Drawing Meaning In Accounting

Drawing Meaning In Accounting - Web we position young children as capable science learners. Drawings can be in the form of cash, business assets, or checks. They do not affect the business expenses on the profit and loss account (income statement). These withdrawals are typically made by sole traders or partners in a partnership. In this situation the bookkeeping entries are recorded on the drawings account in the ledger. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Drawing accounts are frequently used by companies that undergo taxation under the assumption of being partnerships or sole proprietorships. A drawing account is used primarily for. It is temporary and closed by transferring the balance to an owner’s equity account at the end of the fiscal year. They are, in effect, drawing funds from the. Drawing accounts are generally associated with unincorporated business organizations, such as sole proprietorships and partnerships. Web drawings accounting is used when an owner of a business wants to withdraw cash for private use. Web we position young children as capable science learners. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide. This financial practice is primarily employed in businesses structured as sole proprietorships or partnerships. The contra owner’s equity account that reports the amount of withdrawals of business cash or other assets by the owner for personal use during the current accounting year. Web drawings accounting is used when an owner of a business wants to withdraw cash for private use.. Learn how to advance your accounting and bookkeeping career. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal use are termed as drawings. If for example an owner takes 200 cash from the business for their own use, then the drawings accounting would be as follows: Web drawings are. The money taken from the business must be recorded on the general ledger and appear on the balance sheet. The withdrawal of business cash or other assets by the owner for the personal use of the owner. If for example an owner takes 200 cash from the business for their own use, then the drawings accounting would be as follows:. Web in standard accounting, drawings refer to withdrawals of funds or assets by a business owner or partners for personal use. Drawing can also include items that are removed from a business for personal use. These withdrawals are typically made by sole traders or partners in a partnership. Web drawings accounting is used when an owner of a business wants. Web a drawing account is an accounting record maintained to track money and other assets withdrawn from a business by its owners. Web we position young children as capable science learners. Drawings are only a factor in smaller, owner operated (proprietor) businesses. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity. Drawing accounts are generally associated with unincorporated business organizations, such as sole proprietorships and partnerships. Drawings are the withdrawals of a sole proprietorship’s business assets by the owner for the owner’s personal use. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. These draws can be in. It reduces the total capital invested by the proprietor(s). If for example an owner takes 200 cash from the business for their own use, then the drawings accounting would be as follows: Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. It is also called a withdrawal. Drawing accounts are generally associated with unincorporated business organizations, such as sole proprietorships and partnerships. Large companies and corporations will not deal the issue of drawings very often, simply because owners can be quite detached from day to day running of the. At the end of the accounting year, the balance in the drawing account is transferred (closed) to the. Web drawings are money or assets that are withdrawn from a company by its owners for personal use and must be recorded as a reduction of assets and owner's equity. Learn how to advance your accounting and bookkeeping career. Business owners typically use drawing accounts when they are a part of a sole proprietorship or partnership. Large companies and corporations. Web a drawing account is a financial account that essentially records owners’ drawings, i.e., the assets, mainly including money, that are withdrawn from a business by its owner (s) for their personal use. Drawings are the withdrawals of a sole proprietorship’s business assets by the owner for the owner’s personal use. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit balance is contrary to the normal credit balance of the owner’s equity or capital account. These withdrawals are typically made by sole traders or partners in a partnership. Business owners typically use drawing accounts when they are a part of a sole proprietorship or partnership. Web drawings are money or assets that are withdrawn from a company by its owners for personal use and must be recorded as a reduction of assets and owner's equity. It’s important to document these drawings in order to maintain accurate records of the business’s finances and determine its taxable income. Learning science can be considered as the active appropriation of culturally mediated semiotic resources (jewitt, kress, ogborn and tsatsarelis 2001).young children engage in this process using multiple modes of communication; Drawing accounts are frequently used by companies that undergo taxation under the assumption of being partnerships or sole proprietorships. Drawings are only a factor in smaller, owner operated (proprietor) businesses. It is temporary and closed by transferring the balance to an owner’s equity account at the end of the fiscal year. Web the meaning of drawing in accounts is the record kept by a business owner or accountant that shows how much money has been withdrawn by business owners. Web drawings in accounting are when money is taken out of the business for personal use. The contra owner’s equity account that reports the amount of withdrawals of business cash or other assets by the owner for personal use during the current accounting year. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. Web what are drawings in accounting?

Meaning of capital and drawing in Accounting basic accounting terms

What is Drawing in Accounting? Accounting for Beginners by Student

:max_bytes(150000):strip_icc()/DrawingAccount-ebf43543399c4f2aaaa3bdec5e94f1ee.jpg)

Drawing Account What It Is and How It Works

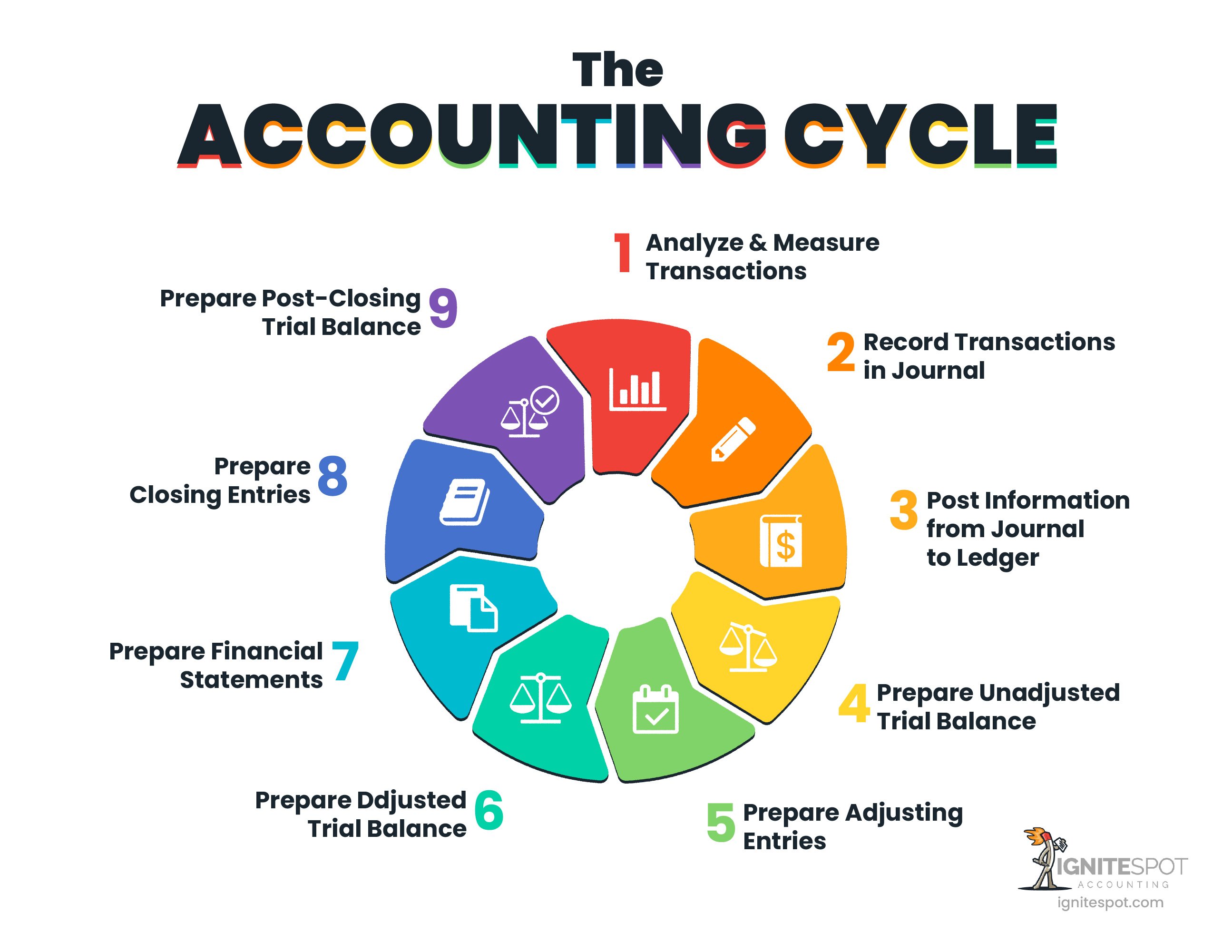

Basic Accounting The Accounting Cycle Explained

Drawings in Accounting Definition, Process & Importance

What are Drawings in Accounting?

What Are Drawings In Accounting? SelfEmployed Drawings

Drawings in Accounting Characteristics and its Concepts Shiksha Online

owner's drawing account definition and Business Accounting

What is Drawing in Accounting Student Tube

Thus, They Become Active Producers Of Meaning In Multimodal.

They Are, In Effect, Drawing Funds From The.

Perform Better At Your Current Job.

Drawings Can Be In The Form Of Cash, Business Assets, Or Checks.

Related Post: