Paga Penalties Chart

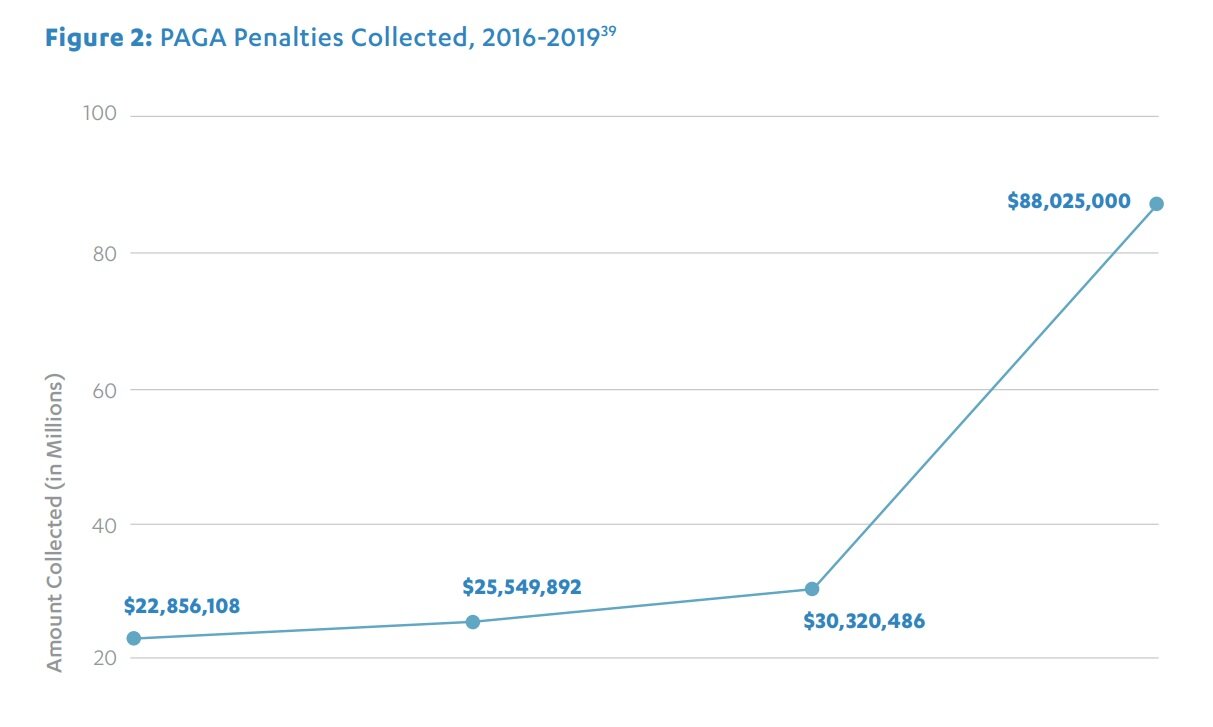

Paga Penalties Chart - Web california labor code § 2699 allows employees whose labor rights have been violated to bring private attorney general act (paga) claims against their employer. Web both cases asserted a claim that the employer was liable for paga penalties for allegedly failing to reimburse certain business expenses, as required by california labor code section 2802. Court of appeal for the 9th circuit just ruled that heightened penalties for subsequent violations under california’s private attorney general act (paga) cannot be imposed until the employer has been notified of the violation by the labor commissioner or a court. If the employee wins the paga claim, the court will order the employer to pay civil penalties of up to $100 for an initial violation and up to $200 for each. V the california labor code private attorneys general act paga(“ ”) provides additional penalties in the form of “one hundred dollars ($100) for each aggrieved employee per pay period for the initial violation and two hundred dollars ($200) Web in a win for employers, the u.s. First, paga “creates an interest in penalties, not only for california and the plaintiff employee, but for nonparty employees as well.” id. Los angeles, llc (2014) 59 cal.4th 348. Accordingly, each predicate violation is entitled to its own. The seminal case in this area is the california supreme court’s decision in iskanian v cls transp. Web courts have only recently begun to grapple with key aspects of paga, including which paga civil penalties apply to various labor code violations, whether multiple paga penalties can be recovered for a single pay period, and the definition of “initial” and “subsequent” violations. Web both cases asserted a claim that the employer was liable for paga penalties for allegedly. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. Web in a successful paga action, the california labor and workforce development agency is entitled to 75% of the recovered penalties, and the remaining 25% goes to the “aggrieved employees.” the split in the california courts. Los angeles, llc (2014) 59 cal.4th 348. Web paga penalties are assessed per pay period for each violation of any code section enumerated in labor code section 2699.5. And penalties for the other. V the california labor code private attorneys general act paga(“ ”) provides additional penalties in the form of “one hundred dollars ($100) for each aggrieved employee per. The seminal case in this area is the california supreme court’s decision in iskanian v cls transp. Web what is paga? Web accordingly, such wages could not be recovered as a penalty under paga, because paga only allows for the recovery of penalties. (1) many labor code violations went unenforced because there was no civil penalty for. Court of appeal. Web paga penalties are assessed per pay period for each violation of any code section enumerated in labor code section 2699.5. Los angeles, llc (2014) 59 cal.4th 348. Web the steadily increasing number can be explained by three characteristics unique to paga actions: Web penalties under paga are assessed against employers in the amount of $100 per employee per pay. Web the ninth circuit rejected this argument because paga’s structure deviated sharply from traditional qui tam actions in two significant ways. Web penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code violation, and $200 per employee per pay period for each subsequent violation. Web california labor code. Penalties for wage statement violations are $250 for the first violation and $1,000 for each subsequent violation, cal. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. In other words, for each employee in the paga period, one penalty is assessed against the employer for. Web paga cases filed has remained relatively flat on average, the amount of employer penalties has increased by a factor of 6, which likely means the amount of employer payouts overall has similarly increased. The astronomical potential penalties attached to paga actions also helps fuel these types of representative actions. While the february 23 ruling in. And penalties for the. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. (1) many labor code violations went unenforced because there was no civil penalty for. Court of appeal for the 9th circuit just ruled that heightened penalties for subsequent violations under california’s private attorney general act (paga). Web courts have only recently begun to grapple with key aspects of paga, including which paga civil penalties apply to various labor code violations, whether multiple paga penalties can be recovered for a single pay period, and the definition of “initial” and “subsequent” violations. Web penalties under paga are assessed against employers in the amount of $100 per employee per. 12, 2019), the california supreme court held that plaintiffs cannot recover the unpaid wages described in labor code section 558 in a private attorneys general act of 2004 (paga) claim. Web relying on raines, the trial court held that the proper measure of paga penalties for any violation of section 226 (a) is set forth in section 226.3, which provides, in relevant part: The following chart identifies labor code violations giving rise to a claim under the private attorneys general act of 2004 (paga). Web paga penalties are assessed per pay period for each violation of any code section enumerated in labor code section 2699.5. Web paga cases filed has remained relatively flat on average, the amount of employer penalties has increased by a factor of 6, which likely means the amount of employer payouts overall has similarly increased. Web what is paga? While the february 23 ruling in. Web both cases asserted a claim that the employer was liable for paga penalties for allegedly failing to reimburse certain business expenses, as required by california labor code section 2802. If the employee wins the paga claim, the court will order the employer to pay civil penalties of up to $100 for an initial violation and up to $200 for each. This ruling drastically limits the amount of penalties that plaintiffs can attempt to recover in paga actions. V the california labor code private attorneys general act paga(“ ”) provides additional penalties in the form of “one hundred dollars ($100) for each aggrieved employee per pay period for the initial violation and two hundred dollars ($200) In other words, for each employee in the paga period, one penalty is assessed against the employer for each predicate violation that occurs within a pay period. The seminal case in this area is the california supreme court’s decision in iskanian v cls transp. As the court explained after examining the legislative history of the statute, paga was enacted for a dual purpose: Web the ninth circuit rejected this argument because paga’s structure deviated sharply from traditional qui tam actions in two significant ways. Los angeles, llc (2014) 59 cal.4th 348.

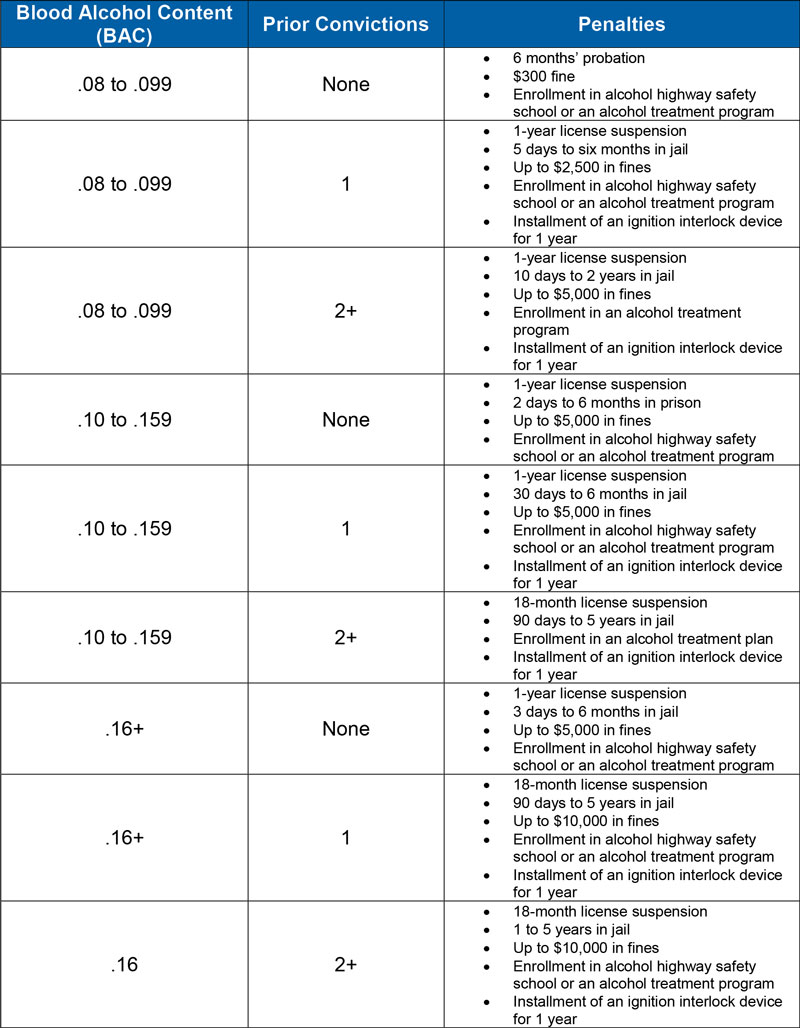

DUI Penalties Chart The GoTo Guy for DUI The Hudson Law Office

Heightened PAGA Penalties Are Inapplicable For Most Wage Statement

Penalites Chart by Darshan Khare 1.pdf 1 PDF Fraud Loans

A Chart For Predicting PenaltyShootout Odds in Real Time FiveThirtyEight

Pa Dui Chart 2021

Meal Period PAGA Penalties PAGA Penalties for Missed Meal Breaks

Employers Beware! Wage & Hour Violations Can Lead to Steep Penalties

PAGA Lawsuit vs Class Action California Business Lawyer & Corporate

Paga penalties chart Fill out & sign online DocHub

The Latest in the PAGA Saga Reform + A New (& subjective) Report

(1) Many Labor Code Violations Went Unenforced Because There Was No Civil Penalty For.

Court Of Appeal For The 9Th Circuit Just Ruled That Heightened Penalties For Subsequent Violations Under California’s Private Attorney General Act (Paga) Cannot Be Imposed Until The Employer Has Been Notified Of The Violation By The Labor Commissioner Or A Court.

Web California Labor Code § 2699 Allows Employees Whose Labor Rights Have Been Violated To Bring Private Attorney General Act (Paga) Claims Against Their Employer.

The Absence Of Class Certification Requirements, That They Are Not Arbitrable, And Cannot Be Waived.

Related Post: