Multistate Withholding Requirements State Comparison Chart

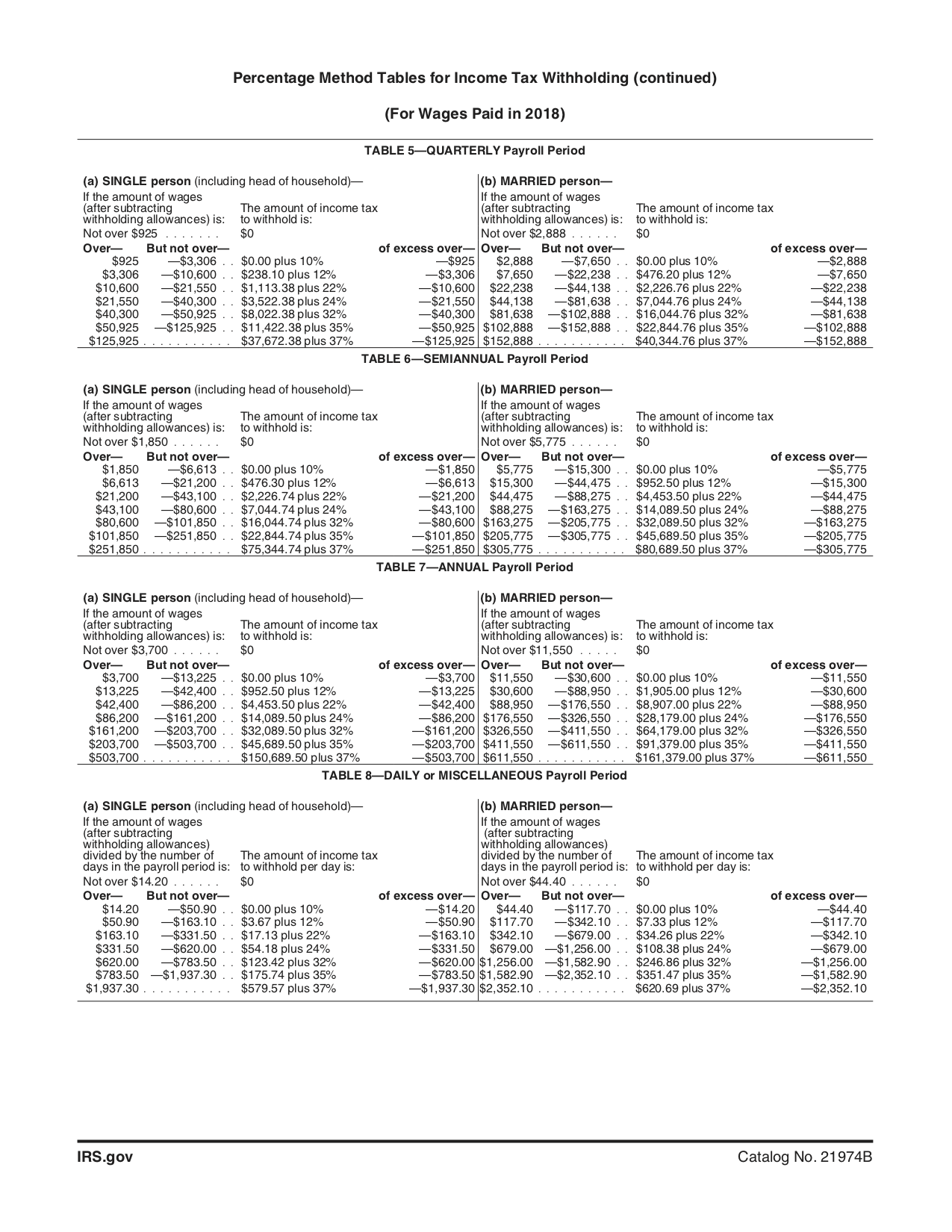

Multistate Withholding Requirements State Comparison Chart - Requirements and obligations of employer are well defined in most cases. Web ah, the joys of employerhood. Web elements of multistate payroll tax withholding compliance. Web withholdings vary by state, as discussed below. Web the assortment of state income tax withholding & nonresident archiving rules can create headaches for equally employers and employees. Web • state meal period and rest break laws chart: Web this means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. Web this rule can be applied in most situations where the employee lives and works in the same state (assuming it is not one of the nine states without income tax withholding: Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws. For the states imposing a personal income tax, the. Web ah, the joys of employerhood. Web • state meal period and rest break laws chart: Web the amount of tax and whatever states employers must edit payroll for je on into employer’s specific situation. But, getting this hang of payroll—especially payroll taxes—takes time. A tool to view or compare state and federal employment laws by topic, across multiple jurisdictions,. Web withholdings vary by state, as discussed below. For the states imposing a personal income tax, the. Employees who reside in one state but work in another can create withholding questions for payroll. Web the assortment of state income tax withholding & nonresident archiving rules can create headaches for equally employers and employees. Web elements of multistate payroll tax withholding. Web this means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. Web the multistate program included dozens of states led by both republicans and democrats, but the system became the target of conspiracy theories and criticism on the. If an employer has operations in more than one state,. A tool to view or compare state and federal employment laws by topic, across multiple jurisdictions, presented in a customizable chart or matrix. Receive it right by learning. Web • state meal period and rest break laws chart: Web multistate laws comparison tool. Multistate compliance requires managing sets of state and local laws, regulations, and deadlines. Web this rule can be applied in most situations where the employee lives and works in the same state (assuming it is not one of the nine states without income tax withholding: Multistate compliance requires managing sets of state and local laws, regulations, and deadlines. In fact, at times the employer might need to. Web ah, the joys of employerhood.. Web this means an employer must withhold taxes on employee earnings after the employee has worked more than 60 days in that state. You must be aware of the specific tax requirements of each state you operate in and stay up to date with any. Web • state meal period and rest break laws chart: To a team of employees. Employees who reside in one state but work in another can create withholding questions for payroll. Requirements and obligations of employer are well defined in most cases. Web ah, the joys of employerhood. A tool to view or compare state and federal employment laws by topic, across multiple jurisdictions, presented in a customizable chart or matrix. Web multistate laws comparison. In fact, at times the employer might need to. Web ah, the joys of employerhood. — the employer is ultimately responsible for proper withholding and reporting of their. Web withholdings vary by state, as discussed below. But, getting this hang of payroll—especially payroll taxes—takes time. Employees who reside in one state but work in another can create withholding questions for payroll. Web multistate laws comparison tool. You must be aware of the specific tax requirements of each state you operate in and stay up to date with any. Web this rule can be applied in most situations where the employee lives and works in the. — the employer is ultimately responsible for proper withholding and reporting of their. Web • state meal period and rest break laws chart: Web designed for multistate employers, this tool helps you overcome the challenge of complying with a potentially intricate web of state and federal laws. If an employer has operations in more than one state, income tax might. A tool to view or compare state and federal employment laws by topic, across multiple jurisdictions, presented in a customizable chart or matrix. If an employer has operations in more than one state, income tax might need to be withheld for multiple states. Web this rule can be applied in most situations where the employee lives and works in the same state (assuming it is not one of the nine states without income tax withholding: To a team of employees to help how your business can be a beautiful thing. Receive it right by learning. Web ah, the joys of employerhood. Requirements and obligations of employer are well defined in most cases. — the employer is ultimately responsible for proper withholding and reporting of their. Employees who reside in one state but work in another can create withholding questions for payroll. For the states imposing a personal income tax, the. Web the multistate program included dozens of states led by both republicans and democrats, but the system became the target of conspiracy theories and criticism on the. But, getting this hang of payroll—especially payroll taxes—takes time. You must be aware of the specific tax requirements of each state you operate in and stay up to date with any. Multistate compliance requires managing sets of state and local laws, regulations, and deadlines. Web multistate laws comparison tool. Web • state meal period and rest break laws chart:

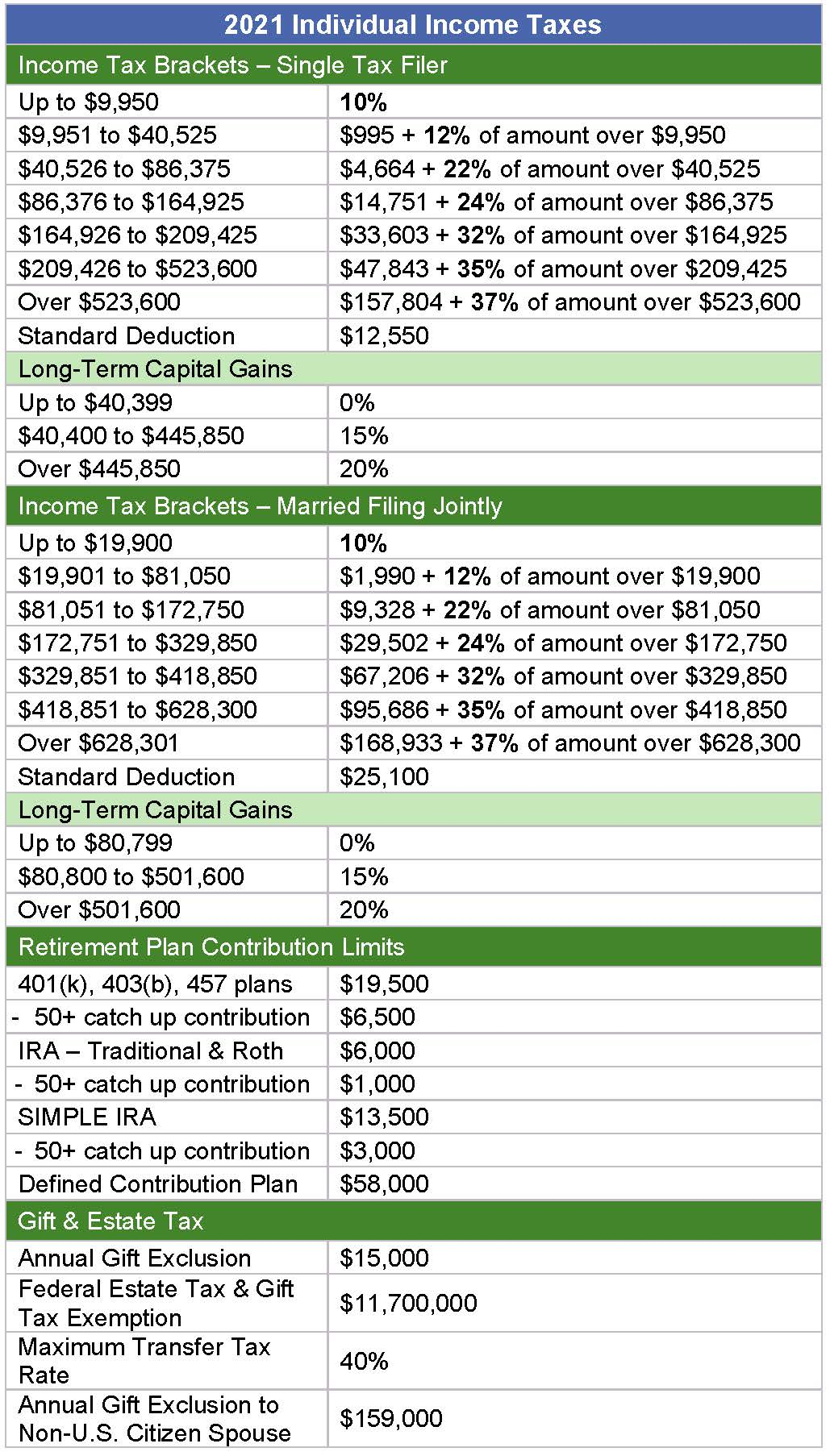

What Are The Federal Tax Tables For 2021 Federal Withholding Tables 2021

Printable Federal Withholding Tables 2022 California Onenow

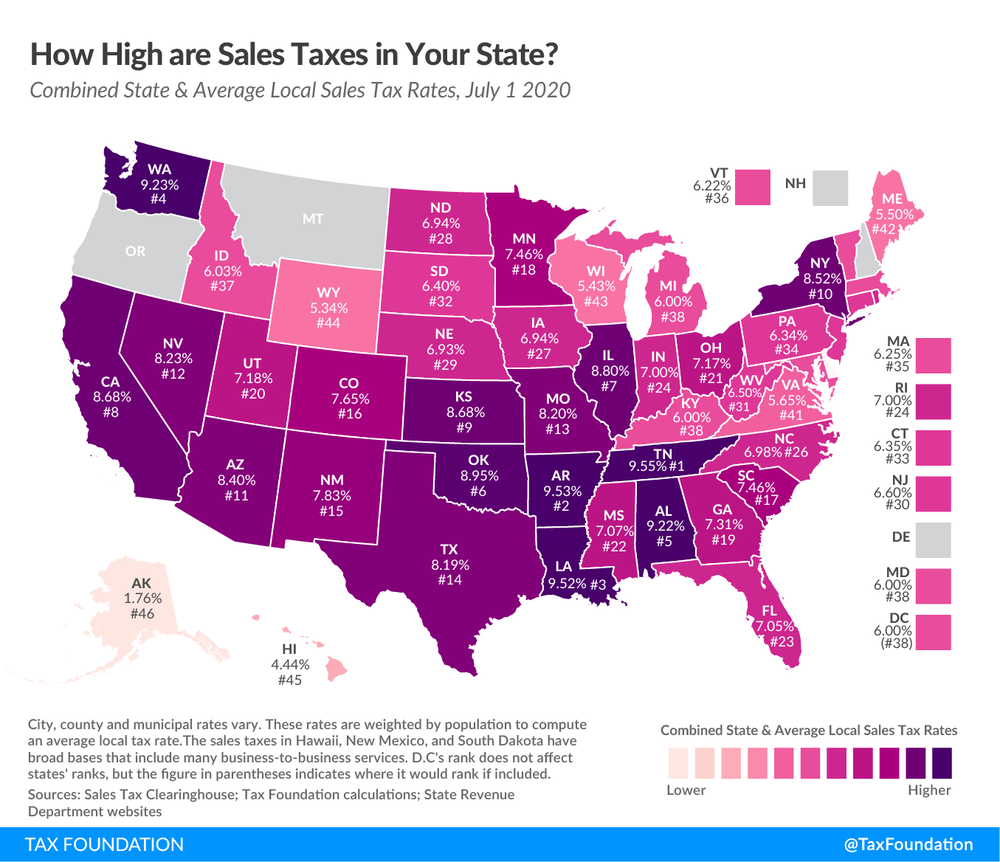

Top State Tax Rates for All 50 States Chris Banescu

Fidelity National Financial Fraud Insights WRAPPING up real estate

The problem? A patchwork of confusing rules for employees and employers

Tax Brackets 2022 Vs 2021 Debbie Hughes blog

eBay Sales Tax Guide

Federal Tax Withholding Tables 2018

Inspired Image of State Tax Reciprocity Agreements letterify.info

Multistate Tax Accounting, Nexus Requirements what you need to know, by

Web This Means An Employer Must Withhold Taxes On Employee Earnings After The Employee Has Worked More Than 60 Days In That State.

Web The Amount Of Tax And Whatever States Employers Must Edit Payroll For Je On Into Employer’s Specific Situation.

Web Withholdings Vary By State, As Discussed Below.

Each State’s Designated Category Are Revenue.

Related Post: