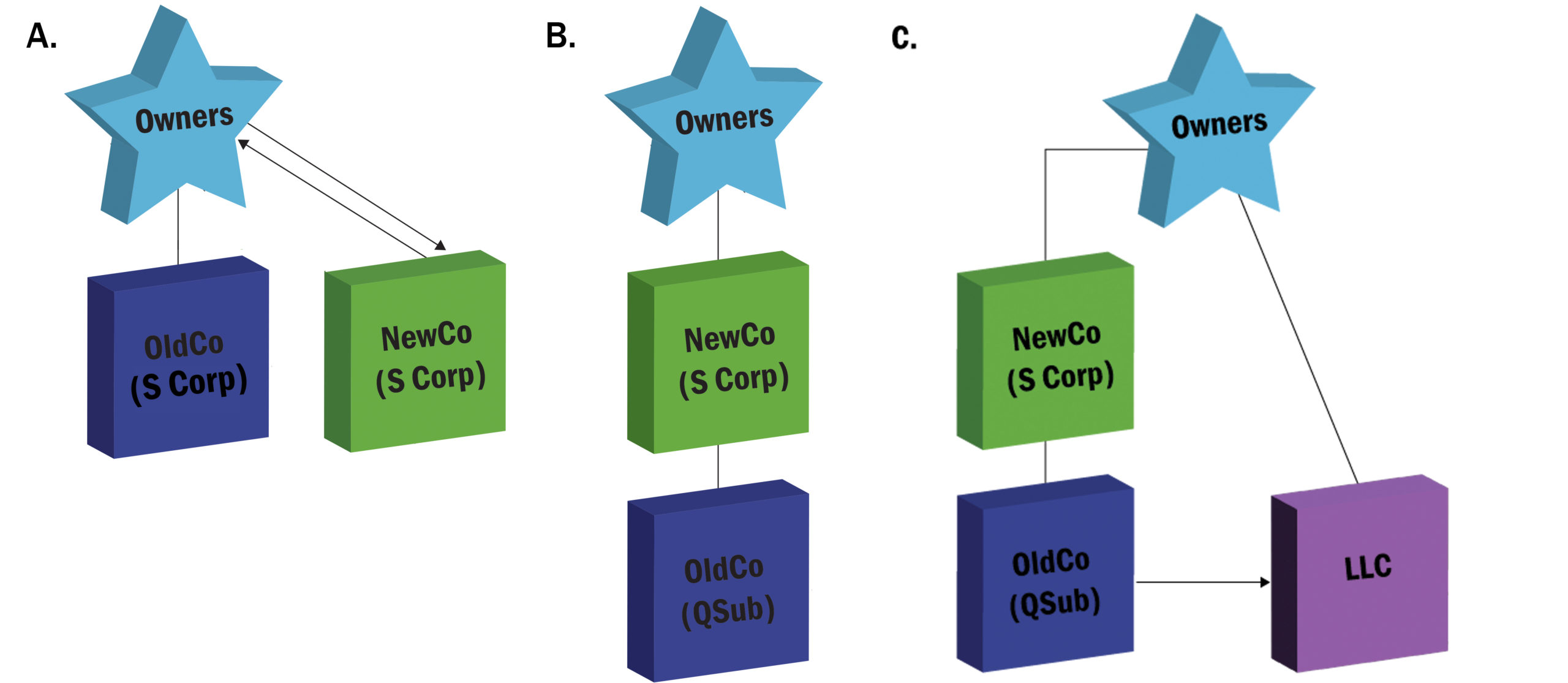

F Reorganization Chart

F Reorganization Chart - Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. This allows a business to avoid. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. Web background on f reorganizations. F reorganizations have become a commonly used structure in the market when buyers, especially private equity buyers,. Web perhaps one of the most frequently executed corporate reorganizations is the “f” reorganization. 368 (a) (1) (f), an “f” reorganization is a “mere change in identity, form, or place of organization of one corporation, however effected.”. Web this item explains how, within the context of a subchapter s corporation target, a sec. Web advisors should consider the advantages of using f reorganizations to solve certain issues that can be encountered when forming a smllc. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. Web background on f reorganizations. Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. This allows a business. 368(a)(1)(f) reorganization private letter ruling may present a structure that allows the. Web an f reorganization falls under the irs code section 368(a)(1)(f) and covers changing a business from one type of form or filing entity to another. Web the basics of an f reorganization dictate that a legal entity (corporation or llc) is merely changing its identity, form, or. Web as explained in i.r.c. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. Web the basics of. Web as explained in i.r.c. Web the basics of an f reorganization dictate that a legal entity (corporation or llc) is merely changing its identity, form, or place of organization. Web this item explains how, within the context of a subchapter s corporation target, a sec. Web an f reorganization falls under the irs code section 368(a)(1)(f) and covers changing. Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. Web an f reorganization falls under the irs code section 368(a)(1)(f) and covers changing a business from one type of form or filing entity to another. Web the basics of an f reorganization dictate that a legal entity. 368(a)(1)(f) reorganization private letter ruling may present a structure that allows the. Section 368 (a) (1) (f) defines an “f” reorganization as a mere change. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. F reorganizations have become a commonly. 368 (a) (1) (f), an “f” reorganization is a “mere change in identity, form, or place of organization of one corporation, however effected.”. Web perhaps one of the most frequently executed corporate reorganizations is the “f” reorganization. 368(a)(1)(f) reorganization private letter ruling may present a structure that allows the. Section 368 (a) (1) (f) defines an “f” reorganization as a. F reorganizations have become a commonly used structure in the market when buyers, especially private equity buyers,. Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. Web background on f reorganizations. Web perhaps one of the most frequently executed corporate reorganizations is the “f” reorganization. Web the. Section 368 (a) (1) (f) defines an “f” reorganization as a mere change. Web the basics of an f reorganization dictate that a legal entity (corporation or llc) is merely changing its identity, form, or place of organization. Web perhaps one of the most frequently executed corporate reorganizations is the “f” reorganization. Web an f reorganization falls under the irs. Web the basics of an f reorganization dictate that a legal entity (corporation or llc) is merely changing its identity, form, or place of organization. Web as explained in i.r.c. Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. This allows a business to avoid. 368 (a). Web this item explains how, within the context of a subchapter s corporation target, a sec. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. Web under the treasury regulations, an f reorganization begins when an existing corporation (“transferor corporation”) transfers (or is deemed to transfer) its. 368 (a) (1) (f), an “f” reorganization is a “mere change in identity, form, or place of organization of one corporation, however effected.”. 368(a)(1)(f) reorganization private letter ruling may present a structure that allows the. Web as explained in i.r.c. Web an f reorganization is defined in internal revenue code section 368 (a) (1) (f) as a mere change of identity, form or place of organization of one corporation. F reorganizations have become a commonly used structure in the market when buyers, especially private equity buyers,. Web the basics of an f reorganization dictate that a legal entity (corporation or llc) is merely changing its identity, form, or place of organization. Section 368 (a) (1) (f) defines an “f” reorganization as a mere change. Web background on f reorganizations. Web advisors should consider the advantages of using f reorganizations to solve certain issues that can be encountered when forming a smllc.

or 338(h)(10) Election? Choose the LessRestrictive Option

F The Good, the Bad, and the Wasteful Lexology

State and local considerations in using an F to

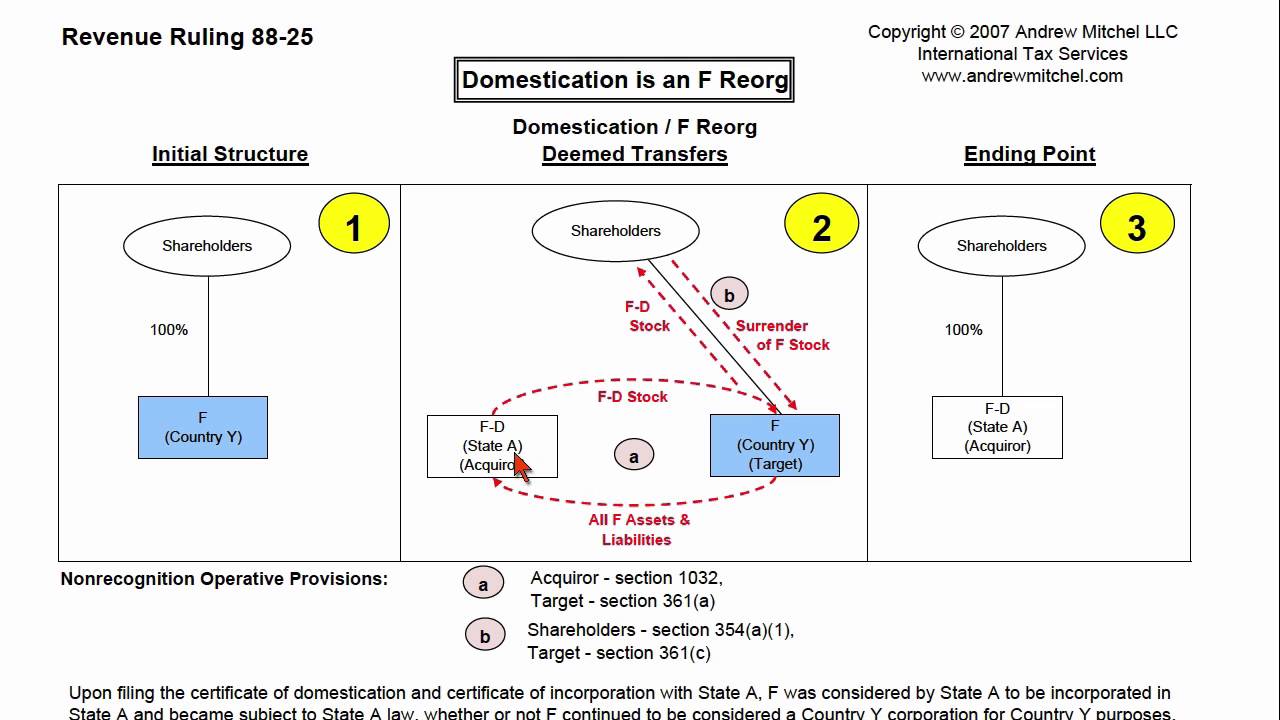

Rev. Rul. 8825, Domestication is an F YouTube

F The Good, the Bad, and the Wasteful Lexology

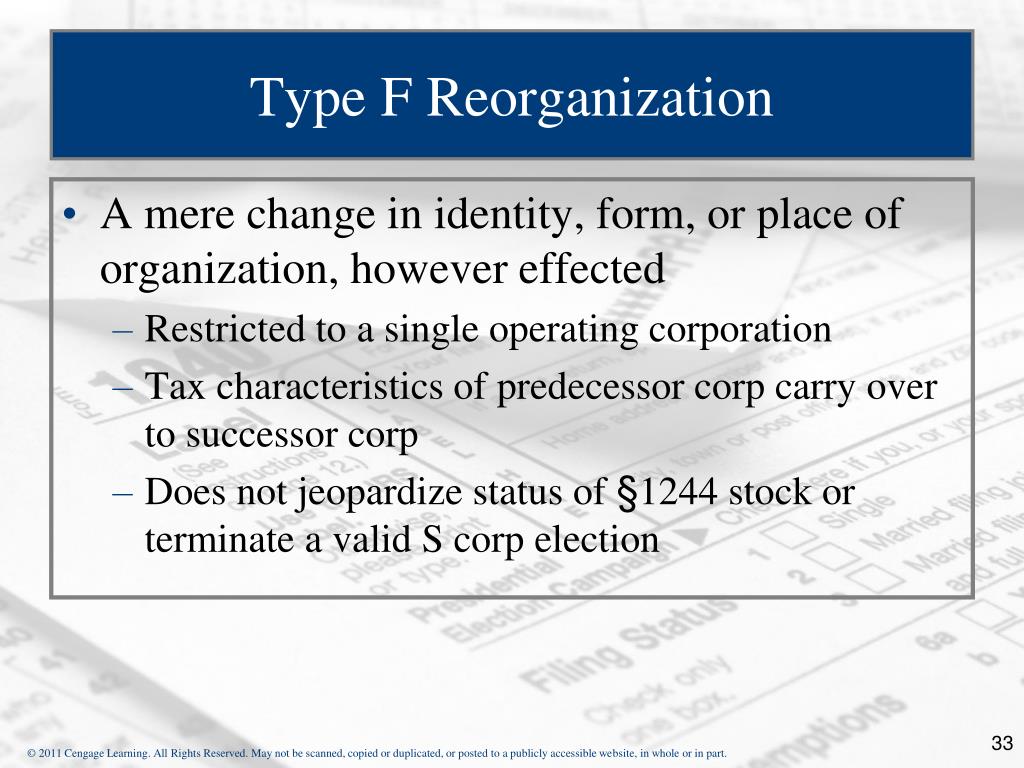

PPT Chapter 7 PowerPoint Presentation, free download ID272367

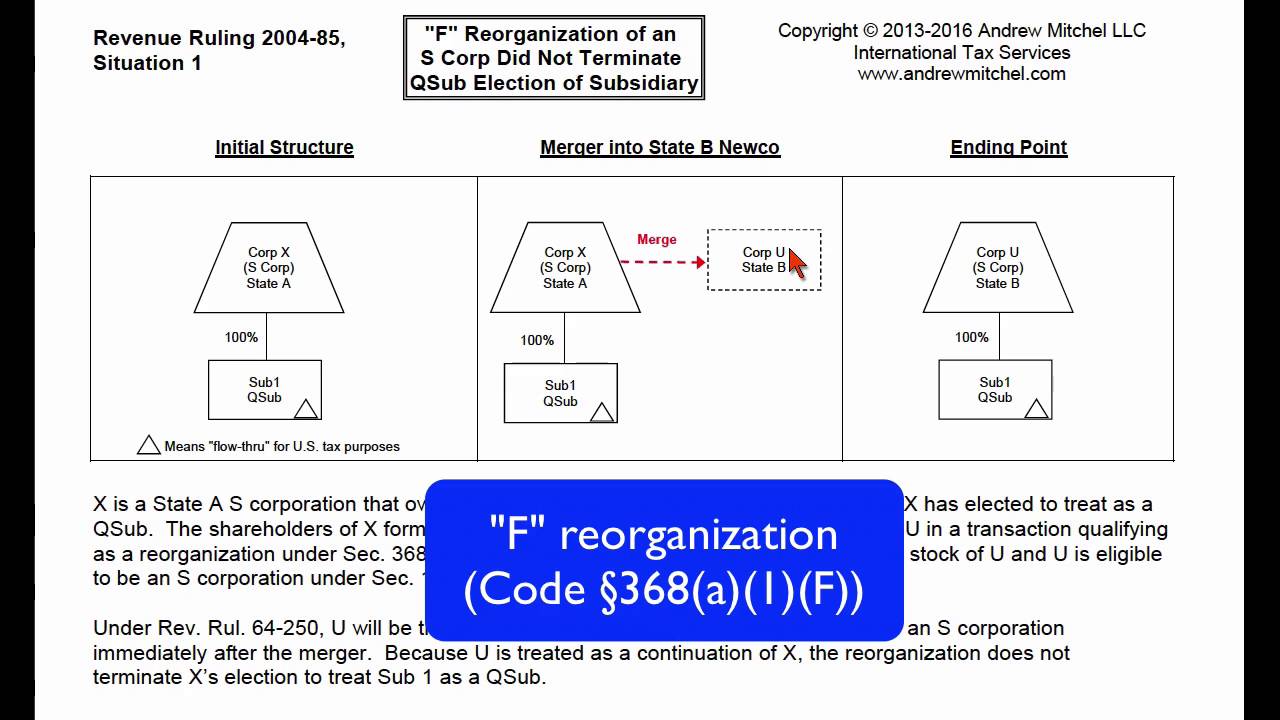

Rev. Rul. 200485, F of an S Corp Did Not Terminate Qsub

M&A in Brief Q4 2022 Nutter McClennen & Fish LLP JDSupra

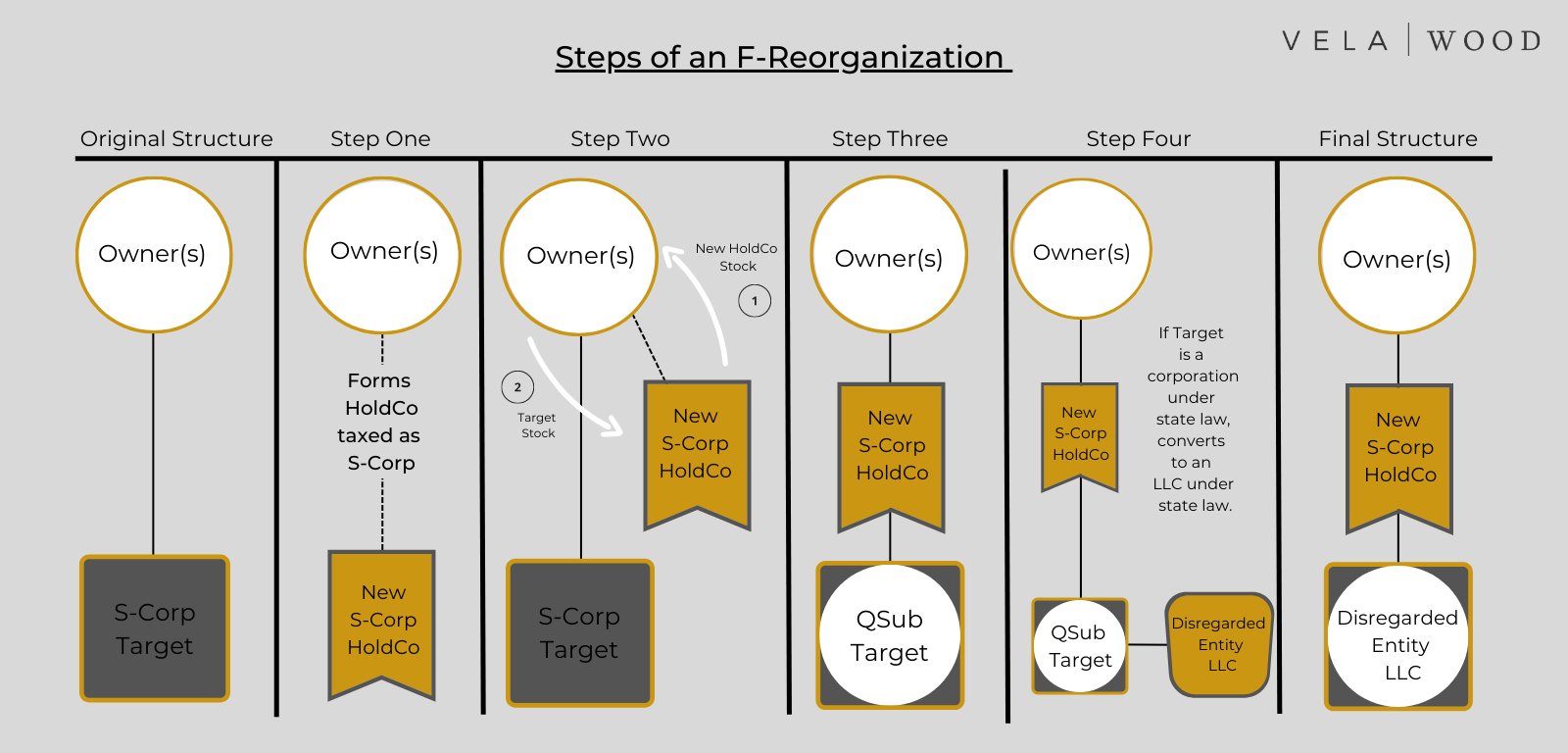

What is an Dallas & Austin Business Lawyers Vela Wood

What Is an “F” Campolo, Middleton & McCormick, LLP

Web An F Reorganization Falls Under The Irs Code Section 368(A)(1)(F) And Covers Changing A Business From One Type Of Form Or Filing Entity To Another.

This Allows A Business To Avoid.

Web Perhaps One Of The Most Frequently Executed Corporate Reorganizations Is The “F” Reorganization.

Related Post: