Ohio County Sales Tax Chart

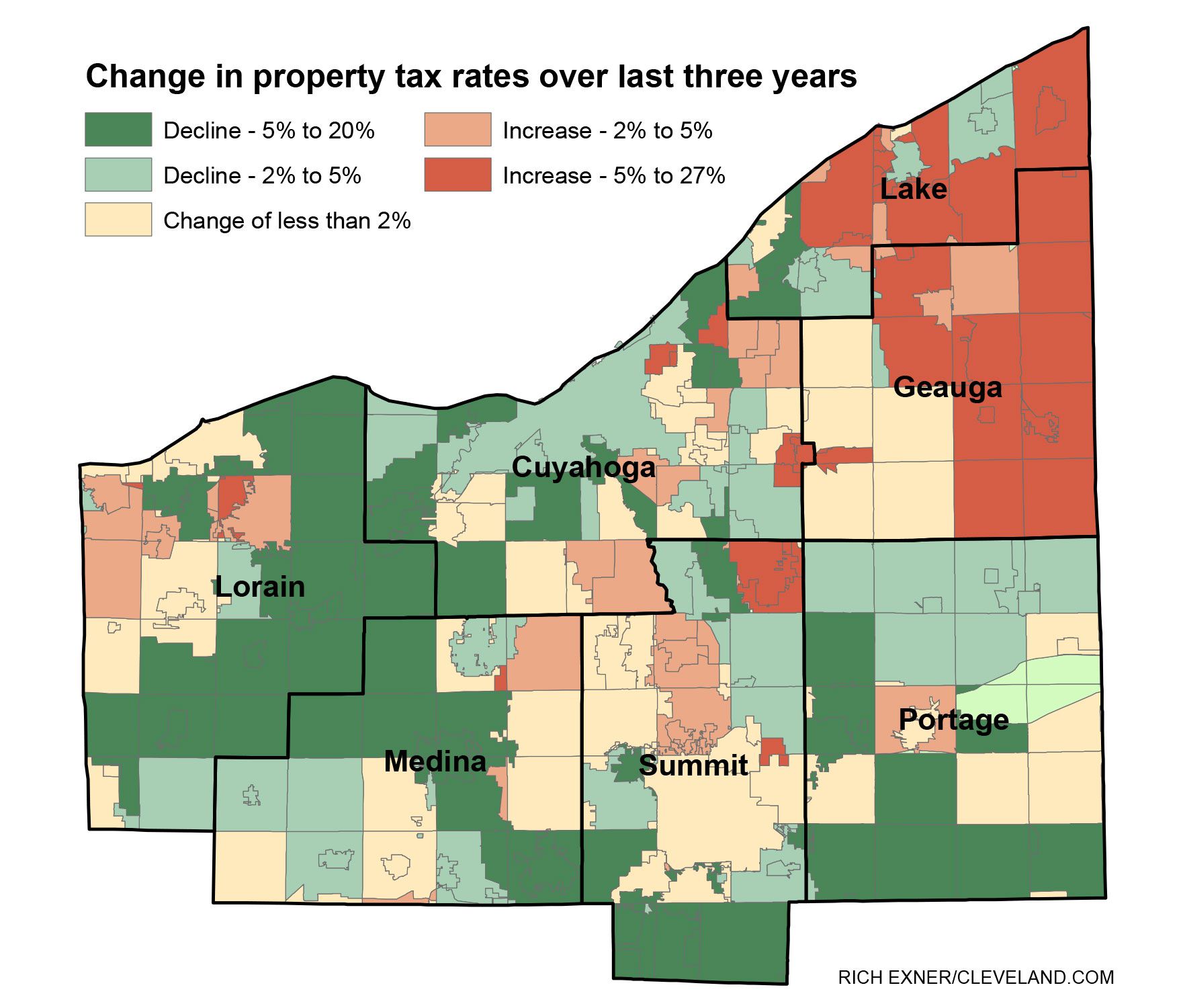

Ohio County Sales Tax Chart - Web the current state sales and use tax rate, 5.5 percent, was established on july 1, 2005. Notifications of ohio sales tax rates and changes or boundary changes. There are a total of 576 local tax jurisdictions across the state, collecting an average local tax of 1.502%. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Click on any county for detailed sales tax rates, or see a full list of ohio counties here. Web download tax rates and geographic information systems (gis) boundary data. For more information about the sales and use tax, look at the options below. Web 1148 rows ohio has state sales tax of 5.75% , and allows local governments to collect a local option sales tax of up to 2.25%. During fiscal year 2009, the tax generated about $7.33 billion in revenue for state govern ment. Web our free online ohio sales tax calculator calculates exact sales tax by state, county, city, or zip code. Web 1148 rows ohio has state sales tax of 5.75% , and allows local governments to collect a local option sales tax of up to 2.25%. Notifications of ohio sales tax rates and changes or boundary changes. Web sales and use tax electronic filing | department of taxation. Key sales & use tax resources. Click any locality for a full. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. Web state and permissive sales tax rates, by county, july 2023. Web download tax rates and geographic information systems (gis) boundary data. Web 2024 ohio sales tax by county. A sample of the 1,412 ohio state sales tax rates in our database is provided below. Web to determine the 2024 oh sales tax rate, start with the statewide sales tax rate of 5.75%. Web the state sales and use tax rate is 5.75 percent. Free sales tax calculator tool to estimate total amounts. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. Notifications of ohio sales tax rates and. A sample of the 1,412 ohio state sales tax rates in our database is provided below. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale of selected services. Counties and regional transit authorities may levy additional sales and use taxes. Map of current sales tax rates. Web look up. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. Web the state sales and use tax rate is 5.75 percent. A sample of the 1,412 ohio state sales tax rates in our database is provided below. Web look up 2024 ohio sales tax rates in an easy to navigate table listed by county and. Counties and regional transit authorities may levy additional sales and use taxes. Web this interactive sales tax map map of ohio shows how local sales tax rates vary across ohio's 88 counties. Web zip county rate zip county rate zip county rate zip county rate county rate table by zip code may 2024 43001 licking 7.25% 43002 franklin 7.50% 43003. Counties and regional transit authorities may levy additional sales and use taxes. The state sales tax rate in ohio is 5.75%, but you can customize this table as needed to. The ohio department of taxation offers the following ways to file sales or. Find the sales and use tax rate in your county. Total state and local sales and use. Web the current state sales and use tax rate, 5.5 percent, was established on july 1, 2005. The state sales tax rate in ohio is 5.75%, but you can customize this table as needed to. Web the state sales and use tax rate is 5.75 percent. Free sales tax calculator tool to estimate total amounts. Discover and explore more sales. Web the current state sales and use tax rate, 5.5 percent, was established on july 1, 2005. Find the sales and use tax rate in your county. Web the state sales and use tax rate is 5.75 percent. Total state and local sales and use tax rates, by county, effective july 2024. Web 1148 rows ohio has state sales tax. Web look up 2024 ohio sales tax rates in an easy to navigate table listed by county and city. You can download the ohio sales tax rates database from our partners at salestaxhandbook. For more information about the sales and use tax, look at the options below. Ohio levies a sales and use tax on the retail sale, lease, and. Web state and permissive sales tax rates, by county, july 2023. Web 1148 rows ohio has state sales tax of 5.75% , and allows local governments to collect a local option sales tax of up to 2.25%. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Counties and regional transit authorities may levy additional sales and use taxes. In addition, ohio counties and local transit authorities may levy additional sales and use taxes. Ohio sales tax rates by county, sstp rate database table, county rate table by zip code csv, or county rate table by zip plus 4 csv. Total state and local sales and use tax rates, by county, effective july 2024. Web there were no sales and use tax county rate changes effective april 1, 2024. Notifications of ohio sales tax rates and changes or boundary changes. Ohio has 1,424 cities, counties, and special districts that collect a local sales tax in addition to the ohio state sales tax. Web the state sales and use tax rate is 5.75 percent. Web 2024 ohio sales tax by county. The state's sales and use tax rate is currently 5.75% * municipalities whose boundaries extend both within and beyond franklin county assess a transit rate of 0.50% in addition to the posted state and county sales tax rate. Web ohio’s tax collection schedule sales and use tax for state, county and/or transit tax. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale of selected services. Discover and explore more sales tax resources for the state of ohio on this page.

eBay Sales Tax Guide

WKSU News Noon headlines, July 2, 2012 Storms, schools, sales taxes

Ohio Sales Tax Rate Map New River Kayaking Map

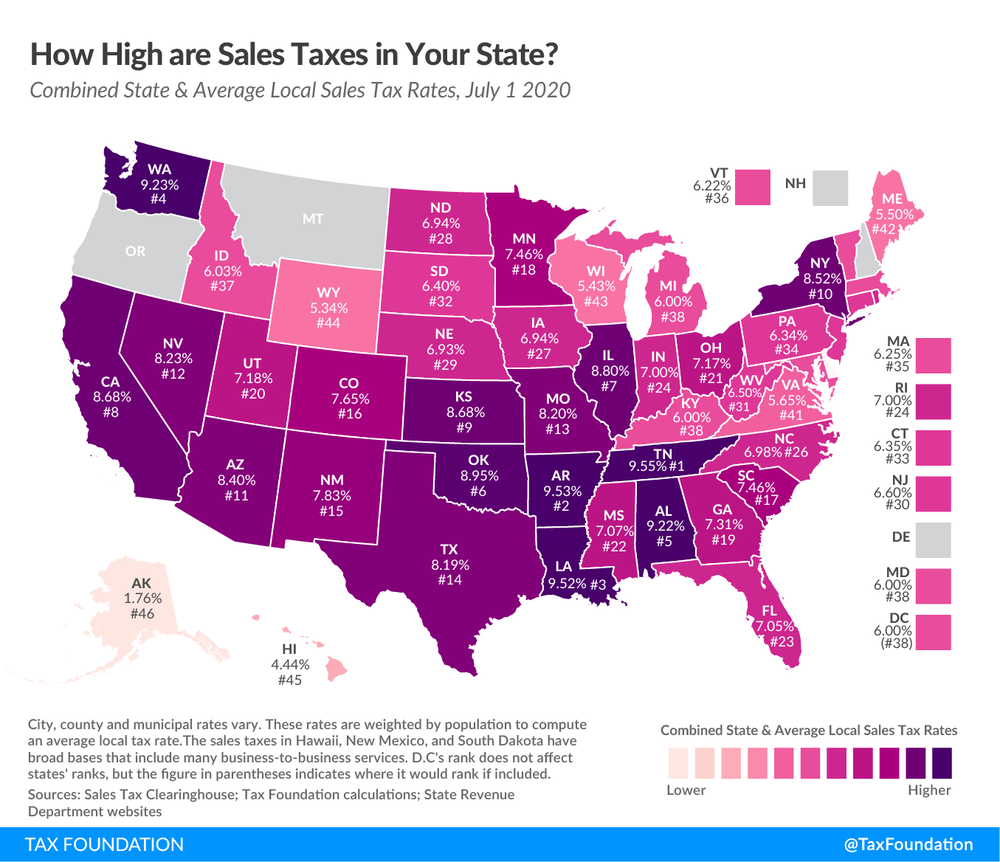

![U.S. Sales Tax by State [1484x1419] MapPorn](https://external-preview.redd.it/t9sLze7hV6ZUinIl1h1wA8Vg4oASGxodMFiNWhYfjYE.png?auto=webp&s=08cfd4239c6068d48a2557b63d1d8404215a5da7)

U.S. Sales Tax by State [1484x1419] MapPorn

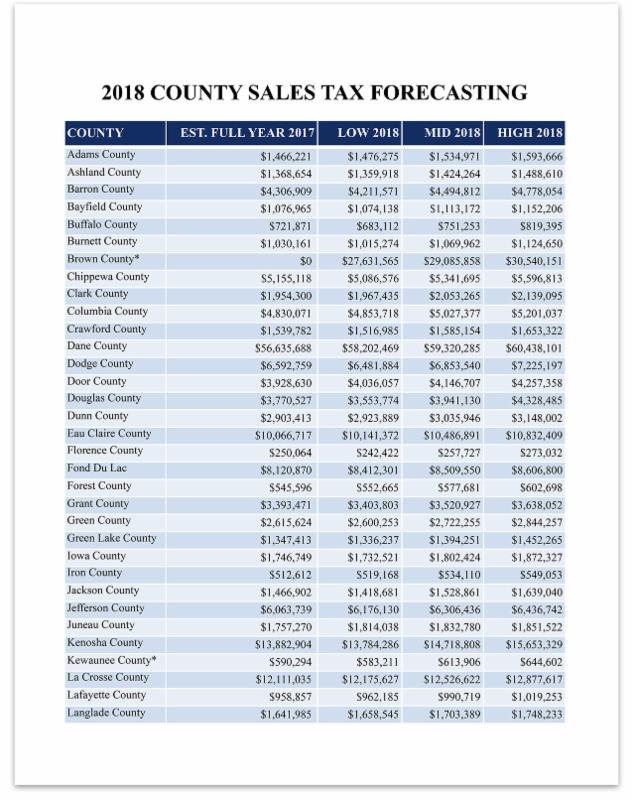

COUNTY SALES TAX FORECASTING

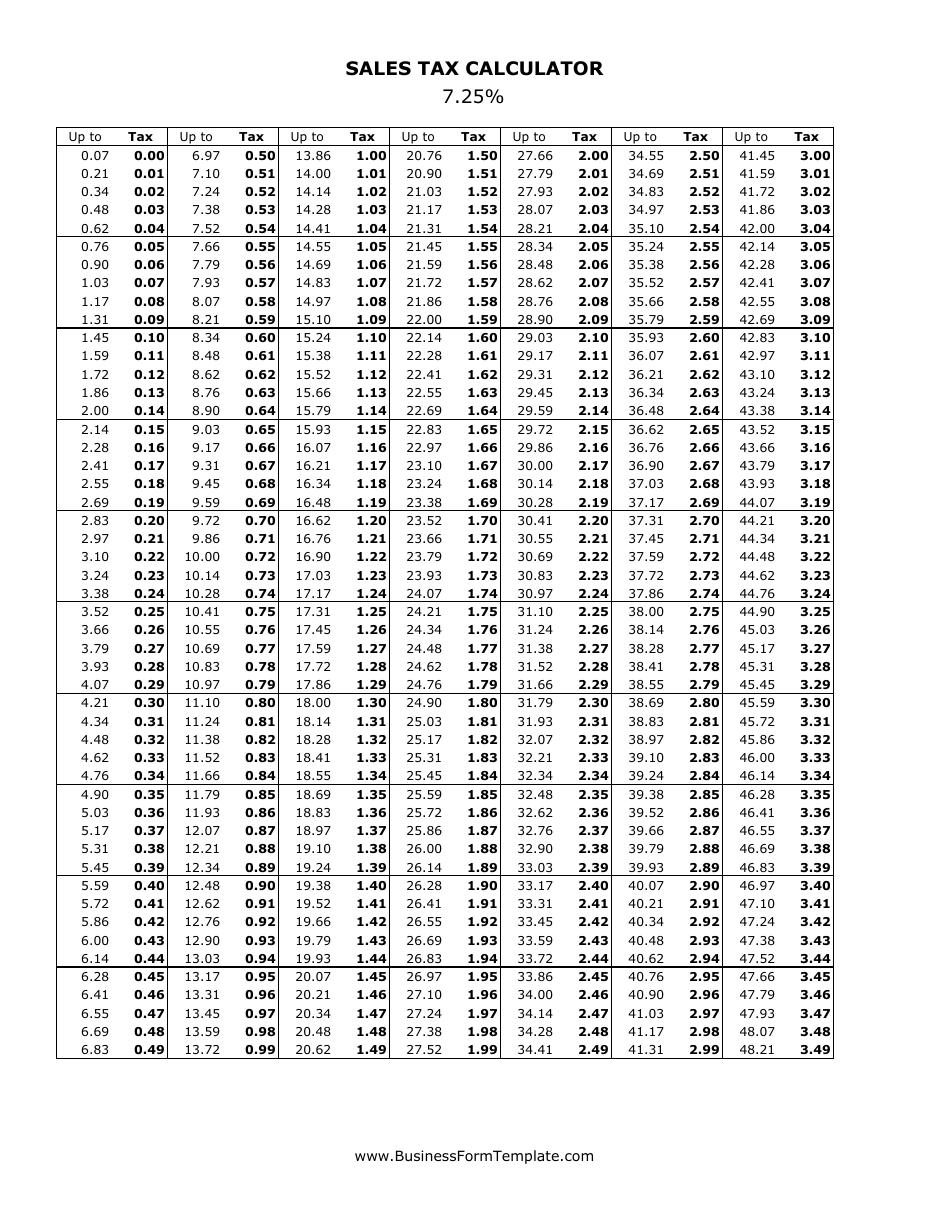

7.25 Sales Tax Chart Printable Printable Word Searches

Ohioans are spending more money on taxable things this year, including

Ohio County Tax Map secretmuseum

Ohio Sales Tax Rate Map New River Kayaking Map

When is Ohio's tax free weekend for school clothes, supplies?

Web Ohio’s Tax Collection Schedule Sales And Use Tax For State, County And/Or Transit Tax.

Then, Identify The Local Sales Tax Rates, Varying Across Counties, Cities, And Districts.

Web Ohio’s Tax Collection Schedule Sales And Use Tax For State, County And/Or Transit Tax.

Find The Sales And Use Tax Rate In Your County.

Related Post: