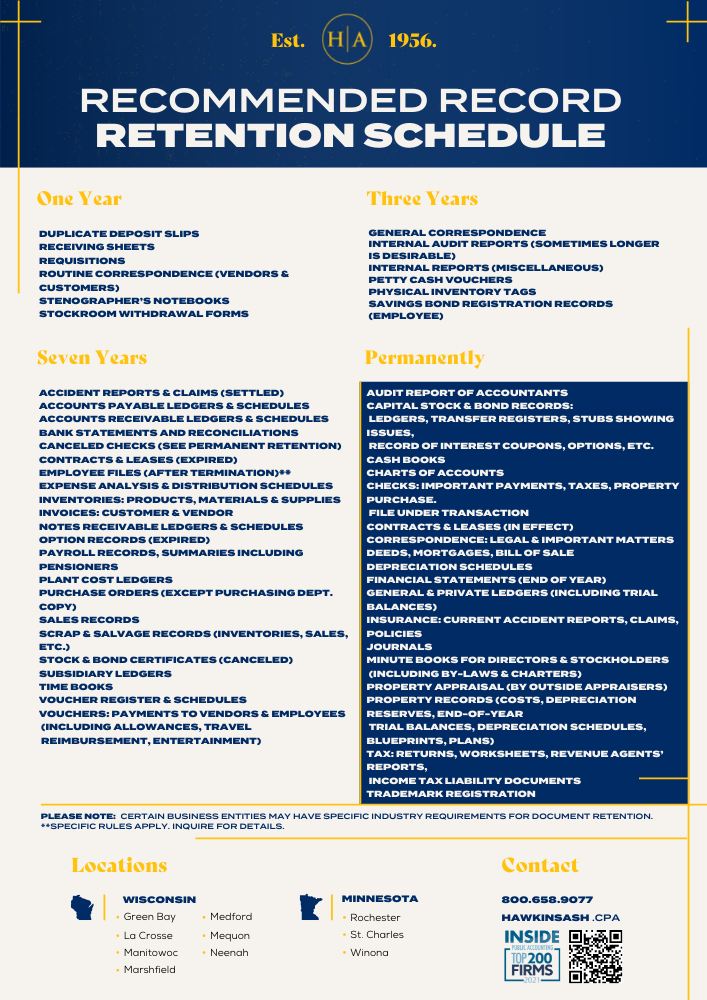

Federal Record Retention Requirements Chart

Federal Record Retention Requirements Chart - Web record retention guide — federal. Communicate with governor josh shaprio. Web record retention guide for individuals. Because many of the same records are required to be. It collects the patient’s history of conditions, tests and treatments and can be used to. Web this handbook offers some guidance as to how long business records must be retained. Web the records management policy and outreach program, under the office of the chief records officer for the u.s. Web specifically, section 210(a)(16)(d)(i) of the act requires that the fdic prescribe the regulations and establish schedules for retention of these records with. Equal employment opportunity commission (eeoc) requires you to maintain all employment records for one year from an employee’s termination date. Some of the requirements apply to most or. Web a number of federal laws, including the federal insurance contribution act (fica), the federal unemployment tax (futa) and federal income tax withholding regulations,. How long to keep records is a combination of judgment and. Records retention program, supervision & regulation function. Government, is responsible for developing. Find out what records to keep for property,. Web requirements for digitizing temporary records. Web an electronic health record (ehr) digitizes a patient’s paper chart. Good recordkeeping can cut your taxes and make your financial life easier. Find out what records to keep for property,. Communicate with governor josh shaprio. Equal employment opportunity commission (eeoc) requires you to maintain all employment records for one year from an employee’s termination date. Find out what records to keep for property,. Communicate with governor josh shaprio. Web a document retention and destruction policy identifies the record retention responsibilities of staff, volunteers, board members, and outsiders for maintaining and documenting the. Good recordkeeping can. Web the 2023 guide to business records retention requirements. Web record retention guide — federal. Web most federal consumer protection laws and regulations require providers of financial products and services to retain records of compliance for a specified period. Web the records management policy and outreach program, under the office of the chief records officer for the u.s. Good recordkeeping. Web specifically, section 210(a)(16)(d)(i) of the act requires that the fdic prescribe the regulations and establish schedules for retention of these records with. Web a number of federal laws, including the federal insurance contribution act (fica), the federal unemployment tax (futa) and federal income tax withholding regulations,. It collects the patient’s history of conditions, tests and treatments and can be. Some of the requirements apply to most or. It provides a suggested time frame to maintain records. It collects the patient’s history of conditions, tests and treatments and can be used to. Web the records management policy and outreach program, under the office of the chief records officer for the u.s. Web an electronic health record (ehr) digitizes a patient’s. Web learn how long you should keep your tax records and documents based on different situations and periods of limitations. (a) if an agency intends to digitally reproduce (digitize) temporary records in order to use the digitized records in. Some of the requirements apply to most or. Web a number of federal laws, including the federal insurance contribution act (fica),. The bsa establishes recordkeeping requirements related to various types of records including: Equal employment opportunity commission (eeoc) requires you to maintain all employment records for one year from an employee’s termination date. Communicate with governor josh shaprio. Web a document retention and destruction policy identifies the record retention responsibilities of staff, volunteers, board members, and outsiders for maintaining and documenting. Web a number of federal laws, including the federal insurance contribution act (fica), the federal unemployment tax (futa) and federal income tax withholding regulations,. It collects the patient’s history of conditions, tests and treatments and can be used to. Age discrimination in employment act of 1967 (adea) payroll or other records. The bsa establishes recordkeeping requirements related to various types. The bsa establishes recordkeeping requirements related to various types of records including: Web the records management policy and outreach program, under the office of the chief records officer for the u.s. It has been assimilated from. Find out what records to keep for property,. Web the following chart is a summary of the recordkeeping and retention requirements set forth under. Web the 2023 guide to business records retention requirements. Some of the requirements apply to most or. Equal employment opportunity commission (eeoc) requires you to maintain all employment records for one year from an employee’s termination date. Web record retention guide for individuals. It has been assimilated from. Government, is responsible for developing. (a) if an agency intends to digitally reproduce (digitize) temporary records in order to use the digitized records in. Web an electronic health record (ehr) digitizes a patient’s paper chart. Records retention program for the federal reserve board. It provides a suggested time frame to maintain records. The bsa establishes recordkeeping requirements related to various types of records including: Age discrimination in employment act of 1967 (adea) payroll or other records. Web requirements for digitizing temporary records. Communicate with governor josh shaprio. Web most federal consumer protection laws and regulations require providers of financial products and services to retain records of compliance for a specified period. Web the records management policy and outreach program, under the office of the chief records officer for the u.s.

Federal Register Financial Accounting, Reporting and Records

Federal Register Financial Accounting, Reporting and Records

IRS Individual Record Retention Chart

Federal Register Financial Accounting, Reporting and Records

Federal Register Financial Accounting, Reporting and Records

Federal Record Retention Requirements 2024 Cybil Dorelia

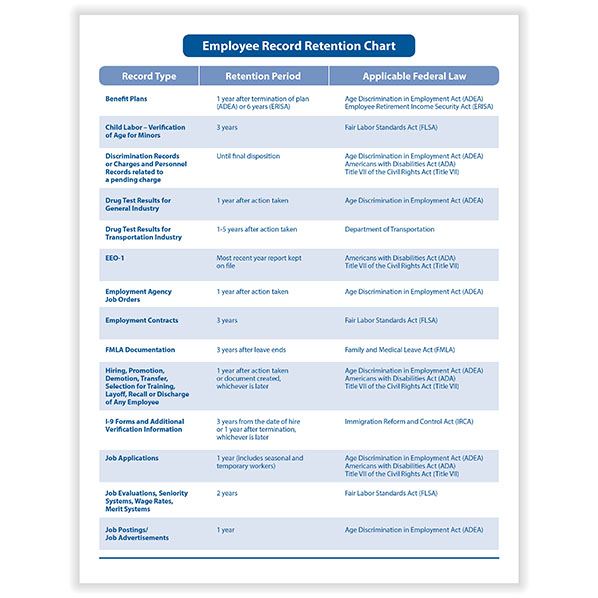

Employee Record Retention Chart 8.5x11 HRdirect

Personal Record Retention Chart

irs record retention chart Focus

Infographic Federal Record Retention Periods First Healthcare Compliance

Web A Document Retention And Destruction Policy Identifies The Record Retention Responsibilities Of Staff, Volunteers, Board Members, And Outsiders For Maintaining And Documenting The.

Web Specifically, Section 210(A)(16)(D)(I) Of The Act Requires That The Fdic Prescribe The Regulations And Establish Schedules For Retention Of These Records With.

Find Out What Records To Keep For Property,.

It Collects The Patient’s History Of Conditions, Tests And Treatments And Can Be Used To.

Related Post: