Irs 4868 Printable Form

Irs 4868 Printable Form - Where to file a paper. Citizen or resident files this form to request. Money back guaranteecancel anytimetrusted by millionsfree mobile app Web how to file a tax extension with form 4868. My extension was rejected for the wrong agi. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. Circumstances may keep you from filing on time. Go to www.freetaxusa.com to start your free return today! Special rules may apply if you are: When you log in to the return, you will first have to complete the personal information section of the program. Web you can obtain form 4868 on the irs website and interactively complete it online, print it, and mail it. 2023 — federal law requires a person to report cash transactions of more than $10,000 by filing form 8300, report of cash payments over $10,000. Web irs form 4868, also called the “application for automatic extension of time to file. Where to file a paper form 4868. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. Web all you need to do is submit form 4868. Mail in the paper irs form 4868. Web 2022 tax federal extension form. Web form 4868, also known as the application for automatic extension of time to file u.s. There are two methods for printing form 4868 application for automatic extension of time to file u.s. Where to file a paper. Irs form 4868 only has nine lines or boxes,. My extension was rejected for the wrong agi. Web 2022 tax federal extension form. Web form 8868, appeals tools. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. Web irs form 4868, also called the “application for automatic extension of time to file u.s. Web all you need to do is submit. Money back guaranteecancel anytimetrusted by millionsfree mobile app Web form 4868 is the irs form you complete to receive an automatic extension to file your return. Web how do i complete my federal extension (form 4868)? Web how to file a tax extension with form 4868. For state tax extensions, see how do i file an extension for my personal. Web you can obtain form 4868 on the irs website and interactively complete it online, print it, and mail it. Special rules may apply if you are: Web complete form 4868 to use as a worksheet. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much. Web 2022 tax federal extension form. Web complete form 4868 to use as a worksheet. There are two methods for printing form 4868 application for automatic extension of time to file u.s. Where to file a paper. My extension was rejected for the wrong agi. You have two options to submit your irs form 4868. You can file a tax extension online in one of several ways with h&r block. Web 2022 tax federal extension form. Web form 4868, also known as the application for automatic extension of time to file u.s. Go to www.freetaxusa.com to start your free return today! Irs form 4868 only has nine lines or boxes,. You have two options to submit your irs form 4868. When you log in to the return, you will first have to complete the personal information section of the program. Web 2022 tax federal extension form. My extension was rejected for the wrong agi. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. When you log in to the return, you will first have to complete the personal information section of the program. My extension was rejected for the wrong agi. Go to www.freetaxusa.com to start your free. Tax filers can use irs free file to request an extension electronically. Where to file a paper form 4868. But if you prefer to mail a paper version of the. Web form 4868 is the irs form you complete to receive an automatic extension to file your return. Web complete form 4868 to use as a worksheet. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. Web filing the irs form 4868 for 2022 printable or online is mandatory for those individuals and businesses that need to file a federal tax return but need an extension of time to do so. Web irs form 4868, application for automatic extension of time to file. You have two options to submit your irs form 4868. For state tax extensions, see how do i file an extension for my personal state taxes? Web irs form 4868, also called the “application for automatic extension of time to file u.s. 2023 — federal law requires a person to report cash transactions of more than $10,000 by filing form 8300, report of cash payments over $10,000. Web complete form 4868 to use as a worksheet. If you think you may owe tax when you file your return, you’ll need to estimate your total tax liability and subtract how much you’ve. You can request an extension for free, but you still need to pay taxes. There are two methods for printing form 4868 application for automatic extension of time to file u.s.

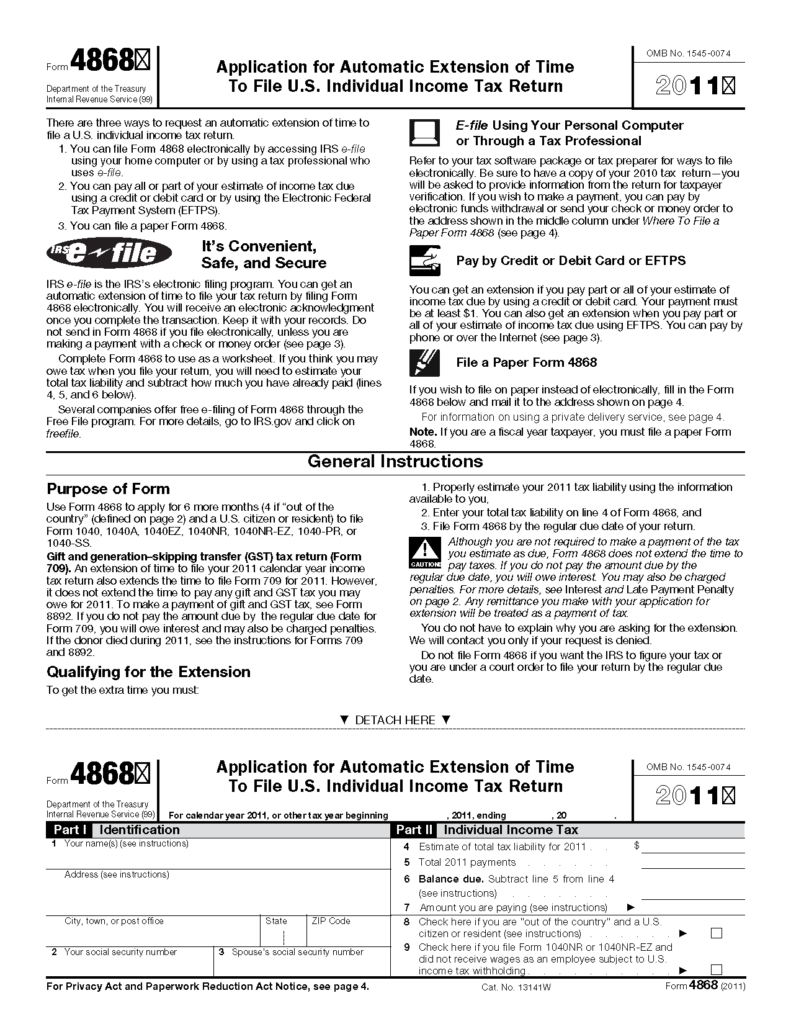

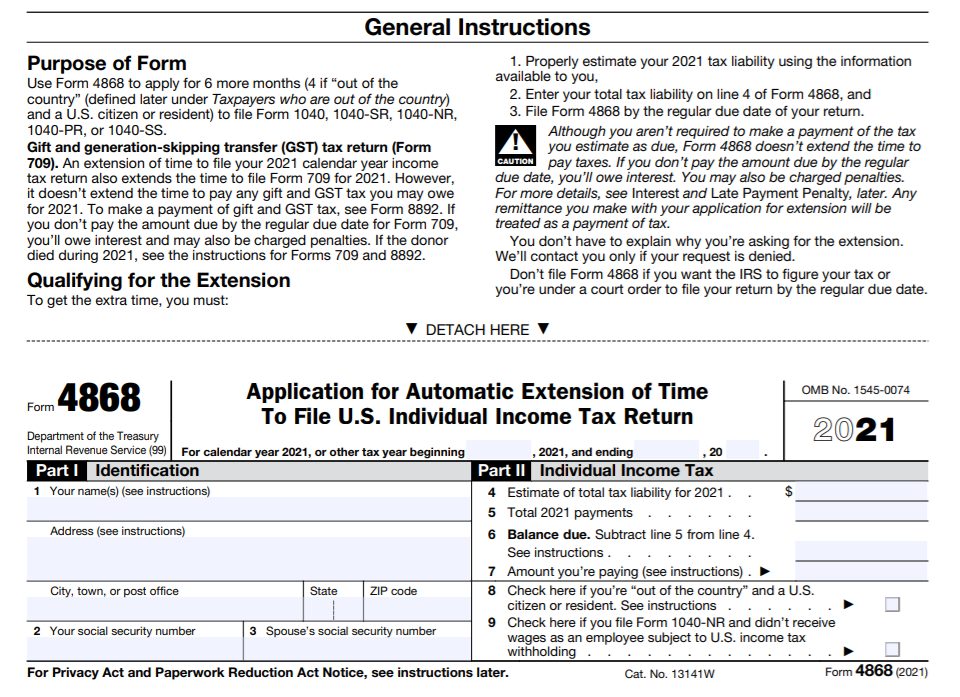

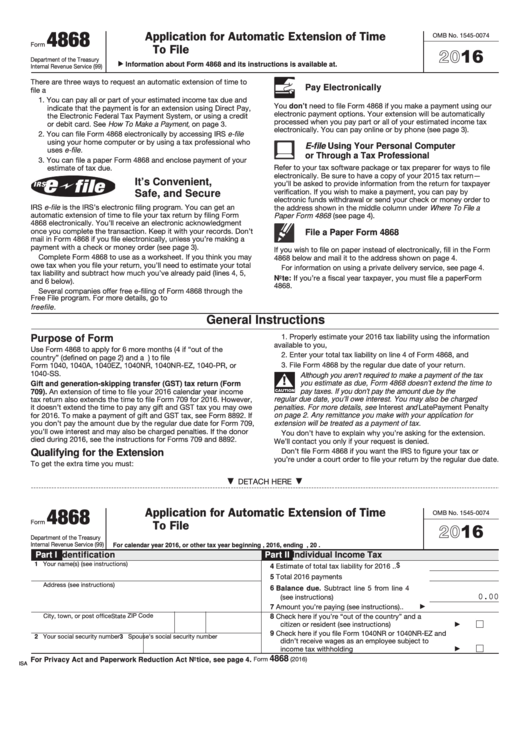

Form 4868 Application For Automatic Extension Of Time To 2021 Tax

EFile IRS Form 4868 File Personal Tax Extension Online

Learn How to Fill the Form 4868 Application for Extension of Time To

Form 4868 Personal Tax Extension IRS 4868

:max_bytes(150000):strip_icc()/4868-ApplicationofExtensionofTime-1-088a69a2d6454cb5837a3a801d330a8d.png)

The Purpose of IRS Form 4868

Fillable Online Printable IRS Form 4868 Tax Extension Tax Year

Form 4868 Fillable Printable Forms Free Online

Printable Form 4868

Form 4868 Application For Automatic Extension Of Time To File U.s

IRS Form 4868 PDF Application to Fill & Download

How To Complete Form 4868.

You Can File A Tax Extension Online In One Of Several Ways With H&R Block.

Web Form 4868, Application For Automatic Extension Of Time To File U.s.

Web All You Need To Do Is Submit Form 4868.

Related Post: