Form 1099 Printable

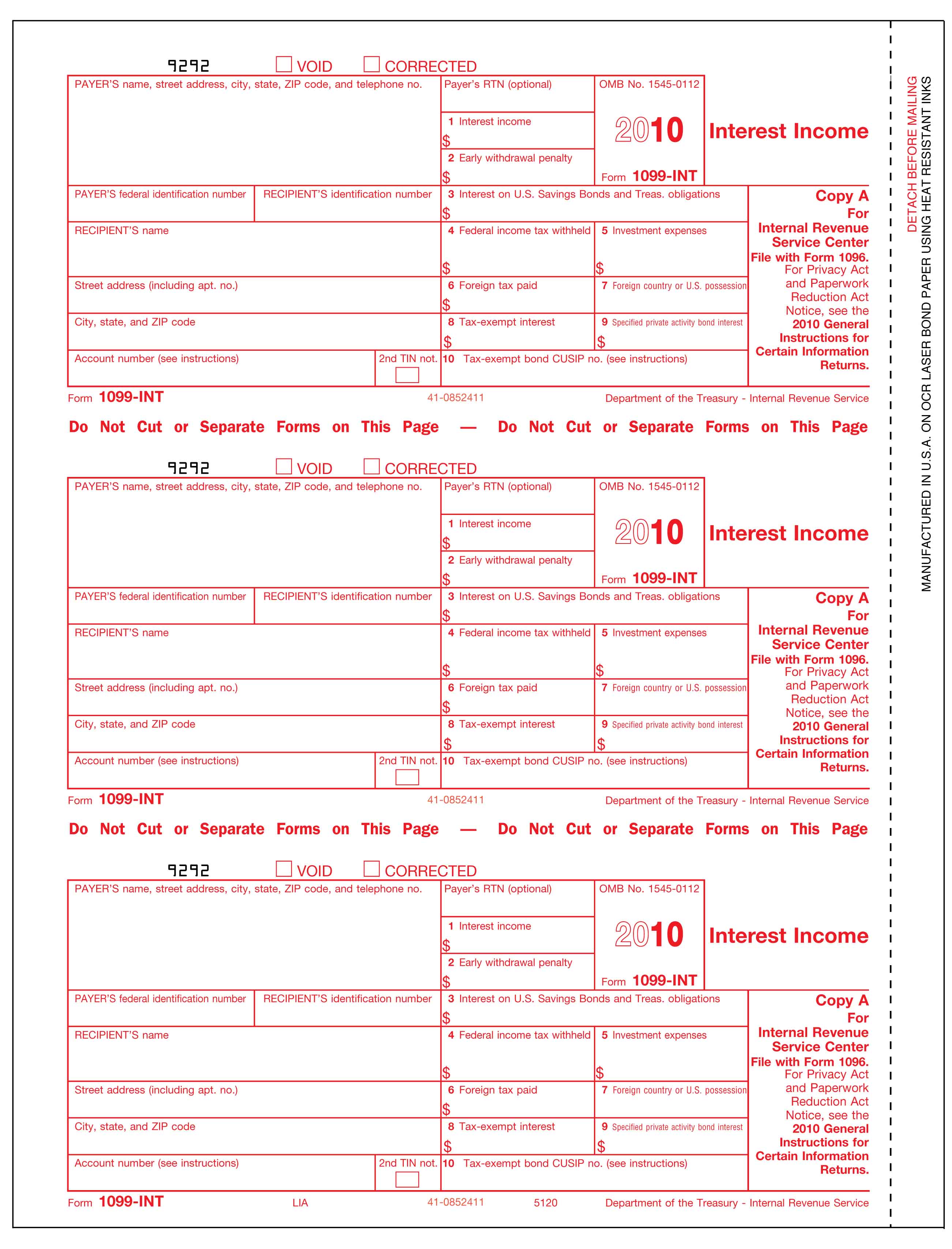

Form 1099 Printable - To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Web updated march 20, 2024. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Corrected for privacy act and paperwork reduction act notice, see the. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. For internal revenue service center. Web updated november 06, 2023. 1099 forms can report different types of incomes. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. 1099 forms can report different types of incomes. To ease statement furnishing requirements, copies b, 1, and 2. 1099 forms can report different types of incomes. Web updated november 06, 2023. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. For internal revenue service center. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Web updated november 06, 2023. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. 1099 forms can report different types of incomes. To ease statement furnishing requirements,. For internal revenue service center. Corrected for privacy act and paperwork reduction act notice, see the. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Form 1099. For internal revenue service center. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web updated november 06, 2023. Form 1099 is a collection of forms used to report payments that typically aren't from an employer.. Corrected for privacy act and paperwork reduction act notice, see the. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages,. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends,. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received. Web updated march 20, 2024. For internal revenue service center. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. 1099 forms can report different types of incomes. Payments above a specified dollar threshold for rents, royalties,. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. For internal revenue service center. Web updated march 20, 2024. Web updated november 06, 2023. To ease statement furnishing requirements, copies b, 1, and 2 have been. 1099 forms can report different types of incomes. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. For internal revenue service center. Web updated november 06, 2023. Web updated march 20, 2024. Corrected for privacy act and paperwork reduction act notice, see the. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form.

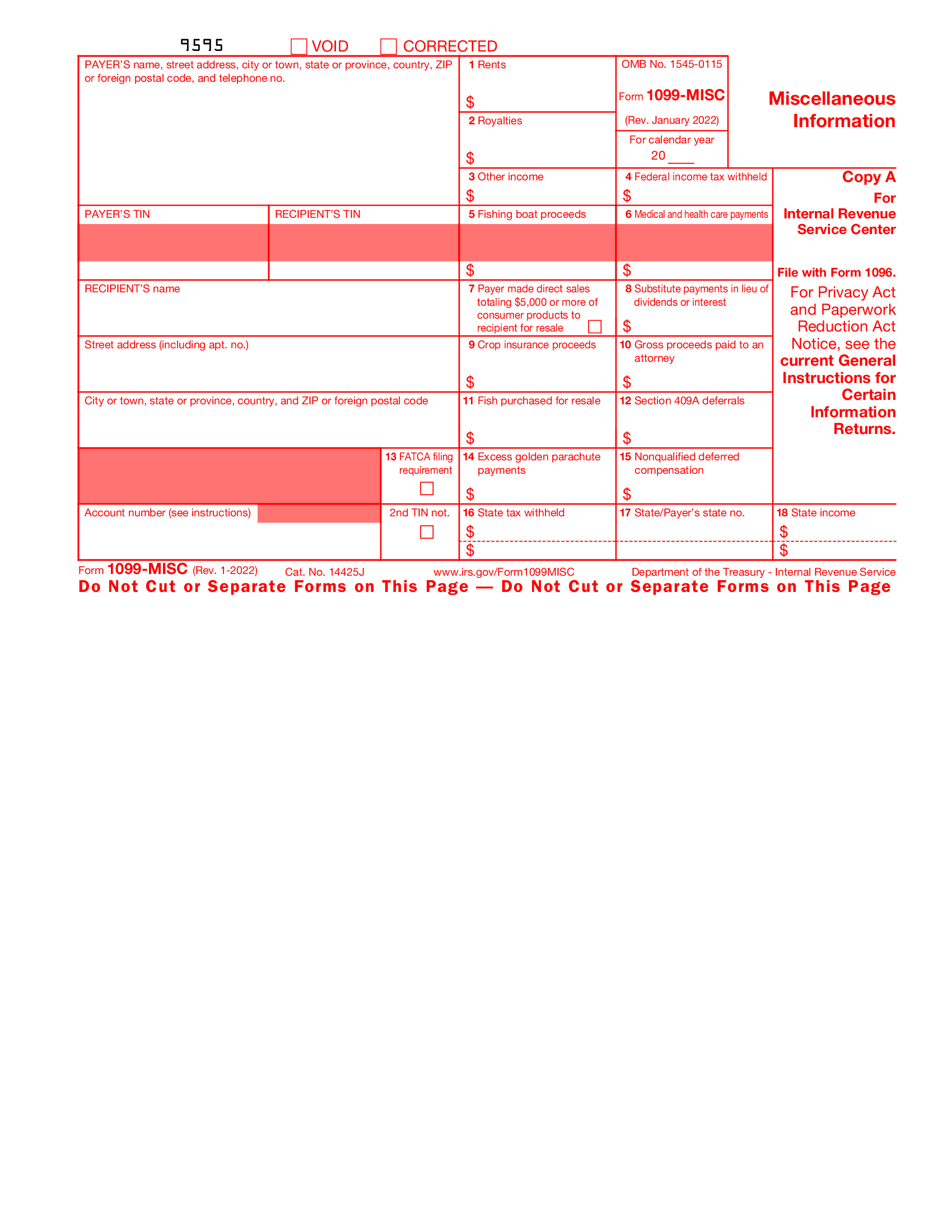

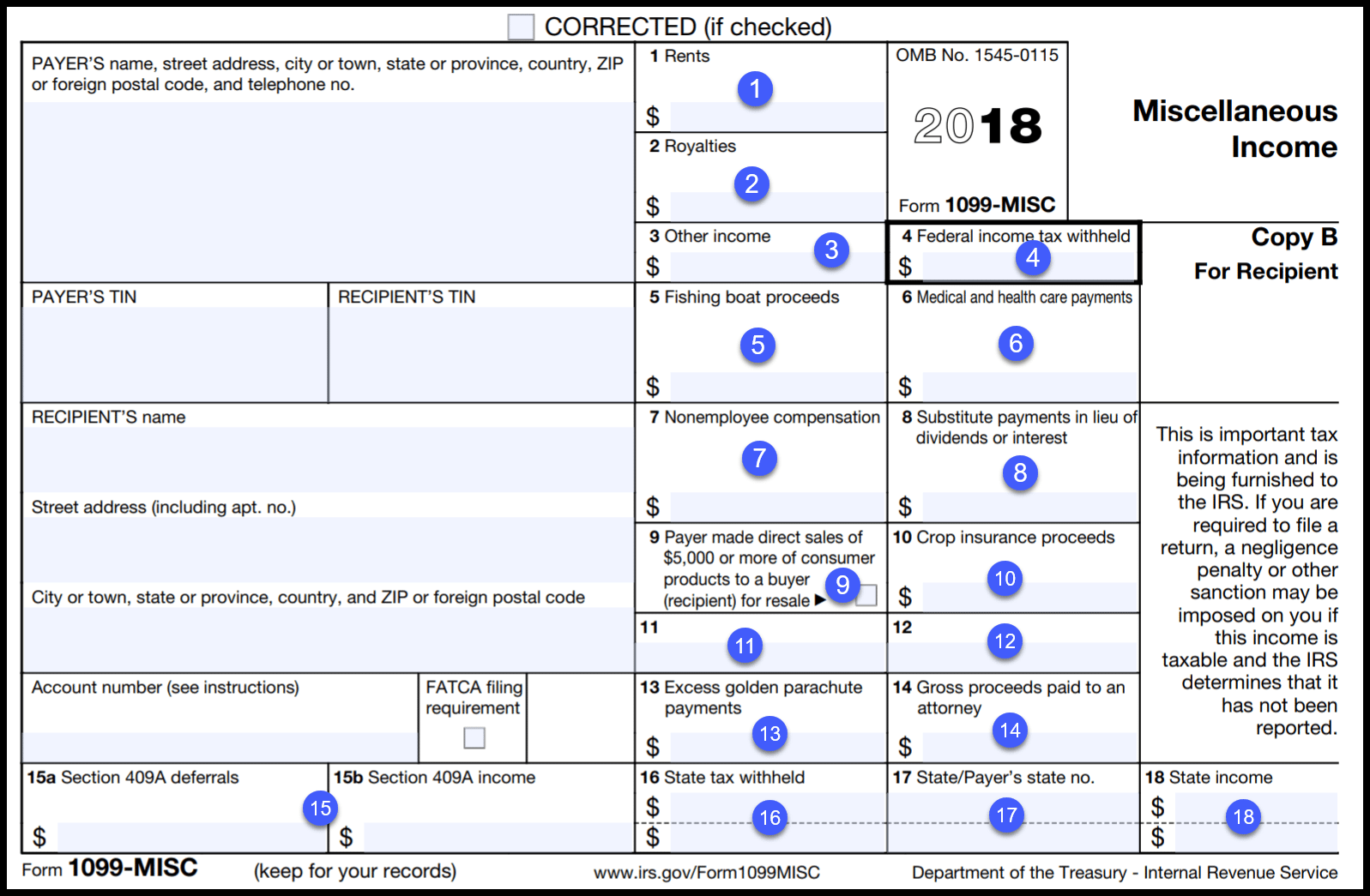

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Fillable 1099 Misc Irs 2022 Fillable Form 2024

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

1099 Form Template. Create A Free 1099 Form Form.

![]()

Printable 1099 Form Pdf Free Printable Download

1099 Printable Forms

1099 Irs Form Printable Printable Forms Free Online

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

1099 Format, 1099 Forms, 1099 Tax Forms Print Forms

To Ease Statement Furnishing Requirements, Copies B, 1, And 2 Have Been Made Fillable Online In A Pdf Format Available At Irs.gov/Form1099Misc And Irs.gov/Form1099Nec.

These Can Include Payments To Independent Contractors, Gambling Winnings, Rents, Royalties, And More.

Related Post: