Owners Draw Account

Owners Draw Account - This is a contra equity account that is. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. This method of payment is common across. Many small business owners compensate themselves using a draw rather. The drawing account is also a. Need to make sure i'm handling owner equity and owner draw correctly. Web an owner’s draw refers to an owner taking funds out of the business for personal use. Web owner’s drawing is a temporary contra equity account with a debit balance that reduces the normal credit balance of an owner's equity capital account in a business organized. Web owner draw is an equity type account used when you take funds from the business. In five career races, fierceness owns. In a corporation, owners can receive compensation by a salary or. Web december 10, 2018 08:45 pm. An owner's draw is a way for a business owner to withdraw money from the business for personal use. When you put money in the business you also use an equity account. Web owner draws are only available to owners of sole proprietorships. What is a drawing account? Owner withdrawals from businesses that are taxed as separate entities. Web december 10, 2018 08:45 pm. This method of payment is common across. In this situation the bookkeeping entries are recorded on the. The drawing account is an accounting record used in a business organized as a sole proprietorship or a partnership, in. What is a drawing account? The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. Web owner draws are only available to owners of sole proprietorships and partnerships. Web the drawing or. If you're a sole proprietor, you must be paid with an owner's draw instead of a. Web learn how to pay an owner of a sole proprietor business in quickbooks online. In a corporation, owners can receive compensation by a salary or. Last updated december 10, 2018 8:45 pm. Web the drawing or withdrawal account for a sole proprietorship is. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. The drawing account is an accounting record used in a business organized as a sole proprietorship or a partnership, in. Web owner's drawing account definition. Web owner’s drawing is a temporary contra equity. Need to make sure i'm handling owner equity and owner draw correctly. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web december 10, 2018 08:45 pm. The contra owner’s equity account used to record the current year’s withdrawals of business assets by the sole proprietor for. This is a contra equity account that is. Web december 10, 2018 08:45 pm. The account in which the draws are recorded is a. Owners equity does not close out to retained earnings, it is the other way around. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Web owner draw is an equity type account used when you take funds from the business. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Web december 10, 2018 08:45 pm. What is a drawing account? Retained earnings closes to owner equity. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. Many small business owners compensate themselves using a draw rather. Also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. A drawing account is an accounting record. What is a drawing account? A drawing account is an accounting record maintained to track money and other assets withdrawn from a business by its owners. The drawing account is an accounting record used in a business organized as a sole proprietorship or a partnership, in. If you're a sole proprietor, you must be paid with an owner's draw instead. What is a drawing account? Web owner's drawing account definition. Web owner draws are only available to owners of sole proprietorships and partnerships. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. This method of payment is common across. Need to make sure i'm handling owner equity and owner draw correctly. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Web the drawing or withdrawal account for a sole proprietorship is a temporary owner equity’s account that is closed at the end of the accounting year. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. A drawing account is used primarily for businesses that are taxed as sole proprietorships or partnerships. Web owner’s draws are withdrawals of a sole proprietorship’s cash or other assets made by the owner for the owner’s personal use. Web a drawing account, sometimes referred to as a “draw account” or “owner’s draw,” is a critical accounting record used to track money and other assets. Also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. If you're a sole proprietor, you must be paid with an owner's draw instead of a.

Owners Draw

owner's drawing account definition and meaning Business Accounting

how to take an owner's draw in quickbooks Masako Arndt

What is a Drawing Account? Kashoo

What Is an Owner's Draw? Definition, How to Record, & More

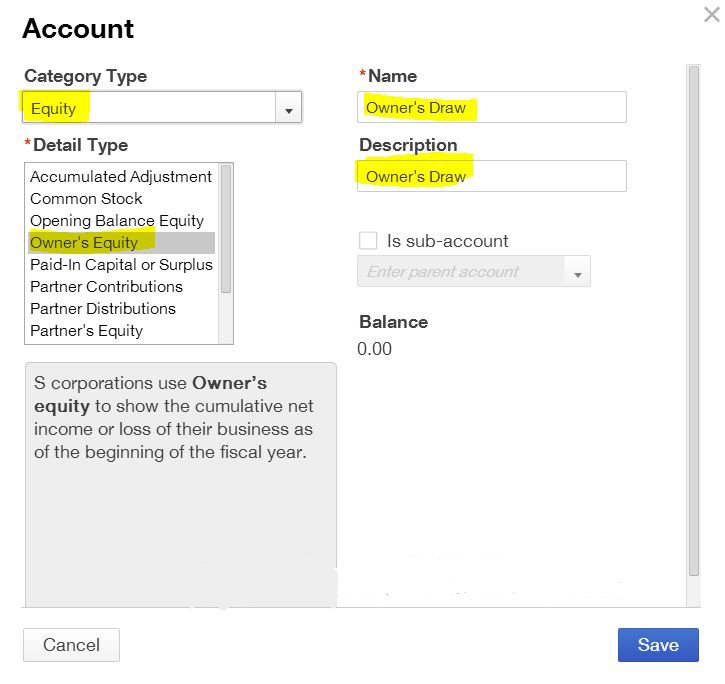

How to Create an Owner's Draw Account in QuickBooks Online Luca Financial

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

owner's drawing account definition and meaning Business Accounting

Owners draw QuickBooks Desktop Setup, Record & Pay Online

How to record an Owner's Draw The YarnyBookkeeper

Business Owners Might Use A Draw For.

A Drawing Account Is An Accounting Record Maintained To Track Money And Other Assets Withdrawn From A Business By Its Owners.

Web Learn How To Pay An Owner Of A Sole Proprietor Business In Quickbooks Online.

In This Situation The Bookkeeping Entries Are Recorded On The.

Related Post: