Libor Vs Sofr Rate Chart

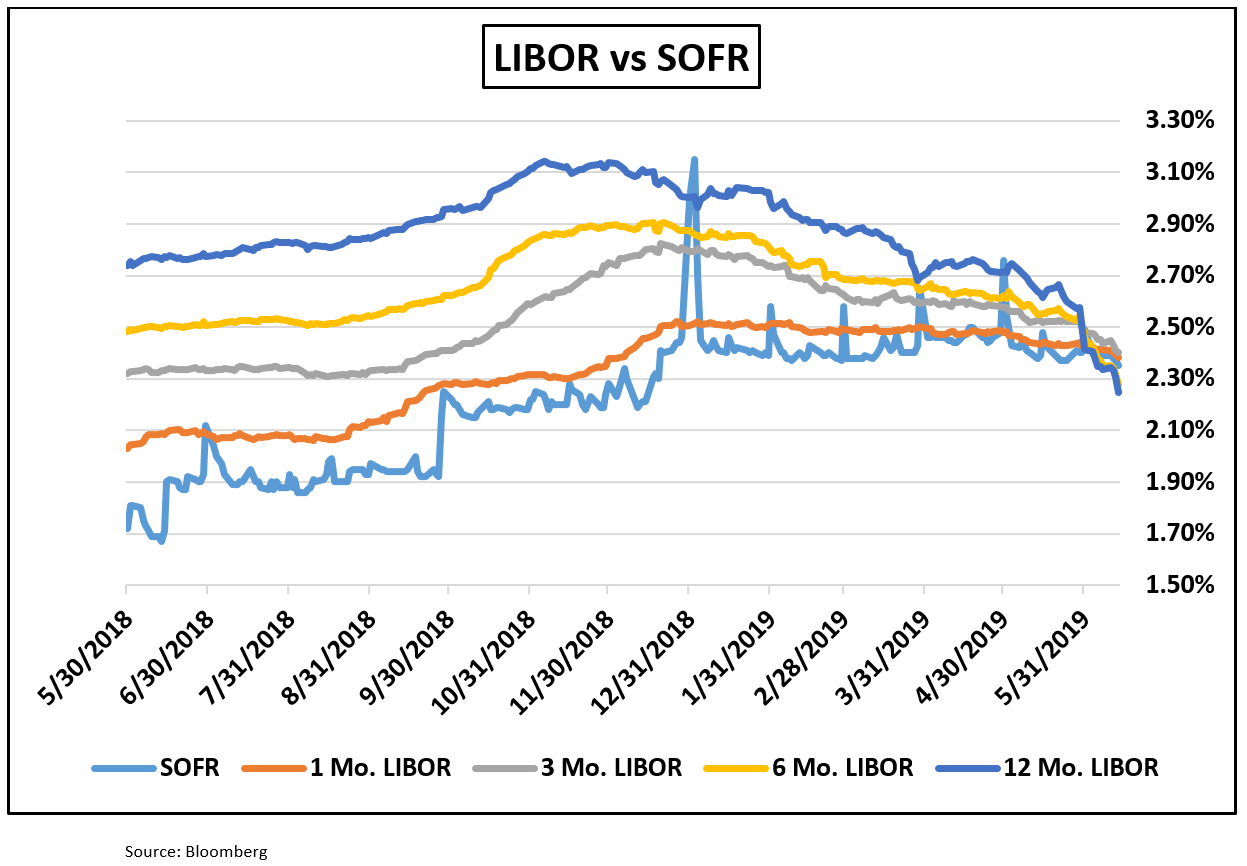

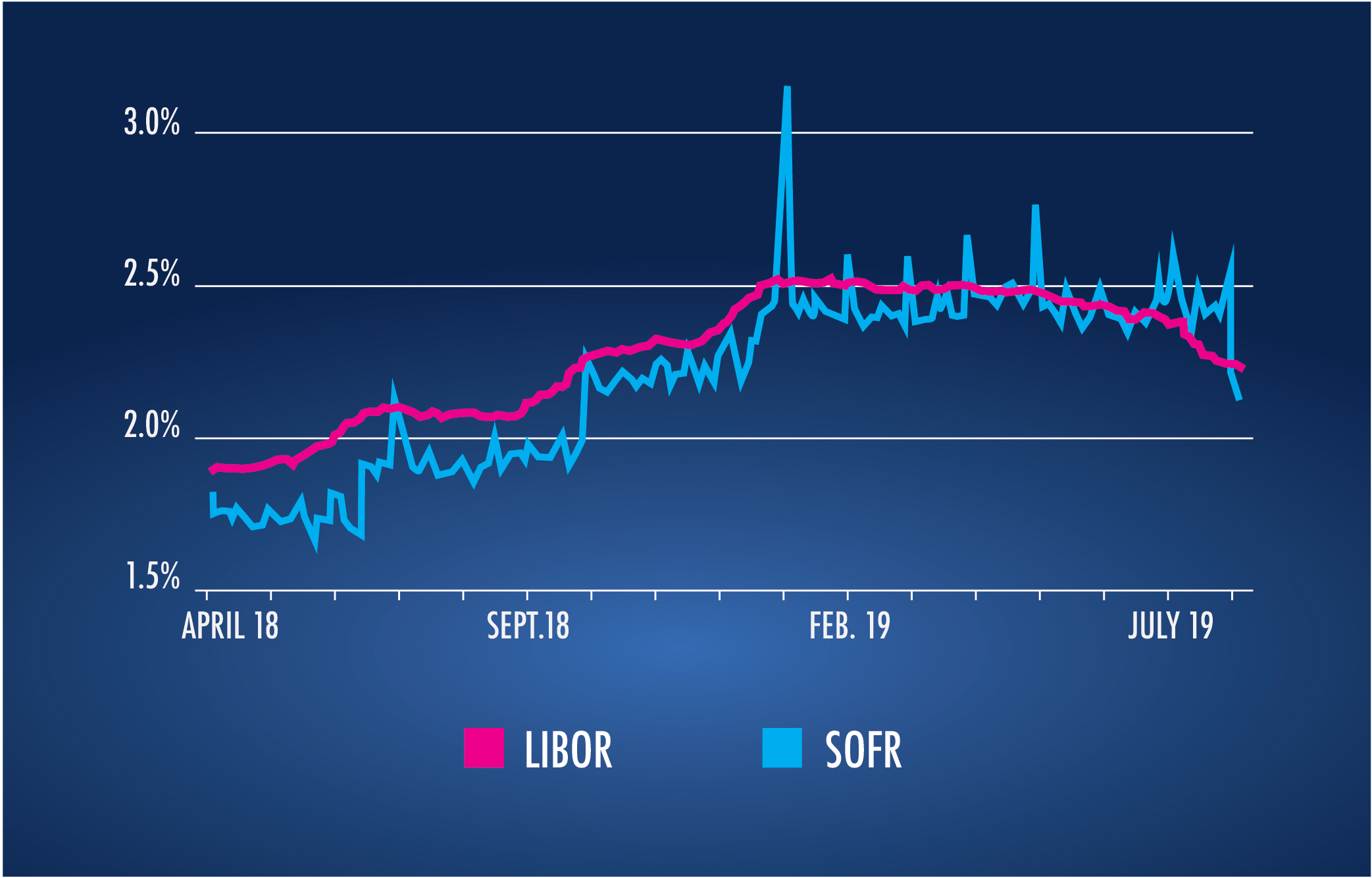

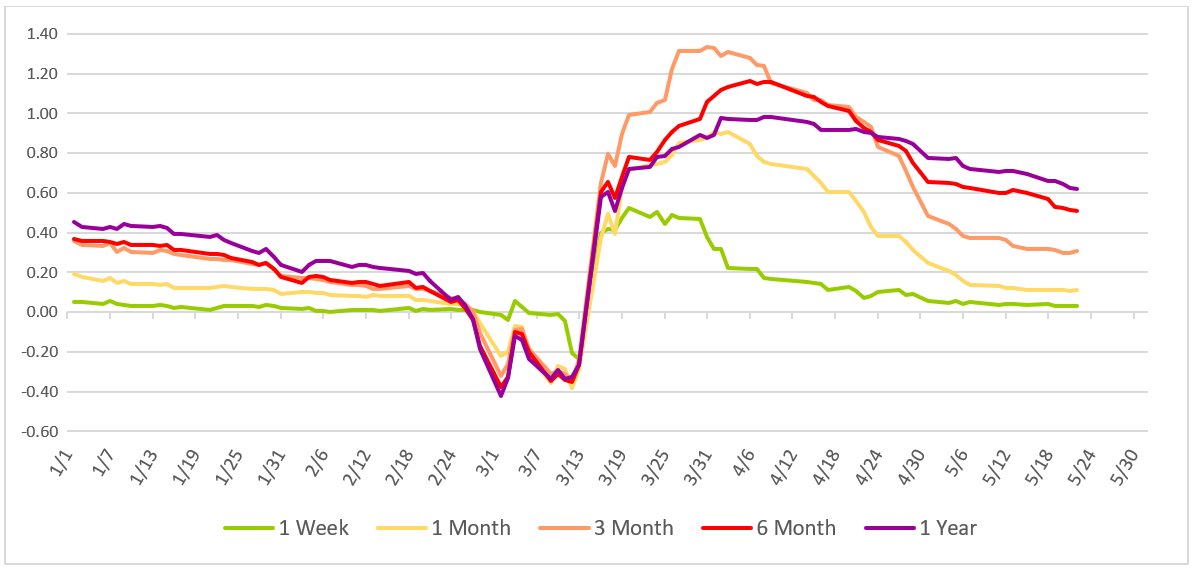

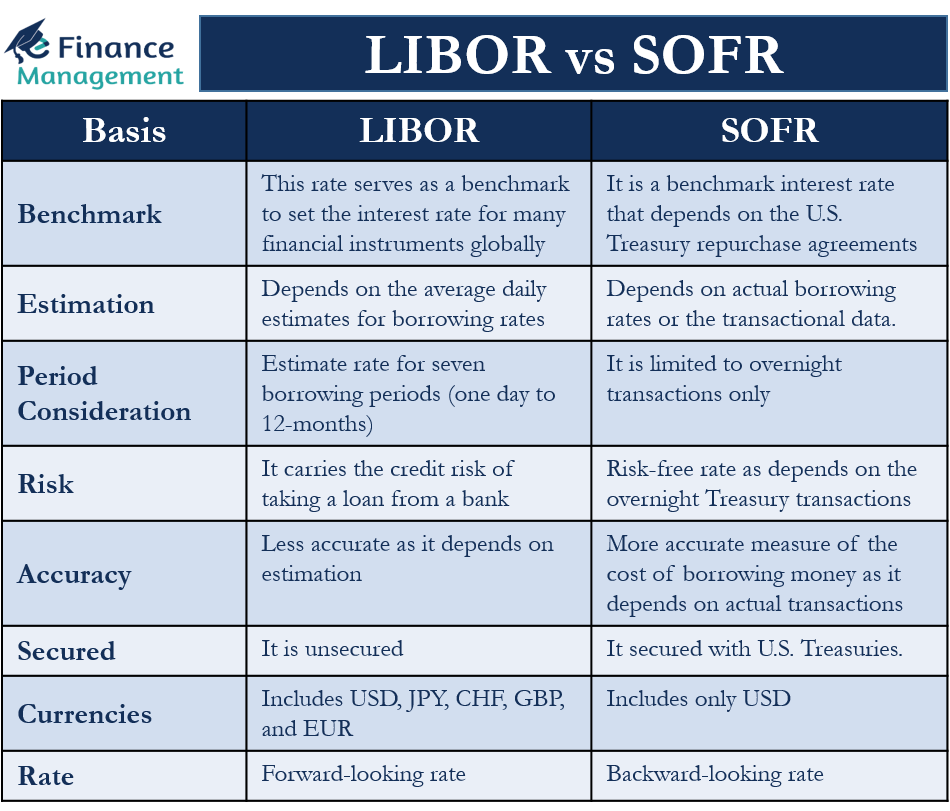

Libor Vs Sofr Rate Chart - We are supporting firms to continue the active transition of any outstanding libor exposures. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Web the secured overnight financing rate (sofr) is j.p. Web there are some key differences between libor and sofr. Web summary of key differences. Secured overnight financing rate is at 5.34%, compared to 5.33% the previous market day and 5.08% last year. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018. • it is a rate produced by the federal reserve bank of new york for the public good; Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. Web secured overnight financing rate data. Libor is an interest rate benchmark used in financial markets which is being phased out. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Federal home loan bank of san francisco, federal reserve board, fnma. • it is a rate produced by the federal reserve bank of. The secured overnight financing rate or sofr is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web sofr has a number of characteristics that libor and other rates based on wholesale term similar unsecured funding markets do not: Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. Libor and. 32 libor settings have ceased permanently. This is higher than the long term average of 2.10%. Libor and sor have been discontinued or are no longer representative across all currency and tenor. Web what’s the main difference between libor vs. The sofr includes all trades in the broad general collateral rate plus bilateral treasury repurchase agreement (repo) transactions cleared through. This is higher than the long term average of 2.10%. Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. Web summary of key differences. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. In singapore, sor and sibor were also widely used for various sgd denominated financial instruments. Web secured overnight financing rate data. Why is libor being replaced? Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Interest rate derivatives research, j.p. Web sofr is nearly risk free as an overnight secured rate collateralized with u.s. Points 2 and 3 particularly make the transition from libor to sofr challenging. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Why is libor being replaced? Web the federal reserve board on friday adopted a final rule that implements the. Interest rate derivatives research, j.p. Web what’s the main difference between libor vs. Web the london interbank offered rate (libor) was a global interest rate benchmark used to determine interest rates for various financial instruments. Libor and sor have been discontinued or are no longer representative across all currency and tenor. Web the secured overnight financing rate (sofr) is libor’s. Libor and sor have been discontinued or are no longer representative across all currency and tenor. The secured overnight financing rate or sofr is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Web the secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities.. In singapore, sor and sibor were also widely used for various sgd denominated financial instruments. Web what’s the main difference between libor vs. Federal home loan bank of san francisco, federal reserve board, fnma. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. Libor is an interest rate benchmark used in. Rate comparison chart of prime rate and fed funds rate. Web the secured overnight financing rate (sofr) is libor’s replacement in the united states. Before we dive into answering these questions, let’s take a look at the characteristics of the two rates. Treasury bonds, while libor is credit sensitive and embeds a bank credit risk premium. Web last updated january. Publication of most libor settings has now ended. We are supporting firms to continue the active transition of any outstanding libor exposures. Web sofr vs libor the secured overnight financing rate is seen as an alternative to the london interbank offered rate, which is a benchmark for $200 trillion of u.s. 32 libor settings have ceased permanently. Interest rate derivatives research, j.p. While there are obvious advantages to moving to a truly market based rfr, there are significant challenges transitioning from an unsecured forward term rate (libor) to a secured overnight rate (sofr): Rate comparison chart of prime rate and fed funds rate. The sofr includes all trades in the broad general collateral rate plus bilateral treasury repurchase agreement (repo) transactions cleared through the. Libor is an interest rate benchmark used in financial markets which is being phased out. Web the secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Unlike the libor, there’s extensive trading in the treasury repo market—roughly $4.8 trillion in june 2023—theoretically making it a more accurate indicator of borrowing costs. The secured overnight financing rate (sofr) is a broad measure of the cost of borrowing cash overnight collateralized by treasury securities. Libor, on the other hand, is set by a panel of banks submitting estimates of what they think their borrowing costs are. Web the federal reserve board on friday adopted a final rule that implements the adjustable interest rate (libor) act by identifying benchmark rates based on sofr (secured overnight financing rate) that will replace libor in certain financial contracts after june 30, 2023. Morgan’s preferred alternative to usd libor. The federal reserve created the alternative reference rates committee (arrc) in 2014 to develop sofr as an alternative rfr, which has been published on an overnight basis since 2018.

Libor To Sofr Spread

Flooring It! LIBOR vs. SOFR LSTA

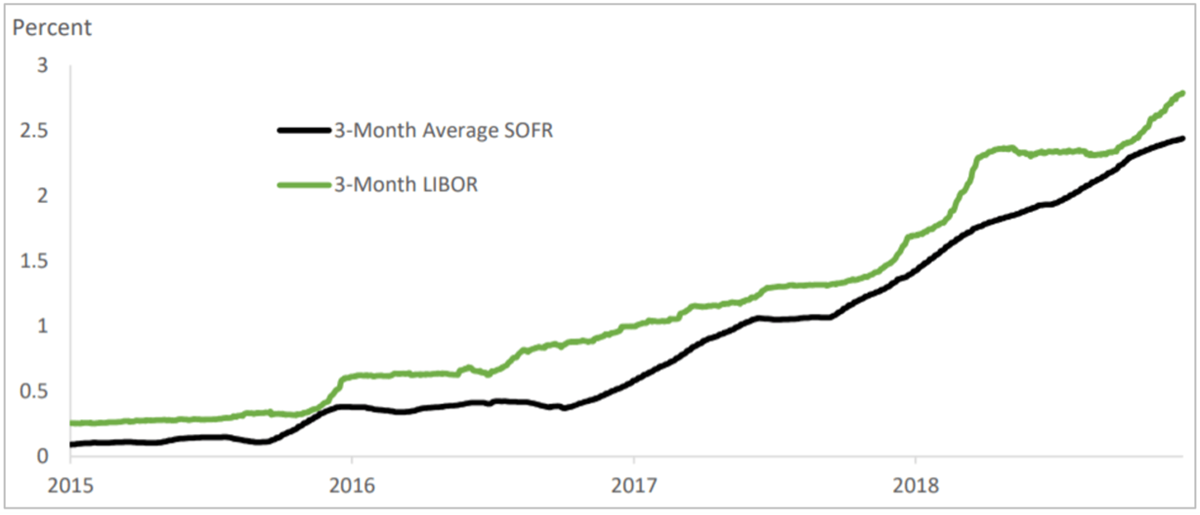

An Update on the Transition from LIBOR to SOFR

The LIBOR Transition Mission Capital

Libor Vs Sofr Rate Chart 2023

Sofr Vs Libor Chart 2021

LIBOR vs SOFR Meaning, Need, and Differences

Comparing LIBOR, BSBY & SOFR Curves LSTA

The impact of Reference Rate reform Transition from LIBOR to SOFR

LIBOR to SOFR Are You Ready?

Web There Are Some Key Differences Between Libor And Sofr.

Web Sofr Has A Number Of Characteristics That Libor And Other Rates Based On Wholesale Term Similar Unsecured Funding Markets Do Not:

Web Secured Overnight Financing Rate Data.

Web The London Interbank Offered Rate (Libor) Was A Global Interest Rate Benchmark Used To Determine Interest Rates For Various Financial Instruments.

Related Post: