Ohio Sers Retirement Chart

Ohio Sers Retirement Chart - You have a number of tools and resources available to help you plan for your retirement and guide you through the retirement application process. Upon retirement members can take a lifetime annuity at age 50. Web strs ohio offers a benefit brochure series that provides details and eligibility requirements pertaining to strs ohio benefits offered during a member’s career and in retirement. Sers calculates your pension based on service credit, your highest three years of earnings, and your age. Web sers offers two types of service retirement: As the 61st largest public pension fund in the country, sers holds $13.6 billion in assets. For unreduced service retirement, you will earn the maximum pension amount based on your service credit and final average salary. The anonymous letter claims that steen could possibly be indebted to orta for paying his legal costs. Web the early retirement reduction chart is reflected in the shaded areas of the benefit calculation tables, beginning on page 30 of the service retirement and plans of payment brochure. The annuity is calculated by dividing the account Web there are three ohio public retirement systems that are connected for the purposes of combining service credit: Web sers is a defined benefit (db) plan: The anonymous letter claims that steen could possibly be indebted to orta for paying his legal costs. Web retirement income is based on a calculation that uses the member’s age, years of service and. The state teachers retirement system of ohio (strs); Web strs ohio offers a benefit brochure series that provides details and eligibility requirements pertaining to strs ohio benefits offered during a member’s career and in retirement. Use the calculators to compare different scenarios and plan your retirement income. Total years of service + highest three years of earnings + age =. Web you can find your current retirement group on your annual statement or in your online account. You have a number of tools and resources available to help you plan for your retirement and guide you through the retirement application process. Web sers is a defined benefit (db) plan: To estimate benefit amounts under other plans of payment, please use. Web retirement income is based on a calculation that uses the member’s age, years of service and final average salary. Web you can find your current retirement group on your annual statement or in your online account. The annuity is calculated by dividing the account Web this benefit calculation table and estimate worksheet for retirement aug. For unreduced service retirement,. The annuity is calculated by dividing the account Web strs ohio offers a benefit brochure series that provides details and eligibility requirements pertaining to strs ohio benefits offered during a member’s career and in retirement. Web sers offers two types of service retirement: The state teachers retirement system of ohio (strs); You have a number of tools and resources available. Web sers offers two types of service retirement: Web to learn the basics of retiring from opers, visit the ready to retire page. Web retirement income is based on a calculation that uses the member’s age, years of service and final average salary. Web sers is a defined benefit (db) plan: Web the early retirement reduction chart is reflected in. You have a number of tools and resources available to help you plan for your retirement and guide you through the retirement application process. To estimate benefit amounts under other plans of payment, please use the benefit estimate calculator available in your. The state teachers retirement system of ohio (strs); And the ohio public employees retirement system (opers). A db. And the ohio public employees retirement system (opers). Web sers offers two types of service retirement: For example, a defined beneit plan participant who retires at age 60 and receives a $25,000 lump sum payment would have his or her benefit reduced $174.25 a month for life ($6.97 x 25 = $174.25). Web sers also provides its members with significant. To estimate benefit amounts under other plans of payment, please use the benefit estimate calculator available in your. Web the ohio retirement for teachers association raised over $60,000 for steen’s legal defense fund. Web strs ohio offers a benefit brochure series that provides details and eligibility requirements pertaining to strs ohio benefits offered during a member’s career and in retirement.. And the ohio public employees retirement system (opers). Web there are three ohio public retirement systems that are connected for the purposes of combining service credit: Deciding to retire is a milestone requiring careful thought and planning. Use the calculators to compare different scenarios and plan your retirement income. Web this benefit calculation table and estimate worksheet for retirement aug. Total years of service + highest three years of earnings + age = your pension. Sers calculates your pension based on service credit, your highest three years of earnings, and your age. You have a number of tools and resources available to help you plan for your retirement and guide you through the retirement application process. Unreduced service retirement and early service retirement with reduced benefits. Web sers also provides its members with significant financial tools for retirement, savings, and healthcare, along with solid support for all its members. School employees retirement system of ohio (sers); Web estimate your retirement benefit amount under the defined benefit, defined contribution or combined plan. Use the calculators to compare different scenarios and plan your retirement income. For example, a defined beneit plan participant who retires at age 60 and receives a $25,000 lump sum payment would have his or her benefit reduced $174.25 a month for life ($6.97 x 25 = $174.25). Deciding to retire is a milestone requiring careful thought and planning. As the 61st largest public pension fund in the country, sers holds $13.6 billion in assets. In 2018, sers had 237,138 active and retired members. For unreduced service retirement, you will earn the maximum pension amount based on your service credit and final average salary. Upon retirement members can take a lifetime annuity at age 50. Web you can find your current retirement group on your annual statement or in your online account. Web ten steps toward a secure retirement.

Ohio Sers Retirement Chart

Sers Ohio Retirement Chart

SERS Ohio approves 75m commitment Private Debt Investor

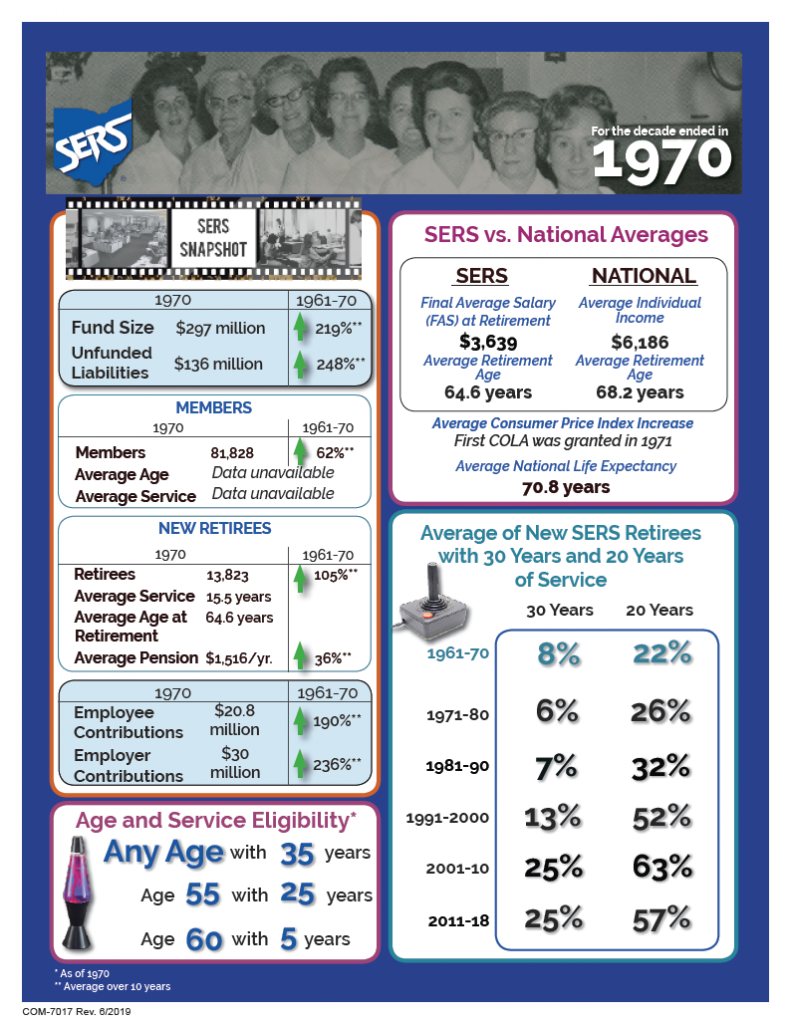

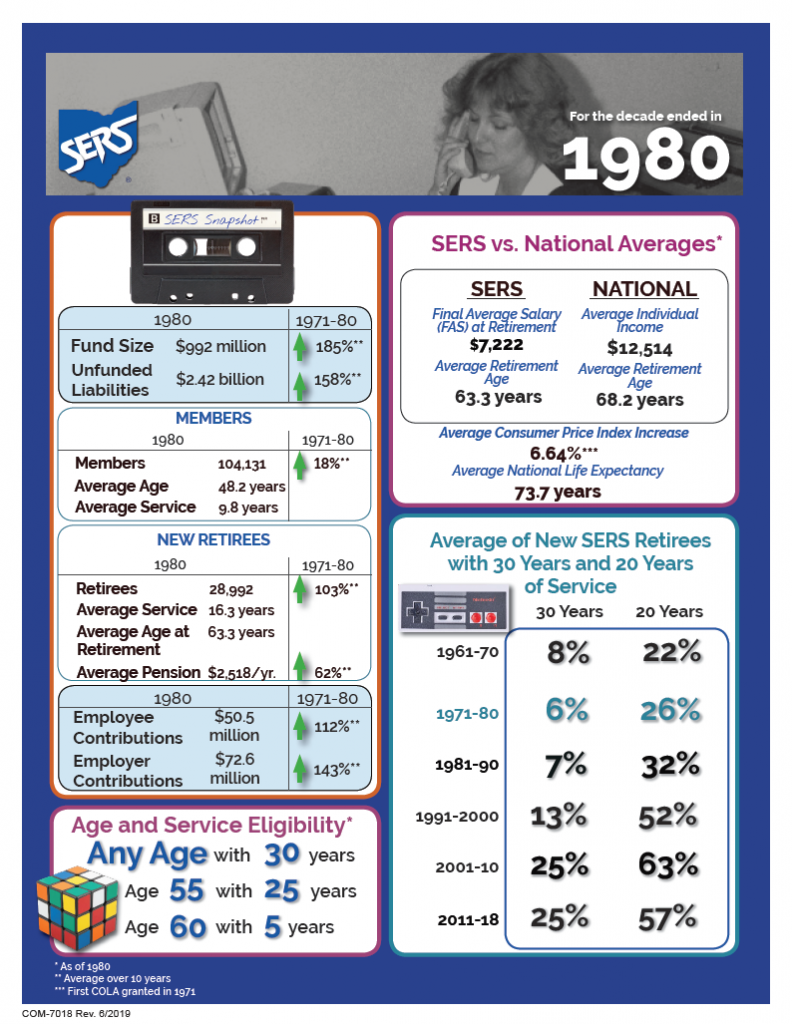

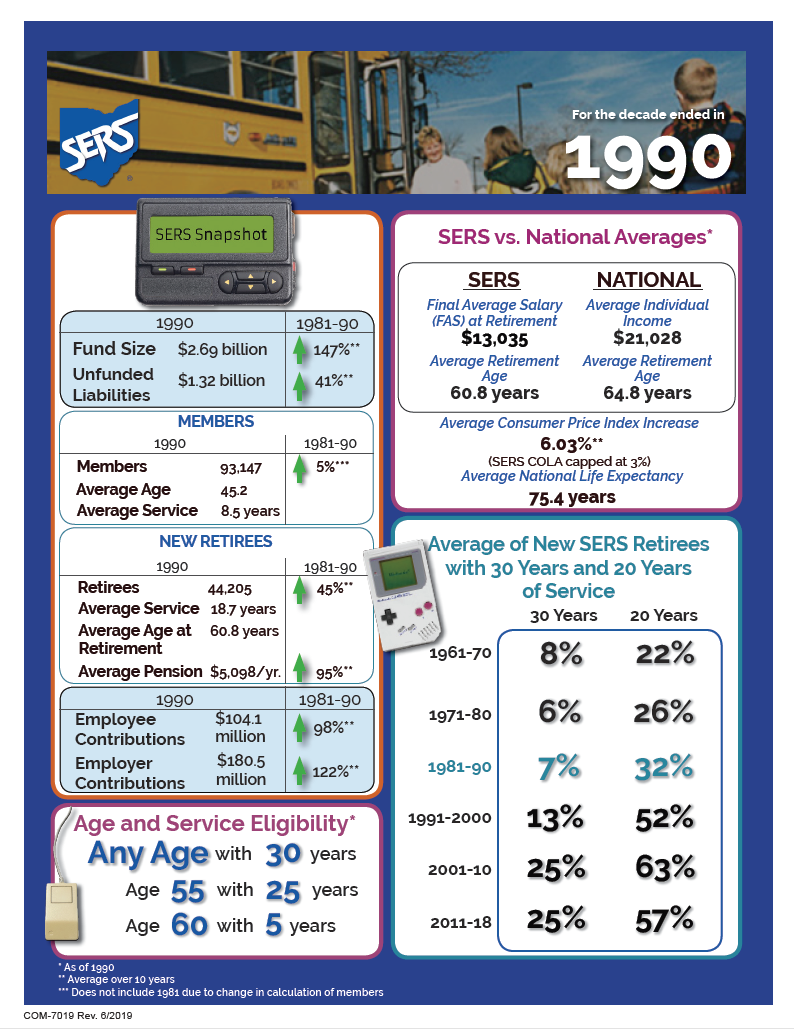

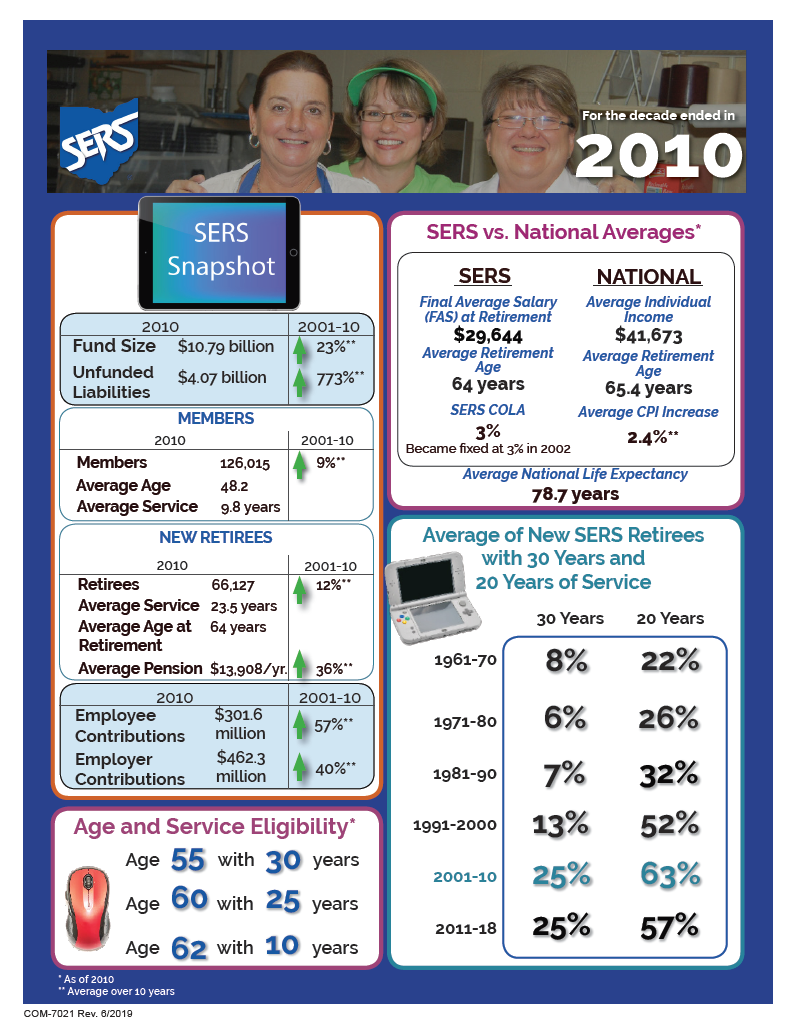

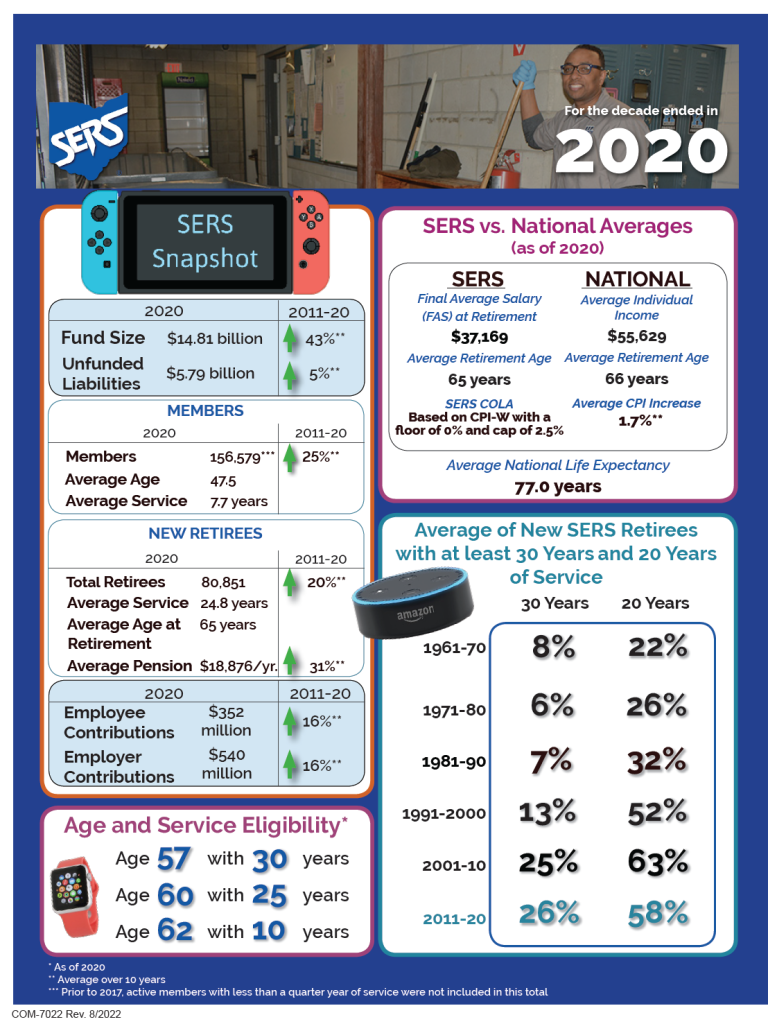

History School Employees Retirement System Ohio SERS

History School Employees Retirement System Ohio SERS

History School Employees Retirement System Ohio SERS

History School Employees Retirement System Ohio SERS

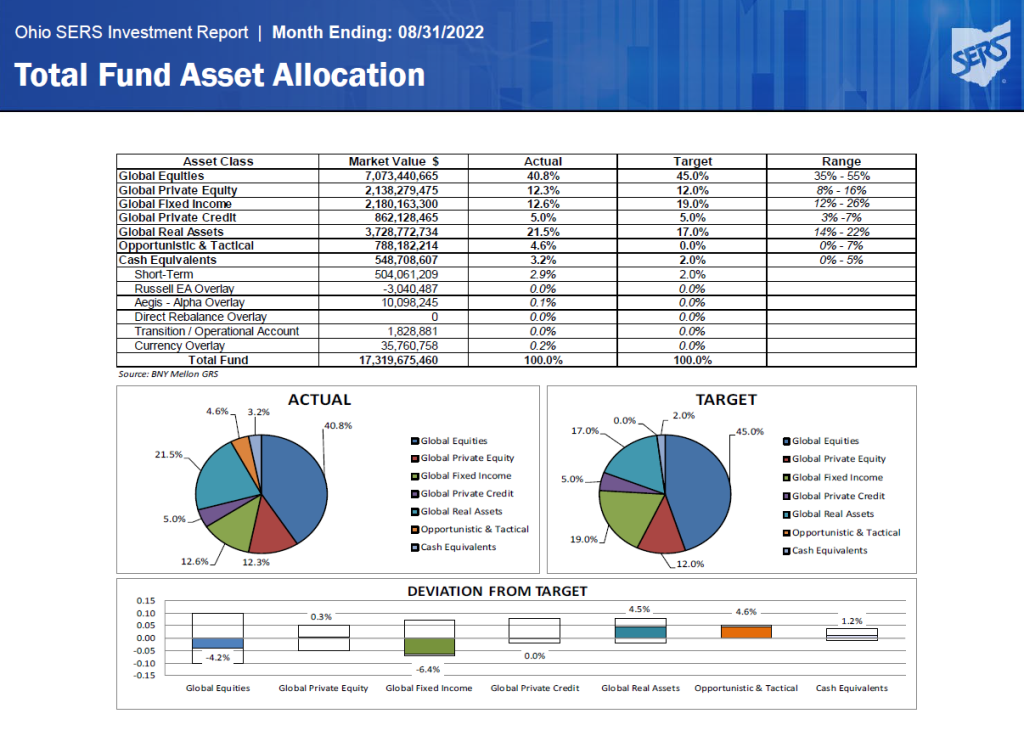

Investments School Employees Retirement System Ohio SERS

Sers Retirement Chart A Visual Reference of Charts Chart Master

History School Employees Retirement System Ohio SERS

Web Retirement Benefits Are Based On The Amount Of Member And Employer Contributions Deposited To Your Account, The Performance Of Investment Choices You Select And The Annuity Rate In Effect At The Time Of Retirement.

Web The Table Below Shows The Amount A Monthly Benefit Is Reduced For Each $1,000 Of Lump Sum Payment.

Web Sers Offers Two Types Of Service Retirement:

Web Retirement Income Is Based On A Calculation That Uses The Member’s Age, Years Of Service And Final Average Salary.

Related Post: