Hammer Pattern Chart

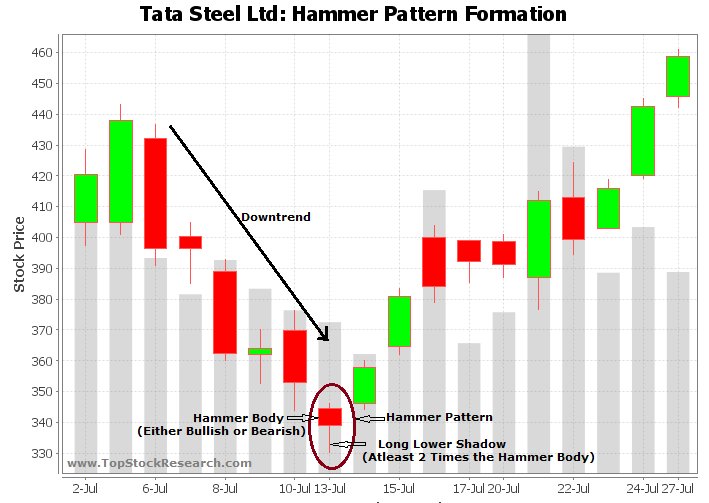

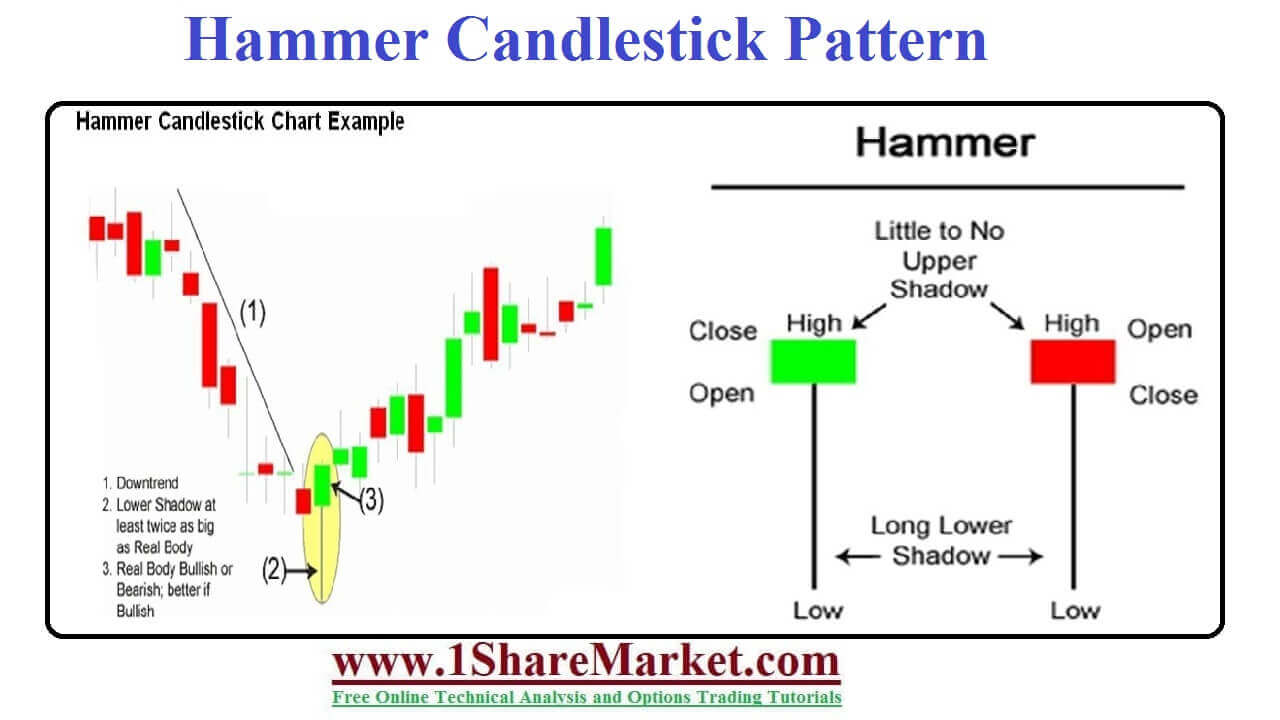

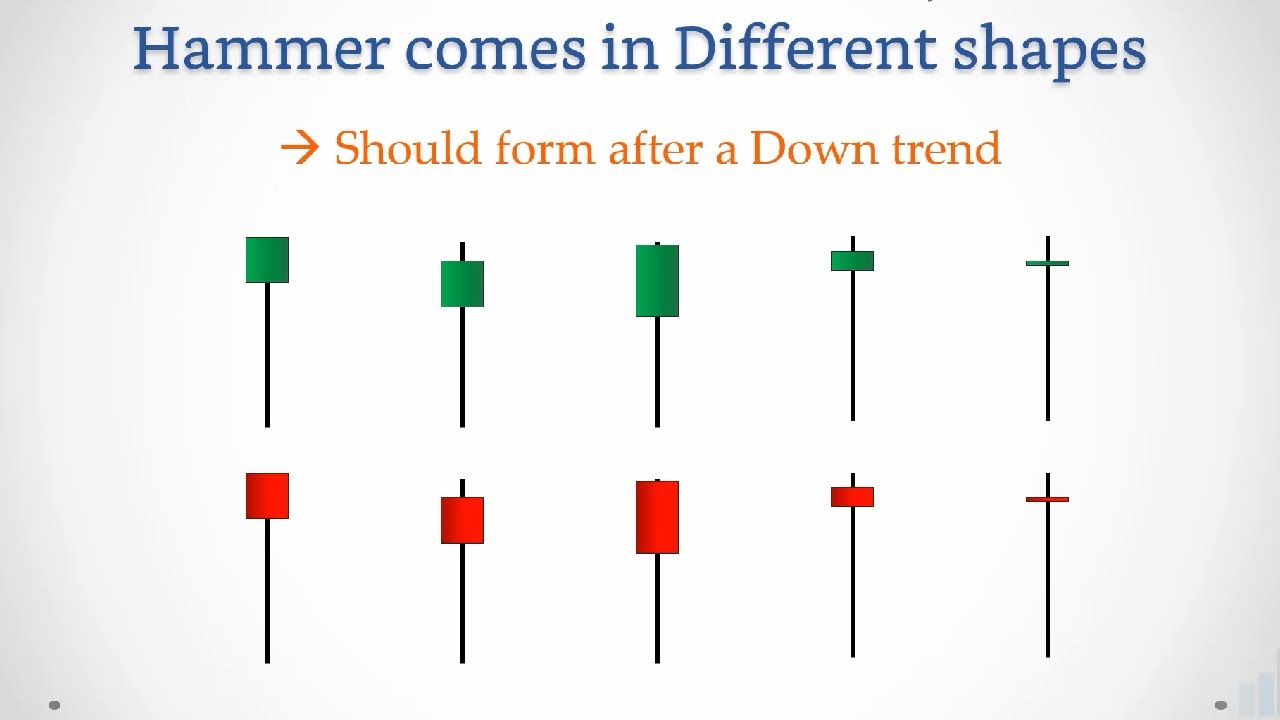

Hammer Pattern Chart - Web carlsberg (cabgy) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. In japanese, it is called takuri meaning feeling the bottom with your foot or trying to measure the depth. the hammer is a classic bottom reversal pattern. As its name implies, the hammer candlestick formation is considered a viable way of following bullish trends or nailing the. Hammer candlestick pattern is a bullish reversal candlestick pattern. Web the hammer pattern consists of a single candlestick that is called an umbrella line because of its form or shape. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. It is formed when a security trades significantly lower than its opening price but rallies to. Web the hammer chart pattern is a single candlestick formation that is used to project bullish trends and identify potential reversals. Web if the pattern appears in a chart with an upward trend indicating a bearish reversal, it is called the hanging man. Technical/fundamental analysis charts & tools. Web the hammer pattern consists of a single candlestick that is called an umbrella line because of its form or shape. This article will focus on the famous hammer candlestick pattern. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Recognizing and correctly. Hammer patterns are one of the most reliable reversal signals you can use in your trading strategy. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end. Trading strategies for forex traders. Hammer candlestick pattern is a bullish reversal candlestick pattern. It is often referred to as a bullish pin bar, or bullish. Trading strategies for forex traders. Technical/fundamental analysis charts & tools. As its name implies, the hammer candlestick formation is considered a viable way of following bullish trends or nailing the. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. Web if the pattern appears in a chart with an upward trend indicating a. Web the hammer is a highly significant bullish reversal candlestick pattern in technical analysis that can signal a potential reversal in price trends. Technical/fundamental analysis charts & tools. Hammer candlestick pattern is a bullish reversal candlestick pattern. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end. Web the hammer candle is another. Web the hammer chart pattern is a single candlestick formation that is used to project bullish trends and identify potential reversals. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web hammer technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. If it appears in a downward trend indicating a bullish reversal, it is a hammer. Financial data sourced. An umbrella line has the shape of an open umbrella with a short real body located at the upper end of the price range, and very little or no upper shadow, and. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. It is formed when a security trades significantly lower. It is formed when a security trades significantly lower than its opening price but rallies to. Hammer candlestick pattern is a bullish reversal candlestick pattern. Web the hammer pattern consists of a single candlestick that is called an umbrella line because of its form or shape. Recognizing and correctly interpreting this pattern can provide traders with a powerful tool for. Bullish engulfing (2) piercing pattern (2) bullish harami (2) hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the. Web the hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. An umbrella line has the shape of an open umbrella with a short real body located at the upper end of the price. Web in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss how to trade on a hammer. As its name implies, the hammer candlestick formation is considered a viable way of following bullish trends or nailing the. At its. If it appears in a downward trend indicating a bullish reversal, it is a hammer. Web in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss how to trade on a hammer. Web below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. It is often referred to as a bullish pin bar, or bullish rejection candle. It’s a bullish reversal candlestick pattern, which indicates the end of a downtrend and the start of a new uptrend. As it is a bullish reversal candlestick pattern, it occurs at the bottom of a downtrend. Trading strategies for forex traders. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Technical/fundamental analysis charts & tools. Hammer candlestick pattern is a bullish reversal candlestick pattern. Financial data sourced from cmots internet technologies pvt. Recognizing and correctly interpreting this pattern can provide traders with a powerful tool for identifying opportunities to enter or. In japanese, it is called takuri meaning feeling the bottom with your foot or trying to measure the depth. the hammer is a classic bottom reversal pattern. This article will focus on the famous hammer candlestick pattern. Web the hammer pattern consists of a single candlestick that is called an umbrella line because of its form or shape.

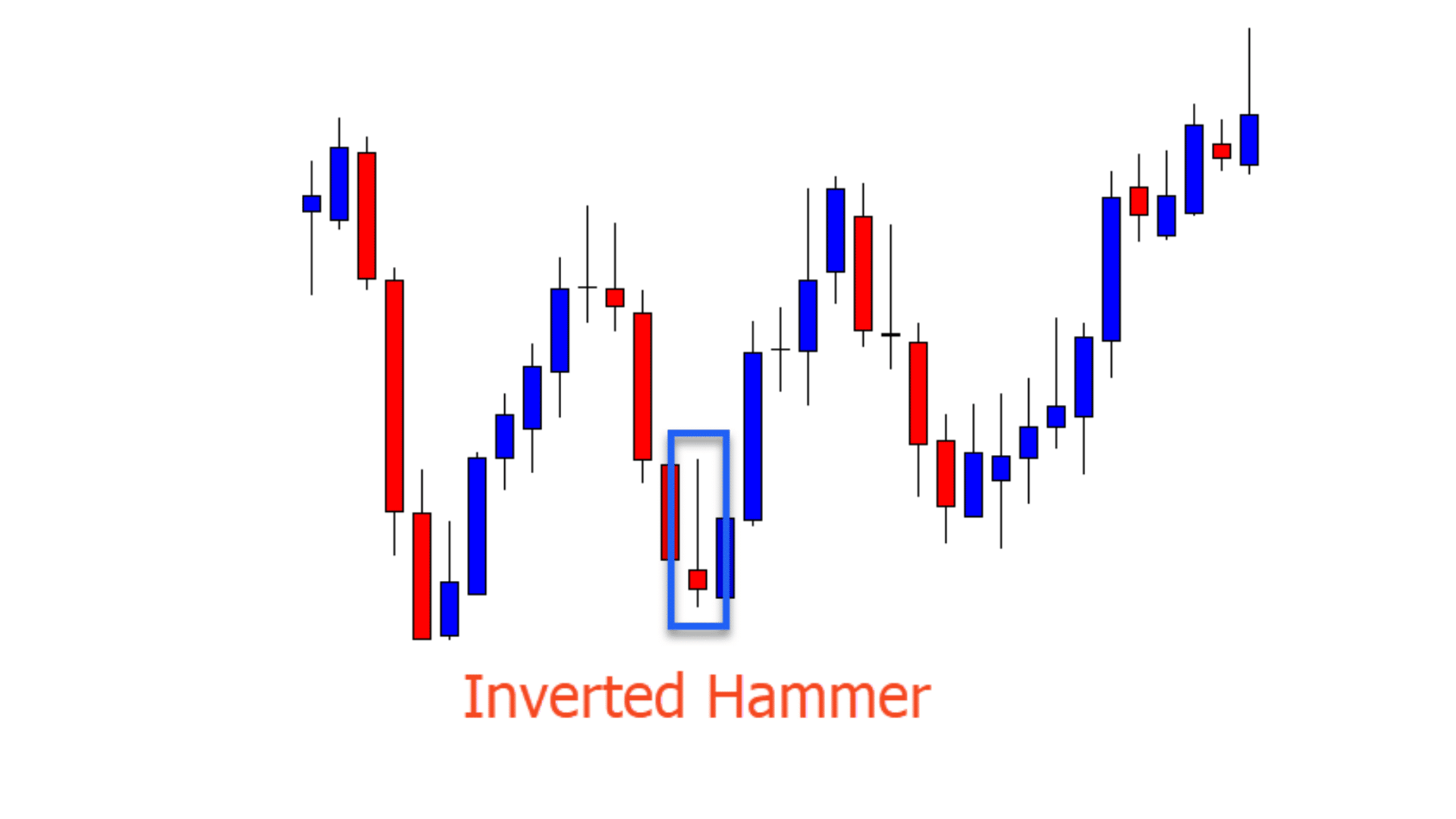

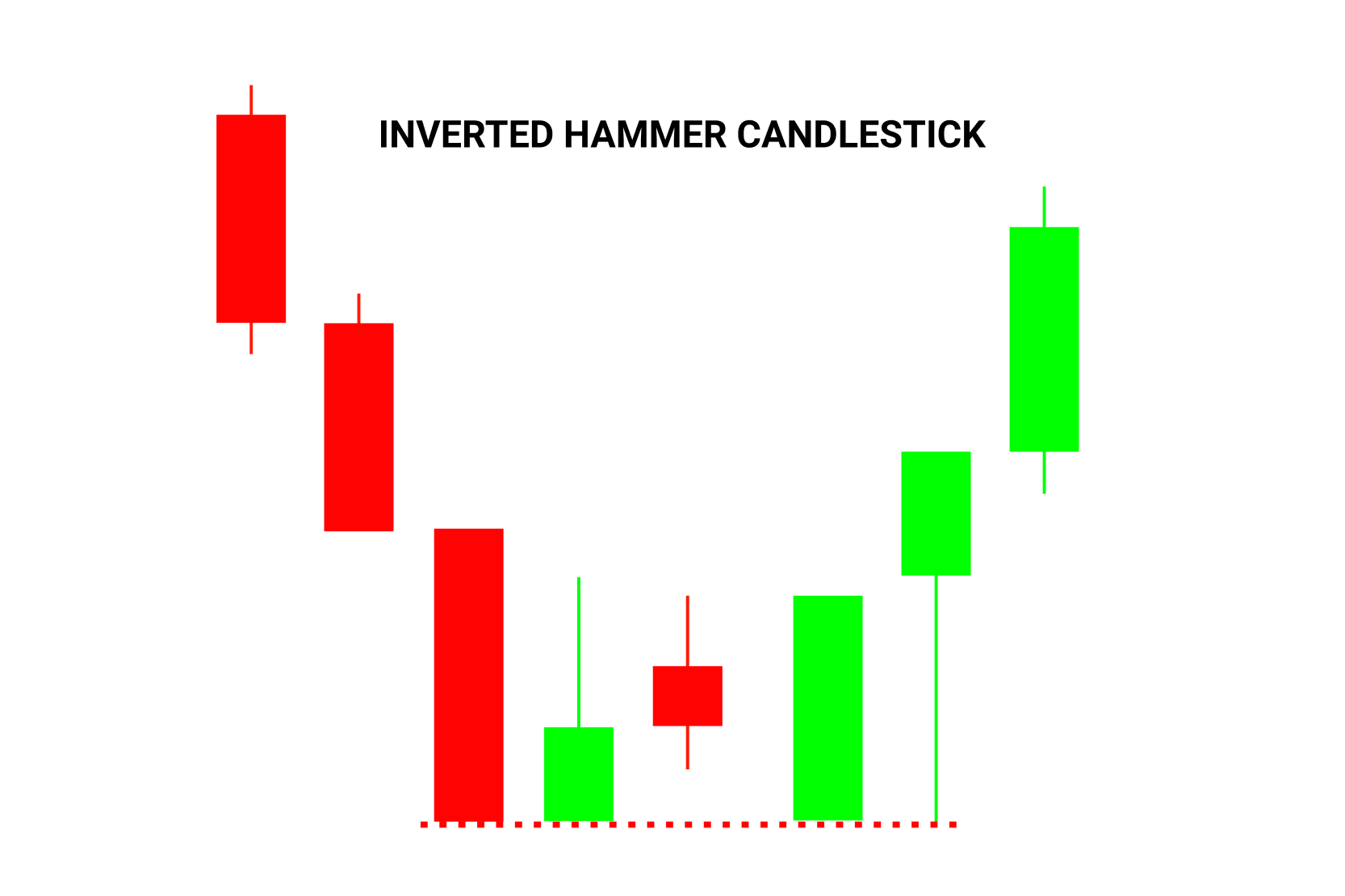

Inverted Hammer Candlestick Pattern Quick Trading Guide

Hammer Candlesticks Chart Patterns ThinkMarkets UK

Tutorial on Hammer Candlestick Pattern

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick Pattern Trading Guide

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Hammer candlestick pattern Defination with Advantages and limitation

Hammer Candlestick Pattern Trading Guide

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

At Its Core, The Hammer Pattern Is Considered A Reversal Signal That Can Often Pinpoint The End.

Web The Hammer Chart Pattern Is A Single Candlestick Formation That Is Used To Project Bullish Trends And Identify Potential Reversals.

Web The Hammer Is A Highly Significant Bullish Reversal Candlestick Pattern In Technical Analysis That Can Signal A Potential Reversal In Price Trends.

Web Carlsberg (Cabgy) Witnesses A Hammer Chart Pattern, Indicating Support Found By The Stock After Losing Some Value Lately.

Related Post: