Hammer Chart Pattern

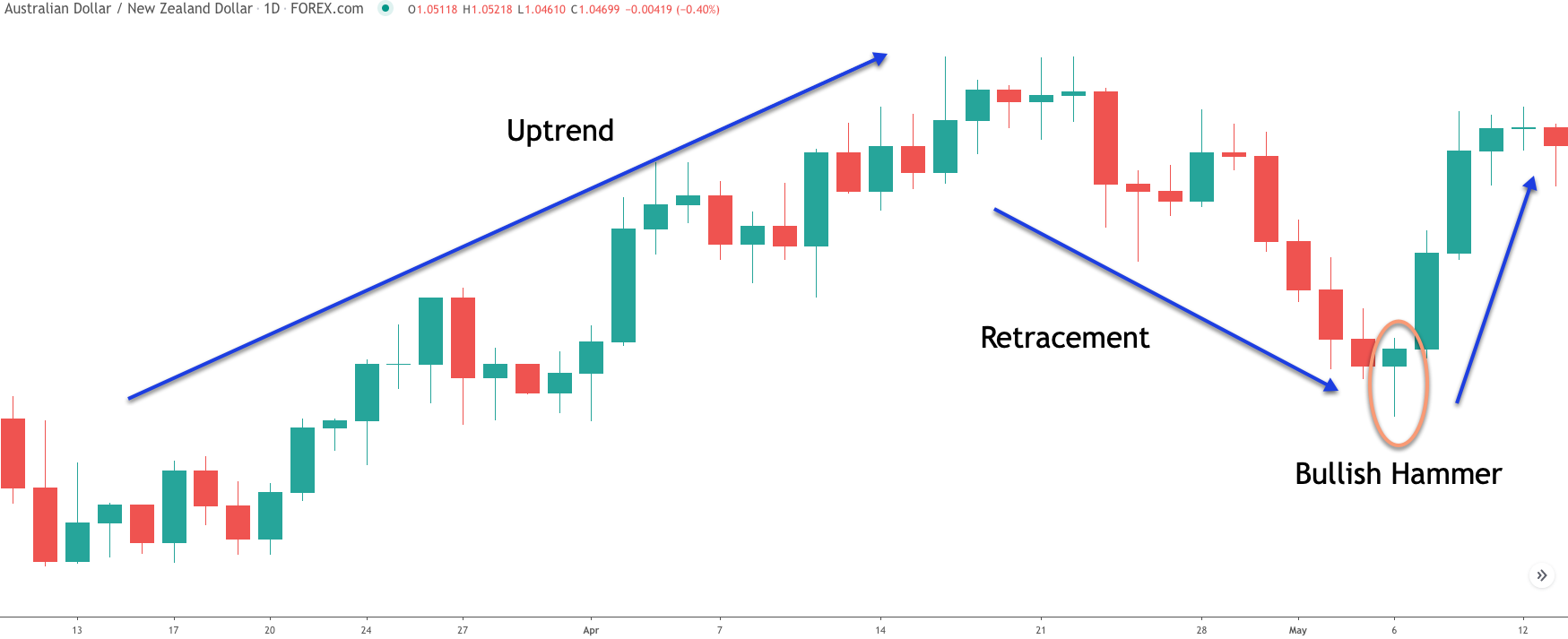

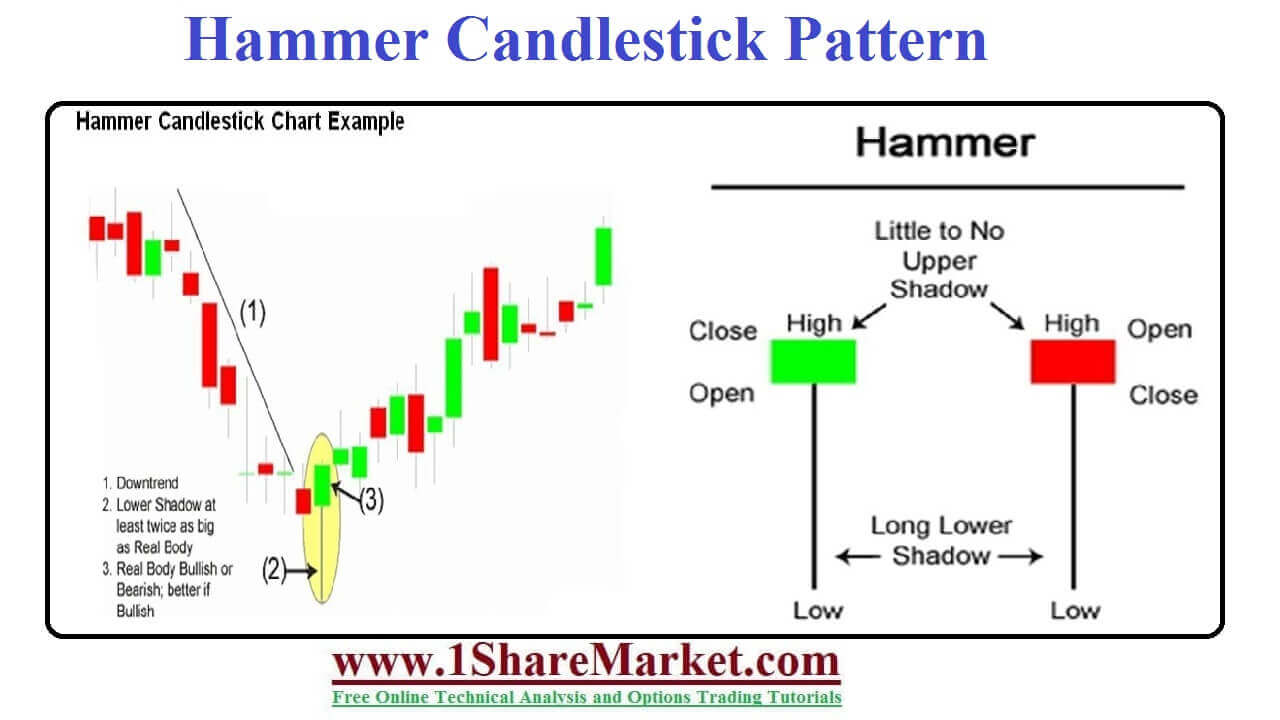

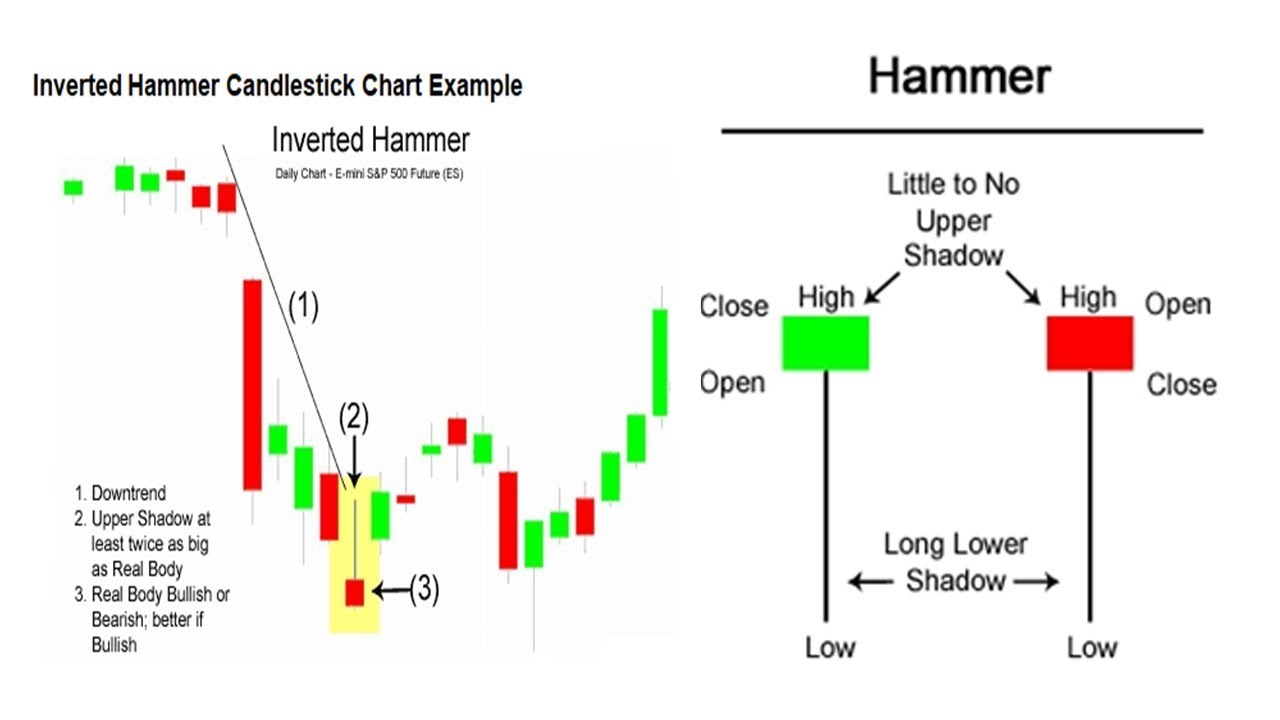

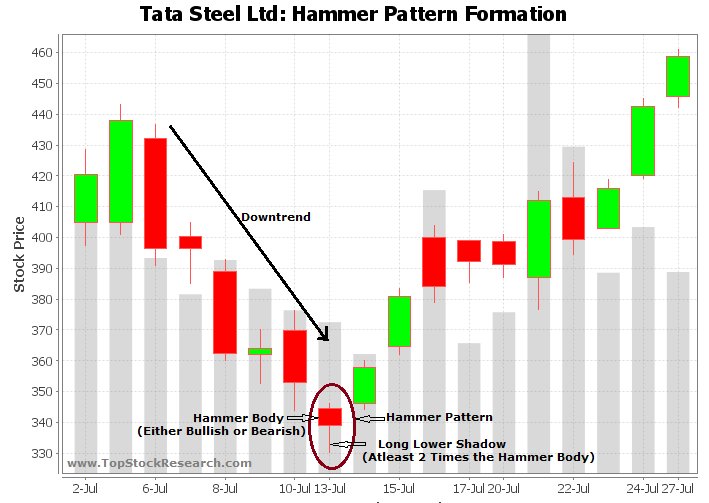

Hammer Chart Pattern - The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. So, it could witness a trend re… Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential trend reversals in various financial markets. Web learn how to identify, trade, and use the hammer candlestick pattern, a bullish reversal signal in japanese candlestick analysis. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. What does the inverted hammer look like? Web learn what a hammer candlestick is and how to use it to identify a potential price reversal to the upside. In this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. Discover the types, benefits, and common mistakes of this chart formation. You will improve your candlestick analysis skills and be able to apply them in trading. Web learn what a hammer candlestick is and how to use it to identify a potential price reversal to the upside. Find out the types, pros and cons, and strategies of this powerful indicator. Traders use this pattern as an early indication that the previous is about to reverse and to identify a reliable price level to open a buy. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body. Irrespective of the colour of the body, both examples in the photo above are hammers. The longer, the lower shadow, the more bullish the pattern. However, a hammer chart pattern was formed. Web tellurian (tell) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. Web learn how to identify and use the hammer candlestick pattern, a bullish reversal signal at the bottom of a downtrend. What does the inverted hammer look like? Find out what the hammer means, how to use it with other indicators. Discover the types, benefits, and common mistakes of this chart formation. Find out the types, pros and cons, and strategies of this powerful indicator. Find out the advantages, limitations and examples of the hammer candle pattern and how to trade it. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during. Find out the types, pros and cons, and strategies of this powerful indicator. Like any other candlestick pattern, it can be particularly useful in tracking price action for the purpose of setting up trades. Fact checked by lucien bechard. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. In this. The longer, the lower shadow, the more bullish the pattern. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. So, it could witness a trend re… Web learn how to identify and trade the hammer candlestick pattern,. Discover the types, benefits, and common mistakes of this chart formation. Web learn how to identify and trade the hammer candlestick pattern, a bullish reversal signal that forms at a swing low. Web learn how to identify and use the hammer candle, a bullish reversal signal in forex trading. You will improve your candlestick analysis skills and be able to. The information below will help you identify this pattern on the charts and predict further price dynamics. Web the bullish hammer is a significant candlestick pattern that occurs at the bottom of the trend. However, a hammer chart pattern was formed in its last trading session. Web learn how to identify and use the hammer candlestick pattern, a bullish reversal. Web 11h • 3 min read. Discover the types, benefits, and common mistakes of this chart formation. Like any other candlestick pattern, it can be particularly useful in tracking price action for the purpose of setting up trades. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can. Irrespective of the colour of the body, both examples in the photo above are hammers. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. See an example of a hammer pattern and how to confirm it with another candlestick. Web in this guide to understanding the hammer candlestick. Web in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss how to trade on a hammer. Web hammer candlestick patterns are chart formations that indicate a potential reversal in price after a major decline. Irrespective of the colour of the body, both examples in the photo above are hammers. In this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. Web updated may 11, 2024. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web learn how to identify, trade, and use the hammer candlestick pattern, a bullish reversal signal in japanese candlestick analysis. Web learn how to identify and use the hammer candle, a bullish reversal signal in forex trading. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Web learn how to identify and trade the hammer candlestick pattern, a bullish reversal signal that forms at a swing low. Find out the types, pros and cons, and strategies of this powerful indicator. Web learn how to identify and trade hammer candlestick patterns, which signal a potential bullish reversal after a downtrend. Web the hammer pattern is a crucial technical analysis tool used by traders to identify potential trend reversals in various financial markets. Amex:tell have been struggling lately and have lost 13.8% over the past week. Web tellurian (tell) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. Web learn what a hammer candlestick is and how to use it to identify a potential price reversal to the upside.

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

Inverted Hammer Candlestick Pattern Quick Trading Guide

What is a Hammer Candlestick Chart Pattern? NinjaTrader

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

Hammer candlestick pattern Defination with Advantages and limitation

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Pattern Trading Guide Candlestick patterns, Stock

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

Tutorial on Hammer Candlestick Pattern

Web Learn How To Identify And Use The Hammer Candlestick Pattern, A Bullish Reversal Signal At The Bottom Of A Downtrend.

Traders Use This Pattern As An Early Indication That The Previous Is About To Reverse And To Identify A Reliable Price Level To Open A Buy Trade.

Discover The Types, Benefits, And Common Mistakes Of This Chart Formation.

Find Out What The Hammer Means, How To Use It With Other Indicators And Factors, And How It Differs From The Hanging Man Pattern.

Related Post: