Owners Drawings Quickbooks

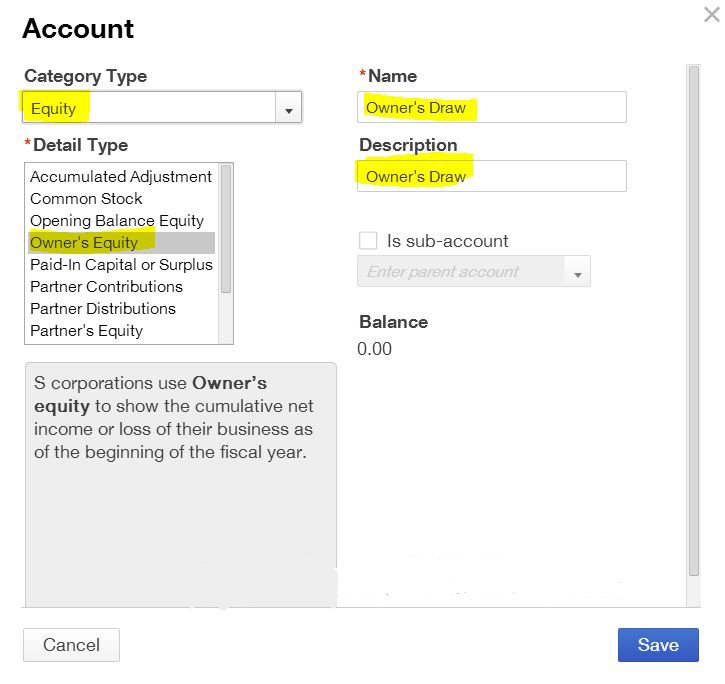

Owners Drawings Quickbooks - Important offers, pricing details & disclaimers. An owner’s draw is when an owner takes money out of the business. It is also helpful to maintain current and prior year draw accounts for tax purposes. The money is used for personal. There is no fixed amount and no fixed interval for these payments. 16k views 2 years ago. Upon setting up the owner’s equity account, quickbooks enables users to categorize these transactions appropriately. Sole proprietors can take money directly out of their company as an owner draw and use the funds to pay personal expenses unrelated to the business. Web when recording an owner's draw in quickbooks online, you'll need to create an equity account. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. Web to properly record an owner’s draw in quickbooks, it is essential to create a dedicated owner’s equity account to track the withdrawal and maintain accurate financial records. Once done, select save and close. Web from understanding what owner’s draw is and how to record it in quickbooks to the essential steps for zeroing out owner’s draw, this article aims. Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Qb automatically provides a retained earnings account with a closing entry for the net income at the end of. Don't forget to like and subscribe. Web the owner's draws are usually taken from your owner's equity account. Web if you're a sole proprietor, you must. As we noted in our earlier articles, drawings are transactions withdrawing equity an owner has either previously put into the business or otherwise built up over time. It represents a reduction in the owner’s equity in. Web july 18, 2019 10:50 am. Qb automatically provides a retained earnings account with a closing entry for the net income at the end. Web from understanding what owner’s draw is and how to record it in quickbooks to the essential steps for zeroing out owner’s draw, this article aims to provide a clear and actionable roadmap for business owners and accounting professionals alike. Don't forget to like and subscribe. Open the chart of accounts and choose add. Know that you can select the. But how do you know which one (or both) is an option for your business? Typically this would be a sole proprietorship or llc where the business and the owner are. Web what is the owner’s draw in quickbooks? I used to use quickbooks, but have transitioned to quicken and the account i set up for owner's draw is reporting. Web july 18, 2019 10:50 am. It is also helpful to maintain current and prior year draw accounts for tax purposes. The owner's equity is made up of different funds, including money you've invested in your business. Owner’s draw refers to the process of withdrawing money from a business for personal use by the owner. It represents a reduction in. Important offers, pricing details & disclaimers. A user guide to help advisors get started with quickbooks online advanced. Fill in the needed information. Typically this would be a sole proprietorship or llc where the business and the owner are. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. As we noted in our earlier articles, drawings are transactions withdrawing equity an owner has either previously put into the business or otherwise built up over time. The owner's equity is made up of different funds, including money you've invested in your business. Is there a better way to do this? Or, the owner can take out funds they contributed.. But how do you know which one (or both) is an option for your business? Web if you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. Business owners can withdraw profits earned by the company. Is there a better way to do this? The money is used for personal. Web creating and tracking owner draw. From poking around in various threads, i've read that: A clip from mastering quick. Is there a better way to do this? Download the quickbooks online advanced user guide. Web july 18, 2019 10:50 am. Web zero out owner's draw / contribution accounts into owner's equity account. Web how to complete an owner's draw in quickbooks online | qbo tutorial | home bookkeeper thanks for watching. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Don't forget to like and subscribe. From poking around in various threads, i've read that: Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Web business owners often use the company’s bank and credit card accounts to pay personal bills and expenses, or simply withdraw money to pay themselves. Create owner’s draw account under equity type. Web understanding the difference between an owner’s draw vs. Download the quickbooks online advanced user guide. It might seem like raiding the company for. Web in your qbo: Open the chart of accounts and choose add. Important offers, pricing details & disclaimers. Click the plus ( +) icon.Owners draw balances

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Ulysses Fennell

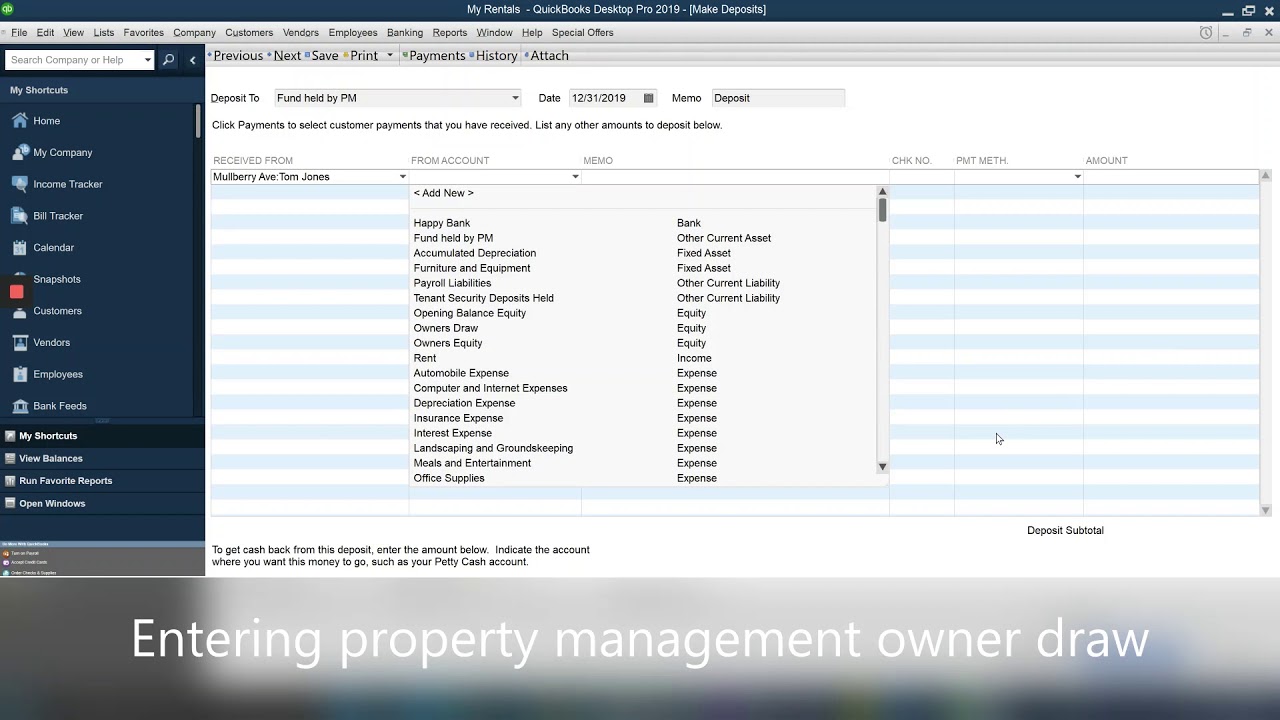

How to enter the property management owner draw to QuickBooks YouTube

Owners Draw Quickbooks Desktop DRAWING IDEAS

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Owner's Draw Via Direct Deposit QuickBooks Online Tutorial The Home

Owners draw QuickBooks Desktop Setup, Record & Pay Online

Quickbooks Owner Draws & Contributions YouTube

Know That You Can Select The Equity Account When Creating A Check For The Owner.

Owner’s Draw Refers To The Process Of Withdrawing Money From A Business For Personal Use By The Owner.

It Is Also Helpful To Maintain Current And Prior Year Draw Accounts For Tax Purposes.

For A Company Taxed As A Sole Proprietor (Trader), I Recommend You Have The Following For Owner/Partner Equity Accounts.

Related Post: