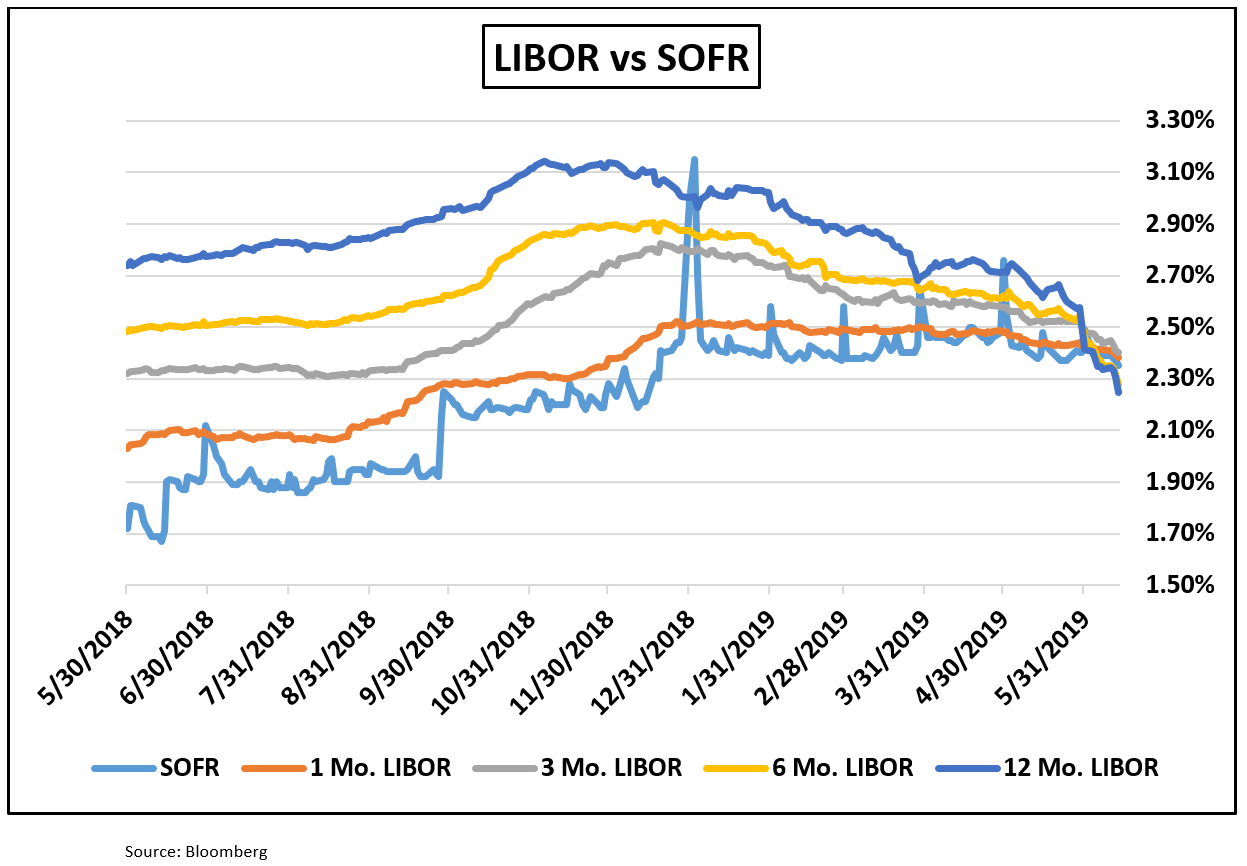

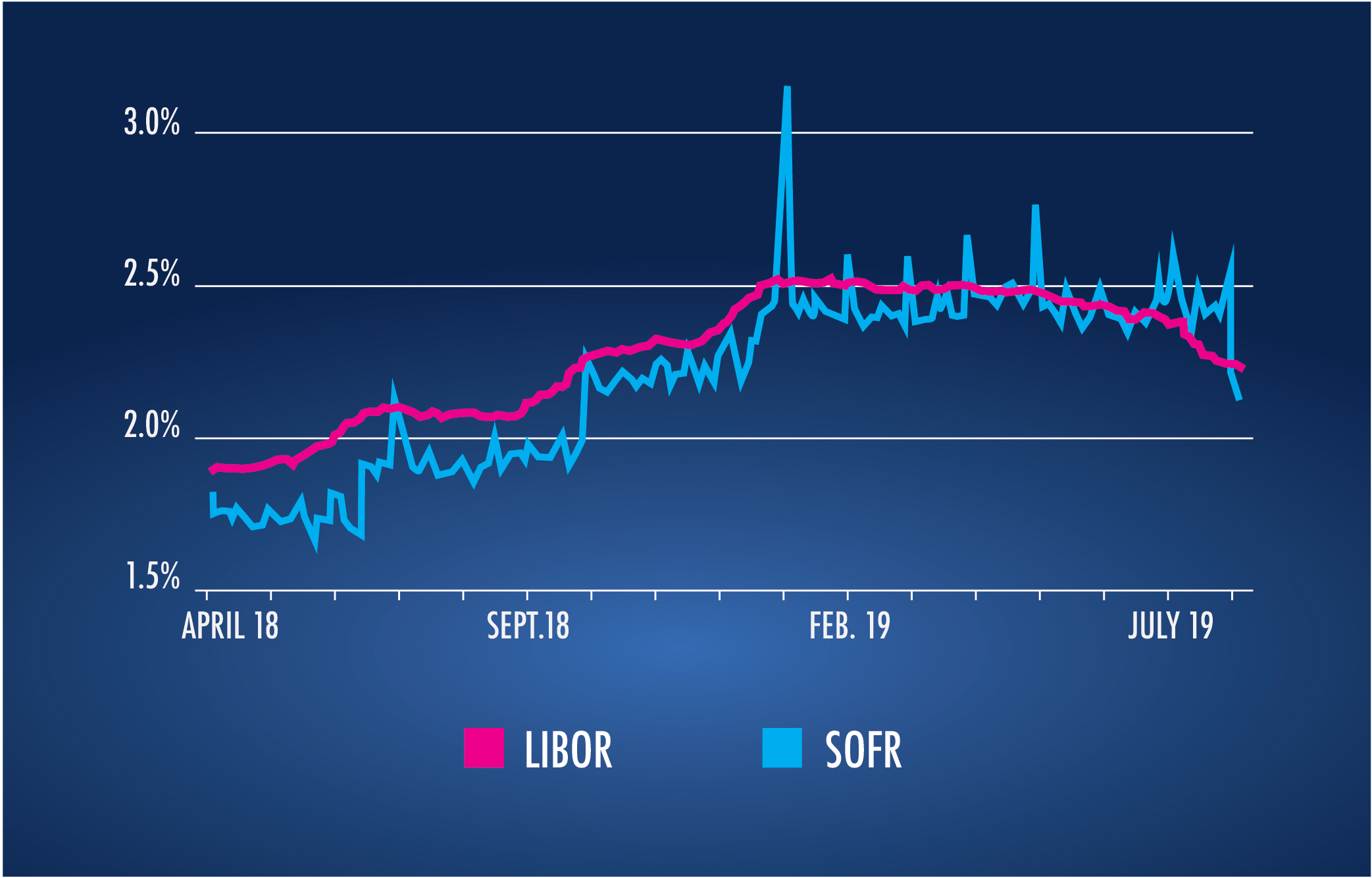

Libor Vs Sofr Chart

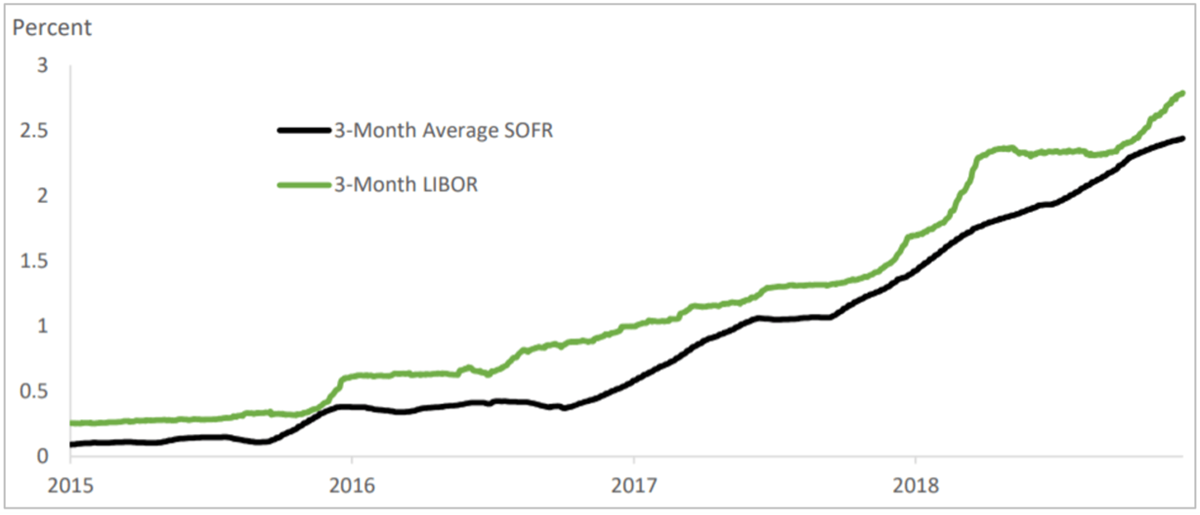

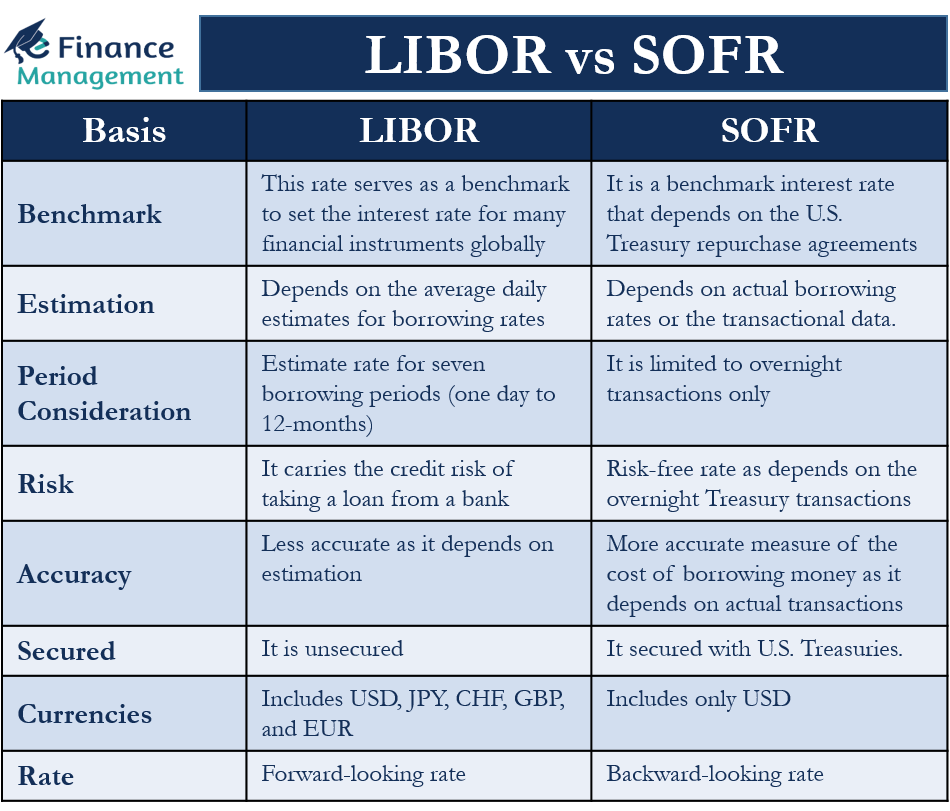

Libor Vs Sofr Chart - Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. The transaction volumes underlying sofr regularly are over $1 trillion in daily volumes. Bis juli 2023 für ausgewählte usd libor laufzeiten sollten alle verbleibenden abhängigkeiten zu. Treasury repo market was able to weather the global financial crisis and the arrc credibly believes that it will remain active enough in order that it can reliably be produced in a wide range of market conditions. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. There are three major differences between sofr and usd libor. • it is a rate produced by the federal reserve bank of new york for the public good; Sofr is produced by the federal reserve bank of new york (frbny) for the public good; Bis anfang des jahres 2022 bzw. To be fair, the transition away from libor could be challenging, since the arrc’s recommended alternative reference rate (arr) — the secured overnight financing rate (sofr) — differs from libor in some key ways. The secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web the federal reserve board on friday adopted a final rule that implements the adjustable interest rate (libor) act by identifying benchmark rates based on sofr (secured overnight financing rate) that will replace libor in certain financial contracts after. While libor was based on panel bank input, sofr is a broad measure of the cost of borrowing cash overnight collateralized by u.s. In singapore, sor and sibor were also widely used for various sgd denominated financial instruments. Why is libor being replaced? There are three major differences between sofr and usd libor. Web sofr vs libor the secured overnight. • it is a rate produced by the federal reserve bank of new york for the public good; Department of the treasury’s office of financial research. Why is libor being replaced? As its name indicates, sofr is an overnight rate. There are three major differences between sofr and usd libor. There are three major differences between sofr and usd libor. Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. Bis juli 2023 für ausgewählte usd libor laufzeiten sollten alle verbleibenden abhängigkeiten zu. Web sofr is based on transactions in the treasury repurchase market and is preferable to libor since it is based on data from. Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. Department of the treasury’s office of financial research. Web the london interbank offered rate (libor) was a global interest rate benchmark used to determine interest rates for various financial instruments. The secured overnight financing rate (sofr) is the benchmark. As its name indicates, sofr is an overnight rate. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Web the main difference between sofr and libor is how the rates are produced. Here’s what you need to know about sofr, how it differs from libor and how. Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Web sofr rate chart: What is sofr rate today? Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. While libor was based on panel bank input,. Web there are some key differences between libor and sofr. What is sofr rate today? Web sofr is based on transactions in the overnight repurchase markets (repo), which averages roughly $1 trillion of transactions every day. Sofr is produced by the federal reserve bank of new york (frbny) for the public good; Here’s what you need to know about sofr,. Here’s what you need to know about sofr, how it differs from libor and how you might be impacted by the. Web the reference rate worked its way organically into deals, pushing the british bankers association to oficially embrace it in 1986 and establish a governance system that involved asking traders across a host of panel banks to estimate each. Sofr is produced by the federal reserve bank of new york (frbny) for the public good; As its name indicates, sofr is an overnight rate. Web sofr averages and index data. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018.. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Treasury repo market was able to weather the global financial crisis and the arrc credibly believes that it will remain active enough in order that it can reliably be produced in a wide range of market conditions. The transaction volumes underlying sofr regularly are over $1 trillion in daily volumes. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. As an overnight secured rate, sofr better reflects the way financial institutions fund themselves today. Treasury repurchase agreements data, reflecting borrowing cost in overnight borrowing collateralized by u.s. Web sofr averages and index data. Bis juli 2023 für ausgewählte usd libor laufzeiten sollten alle verbleibenden abhängigkeiten zu. Web sofr has a number of characteristics that libor and other rates based on wholesale term similar unsecured funding markets do not: The secured overnight financing rate (sofr) is the benchmark rate derived from transactions observed in the treasury “repo” market and is anticipated. There are three major differences between sofr and usd libor. While libor was based on panel bank input, sofr is a broad measure of the cost of borrowing cash overnight collateralized by u.s. Web the secured overnight financing rate (sofr) is j.p. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Morgan’s preferred alternative to usd libor. Why is libor being replaced?

The LIBOR Transition, Part 2 Challenges Associated with SOFR

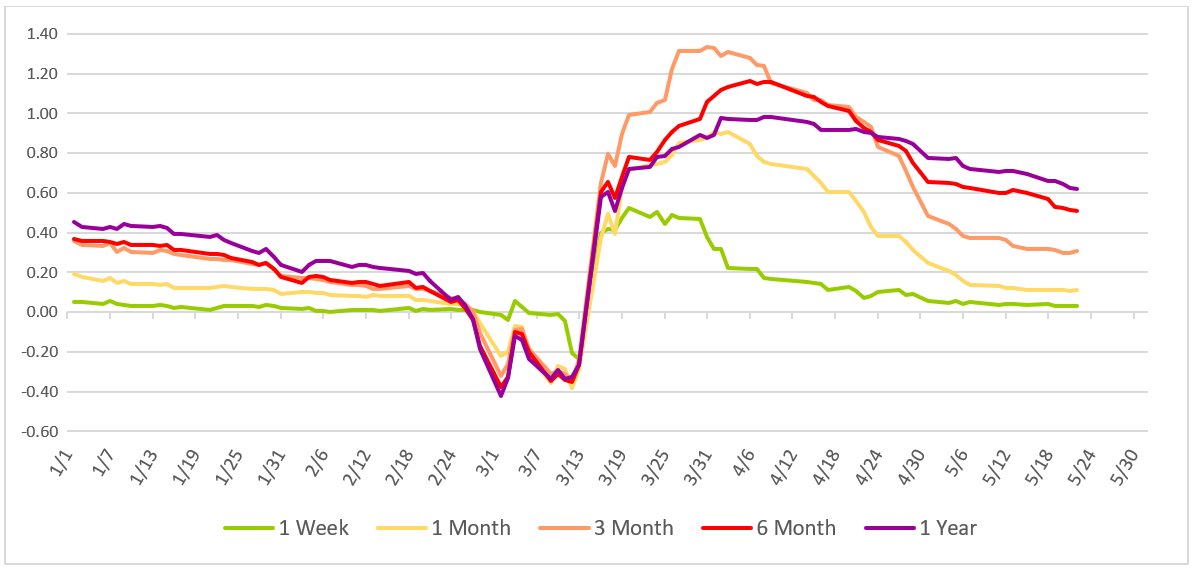

Comparing LIBOR, BSBY & SOFR Curves LSTA

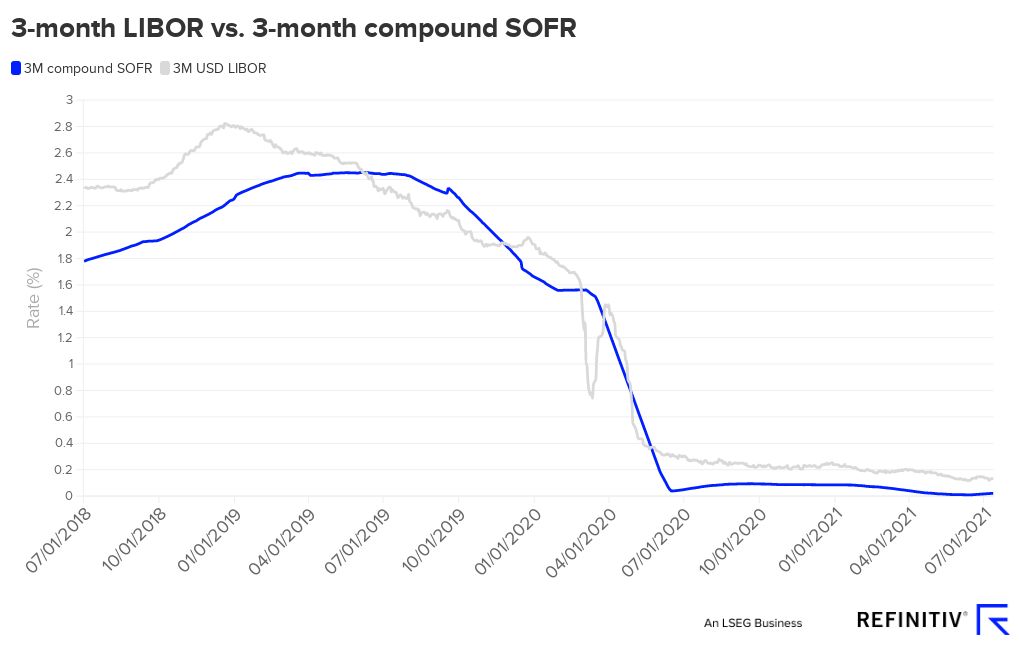

3month LIBOR vs. 3month compound SOFR Flourish

Libor Vs Sofr Rate Chart 2023

The impact of Reference Rate reform Transition from LIBOR to SOFR

LIBOR vs SOFR Meaning, Need, and Differences

Flooring It! LIBOR vs. SOFR LSTA

LIBOR to SOFR Are You Ready?

Libor To Sofr Spread

The LIBOR Transition Mission Capital

Bis Anfang Des Jahres 2022 Bzw.

Web The Federal Reserve Board On Friday Adopted A Final Rule That Implements The Adjustable Interest Rate (Libor) Act By Identifying Benchmark Rates Based On Sofr (Secured Overnight Financing Rate) That Will Replace Libor In Certain Financial Contracts After June 30, 2023.

What Is Sofr Rate Today?

In Singapore, Sor And Sibor Were Also Widely Used For Various Sgd Denominated Financial Instruments.

Related Post: