Paga Penalty Chart

Paga Penalty Chart - 5th __ (2021), which will impact employers facing paga lawsuits. This insight will examine the three biggest questions employers have about paga as we head into the new year. Web what is paga? Web paga’s plain language indicates that an employer will be assessed a lower, “initial” penalty for each initial pay period in which a violation occurs, and a higher, “subsequent” penalty for each subsequent pay period in which a violation occurs. Bucking the trend of unrelentingly bad news for employers in the state, the california court of appeal has held that the default (lower) penalties found in the labor code private attorneys general act (“paga”) and not the heightened penalties set forth in labor code section 226.3. Moniz clarified several critical issues employers routinely face in paga litigation. When a provision of the labor code provides for a specific penalty, that penalty applies. Web christmas came early this year for california employers. Any subsequent violations are punishable by $200 per employee, per pay period. The three questions the court will address are as. Web relying on raines, the trial court held that the proper measure of paga penalties for any violation of section 226 (a) is set forth in section 226.3, which provides, in relevant part: When a provision of the labor code provides for a specific penalty, that penalty applies. Web in a win for employers, the u.s. Web paga penalties for. Web accordingly, such wages could not be recovered as a penalty under paga, because paga only allows for the recovery of penalties. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code violation, and $200 per employee per pay period for each subsequent violation. Moniz clarified several critical. Web failure to pay overtime, failure to provide meal breaks and failure to provide rest breaks carry an initial paga penalty of $50.00, and a subsequent penalty of $100.00. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. Court of appeal for the 9th circuit. Web in a win for employers, the u.s. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. 5th __ (2021), which will impact employers facing paga lawsuits. (2018) 23 cal.app.5th 667 ―“a paga claim is derivative, but it is derivative of section 226(a) and section. 5th __ (2021), which will impact employers facing paga lawsuits. Web posted in meal and rest breaks, new cases. Web attempts to curb abuse of the statute, through legislation, have been generally unsuccessful. Web paga’s plain language indicates that an employer will be assessed a lower, “initial” penalty for each initial pay period in which a violation occurs, and a. For good measure, the supreme court noted that paga penalties are required to be split 75%/25% between the government and the employees, while the section 558 wages are not. Moniz clarified several critical issues employers routinely face in paga litigation. Web usa january 20 2022. 5th __ (2021), which will impact employers facing paga lawsuits. Web the employer’s first labor. Coastal pacific food distributors, inc. 5th __ (2021), which will impact employers facing paga lawsuits. (2018) 23 cal.app.5th 667 ―“a paga claim is derivative, but it is derivative of section 226(a) and section 226.3, not section 226(e)” 9 whether “injury” is required for On january 11, 2022, judge cunningham of the los angeles superior court conditionally approved a $7.5 million. Coastal pacific food distributors, inc. Everything you need to know about paga penalties and who is entitled to receive penalties. Web usa january 20 2022. Web posted in meal and rest breaks, new cases. Web paga’s plain language indicates that an employer will be assessed a lower, “initial” penalty for each initial pay period in which a violation occurs, and. Bucking the trend of unrelentingly bad news for employers in the state, the california court of appeal has held that the default (lower) penalties found in the labor code private attorneys general act (“paga”) and not the heightened penalties set forth in labor code section 226.3. Web relying on raines, the trial court held that the proper measure of paga. Code section 2699(f) of $100 per employee per initial violation and $200 per employee per each subsequent violation applies. 5th __ (2021), which will impact employers facing paga lawsuits. Web attempts to curb abuse of the statute, through legislation, have been generally unsuccessful. First, departing from turrieta v.lyft, inc., 69 cal. Web in a win for employers, the u.s. For good measure, the supreme court noted that paga penalties are required to be split 75%/25% between the government and the employees, while the section 558 wages are not. Web paga’s plain language indicates that an employer will be assessed a lower, “initial” penalty for each initial pay period in which a violation occurs, and a higher, “subsequent” penalty for each subsequent pay period in which a violation occurs. Web in a win for employers, the u.s. Penalties under paga are assessed against employers in the amount of $100 per employee per pay period for an initial labor code violation, and $200 per employee per pay period for each subsequent violation. Web what is paga? And penalties for the other employment. The three questions the court will address are as. When a provision of the labor code provides for a specific penalty, that penalty applies. Web christmas came early this year for california employers. Code section 2699(f) of $100 per employee per initial violation and $200 per employee per each subsequent violation applies. Penalties for wage statement violations are $250 for the first violation and $1,000 for each subsequent violation, cal. 12, 2019), the california supreme court held that plaintiffs cannot recover the unpaid wages described in labor code section 558 in a private attorneys general act. Web when no civil penalty is specifically specified, the default paga penalty provided by cal. Web attempts to curb abuse of the statute, through legislation, have been generally unsuccessful. Web paga penalties for unpaid minimum wages and meal period violations are $50 for each initial violation and $100 for any subsequent violation, cal. Web in a successful paga action, the california labor and workforce development agency is entitled to 75% of the recovered penalties, and the remaining 25% goes to the “aggrieved employees.” the split in the california courts of appeal.

Emmanuel Paga back in the team after apologising for penalty miss in

The Fight to Replace PAGA California New Car Dealers Association

Penalty Chart Section Penalty to Penalty levied in case of Fraud Loans

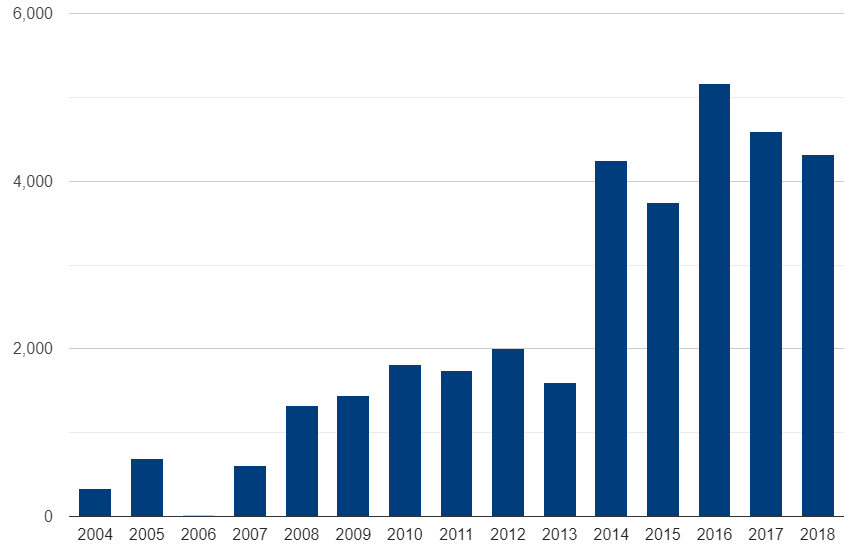

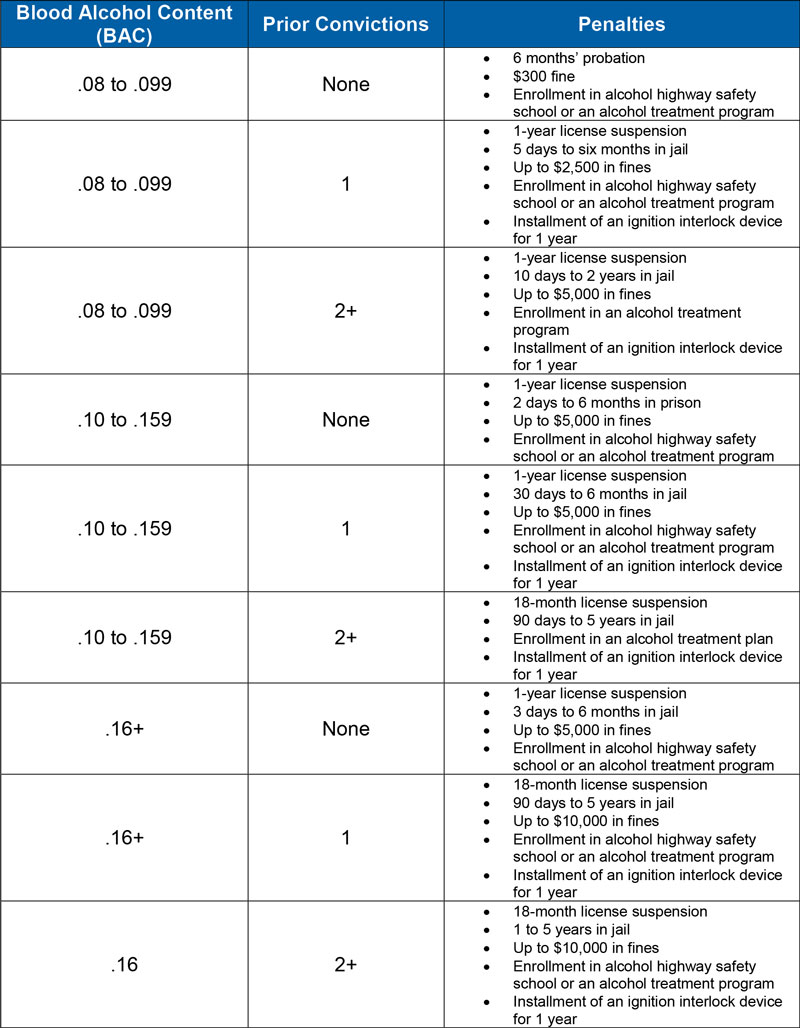

Pa Dui Penalty Chart

Paga penalties chart Fill out & sign online DocHub

A Chart For Predicting PenaltyShootout Odds in Real Time FiveThirtyEight

Penalty chart under Tax Act, 1961

APP DE RENDA EXTRA Penalty Shootout PAGA MESMO? APP QUE ESTA PAGANDO

Employers Beware! Wage & Hour Violations Can Lead to Steep Penalties

DUI Penalties Chart The GoTo Guy for DUI The Hudson Law Office

This Insight Will Examine The Three Biggest Questions Employers Have About Paga As We Head Into The New Year.

Web On November 30, 2021, The Court Of Appeal, First Appellate District, Issued An Important Opinion In Moniz V.adecco Usa, Inc., __ Cal.

(2018) 23 Cal.app.5Th 667 ―“A Paga Claim Is Derivative, But It Is Derivative Of Section 226(A) And Section 226.3, Not Section 226(E)” 9 Whether “Injury” Is Required For

Web The Employer’s First Labor Violation Is Punishable By A Civil Penalty Of $100 Per Employee, Per Pay Period.

Related Post: