Owner Draws In Quickbooks

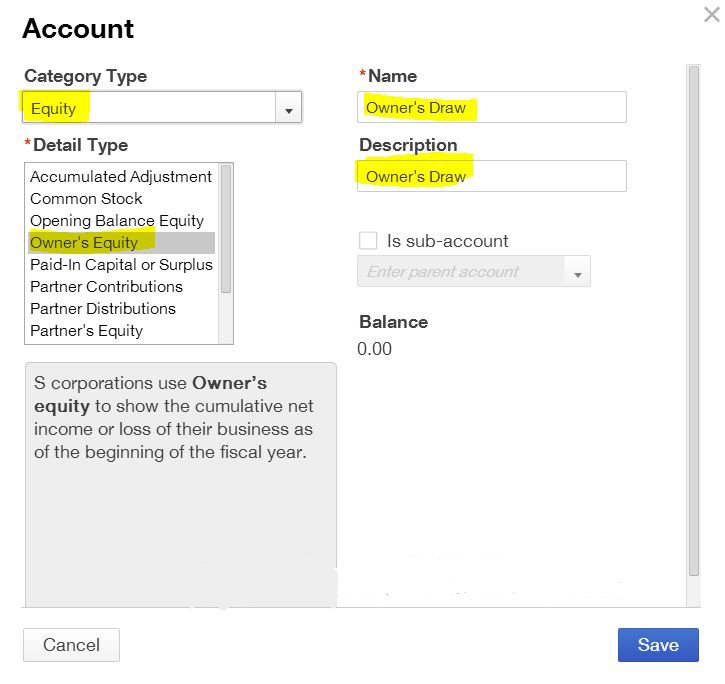

Owner Draws In Quickbooks - Important offers, pricing details & disclaimers. It is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Web owner’s draw in quickbooks: Select the equity account option. Web learn how to pay an owner of a sole proprietor business in quickbooks online. This can be achieved through various methods such as creating a journal entry or using the owner’s equity account. Web before deciding which method is best for you, you must first understand the basics. Here's an article for more details: Know that you can select the equity account when creating a. Owner’s equity, owner’s investment, or owner’s draw. Learn about recording an owner’s. Set up and pay an owner's draw. 10k views 2 years ago. 40k views 4 months ago intermediate expense topics in. However, corporations cannot take the owner’s draw. Web owner’s draw in quickbooks: Such corporations take profits in the form of distributions or dividends. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. Web what is the owner’s draw in quickbooks? Important offers, pricing details & disclaimers. Select the date in the report period field. Here's an article for more details: Web learn how to pay an owner of a sole proprietor business in quickbooks online. Click chart of accounts and click add. 3. Draws can happen at regular intervals or when needed. Draws can happen at regular intervals or when needed. Web what is the owner’s draw in quickbooks? Web owner’s draw in quickbooks: Enter owner draws as the account. This will handle and track the withdrawals of the company's assets to pay an owner. Web owner's draw/personal expenses. Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. You can customize the report for the owner's draw you have set up in quickbooks online (qbo). Set up and pay an owner's draw. Draws can happen at regular intervals or when needed. Open the chart of accounts and choose add. This article describes how to setup and pay owner’s draw in quickbooks online & desktop. Another way of recording a draw is to manually create a check. Download the quickbooks online advanced user guide. Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its. However, corporations cannot take the owner’s draw. Web this quickbooks tutorial video shows you how to record an owner’s draw in quickbooks 2023. It is necessary to make a record for the transactions of the owner’s withdrawal for the financial reasons of the company. Download the quickbooks online advanced user guide. 16k views 2 years ago. Web recording the owner’s draw transaction in quickbooks involves accurately documenting the withdrawal amount and linking it to the designated equity account for comprehensive financial tracking. Web you are right about categorizing the downloaded draw instead of recording it as a transfer. You may see one or more of these names: Web owner’s draw in quickbooks: Important offers, pricing details. Here's an article for more details: This will handle and track the withdrawals of the company's assets to pay an owner. This can be achieved through various methods such as creating a journal entry or using the owner’s equity account. Select the equity account option. 16k views 2 years ago. If your business is formed as a c corporation or an s corporation, you will most likely receive a paycheck just like you did when you were employed by someone else. Important offers, pricing details & disclaimers. Here's an article for more details: Another way of recording a draw is to manually create a check. Don't forget to like and. Web owner’s draw in quickbooks refers to the distribution of funds or assets from a business to its owners for personal use or investments. There are an array of ways available that can help record an owner’s draw in quickbooks, such as banking and chart of accounts options. Another way of recording a draw is to manually create a check. Web recording the owner’s draw transaction in quickbooks involves accurately documenting the withdrawal amount and linking it to the designated equity account for comprehensive financial tracking. This transaction impacts the owner’s equity and is essential for accurate financial management within. You may see one or more of these names: Know that you can select the equity account when creating a. A clip from mastering quick. This will handle and track the withdrawals of the company's assets to pay an owner. Open the chart of accounts and choose add. Web owner's draw/personal expenses. Select the date in the report period field. Web owner’s draw in quickbooks: If your business is formed as a c corporation or an s corporation, you will most likely receive a paycheck just like you did when you were employed by someone else. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. Such corporations take profits in the form of distributions or dividends.

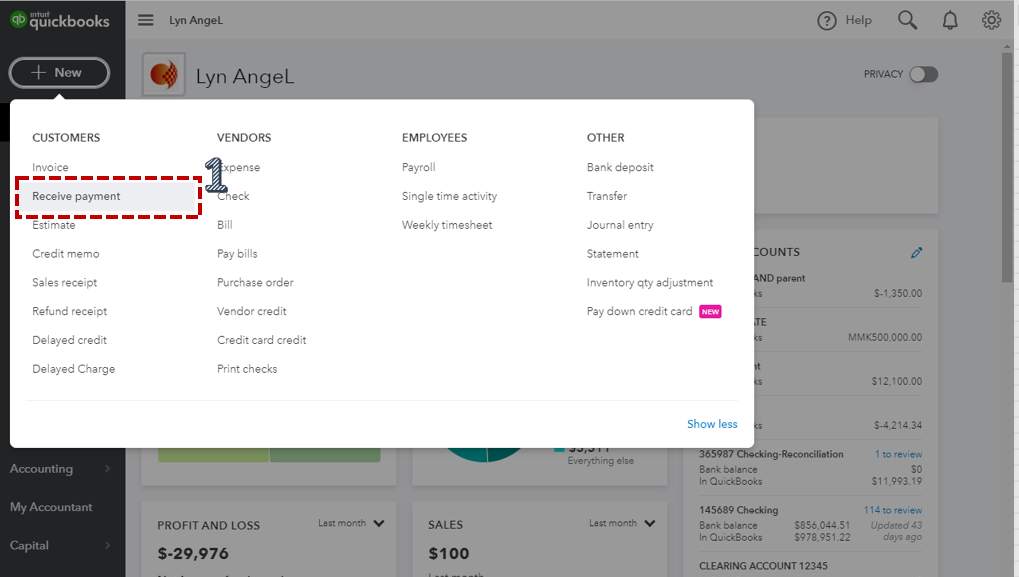

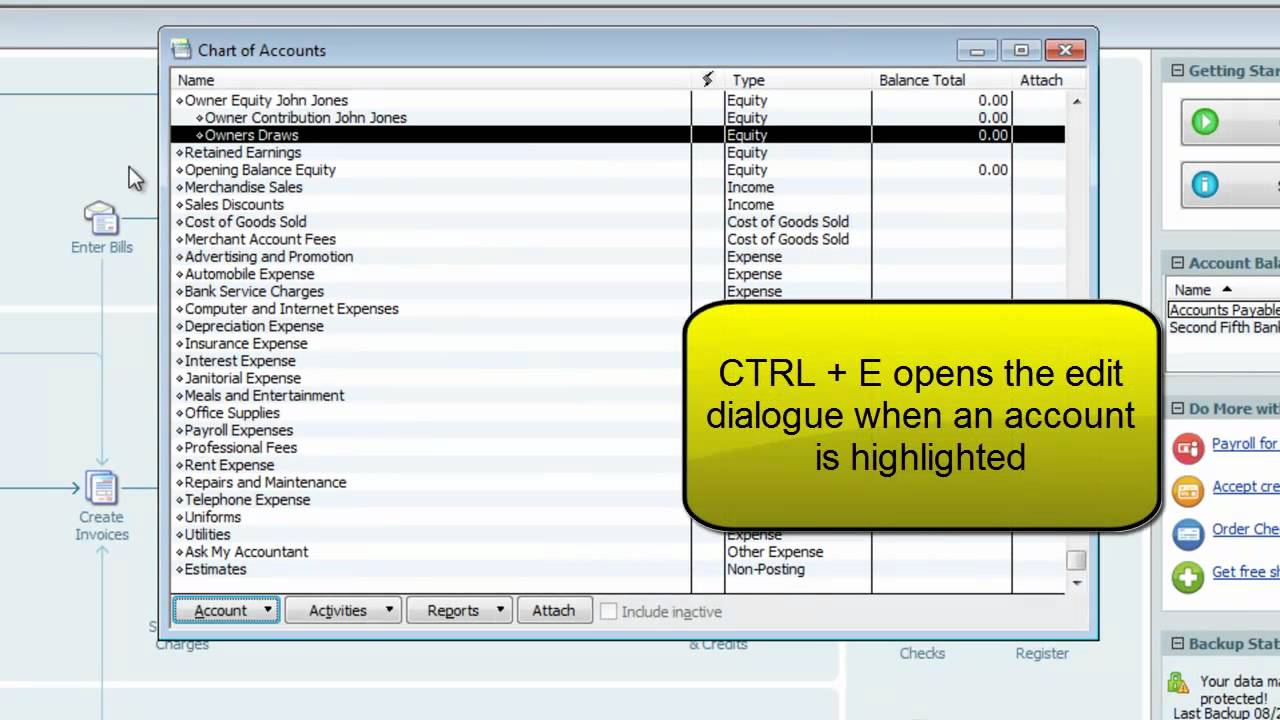

How to record personal expenses and owner draws in QuickBooks Online

Owners draw QuickBooks Desktop Setup, Record & Pay Online

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Owners draw balances

Owner Draw Report Quickbooks

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

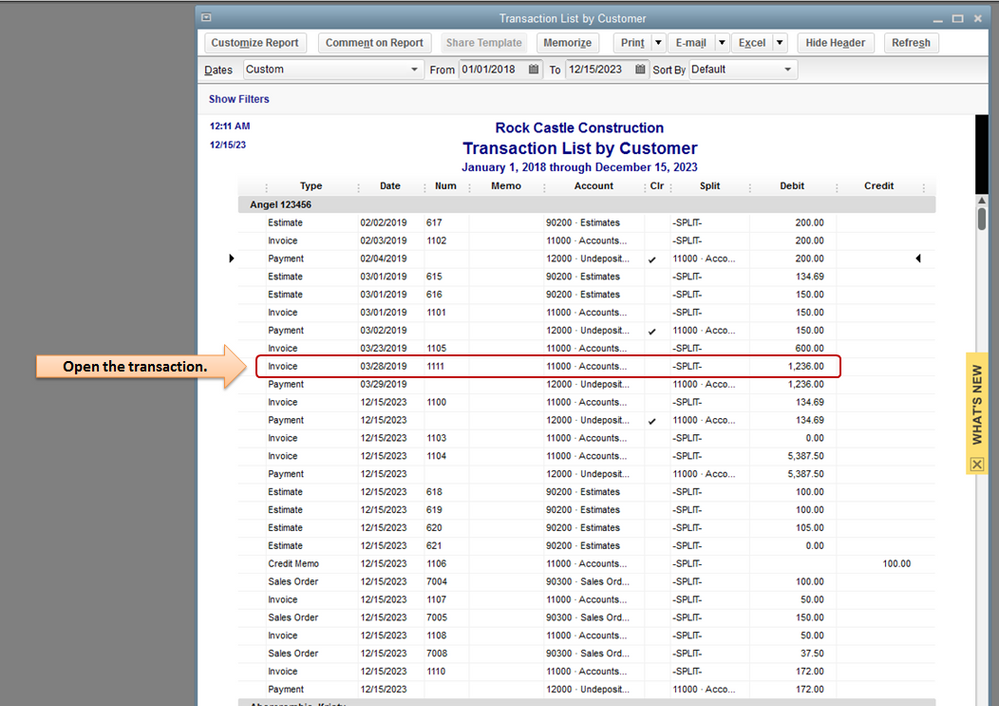

How to pay invoices using owner's draw? QuickBooks Community

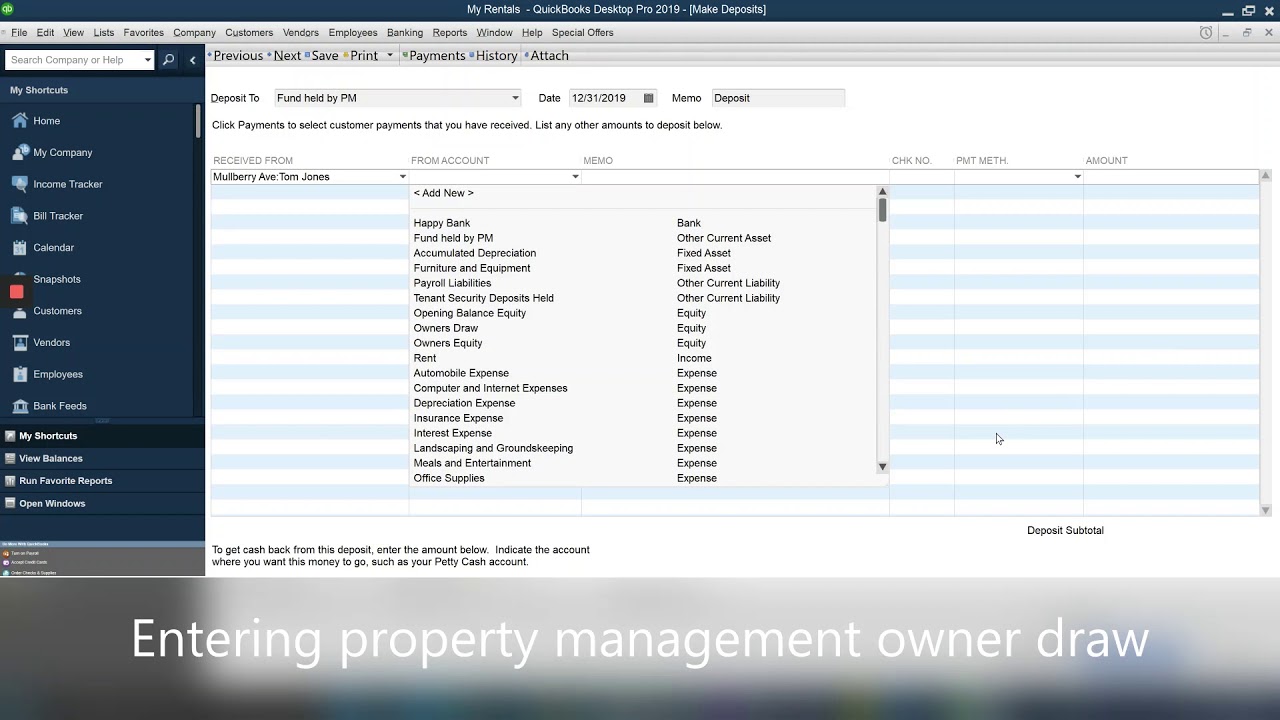

How to enter the property management owner draw to QuickBooks YouTube

Quickbooks Owner Draws & Contributions YouTube

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Web You Are Right About Categorizing The Downloaded Draw Instead Of Recording It As A Transfer.

Select The Equity Account Option.

Web Type The Name Of The Owner's Draw Account In The Search Box.

Owner’s Draw Refers To The Process Of Withdrawing Money From A Business For Personal Use By The Owner.

Related Post: