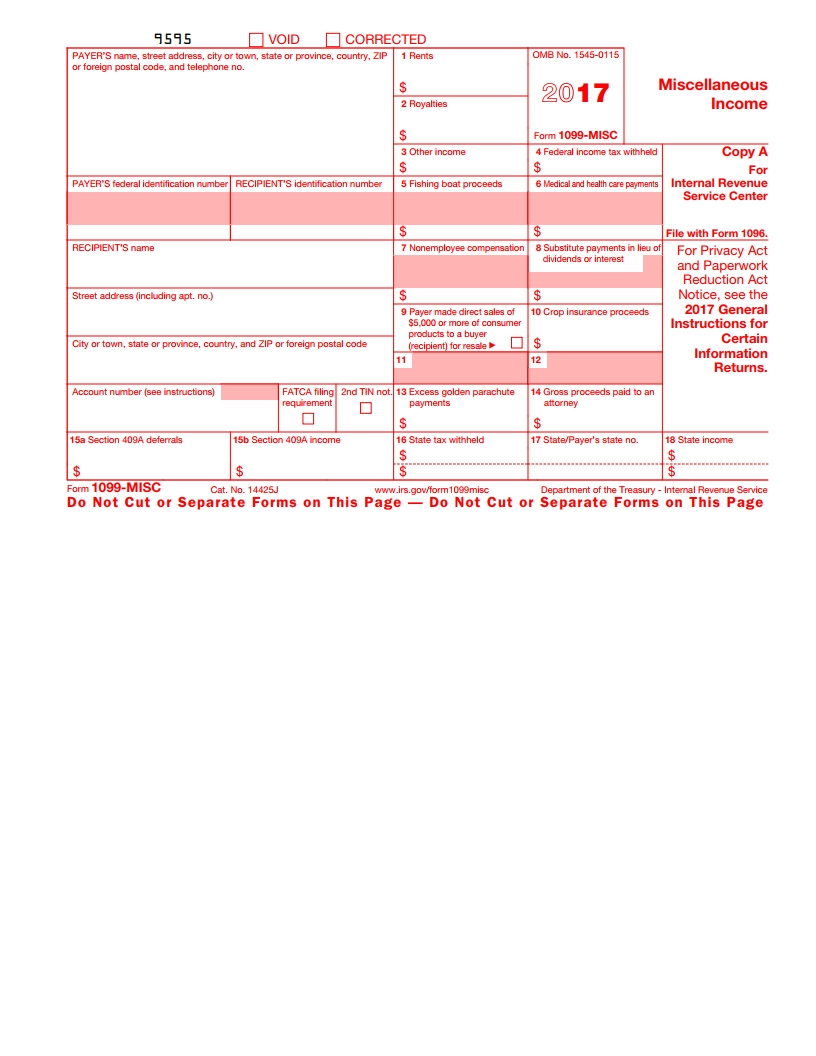

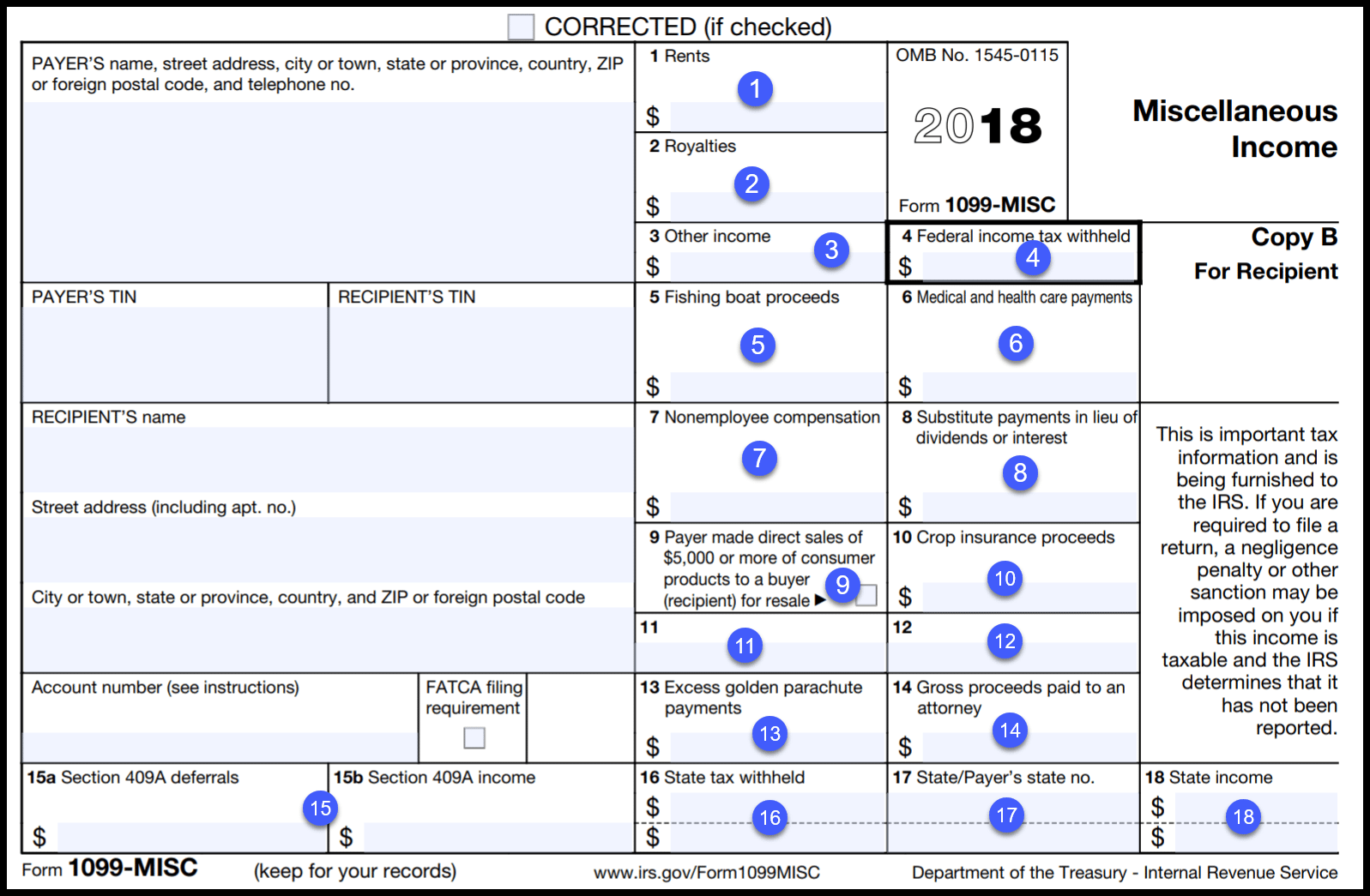

Free 1099 Printable Form

Free 1099 Printable Form - You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Known as the information returns intake system (iris), this free electronic filing service is secure, accurate and requires no special software. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or. Receipts, invoices and any other payment information. The 1099 form is a common irs form covering several potentially taxable income situations. Persons with a hearing or speech disability with access to tty/tdd equipment can. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Their full legal name and address. Printing 1099s from sage 50. Receipts, invoices and any other payment information. Persons with a hearing or speech disability with access to tty/tdd equipment can. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you. Can you print 1099s on plain paper? Known as the information returns intake system (iris), this free electronic filing service is secure, accurate and requires no special software. Persons with a hearing or speech disability with access to tty/tdd equipment can. The 1099 form is a common irs form covering several potentially taxable income situations. Once you've received your copy of the form, you'll want to familiarize. The 1099 form is a common irs form covering several potentially taxable income situations. Known as the information returns intake system (iris), this free electronic filing service is secure, accurate and requires no special software. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Where to order printable 1099 forms. Getting a 1099 form doesn't mean. Receipts, invoices and any other payment information. How to print 1099s from a spreadsheet. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web updated november 06, 2023. Where to order printable 1099 forms. What is the difference between. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. When should you print and send your 1099s? Known as the information returns intake system (iris), this free electronic filing service is secure, accurate and requires no special software. Once you've received your copy of the form, you'll. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web updated march 20, 2024. A 1099 is a type of form that shows income you received that wasn't from your employer. Gather information for all of your payees. When should. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Web click to expand. Web washington — the internal revenue service announced today that businesses can now file form 1099 series information returns using a new online portal, available free from the irs. Form 1099 is. Web updated november 06, 2023. What to do before you print your 1099s. How to print 1099s from a pdf. A 1099 is a type of form that shows income you received that wasn't from your employer. Persons with a hearing or speech disability with access to tty/tdd equipment can. How to print 1099s from a spreadsheet. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. However, the issuer has reported your. You can complete these copies online for furnishing statements to recipients and for retaining. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or. What is the difference between. 1099 forms can report different types of incomes. A 1099 is a type of form that shows income you received that wasn't from your employer. When should you print and send your 1099s? Web updated march 20, 2024. Persons with a hearing or speech disability with access to tty/tdd equipment can. Receipts, invoices and any other payment information. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. What to do before you print your 1099s. Known as the information returns intake system (iris), this free electronic filing service is secure, accurate and requires no special software. How to print 1099s from quickbooks. File to download or integrate. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you. Web updated november 06, 2023. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Web updated february 09, 2024. Web click to expand. However, the issuer has reported your. How to print 1099s from a pdf.

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Irs 1099 Printable Form Printable Forms Free Online

![]()

Printable 1099 Form Pdf Free Printable Download

Free Printable Irs 1099 Misc Form Printable Forms Free Online

1099 Form Template. Create A Free 1099 Form Form.

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099

1099 Printable Forms

Free Fillable And Printable 1099 Forms

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

1099 Irs Form Printable Printable Forms Free Online

What Is The Difference Between.

Web Washington — The Internal Revenue Service Announced Today That Businesses Can Now File Form 1099 Series Information Returns Using A New Online Portal, Available Free From The Irs.

Persons With A Hearing Or Speech Disability With Access To Tty/Tdd Equipment Can.

Depending On What’s Happened In Your Financial Life During The Year, You Could Get One Or More 1099 Tax Form “Types” Or.

Related Post: