Owners Drawing

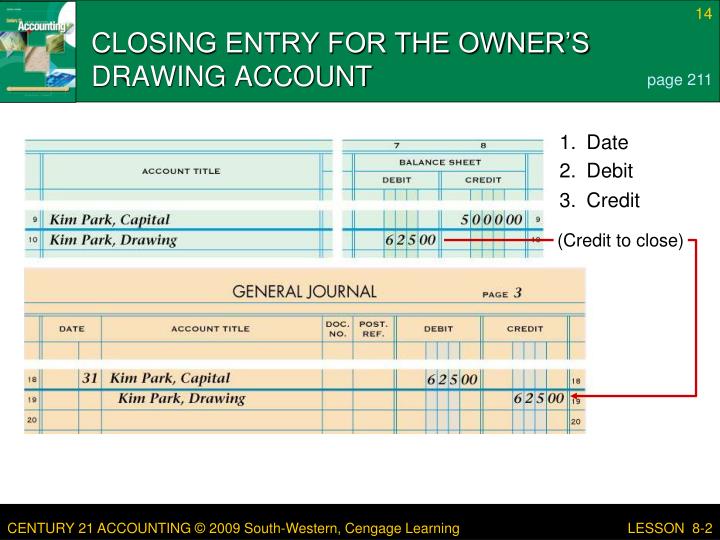

Owners Drawing - Also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. Withholding tax for abc to deduct from kevin’s monthly salary is: Web example of owner’s draws let’s assume that r. Instead, you withdraw from your owner’s equity, which includes all the. At the end of the fiscal year, the balance in this account is transferred to the. Web owner’s drawing is a temporary contra equity account with a debit balance that reduces the normal credit balance of an owner's equity capital account in a business organized as a sole proprietorship or partnership by recording the current year’s withdrawals of asses by its owners for personal use. Smith, drawing (an owner’s equity account with a debit balance) a credit to cash Most types of businesses permit draws, but you should consider whether and when to take one. They can only draw as much as their owner’s equity allows. An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. Smith, drawing (an owner’s equity account with a debit balance) a credit to cash Business owners may use an owner’s draw rather than taking a salary from the business. English football league chairman rick parry has told reading fans he is trying to force out the league one club’s unpopular owner dai yongge but he cannot make. These draws can. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. An owner's draw is money taken out of a business for personal use. Web kevin is paid a monthly amount of $4,167 (0 dp), and we will assume a flat income. Web owner's drawing account definition. They can only draw as much as their owner’s equity allows. Smith, drawing (an owner’s equity account with a debit balance) a credit to cash Updated on july 30, 2020. An owner's draw is money taken out of a business for personal use. Smith, drawing (an owner’s equity account with a debit balance) a credit to cash The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your. Business owners might use a draw for compensation versus paying themselves a salary. This is a contra equity account that is paired with and offsets the owner's capital account. Owner’s drawing account is also known as. When taking an owner's draw, the business cuts a check to the owner for the full amount of the draw. Web what is an. When you create your account, be sure to choose equity or owners equity as the type of account. Withholding tax for abc to deduct from kevin’s monthly salary is: Accountants may help business owners take an owner's draw as compensation. In other words, it is a distribution of earnings to the owner (s) of a business, as opposed to a. Atlanta braves 10,000 times and released its mlb picks, predictions and best bets for sunday night baseball Web owner draws are only available to owners of sole proprietorships and partnerships. Owner’s equity refers to your share of your business’ assets, like your initial investment and any profits your business has made. Web the owner's draw method. Accountants may help business. The choice between payment methods as a business owner is actually a choice between the ways you can be taxed. Typically, you account for owner draws with a temporary account that offsets the company’s owner equity or owner capital account. In a corporation, owners can receive compensation by a salary or dividends from ownership shares but not owner draws. Web. The company’s entry to record each month’s draws will be: The post position draw for the preakness is set for monday, may 13. Create an owner's equity account. At the end of the fiscal year, the balance in this account is transferred to the. However, owners can’t simply draw as much as they want; Once you record the check, your checking account will decrease and the owner draw account will increase by the amount of the check and is shown on your balance sheet. To learn how to create accounts in your quickbooks, choose your product: When done correctly, taking an owner’s draw does not result in you owing more or less. Atlanta braves. The owner's draw is essential for several reasons. At the end of the fiscal year, the balance in this account is transferred to the. Before you can pay an owner’s draw, you need to create an owner’s equity account first. Accountants may help business owners take an owner's draw as compensation. Yuliya nechay / getty images. The post position draw for the preakness is set for monday, may 13. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. The company’s entry to record each month’s draws will be: Web kevin is paid a monthly amount of $4,167 (0 dp), and we will assume a flat income tax rate of 20 per cent under a withholding income system. Once you record the check, your checking account will decrease and the owner draw account will increase by the amount of the check and is shown on your balance sheet. This is a contra equity account that is paired with and offsets the owner's capital account. English football league chairman rick parry has told reading fans he is trying to force out the league one club’s unpopular owner dai yongge but he cannot make. A drawing account is used primarily for businesses that are taxed as. Web the owner's draw method. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Rather than classifying owner's draws.

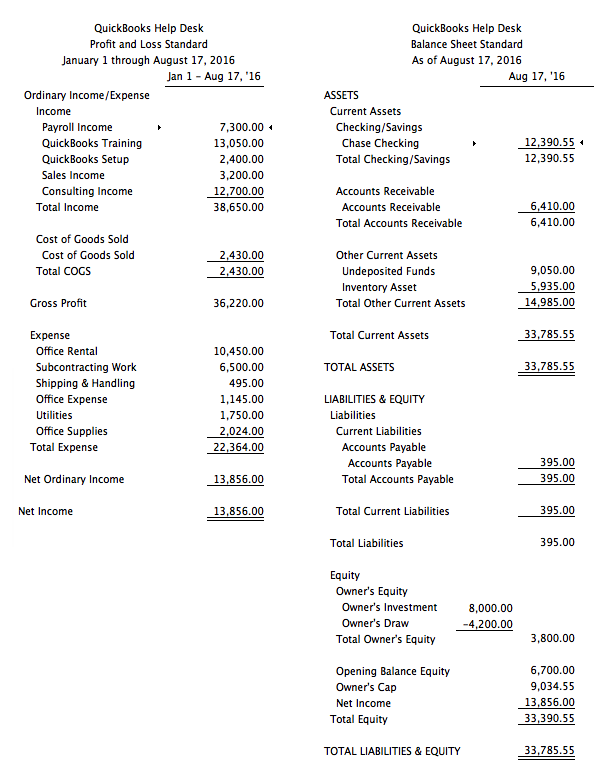

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)

Owner's Draw What Is It?

Owners Drawing at Explore collection of Owners Drawing

how to take an owner's draw in quickbooks Masako Arndt

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

owner's drawing account definition and Business Accounting

how to take an owner's draw in quickbooks Masako Arndt

Single continuous line drawing of two young happy business owner

Owners Drawing at Explore collection of Owners Drawing

Young caucasian owner holding key to his new house

To Learn How To Create Accounts In Your Quickbooks, Choose Your Product:

Web Owner’s Draws Are Flexible.

Web Owner’s Draw Or Owner’s Withdrawal Is An Account Used To Track When Funds Are Taken Out Of The Business By The Business Owner For Personal Use.

Business Owners Might Use A Draw For Compensation Versus Paying Themselves A Salary.

Related Post: