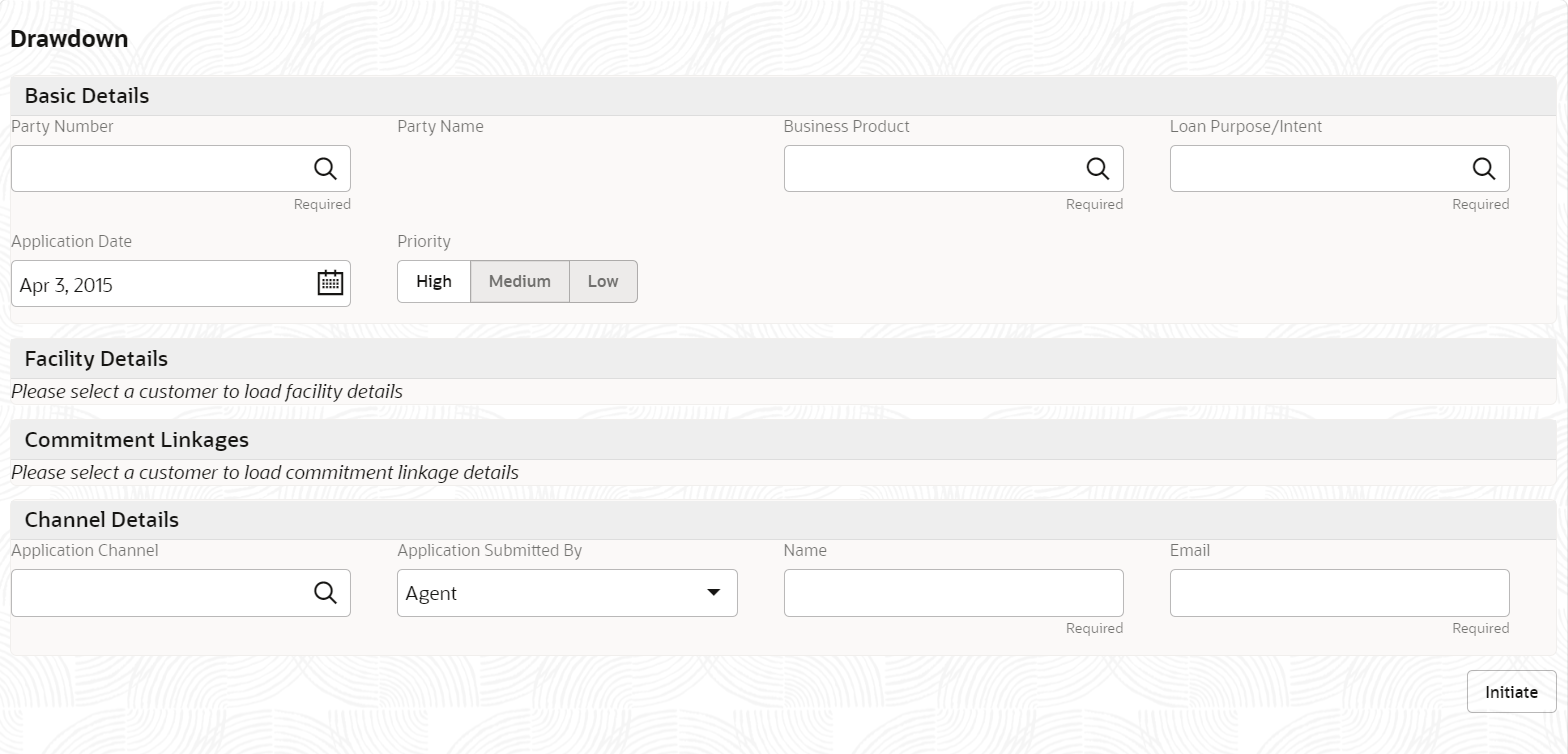

Draw Down A Loan

Draw Down A Loan - If your home loan is approved, your lender won’t simply pay the cash straight into your bank account for a property purchase. Web draw term loans allow borrowers to access funds throughout a draw period. Business loanssba loanbank loanworking capital loans Jaishankar at a meeting in new delhi, india, may 9, 2024. Web a loan drawdown is the process by which you receive funds from a loan agreement. Instead, they’ll release the funds to the. It’s when the lender releases the funds to you, either in a lump sum or in installments,. Drawdowns usually have to do with the reception of funds from either a retirement account, bank loan, or money deposited into an individual account. Web a loan drawdown refers to the process of disbursing or paying out funds from a loan. Web a drawdown mortgage is a type of equity release plan, popularly known as a drawdown lifetime mortgage, that allows homeowners, usually aged 55 and above, to. Web according to the legalshield analysis, if consumer legal stress in battleground states remains muted, that could point to favorable results for incumbents including. Anyone who paid off their help loan during the year will receive. Web a drawdown loan, sometimes known as a drawdown facility, allows the borrower to take out additional credit with ease. The terms drawdown and. Discover the pros and cons of a drawdown mortgage, calculate your returns and compare the best deals on the whole market with equity release supermarket. The key differences are as follows: Anyone who paid off their help loan during the year will receive. Business loanssba loanbank loanworking capital loans Web put simply, a drawdown loan allows you to borrow 'in. Web the $105 million of gross funds received from the sale of the prv and the $20 million drawn from the existing loan facility add to the $82 million in cash, cash. Solana ( sol 0.46%) is one. It’s when the lender releases the funds to you, either in a lump sum or in installments,. Instead, they’ll release the funds. Web a drawdown loan, sometimes known as a drawdown facility, is the release of an amount of money under an agreement with a lender. When a borrower is approved for a loan, they may not receive the full amount of the loan. Web a loan drawdown is the process by which you receive funds from a loan agreement. Jaishankar at. Web a drawdown loan, sometimes known as a drawdown facility, is the release of an amount of money under an agreement with a lender. Web a drawdown mortgage is a type of equity release plan, popularly known as a drawdown lifetime mortgage, that allows homeowners, usually aged 55 and above, to. Web in a word, yes. Web new drawdown customers. Web put simply, a drawdown loan allows you to borrow 'in chunks' and repay the full amount borrowed, rather than taking out a loan for a larger amount than you need, which could. This is often seen with flexible mortgage accounts. Web a drawdown loan, sometimes known as a drawdown facility, allows the borrower to take out additional credit with. Web a drawdown loan, sometimes known as a drawdown facility, is the release of an amount of money under an agreement with a lender. Solana ( sol 0.46%) is one. A delayed draw term is negotiated between the borrower and the lender. Jaishankar at a meeting in new delhi, india, may 9, 2024. Compare loansstart your mortgageskip the bankgreat incentives Discover the pros and cons of a drawdown mortgage, calculate your returns and compare the best deals on the whole market with equity release supermarket. Jaishankar at a meeting in new delhi, india, may 9, 2024. Web according to the legalshield analysis, if consumer legal stress in battleground states remains muted, that could point to favorable results for incumbents including.. Anyone who paid off their help loan during the year will receive. Instead, they’ll release the funds to the. The key differences are as follows: Web a drawdown mortgage is a type of equity release plan, popularly known as a drawdown lifetime mortgage, that allows homeowners, usually aged 55 and above, to. We asked the office of federal education minister. Drawdown can mean the act of borrowing under a loan agreement on a particular day. Anyone who paid off their help loan during the year will receive. Web maldivian foreign minister zameer moosa (left) shakes hands with india’s minister for external affairs s. Web a drawdown loan, sometimes known as a drawdown facility, is the release of an amount of. When a borrower is approved for a loan, they may not receive the full amount of the loan. If your home loan is approved, your lender won’t simply pay the cash straight into your bank account for a property purchase. Web according to the legalshield analysis, if consumer legal stress in battleground states remains muted, that could point to favorable results for incumbents including. Web a drawdown mortgage is a type of equity release plan, popularly known as a drawdown lifetime mortgage, that allows homeowners, usually aged 55 and above, to. Disbursements refer to either cash. This is often seen with flexible mortgage accounts. Web put simply, a drawdown loan allows you to borrow 'in chunks' and repay the full amount borrowed, rather than taking out a loan for a larger amount than you need, which could. It’s when the lender releases the funds to you, either in a lump sum or in installments,. The key differences are as follows: Web a drawdown loan, sometimes known as a drawdown facility, allows the borrower to take out additional credit with ease. Web a loan drawdown is the process by which you receive funds from a loan agreement. Web by staff writerlast updated december 08, 2023. Web the $105 million of gross funds received from the sale of the prv and the $20 million drawn from the existing loan facility add to the $82 million in cash, cash. Drawdowns usually have to do with the reception of funds from either a retirement account, bank loan, or money deposited into an individual account. Web draw term loans allow borrowers to access funds throughout a draw period. Web in a word, yes.

What Doese Draw Down Loan Mean

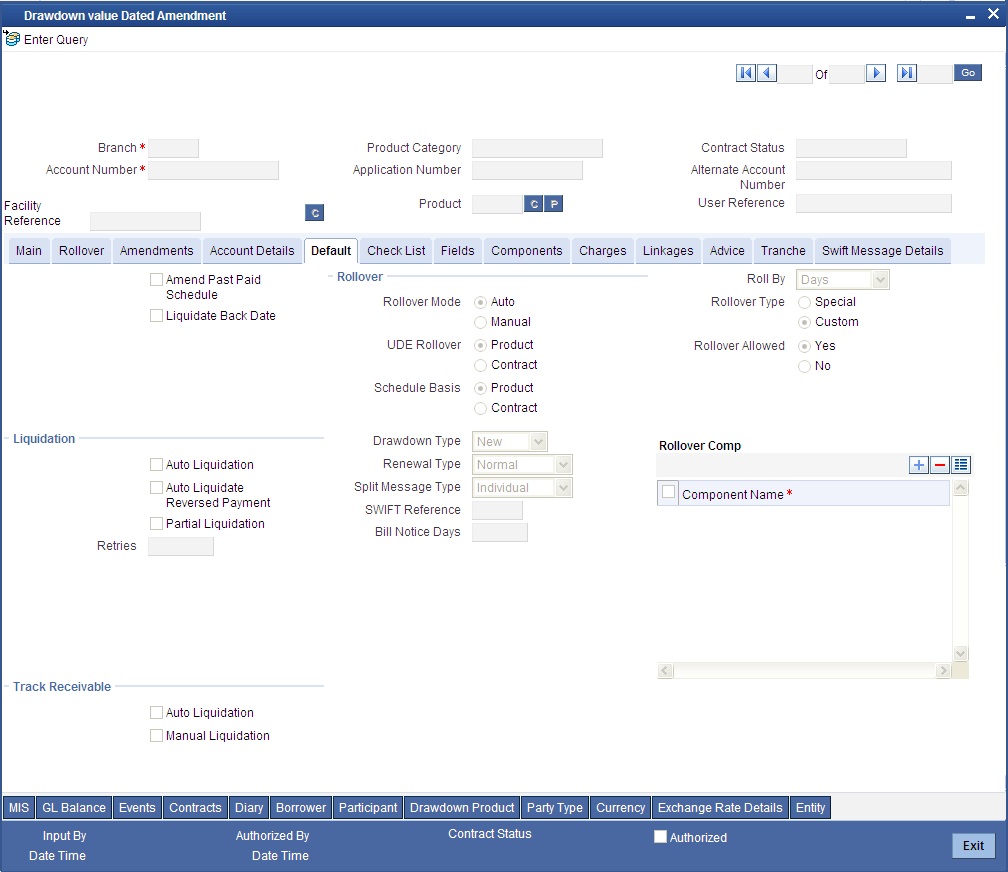

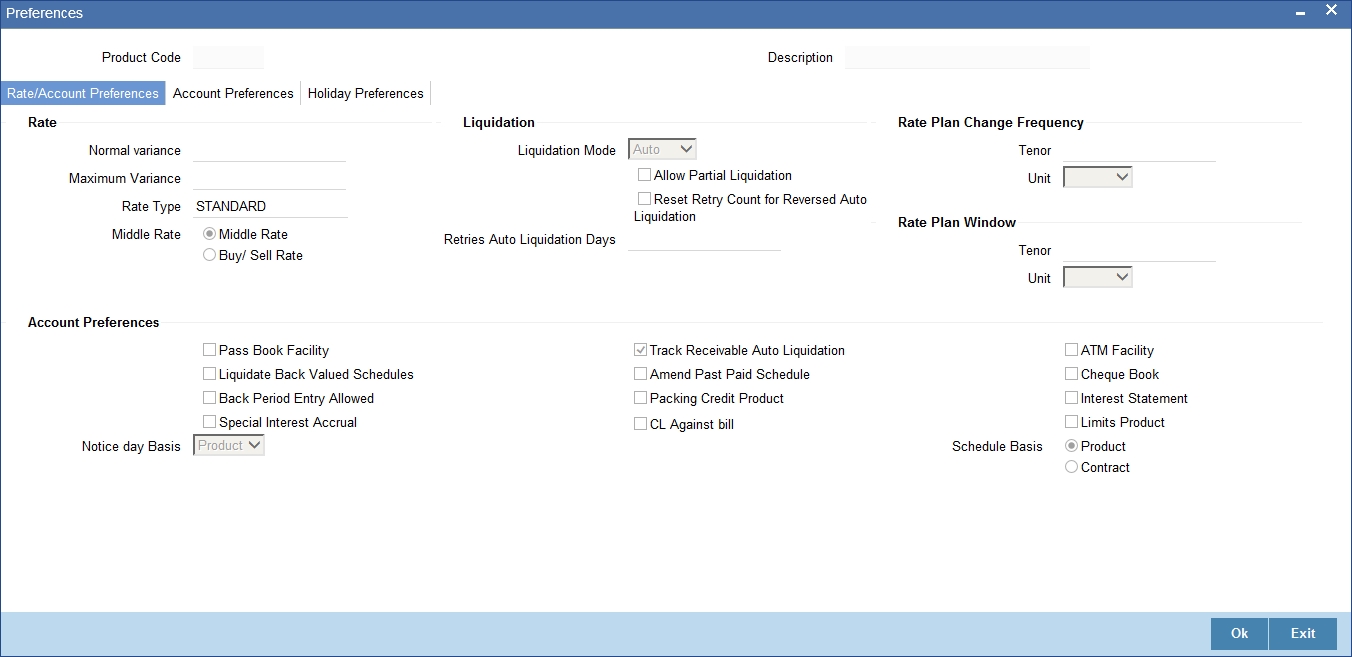

8. Rollingover a Drawdown Loan

pengola Blog

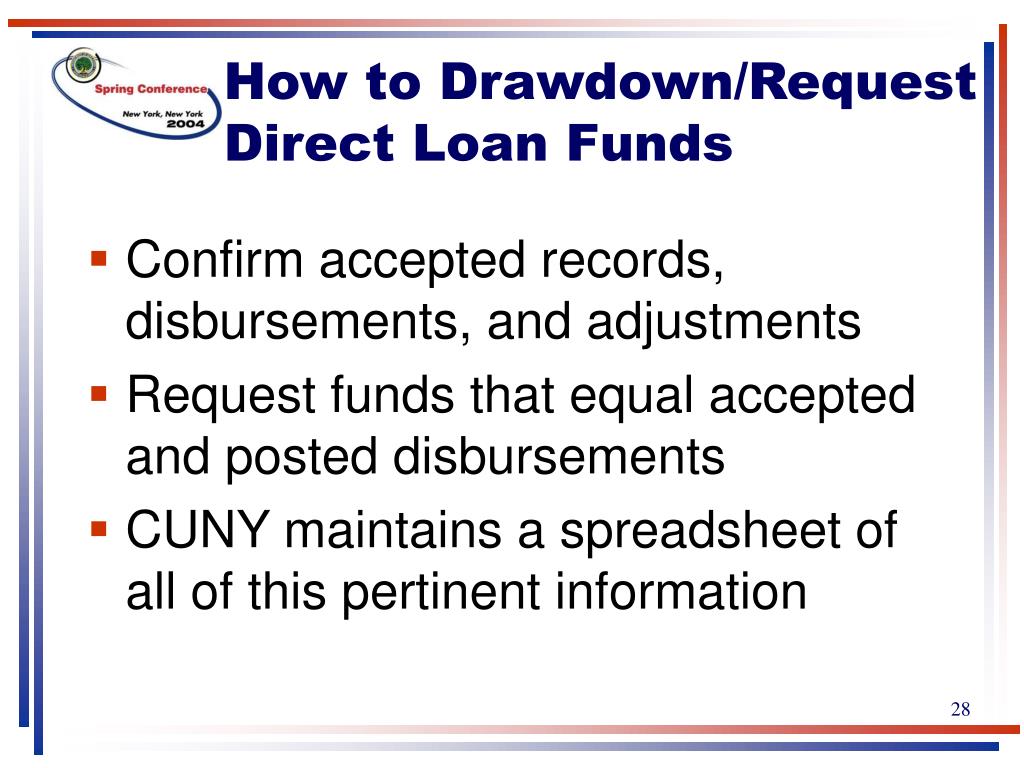

How to Drawdown from Loan Account on Customer Portal of Bajaj Finance

8. Rollingover a Drawdown Loan

What Doese Draw Down Loan Mean

8. Rollingover a Drawdown Loan

Loan Drawdown

How to Drawdown/Withdraw from your Flexi Loan Bajaj Finserv YouTube

Request loan drawdown Templates & Legal Help

Instead, They’ll Release The Funds To The.

Jaishankar At A Meeting In New Delhi, India, May 9, 2024.

Discover The Pros And Cons Of A Drawdown Mortgage, Calculate Your Returns And Compare The Best Deals On The Whole Market With Equity Release Supermarket.

Compare Loansstart Your Mortgageskip The Bankgreat Incentives

Related Post: