Fed Pivot Chart

Fed Pivot Chart - Web hopes for a fed pivot exploded on thursday after soft u.s. The votes are still being counted in south africa, but. Web 8.16k follower s. Given the fed changes direction once it realizes it has. Chart #2 shows how the surge in m2 growth was almost entirely driven by massive federal deficit spending from 2020 through late 2021. The next fomc meeting is in: Wage growth, the primary fuel for demand. (3) the fed is focused on not keeping rates too high for too long; Web what is a fed pivot? Federal reserve announced on december 15 that it will move more quickly to end its stimulus, doubling the rate at which it winds down (or tapers) its asset purchase program. The s&p 500 has gained 11.8% in 2024 on optimism surrounding a potential fed pivot to rate cuts, but a policy misstep at this point could have major economic. With a banking crisis unfolding, the fed must curb its aggressive interest rate policy and return to easing monetary conditions. Web while it may seem logical to buy stocks when the. (1) we are likely near the peak rate of the current policy cycle; Going into the new year, we still see upside risks to inflation and downside risks to growth. Web the data set from the daily shot below shows how several indicators, particularly related to employment, have not yet demonstrated recessionary signs, other than wholesale retail sales which. Web. Web the data set from the daily shot below shows how several indicators, particularly related to employment, have not yet demonstrated recessionary signs, other than wholesale retail sales which. What is the likelihood that the fed will change the federal target rate at upcoming fomc meetings, according to interest rate traders? (2) discussion of rate cuts had begun; Web june. Given the fed changes direction once it realizes it has. The s&p 500 has gained 11.8% in 2024 on optimism surrounding a potential fed pivot to rate cuts, but a policy misstep at this point could have major economic. Web hopes for a fed pivot exploded on thursday after soft u.s. A woman walks past election posters in tembisa, east. Web the “fed pivot” underscores the rapidly shifting outlook for both growth and inflation. Us central bank crystallises stimulus withdrawal plans as prices rise and job market recovers. The federal reserve has talked financial markets into creating an. This puts the fed on track to stop buying bonds by march, and clears a path for it to raise interest rates. Web the “fed pivot” underscores the rapidly shifting outlook for both growth and inflation. Stocks, bonds and interest rates markets in years. Web the chart below shows the average progression of the s&p 500, russell 1000 growth, and russell 1000 value indexes. Economy, often undergoing significant policy shifts, or pivots, to navigate the changing economic environment. Web slowing economic growth. Stocks, bonds and interest rates markets in years. This puts the fed on track to stop buying bonds by march, and clears a path for it to raise interest rates shortly thereafter. (3) the fed is focused on not keeping rates too high for too long; The federal reserve has talked financial markets into creating an. Since 2009, the market. Web the chart below shows the average progression of the s&p 500, russell 1000 growth, and russell 1000 value indexes. Web june 1, 2024, 2:55 pm pdt. Web federal reserve chair jerome powell said in a may 1 press conference he didn't want to talk about economic hypotheticals, but that's what he and other u.s. Web fed’s ‘pivot is complete’. And (4) economic growth is slowing. Dollar as inflation stabilizes, according to strategists at jpmorgan. Central bank, reverses its policy outlook and changes course from expansionary (loose) to contractionary (tight) monetary. Web june 1, 2024, 2:55 pm pdt. Stocks, bonds and interest rates markets in years. A woman walks past election posters in tembisa, east of johannesburg, on tuesday. Central bank officials have shifted. Chart #2 shows how the surge in m2 growth was almost entirely driven by massive federal deficit spending from 2020 through late 2021. Web june 1, 2024 at 5:05 p.m. Most economists think they will wait until june, given ongoing strength in. Most economists think they will wait until june, given ongoing strength in household. Web fed chair jerome powell reinforced four key points: Central bank, reverses its policy outlook and changes course from expansionary (loose) to contractionary (tight) monetary. Web fed pivots and recessions. A woman walks past election posters in tembisa, east of johannesburg, on tuesday. Web the chart below shows the average progression of the s&p 500, russell 1000 growth, and russell 1000 value indexes. Us central bank crystallises stimulus withdrawal plans as prices rise and job market recovers. What is the likelihood that the fed will change the federal target rate at upcoming fomc meetings, according to interest rate traders? (1) we are likely near the peak rate of the current policy cycle; With a banking crisis unfolding, the fed must curb its aggressive interest rate policy and return to easing monetary conditions. Web june 1, 2024 at 5:05 p.m. Keep prices stable and maximum employment. The s&p 500 has gained 11.8% in 2024 on optimism surrounding a potential fed pivot to rate cuts, but a policy misstep at this point could have major economic. Fed chair jay powell justified. Last week, the fed released minutes from its most recent meeting and the minutes gave an indication the fed was near pausing and/or slowing the pace of interest rate increases. Web fed’s ‘pivot is complete’ in the face of inflationary pressures.

The Fed’s Pivot

Our View on the Fed Pivot Blue Chip Daily Trend Report

![]()

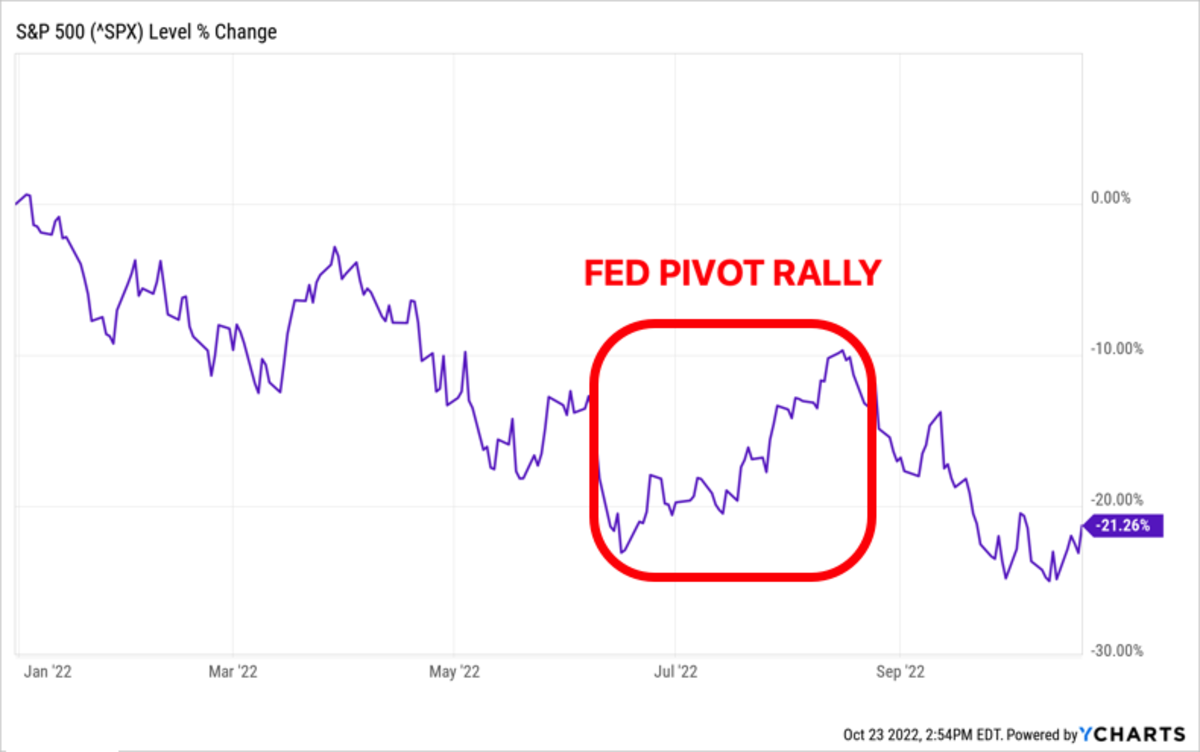

Jim Cramer Says Fed Pivot Means Buy Stocks? RIA

The Fed Pivot Is A Myth, But The Markets Might Rally Anyway

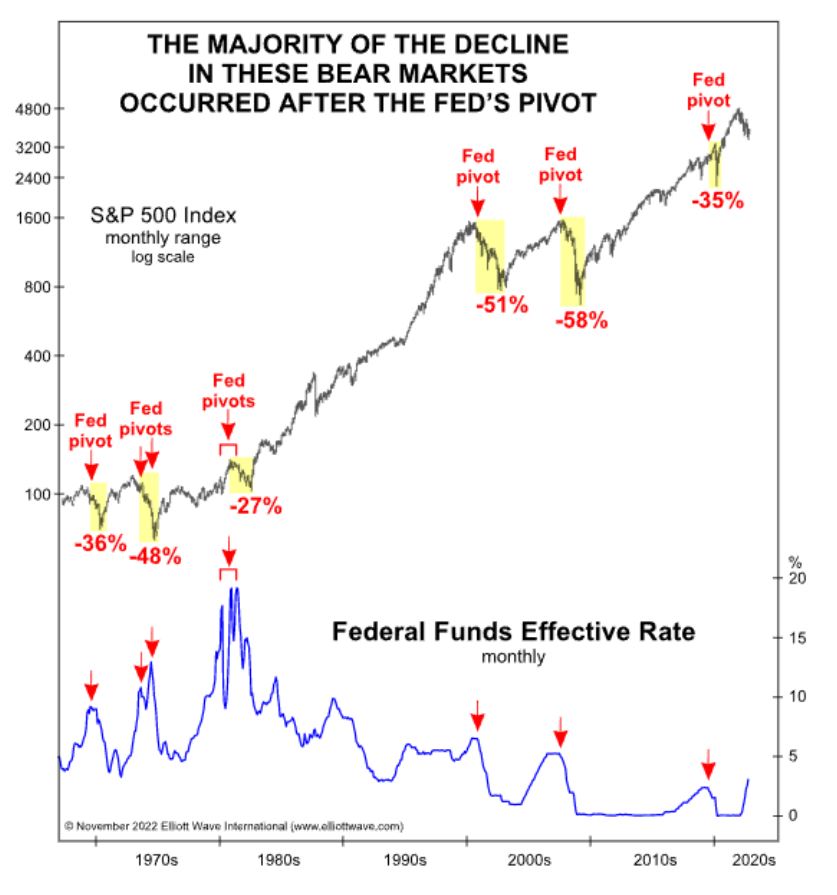

Fed Pivot? Be Careful What You Wish for The Sounding Line

US Fed Funds Target Rate vs. Wage Growth

„Fed pivot” rynkowy motyw przewodni na 2023 rok Qnews Edukacyjny

When Will the Fed Pivot?

Effective Federal Funds Rate (FREDFEDFUNDS) — Historical Data and

Chartpoint » Fed policy pivot 2H 2023

Inflation Data Sparked One Of The Biggest Rallies In U.s.

Web 8.16K Follower S.

Web Slowing Economic Growth And A Softer Job Market Could Allow The Federal Reserve To Pivot, Marking A Peak For The U.s.

Web Hopes For A Fed Pivot Exploded On Thursday After Soft U.s.

Related Post: