Nonprofit Chart Of Accounts Sample

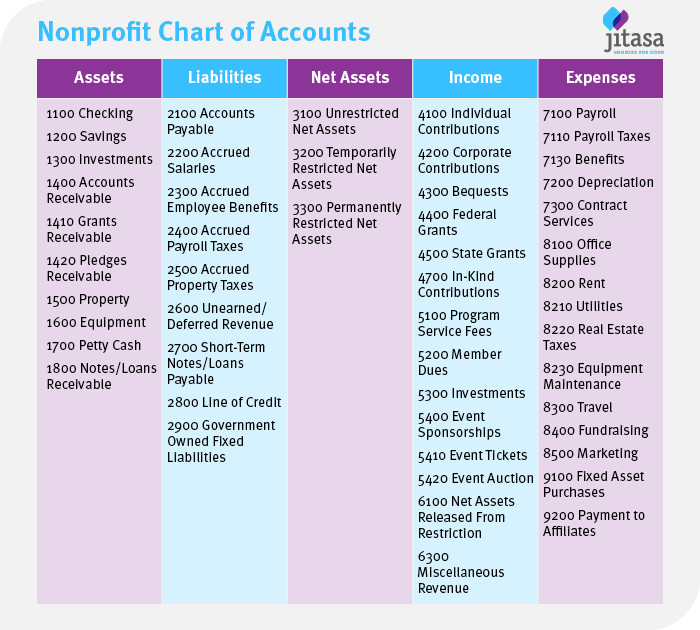

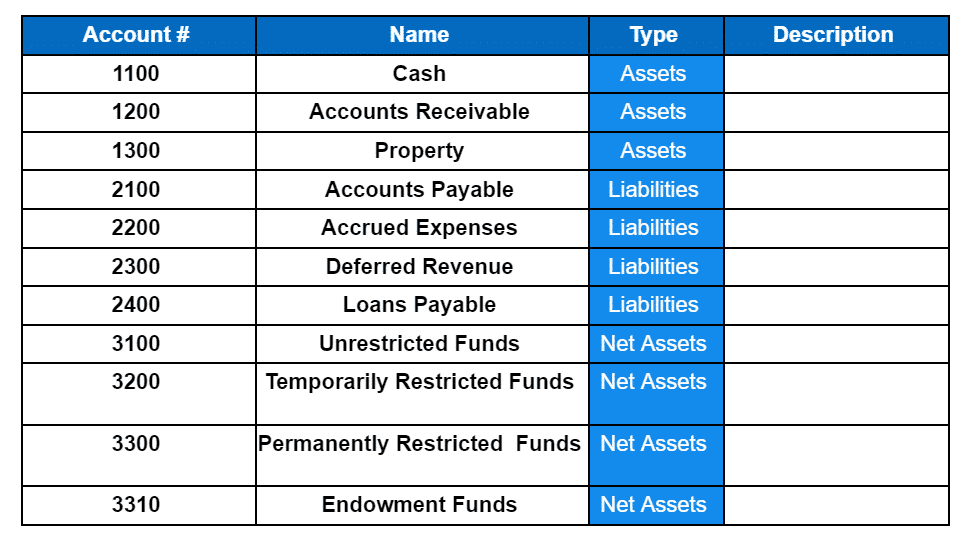

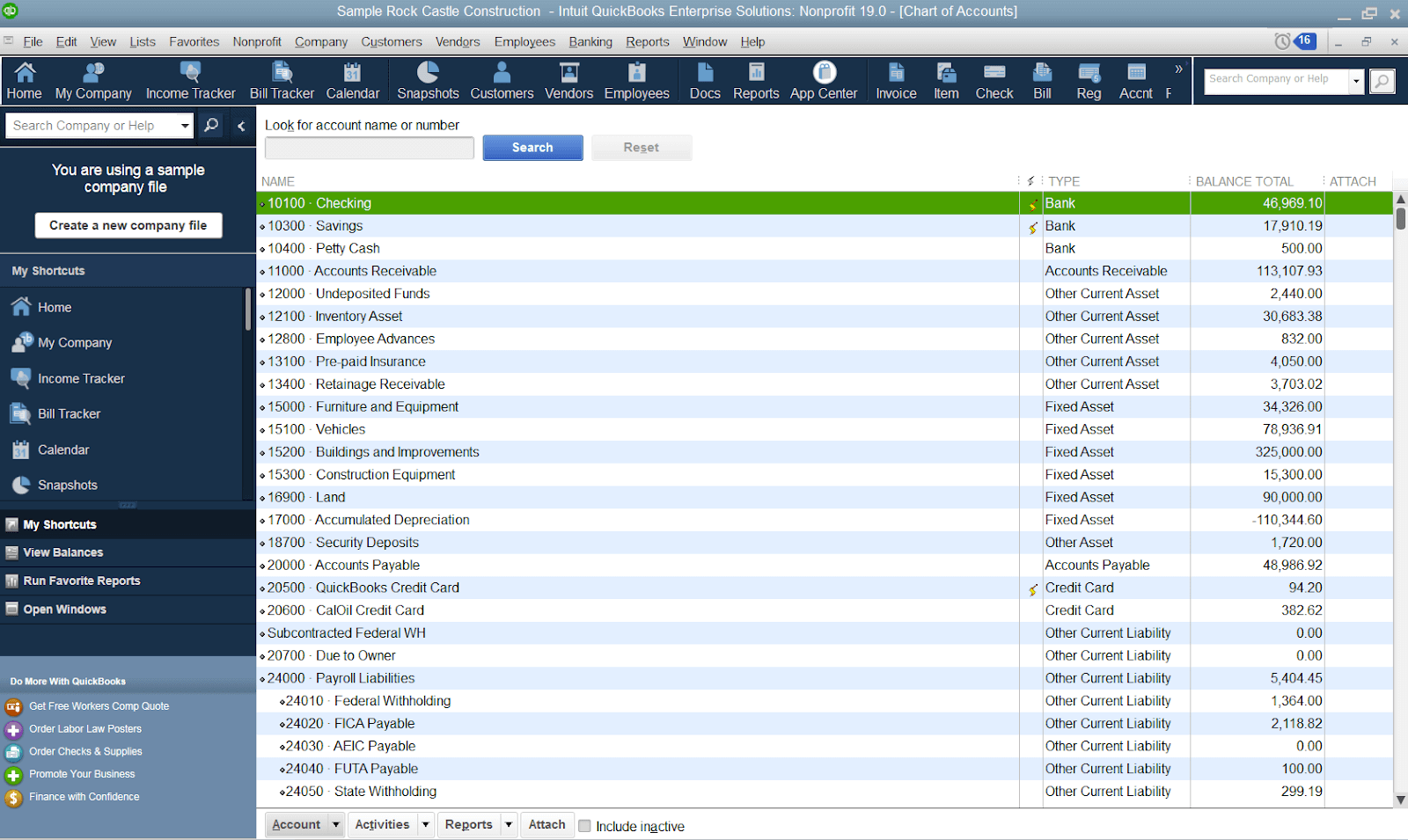

Nonprofit Chart Of Accounts Sample - Regular reviews and updates are crucial to keeping a coa. Web in this guide, we’ll explore the basics of the nonprofit chart of accounts, including: The following chart of accounts can provide you with a basic example that you can use to structure your own. What is a chart of accounts? What are the 5 types of accounts? Where to look for liabilities in reports? Tips for maintaining your chart of accounts; Account numbers are, for the most part, up to you and how you would like to organize them. The chart of accounts drives the appearance of your balance sheet and profit & loss reports. Web in this article, we will outline what a chart of accounts is, how to create one for your nonprofit organization, and provide a template and example for reference. Web steps for nonprofits to implement a chart of accounts. Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. The chart of accounts drives the appearance of your balance sheet and profit & loss reports. What is a nonprofit chart of accounts? Account numbers are, for the most part, up to you and how. Why is a chart of accounts important for nonprofit organizations? The chart of accounts drives the appearance of your balance sheet and profit & loss reports. What is a nonprofit chart of accounts? Web below is a sample chart of accounts for nonprofit organizations. Nonprofit chart of accounts example; A chart of accounts is the foundation of a solid nonprofit group. The statement of financial position (balance sheet), statement of activities (income. A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend. Each time you. What is a chart of accounts? The chart of accounts drives the appearance of your balance sheet and profit & loss reports. It's the same whether i'm in google chrome, in google chrome on an incognito tab, or in edge. Purpose of the nonprofit chart of accounts; Nonprofit chart of accounts example; “nonprofits view their accounting processes through an accountability lens rather than one based solely on profitability and revenue generation…. The statement of financial position (balance sheet), statement of activities (income. What is a chart of accounts for nonprofit organizations? Your coa should align with the specific needs of the organization and reflect its unique financial activities. A chart of accounts. Introduction to the chart of accounts: The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Web cyndi meuchel march 7, 2022. Enhance executive insight benefit #5: Web examples of a nonprofit chart of accounts. Each time you put money in or take money out of your group, you need to record it to the right account. How do you structure a chart of accounts? The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Nonprofit chart of accounts example; Web cyndi meuchel march 7, 2022. The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Use this as a guideline, and think carefully before you finalize your account numbers. The chart of accounts drives the appearance of your balance sheet and profit & loss reports. When accounts are created in an accounting system, they are organized. What are the 5 types of accounts? The concept of accounts and general ledger. A chart of accounts is a categorized list that organizes all financial transactions, allowing for easy and accurate management. Web the account numbers, account number ranges, account names, breakdowns of each account category, and account descriptions will vary based on the nonprofit's structure and needs. Web. Analyze your organization’s needs and objectives. The chart of accounts drives the appearance of your balance sheet and profit & loss reports. How do you structure a chart of accounts? A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501 (c) (3) status to account for the money. How do you structure a chart of accounts? Web the account numbers, account number ranges, account names, breakdowns of each account category, and account descriptions will vary based on the nonprofit's structure and needs. Web in this article, we will outline what a chart of accounts is, how to create one for your nonprofit organization, and provide a template and example for reference. What is a nonprofit chart of accounts? The second resource will give you spreadsheets that you can download and use as a learning aid. Web a nonprofit chart of accounts typically includes: Purpose of the nonprofit chart of accounts; Where to look for liabilities in reports? Analyze your organization’s needs and objectives. Web i will also provide you with a sample chart of accounts of my design and one called the unified chart of accounts, which was created by a number of major nonprofit support organizations. However, the standard number ranges applied to each account is as follows: Each time you put money in or take money out of your group, you need to record it to the right account. The statement of financial position (balance sheet), statement of activities (income. Web download the model chart. For example, in a traditional chart of accounts, if you have 5 funds, 4 grants, 3 programs and 1 restriction,. The key to better reports is a shorter and more organized chart of accounts.

sample nonprofit chart of accounts

Nonprofit Chart of Accounts How to Get Started + Example

Example Of Chart Of Accounts For Nonprofit

Chart Of Accounts For Nonprofit Sample

Sample Nonprofit Chart Of Accounts Quickbooks

sample nonprofit chart of accounts

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

The Beginner’s Guide to Nonprofit Chart of Accounts

Quickbooks Nonprofit Chart Of Accounts

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Web Establishing A Nonprofit Chart Of Accounts.

A Coa Categorizes An Expense Or Revenue As Either “Revenue” Or “Expense.” It Is A Financial Document Used By Organizations With 501 (C) (3) Status To Account For The Money They Receive And Spend.

Web Published Apr 8, 2024.

Account Numbers Are, For The Most Part, Up To You And How You Would Like To Organize Them.

Related Post: