Dumb Money Vs Smart Money Chart

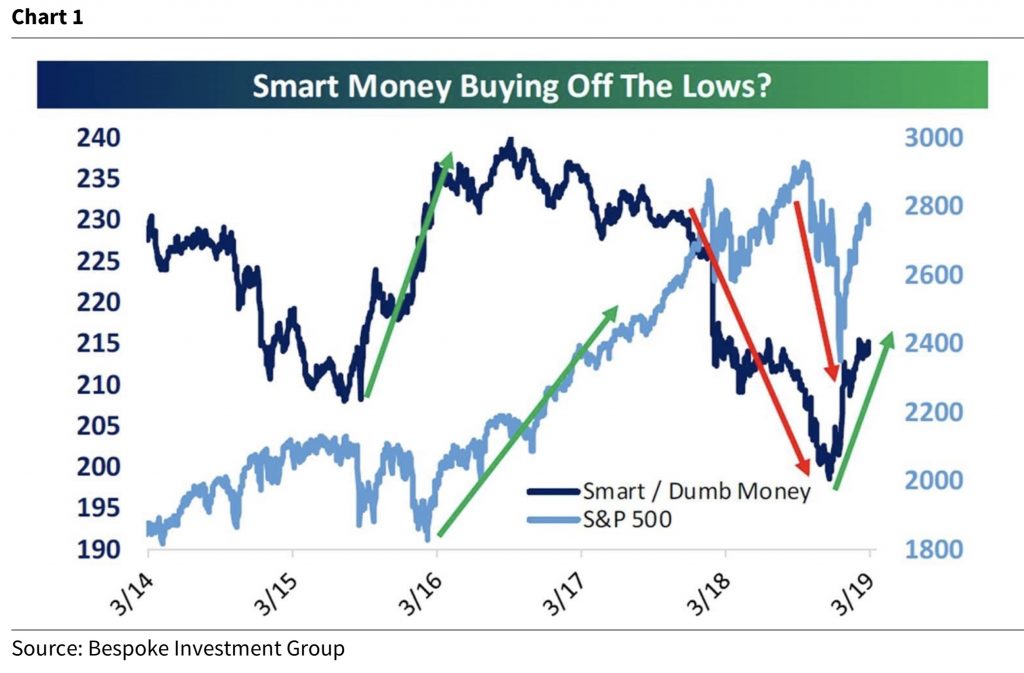

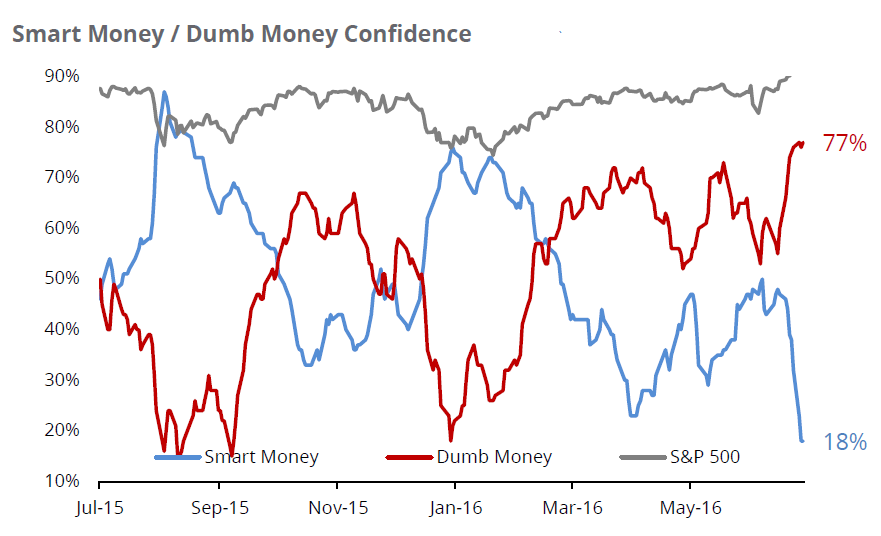

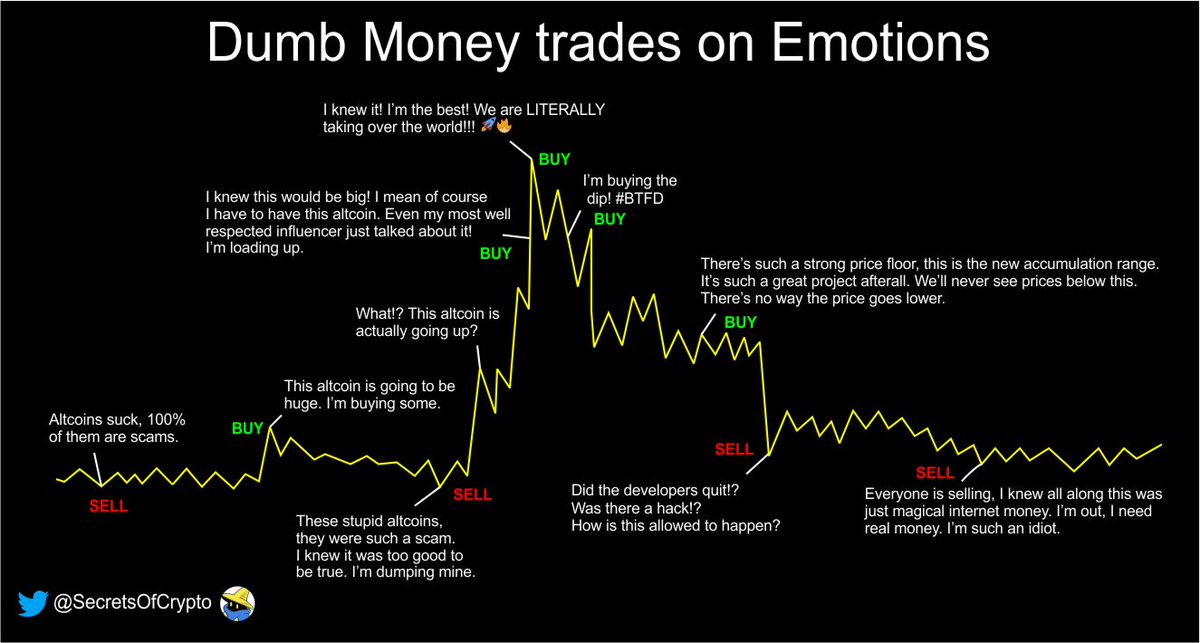

Dumb Money Vs Smart Money Chart - Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Dumb money tends to buy and sell at the worst possible time. We go over how they are calculated, how to read the charts, and what is smart vs. Web as you can see from the chart above, the dumb money confidence (orange line) is at a high and smart money confidence (blue line) is at a low despite the good performance of the s&p 500 (green line). Web the smart money vs. Web as a result, the typical individual investor suffers from extremely poor performance. Retailers don't have enough money even if they don't do sip in mfs. Retailers mostly do sips, so the money goes to mfs (i.e. Web uncover the secrets behind smart money and dumb money in trading with our faqs, empowering you to navigate the markets like a seasoned investor! Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Web the smart money flow index (smfi) is an indicator used to identify the buying behavior of smart versus dumb money in the u.s. Web as you can see from the chart above, the dumb money confidence (orange line) is at a high and smart money confidence (blue line) is at a low despite the good performance of the s&p. Insider trading activity, a telltale sign of smart money, can be deciphered by those adept at reading between the lines. Dumb money chart provides a visual representation, yet interpreting it requires skill and expertise. We go over how they are calculated, how to read the charts, and what is smart vs. The smart money flow index (smfi) is calculated according. Retailers mostly do sips, so the money goes to mfs (i.e. Or, they're just contrarian investors who prefer to sell into a rising market and. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Diis) which is smart money. Shortly after the opening and within the last hour of trading. Dumb money chart provides a visual representation, yet interpreting it requires skill and expertise. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Dumb money tends to buy and sell at the worst possible time. We go over how they. Shortly after the opening and within the last hour of trading. Web trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this isn’t actually a slight against early day traders. Web the smart money flow index (smfi) is an indicator used to identify the buying. Web the smart money flow index (smfi) is an indicator used to identify the buying behavior of smart versus dumb money in the u.s. Web in this video, you will learn the basics of the smart/dumb money confidence indicators. Web as you can see from the chart above, the dumb money confidence (orange line) is at a high and smart. Web in general, smart money indicators are used to assess institutional investors’ stock buying behavior for insight into their actions and approaches. Web as you can see from the chart above, the dumb money confidence (orange line) is at a high and smart money confidence (blue line) is at a low despite the good performance of the s&p 500 (green. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Web uncover the secrets behind smart money and dumb money in trading with our faqs, empowering you to navigate the markets like a seasoned investor! Web the smart money vs. Dumb money tends to buy and sell at the worst possible time. Web. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Web this means that i think it's supposed to be a certain amount of smart money and dumb money. Retailers don't have enough money even if they don't do sip in. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Web this means that i think it's supposed to be a certain amount of. Web with the volatility in stocks this week, the spread between smart money and dumb money confidence rose to 55%, the widest since january 2016. Web as a result, the typical individual investor suffers from extremely poor performance. Shortly after the opening and within the last hour of trading. Or, they're just contrarian investors who prefer to sell into a rising market and. Web uncover the secrets behind smart money and dumb money in trading with our faqs, empowering you to navigate the markets like a seasoned investor! Insider trading activity, a telltale sign of smart money, can be deciphered by those adept at reading between the lines. Web in general, smart money indicators are used to assess institutional investors’ stock buying behavior for insight into their actions and approaches. The smart money flow index is based on the concept of don hays’ smart money index (smi), but uses a more efficient formula to. Retailers mostly do sips, so the money goes to mfs (i.e. This article appears courtesy of riskhedge. Beware of bugs in the reality simulation is a common side effect. Look at the size of diis and fiis. For example, consider the recent market turmoil triggered by the coronavirus pandemic. Dumb money chart provides a visual representation, yet interpreting it requires skill and expertise. Web in this video, you will learn the basics of the smart/dumb money confidence indicators. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants.

Smart Money Versus Dumb Money Which are You?

Smart Money / Dumb Money Sentiment Indicators ValueTrend

Here Is An important Look At What The “Smart Money” And “Dumb Money

Smart Money/Dumb Money The Joseph Group

DUMB MONEY VS SMART MONEY ) for FXSPX500 by 001011001010001110110

Smart money vs dumb money divergences for AMEXHYG by Roral — TradingView

Smart Money Versus Dumb Money Which are You?

A Dumb vs Smart Money Index (and how to get on the smart side)

Secrets on Twitter "5/ Dumb Money vs. Smart Money Comparison Why is it

Smart Money vs. Dumb Money? A Quick Look at a Unique Sentiment

Web Trades Made At The Beginning Of The Day Are Labeled The “Dumb Money,” Whereas Those Placed At The End Are Called The “Smart Money.” This Isn’t Actually A Slight Against Early Day Traders.

Web As You Can See From The Chart Above, The Dumb Money Confidence (Orange Line) Is At A High And Smart Money Confidence (Blue Line) Is At A Low Despite The Good Performance Of The S&P 500 (Green Line).

Web The Smart Money Vs.

We Go Over How They Are Calculated, How To Read The Charts, And What Is Smart Vs.

Related Post: