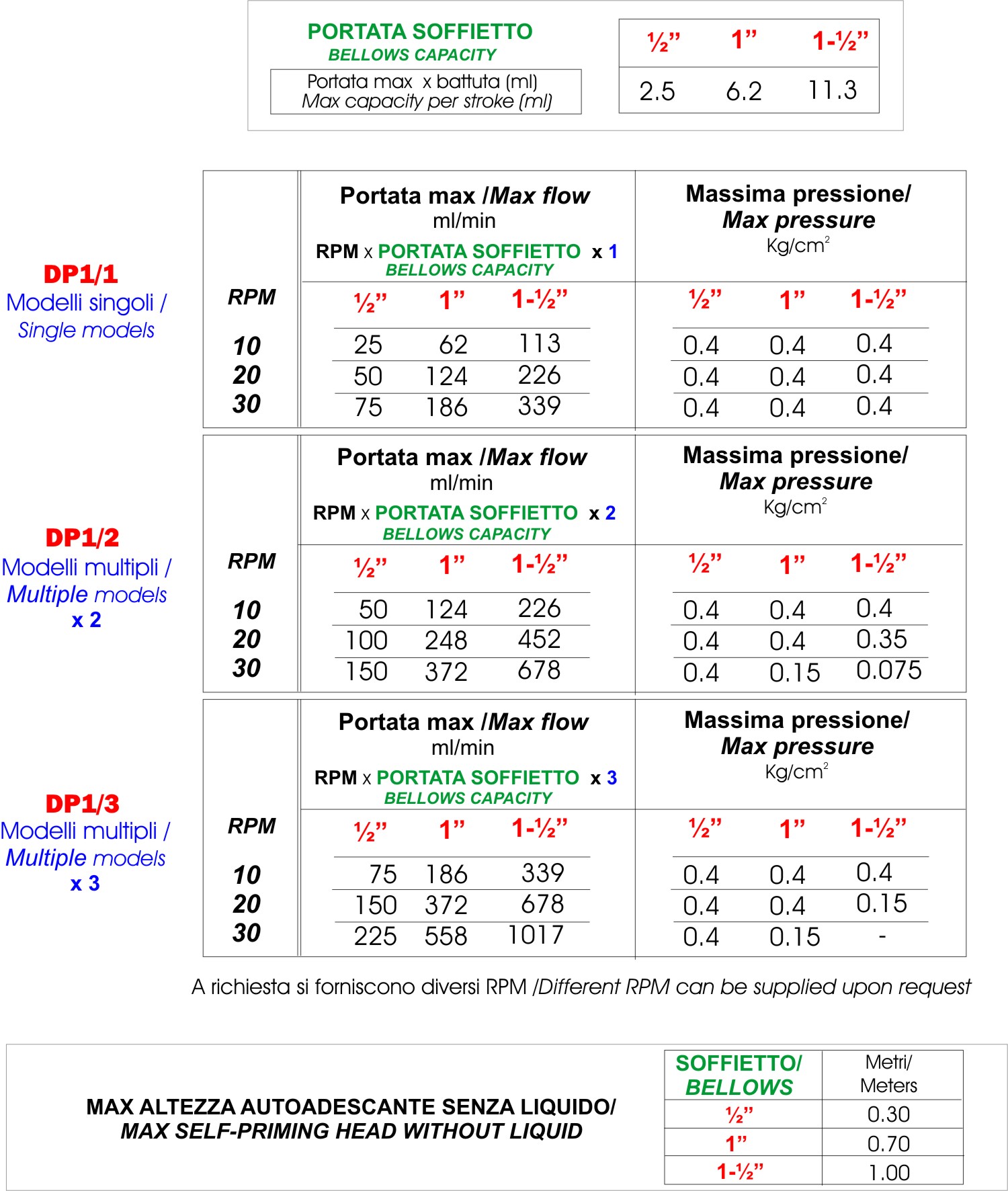

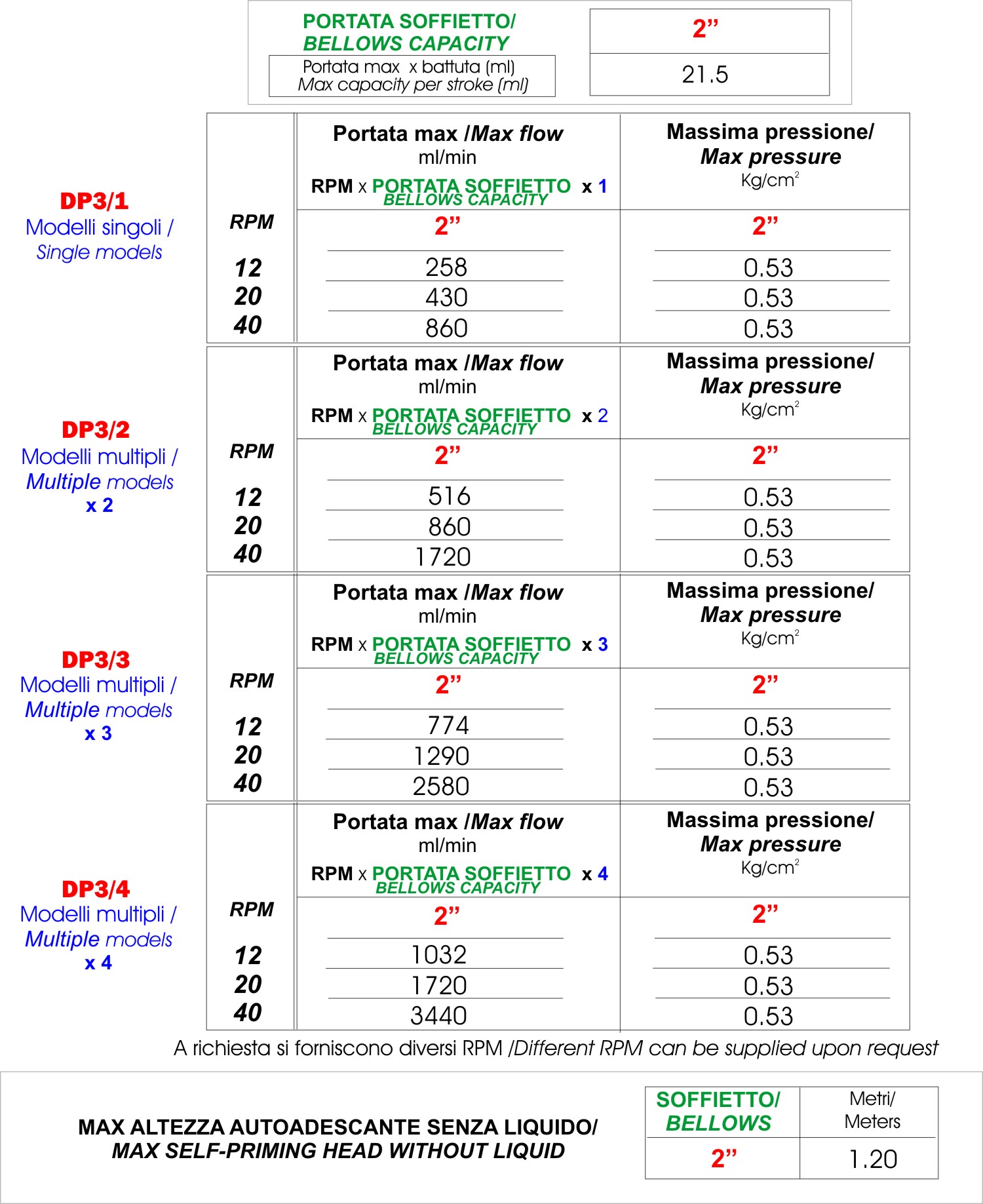

Dp1 Dp2 Dp3 Comparison Chart - Compare the perils covered, the type of insurance (named or open), and the cost of each policy. There are three dwelling fire forms: Web dp3, also known as a dwelling fire form 3 policy, offers more robust coverage than a dp1. Obie offers quotes for all three and can help you secure the right coverage with fast delivery and additional endorsements. Web dp1, dp2 , dp3: When it comes to insuring your property, it’s important to understand the differences between the various types of dwelling policies available. Web a spreadsheet that compares the coverage options and perils for different types of homeowners insurance policies, such as dp1, dp2, dp3, ho2, ho3, etc. In fact, it provides coverage against 18 perils, including burglary, flooding, freezing pipes, and vandalism that are not available under the dp1 policy. It’s an open perils policy, which means it covers far more types of loss than dp1. A dp3 policy is an open perils policy, which means they insure against all perils except those specifically excluded in the policy. Web according to imo guidelines, dp systems are rated dp1, dp2, or dp3. Rather than listing a few covered perils, the dp3 covers all perils except those listed in. Ho3 is that some coverages are added by default and others are optional. It is more affordable than a dp3 policy and covers more perils than the dp1 policy. Dp1 systems. Web learn the key differences between dp1, dp2, and dp3 dwelling policies for rental properties. Compare the perils covered, the type of insurance (named or open), and the cost of each policy. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. Rather than listing a few covered perils, the dp3 covers all perils except those. It is more affordable than a dp3 policy and covers more perils than the dp1 policy. The dp1 and dp3 represent the two ends of the coverage spectrum, with the dp1 being the most basic and limited policy, while the dp3 offers the highest level of comprehensive protection. Each form offers more protection than the last. We’re here to answer. Web according to imo guidelines, dp systems are rated dp1, dp2, or dp3. The dp1 and dp3 represent the two ends of the coverage spectrum, with the dp1 being the most basic and limited policy, while the dp3 offers the highest level of comprehensive protection. See the differences in occupancy, deductibles, loss of use, personal property, and additional coverages for. A dp2 policy usually covers the home for damage from: Web dp3, also known as a dwelling fire form 3 policy, offers more robust coverage than a dp1. Ho3 is that some coverages are added by default and others are optional. Named perils vs open perils policies; Let's start by taking a look at the differences between dp1 vs dp3. Ho3 is that some coverages are added by default and others are optional. Web a dp2 or dp3 policy is usually a better fit. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. Each form offers more protection than the last. Which policy is right for me? Web dp1, dp2 , dp3: They’re usually more expensive than a dp1 or dp2 policy, but they cover you against more. The triple redundant dp controller is still used and a minimum of three operator stations is required. A dp2 policy usually covers the home for damage from: Named perils vs open perils policies; When it comes to insuring your property, it’s important to understand the differences between the various types of dwelling policies available. Dp1 systems are the most basic, with the ability to keep their position in automatic mode. In fact, it provides coverage against 18 perils, including burglary, flooding, freezing pipes, and vandalism that are not available under the dp1 policy.. A dp3 policy is an open perils policy, which means they insure against all perils except those specifically excluded in the policy. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. Web learn the key differences between dp1, dp2, and dp3 dwelling policies for rental properties. Web the three most common. They’re usually more expensive than a dp1 or dp2 policy, but they cover you against more. Compare the perils covered, the type of insurance (named or open), and the cost of each policy. A dp3 is the most expensive policy. You’ll notice the biggest difference in dp3 vs. Of course, if the duplex or townhome in question is also your. You’ll notice the biggest difference in dp3 vs. Of course, if the duplex or townhome in question is also your residence, you’re going to want to look into an ho3 homeowners policy. Web the three most common rental insurance policies are the dp1, dp2, and dp3. A dp3 is the most expensive policy. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. The dp1 and dp3 represent the two ends of the coverage spectrum, with the dp1 being the most basic and limited policy, while the dp3 offers the highest level of comprehensive protection. Ho3 is that some coverages are added by default and others are optional. A dp2 policy usually covers the home for damage from: There are three dwelling fire forms: In addition, both the dp2 and dp3 provide replacement cost value (rcv) where the insurer doesn’t deduct the property’s depreciation from your claim (note: The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. Rather than listing a few covered perils, the dp3 covers all perils except those listed in. The triple redundant dp controller is still used and a minimum of three operator stations is required. A dp3 policy is an open perils policy, which means they insure against all perils except those specifically excluded in the policy. Which policy is right for me? Web dp1 is also a more affordable option than dp2 and dp3.

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Michelle Ferrigno, Insurance Agent Coverages Explained 'Landlord

Dp1 Dp2 Dp3 Insurance Comparison Chart Best Picture Of Chart

DP1 and DP3 comparison chart American Modern Insurance Agents

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

.png)

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

See The Differences In Occupancy, Deductibles, Loss Of Use, Personal Property, And Additional Coverages For Each Policy.

When It Comes To Insuring Your Property, It’s Important To Understand The Differences Between The Various Types Of Dwelling Policies Available.

It’s An Open Perils Policy, Which Means It Covers Far More Types Of Loss Than Dp1.

We’re Here To Answer Your Questions.

Related Post: