Market Structure Chart

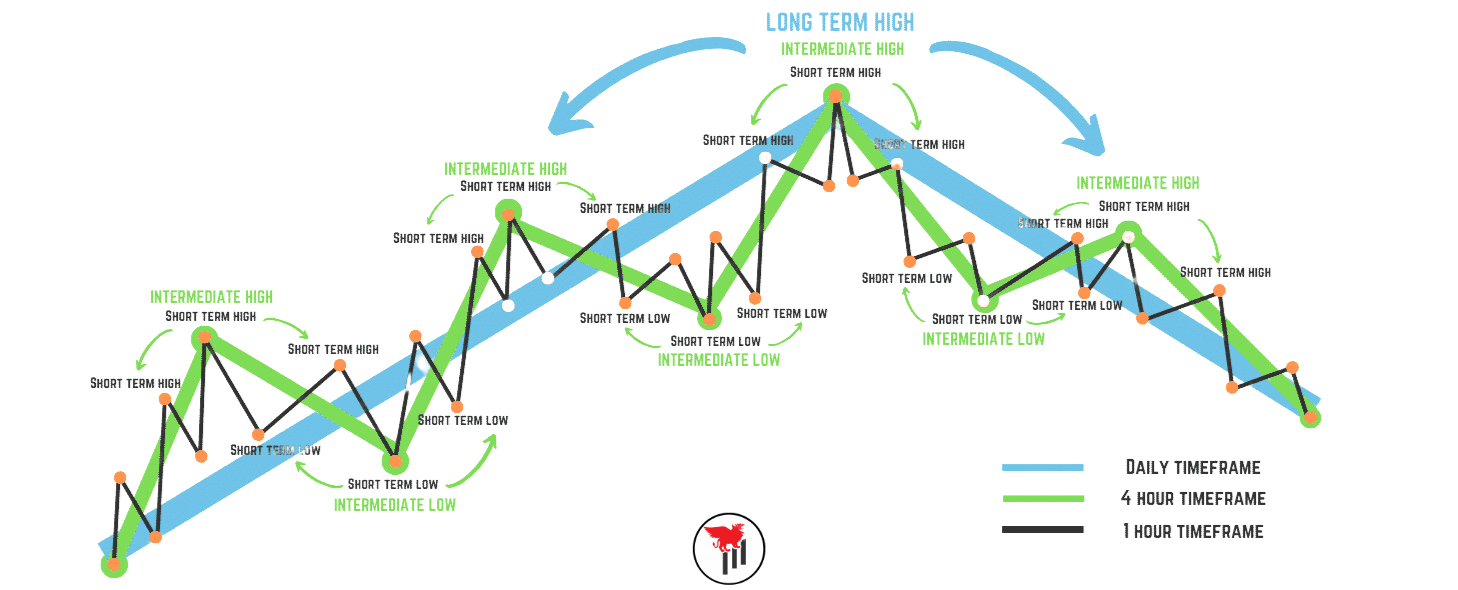

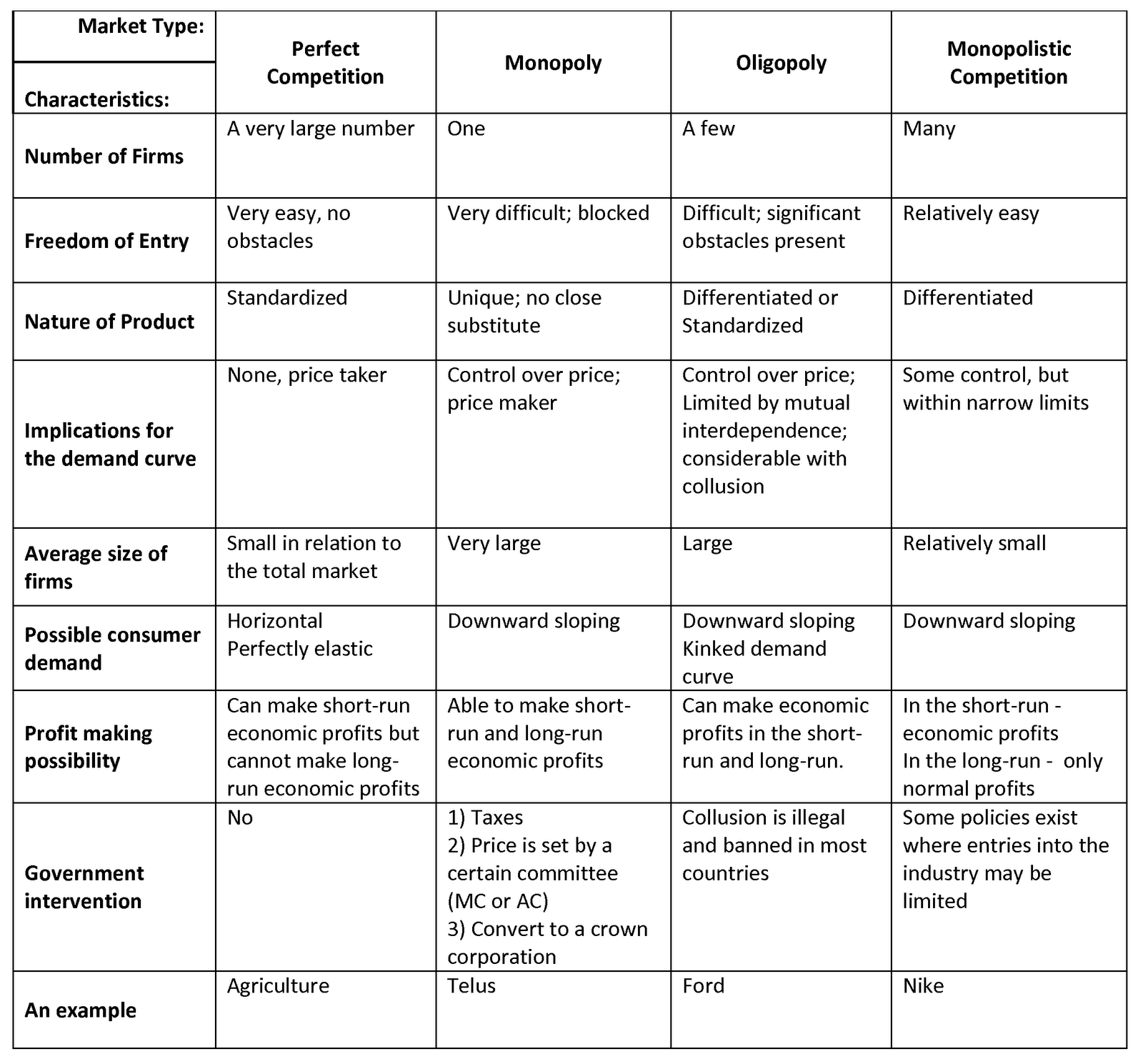

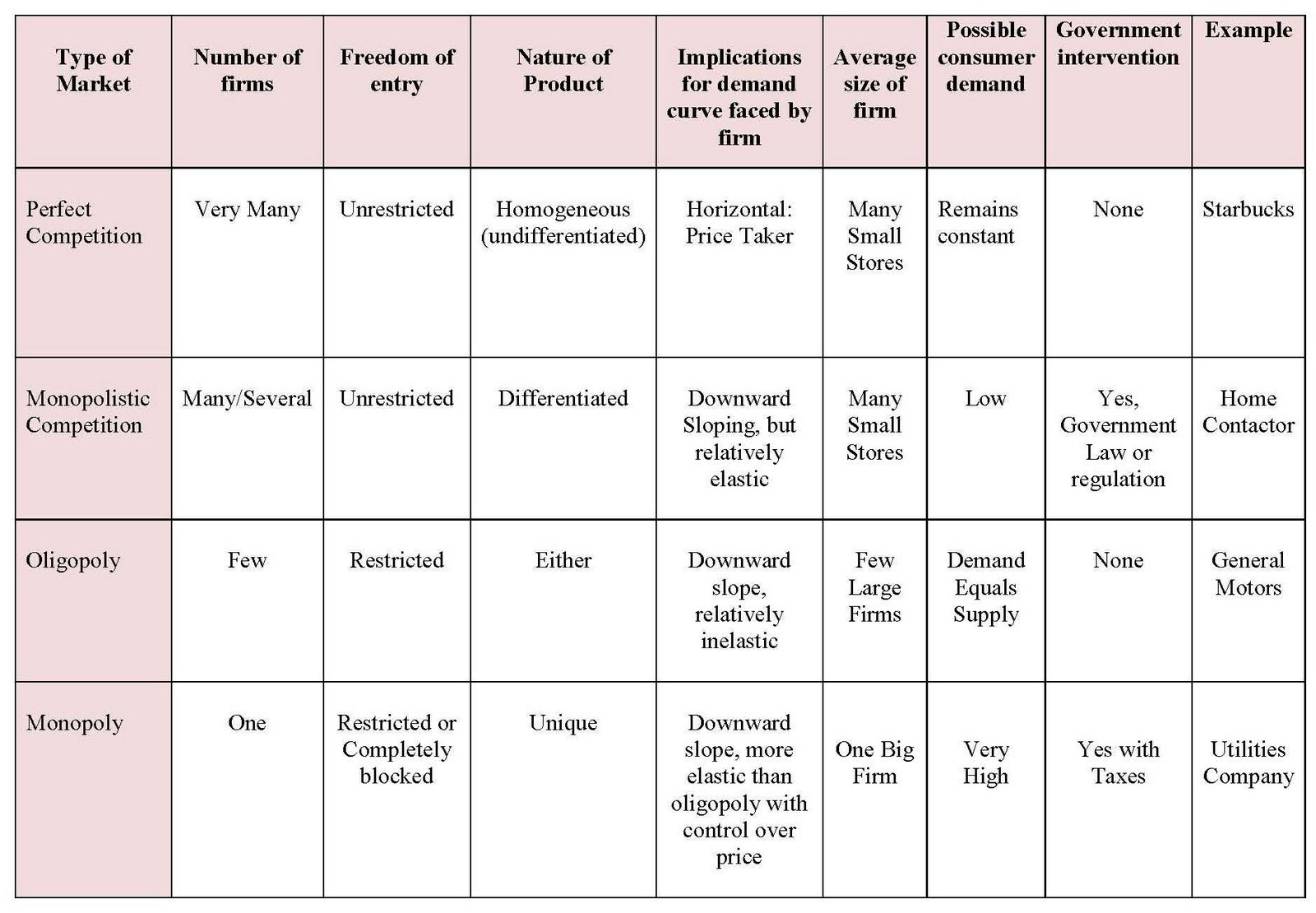

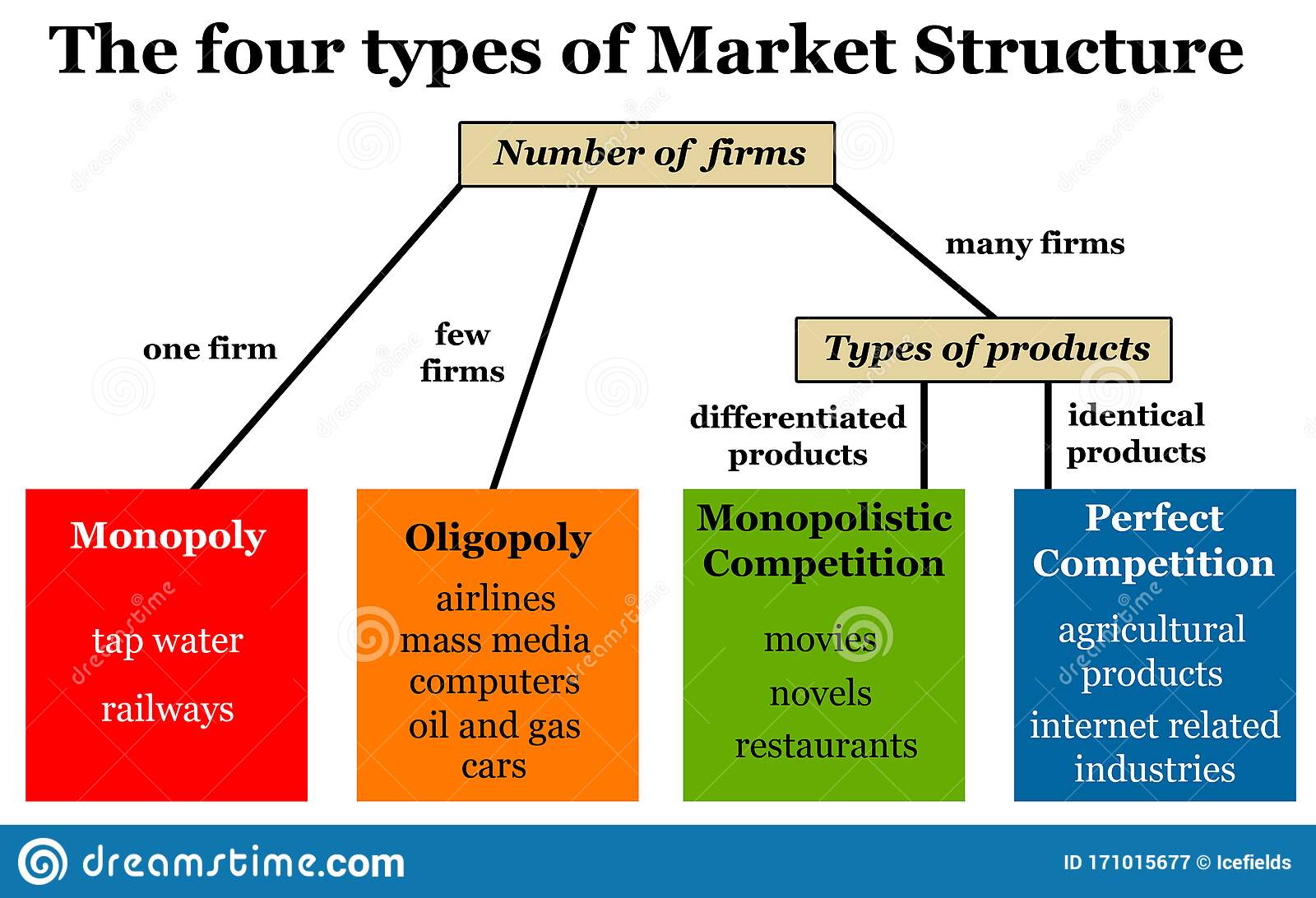

Market Structure Chart - From bullish moves, to bearish and in between with ranges. Market structure makes it easier to understand the characteristics of diverse markets. Web in this revision video we look through some of the major diagrams that might help you to score high analysis marks in questions on market structures such as perfect competition, monopolistic competition, oligopoly, monopoly and contestable markets It highlights support and resistance levels, swing highs, and swing lows. Web the ultimate guide to market structure with 30+ charts! Web the organizational chart will help the team understand the responsibilities of all the employees, helping to reduce wasted time and increase efficiency. The framework or structure that any given market is currently trading in. It provides us with a narrative with which to look at price. Web market structure refers to how different industries are classified and differentiated based on their degree and nature of competition for services and goods. We can identify the key differences in each market form, which revolve around: In this post, we'll delve deep into market structure, presenting insightful examples to enhance your understanding of this concept. Define differentiated, and homogeneous products. Perfect competition, monopolistic competition, oligopoly, and monopoly. Web deep understanding of the charts and market structure. Web find the best home warranty by comparing the top home warranty companies, learn about their costs, coverage and reviews. Web market structure is the most fundamental aspect of analysing charts, mastering it goes a long way in increasing one's reading of price. Web when analyzing market structure, traders closely examine price charts to identify key components such as significant price levels, trends, support and resistance zones, and the overall market context. Web find the best home warranty by comparing. Web the ultimate guide to market structure with 30+ charts! Monopoly (one firm), oligopoly (a few firms) + monopolistic competition, contestable markets and collusion. When we talk about the market structure shift (mss) in trading, we’re referring to a technical pattern (or patterns) that signals a potential reversal in the market’s trend. From bullish moves, to bearish and in between. The framework or structure that any given market is currently trading in. Web market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Not interested in this webinar. Monopoly (one firm), oligopoly (a few firms) + monopolistic competition, contestable. Market structure refers to the organizational characteristics and features of a special request, which can significantly impact the geste and interpretation of enterprises running within it. Perfect competition, monopolistic competition, oligopoly, and monopoly. Web market structure refers to how different industries are classified and differentiated based on their degree and nature of competition for services and goods. Web our web. Web the ultimate guide to market structure with 30+ charts! Are you curious how price patterns, support & resistance (s&r), and trend & momentum can be used to. It provides us with a narrative with which to look at price. Web the organizational chart will help the team understand the responsibilities of all the employees, helping to reduce wasted time. From bullish moves, to bearish and in between with ranges. Market structure is often referred to as price action. Web a market structure trading strategy involves analyzing and interpreting various elements that shape price movements, such as swing highs and lows, support and resistance levels, and trendlines. The number of firms can vary from one to. In this post, we'll. It provides us with a narrative with which to look at price. Web the market structure shift is a key part of the ict trading methodology, which is a trading theory that relies on chart analysis and smart money concepts. How many companies can exist in each of the four types of. By the time you are done with this. Web the organizational chart will help the team understand the responsibilities of all the employees, helping to reduce wasted time and increase efficiency. At a glance market structure looks quite simple but when studied in depth it has many nuances & can provide with very valuable information. Web market structure refers to how different industries are classified and differentiated based. Web the ultimate guide to market structure with 30+ charts! Market structure can help you understand the behavior, condition, and current flow of the market. It highlights support and resistance levels, swing highs, and swing lows. Web four basic types of market structure characterize most economies: Web market structure is the most fundamental aspect of analysing charts, mastering it goes. Web it consists of four types: Web reserve your spot. Market structure is a framework for comprehending the movements and behaviour of markets. It highlights support and resistance levels, swing highs, and swing lows. Perfect competition, oligopolistic markets, monopolistic markets, and monopolistic competition. Web the ultimate guide to market structure with 30+ charts! From bullish moves, to bearish and in between with ranges. The four popular types of market structures include perfect competition, oligopoly market, monopoly market, and monopolistic competition. Web market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements. Perfect competition, monopolistic competition, oligopoly, and monopoly. Web select a light or dark color scheme for the chart and the controls. Not interested in this webinar. Web when analyzing market structure, traders closely examine price charts to identify key components such as significant price levels, trends, support and resistance zones, and the overall market context. When we talk about the market structure shift (mss) in trading, we’re referring to a technical pattern (or patterns) that signals a potential reversal in the market’s trend. We can identify the key differences in each market form, which revolve around: Perfect competition (many firms) 2.

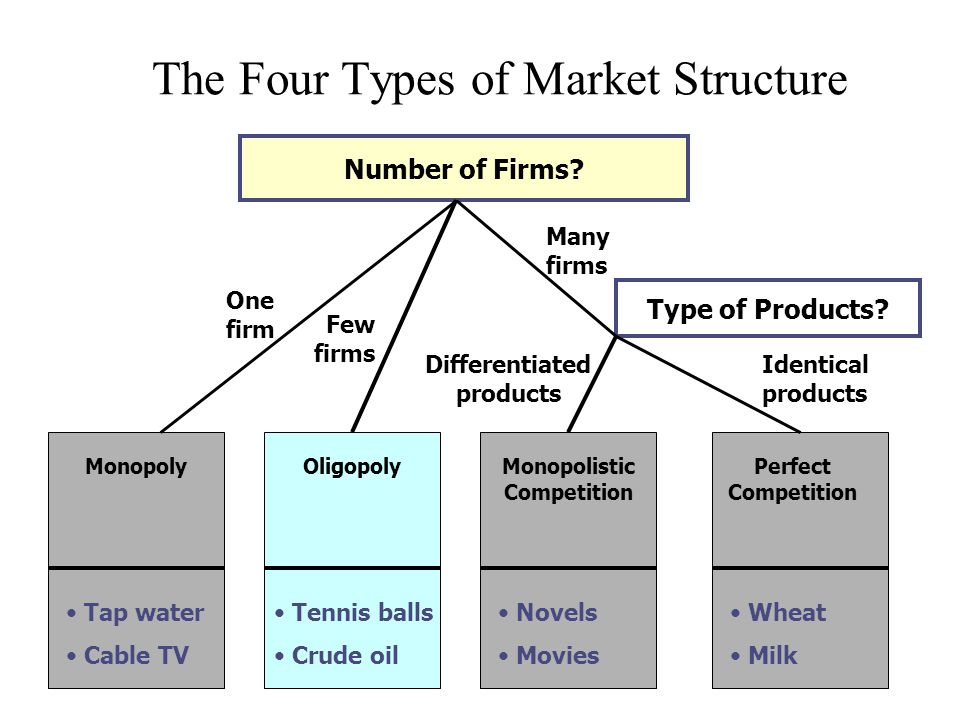

🎉 Four different market structures. The Four Types of Market Structures

Types of Market Structure DangeloqoPayne

Understanding Market Structure in Trading A Comprehensive Guide

Introduction Comparing Market Structures

Market Structure and Chart Patterns by Elyte Traders Elyte. FX Medium

How to Launch a Product in a Competitive Market Super Heuristics

The Four Types of Market Structure 2022 Symphysis

Trading Mantras "Equity & Options" MasterClass Trading charts, Stock

️ Four types of market structure. The Four Types of Market Structures

Market Structure in Trading Dot Net Tutorials

Education | 08/21/2022 22:00:00 Gmt.

The Number Of Firms Operating In A Market Is A Major Feature Of Its Structure.

The Framework Or Structure That Any Given Market Is Currently Trading In.

Market Structure Makes It Easier To Understand The Characteristics Of Diverse Markets.

Related Post: