Ohio Teacher Retirement Chart

Ohio Teacher Retirement Chart - Web prior to 2012, teachers could retire at any age after 30 years of service and receive a pension equal to 66% of the average of their five highest years’ salary, according to strs. Web the early retirement reduction chart is reflected in the shaded areas of the benefit calculation tables, beginning on page 30 of the service retirement and plans of payment brochure. Web 1 employers contribute to strs ohio plans based on teacher payroll. Web retirement plan comparison chart. This is a comprehensive plan that provides. As a participant in the combined plan, a portion of your retirement income comes from the performance of the investment choices you selected for the defined contribution portion of your account during your teaching. Web school employees retirement system of ohio 300 e. Web log in to your account. The 11.09% contribution is subject to change by the retirement board. It reflects your total account balance and earned service credit in strs ohio as of the preceding june 30. It reflects your total account balance and earned service credit in strs ohio as of the preceding june 30. The calculator has been updated to reflect the change in retirement eligibility requirements for defined benefit plan participants that eliminates the age 60. Web log in to your account. Web as a new member of the state teachers retirement system of. Web retirement plan comparison chart. A portion of employer contributions is set aside to pay for the existing unfunded liability of the retirement system. Strs ohio defined contribution plan; Web as a new member of the state teachers retirement system of ohio (strs ohio), you have 180 days from your first day of paid service to choose one of the. Select “calculators” from the top menu. This is a comprehensive plan that provides. Web orta advocates for the pensions and benefits of ohio's active and retired educators; A portion of employer contributions is set aside to pay for the existing unfunded liability of the retirement system. Web retirement plan comparison chart. Web the online statement is organized just like the printed statement and provides an itemized history of earnings, deposits, projected retirement benefits and retirement credit for each school year. Service retirement and plans of payment brochure or visit the strs ohio website at. Strs ohio’s primary purpose is to provide a monthly benefit in retirement for ohio’s public educators. Web. Select “calculators” from the top menu. For more information about strs ohio’s services, select one of. The 11.09% contribution is subject to change by the retirement board. Service retirement and plans of payment brochure or visit the strs ohio website at. Demands accountability from the state teachers retirement system of ohio; Web to retrieve a copy of this letter, log into esers: Go to the foundation deduction notice application found under ‘financial information’ click on the 2025 link to download the…. See the charts on pages 9 and 10 that give a percentage figure to apply to your final average salary to find your pension amount on an annual basis. Web. The 11.09% contribution is subject to change by the retirement board. Strs ohio defined contribution plan; A portion of employer contributions is set aside to pay for the existing unfunded liability of the retirement system. Web retirement plan comparison chart. Service retirement and plans of payment brochure or visit the strs ohio website at. Go to the foundation deduction notice application found under ‘financial information’ click on the 2025 link to download the…. Web prior to 2012, teachers could retire at any age after 30 years of service and receive a pension equal to 66% of the average of their five highest years’ salary, according to strs. Web the early retirement reduction chart is. Web the headquarters of the state teachers retirement system of ohio is pictured on wednesday, may 15, 2024, in columbus, ohio. The calculator has been updated to reflect the change in retirement eligibility requirements for defined benefit plan participants that eliminates the age 60. The 11.09% contribution is subject to change by the retirement board. Web the online statement is. Web how does it work? Web log in to your account. Service retirement and plans of payment brochure or visit the strs ohio website at. The strs ohio combined plan includes features of the defined benefit and defined contribution plans, so you have benefits while teaching and two elements to your retirement benefit. See the charts on pages 9 and. Strs ohio’s primary purpose is to provide a monthly benefit in retirement for ohio’s public educators. Web how does it work? The calculator has been updated to reflect the change in retirement eligibility requirements for defined benefit plan participants that eliminates the age 60. Web prior to 2012, teachers could retire at any age after 30 years of service and receive a pension equal to 66% of the average of their five highest years’ salary, according to strs. Strs ohio defined contribution plan; Web the early retirement reduction chart is reflected in the shaded areas of the benefit calculation tables, beginning on page 30 of the service retirement and plans of payment brochure. A portion of employer contributions is set aside to pay for the existing unfunded liability of the retirement system. It reflects your total account balance and earned service credit in strs ohio as of the preceding june 30. See the charts on pages 9 and 10 that give a percentage figure to apply to your final average salary to find your pension amount on an annual basis. As a participant in the combined plan, a portion of your retirement income comes from the performance of the investment choices you selected for the defined contribution portion of your account during your teaching. Web log in to your account. Demands accountability from the state teachers retirement system of ohio; Web educators are covered by the state teachers retirement system (strs), which is similar to opers in that it also offers defined benefit, defined contribution, and combined plans. Web school employees retirement system of ohio 300 e. The 11.09% contribution is subject to change by the retirement board. Strs ohio defined benefit plan;

Retirement Benefits May 2012

Sers Ohio Retirement Chart

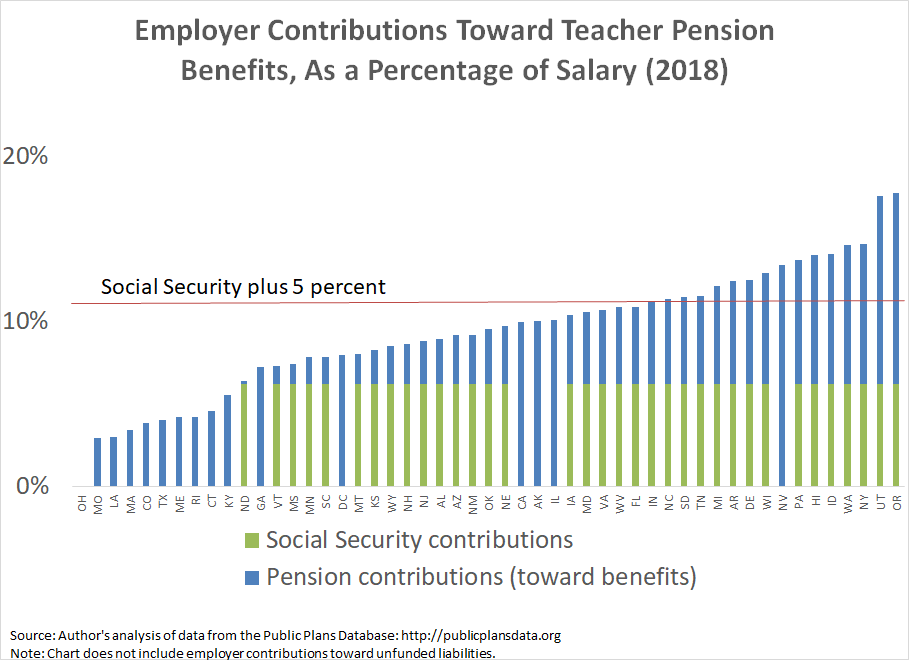

Which States Have the Best (and Worst) Teacher Retirement Plans

State Teachers Retirement System of Ohio What are supplemental

Ohio teacher retirement chart JuraRuadhan

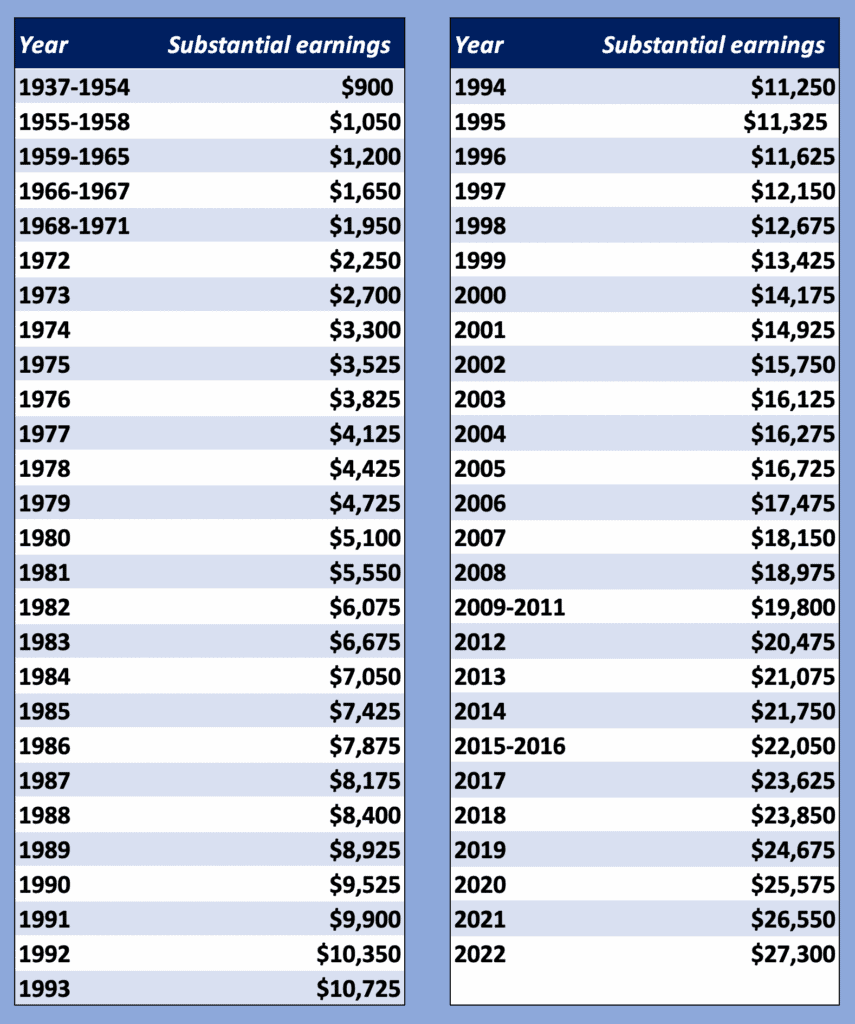

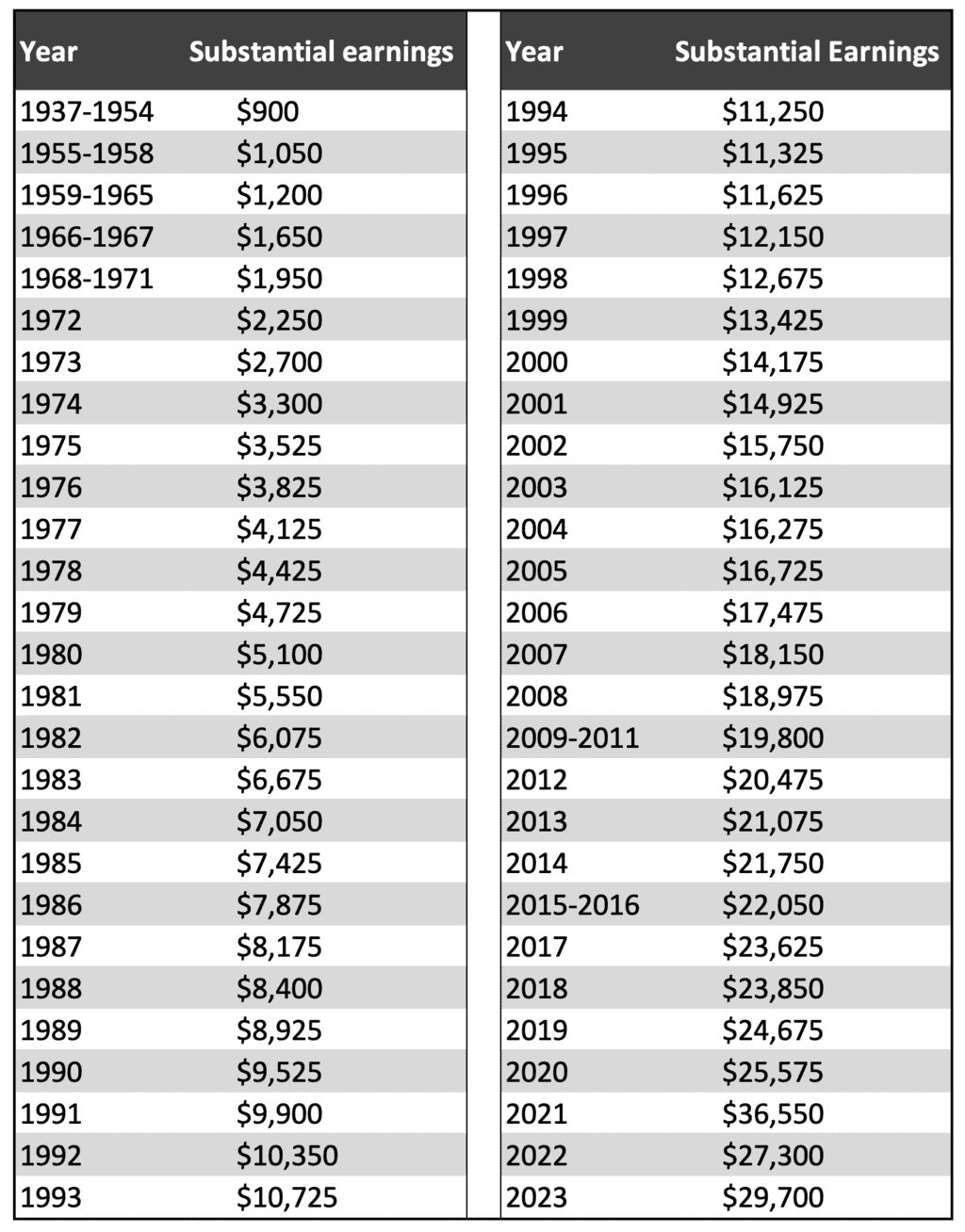

Teacher’s Retirement and Social Security Social Security Intelligence

Tsp retirement calculator NickosZishan

Here's What Retirement Looks Like In America In Six Charts

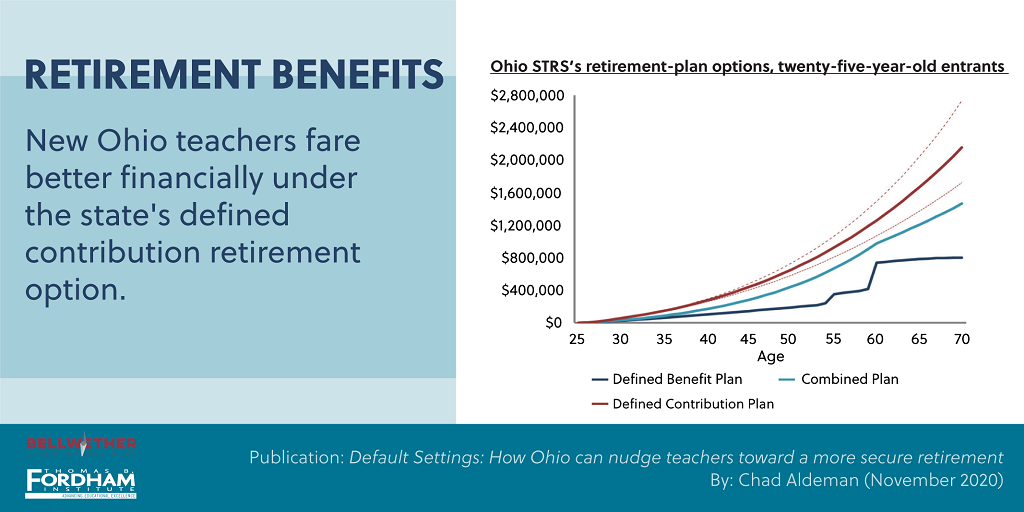

Default Settings How Ohio can nudge teachers toward a more secure

Ohio Teacher Retirement Chart

The Strs Ohio Combined Plan Includes Features Of The Defined Benefit And Defined Contribution Plans, So You Have Benefits While Teaching And Two Elements To Your Retirement Benefit.

We Rely On Membership Dues To Continue Our.

Web Retirement Plan Comparison Chart.

Go To The Foundation Deduction Notice Application Found Under ‘Financial Information’ Click On The 2025 Link To Download The….

Related Post: