Payroll Chart Of Accounts

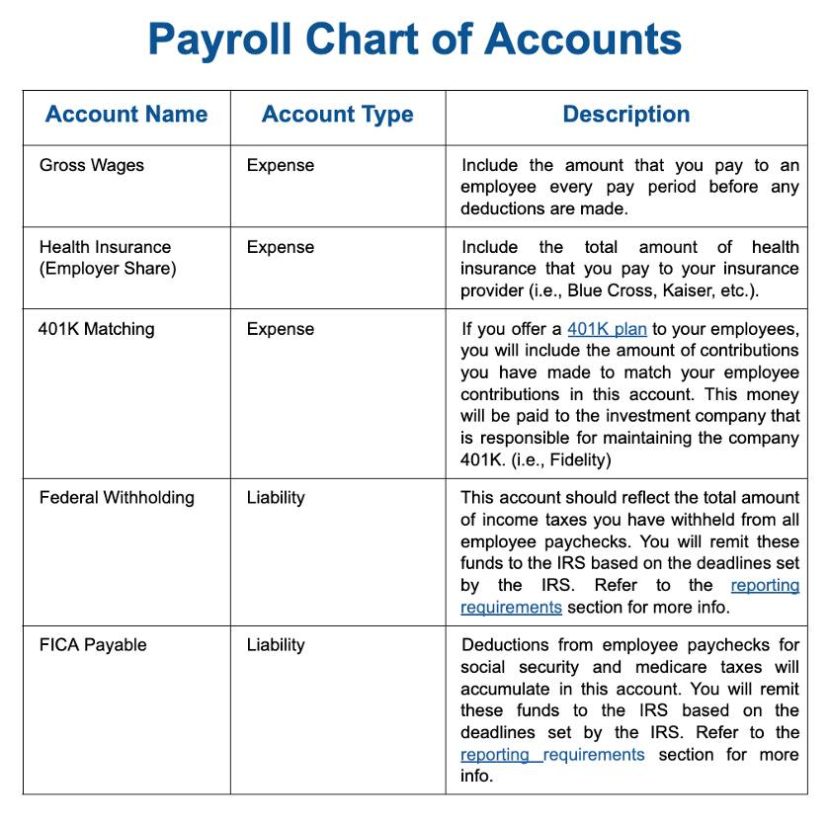

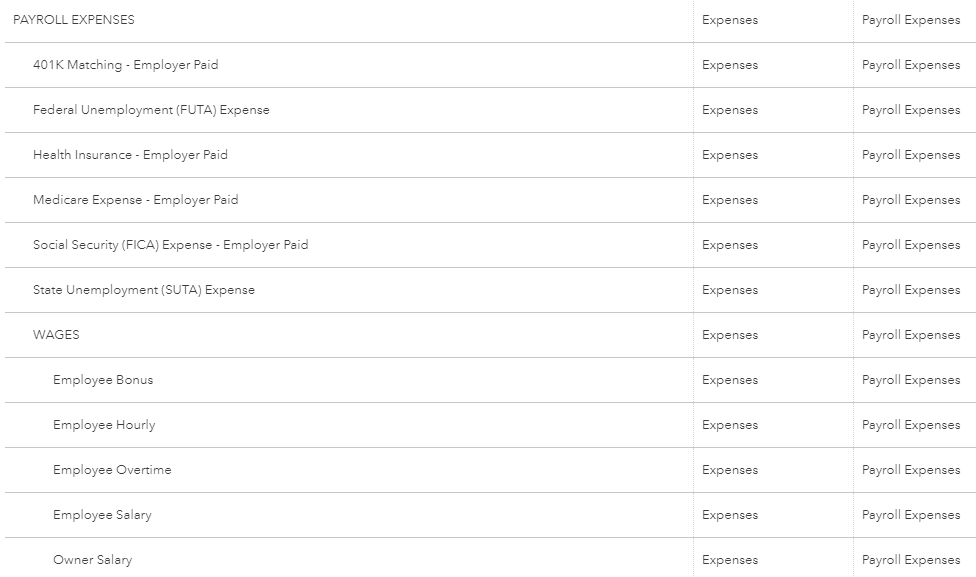

Payroll Chart Of Accounts - Web we've rounded up the best payroll services for small business to help you compare and choose the platform that’s best for your needs. Web here’s what an average payroll chart of accounts list contains: Questions may be directed to the payroll system support group at [email protected]. Web payroll chart of accounts. It provides a logical structure to make it easy to record information and to add or remove accounts. Recording payroll on your books involves making sure that amounts are accurately posted to payroll accounts. Zoho books is an efficient invoicing and payroll software that offers automated billing, detailed financial tracking, and easy compliance management. Learn more about how to configure chart of accounts for payroll in quickbooks payroll powered by employment hero. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner. Hi, i've just started using qb payroll in this financial year so very new to it all. Why is the chart of accounts important? Questions may be directed to the payroll system support group at [email protected]. You also need to account for payroll expenses in your books. Web amanda cameron | dec 17, 2020. Recording these costs can give small business. Typically, a chart of accounts will have four categories. Web set up and configure payroll chart of accounts. Please include this bulletin number in the email subject line. The purpose of payroll accounting is to keep track of employee compensation and related payroll costs. To automate the entire process, you can. Web a chart of accounts is a simple tool to set up and organize the general ledger and accounting system of a business. Web mapping payroll items to general ledger accounts allows you to classify your payroll transactions for your financial statements. Questions may be directed to the payroll system support group at [email protected]. You also need to account for. As we discussed in our article: To understand how payroll ends up in general ledger, you need to review the accounting cycle. Last updated june 01, 2022 3:05 pm. If you’re an employer, you can’t just be on your merry way after paying your employees. Creating a financial roadmap with a chart of accounts. Hello, i'm setting up a new chart of accounts, and i'm seeking a sample payroll accounts with numbering. Web set up and configure payroll chart of accounts. The purpose of this bulletin is to inform all agencies of the upcoming rollover of the chart of accounts strings mapped to the position pools in payserv. File taxes using your documents; Web. Zoho books is an efficient invoicing and payroll software that offers automated billing, detailed financial tracking, and easy compliance management. It requires you to classify different payroll expenses that you incur as you calculate net pay from gross pay (like wages, unemployment taxes, and benefit payments) according to the appropriate expense (and. Recording these costs can give small business. Web. Please include this bulletin number in the email subject line. The purpose of this bulletin is to inform all agencies of the upcoming rollover of the chart of accounts strings mapped to the position pools in payserv. You also need to account for payroll expenses in your books. Seven steps to building the perfect chart of accounts. Accurate payroll processing. Solved•by quickbooks•26•updated january 17, 2024. The coa is tailored to an organization’s needs and can vary widely in complexity. As we discussed in our article: Web a chart of accounts provides a complete listing of every type of account, including account codes and numbers for assets, liabilities and so on. Your accounting transactions are posted to general ledger, but is. Please include this bulletin number in the email subject line. Recording payroll on your books involves making sure that amounts are accurately posted to payroll accounts. Web the chart of accounts, or coa, is a list of the account numbers and names relevant to your company. “the labor in cost of goods sold looks crazy. Last updated june 01, 2022. If you have tipped employees, make sure you’re using a template designed for that type of workforce. Web what is the chart of accounts? This is where payroll accounting comes into play. Your accounting transactions are posted to general ledger, but is the information accurate? Solved•by quickbooks•26•updated january 17, 2024. Web mapping payroll items to general ledger accounts allows you to classify your payroll transactions for your financial statements. Typically, a chart of accounts will have four categories. Why is the chart of accounts important? Web the chart of accounts, or coa, is a list of the account numbers and names relevant to your company. Web we've rounded up the best payroll services for small business to help you compare and choose the platform that’s best for your needs. Web payroll accounting is the process of paying and recording employee compensation. Web a chart of accounts is a simple tool to set up and organize the general ledger and accounting system of a business. Sample payroll chart of accounts with numbering. Rippling is the best payroll solution overall. To ensure your accounting books are accurate, learn how to record payroll transactions. Please include this bulletin number in the email subject line. I know we didn’t pay that much in shop labor this month. It requires you to classify different payroll expenses that you incur as you calculate net pay from gross pay (like wages, unemployment taxes, and benefit payments) according to the appropriate expense (and. As we discussed in our article: Once established, it’s best never to change a chart of accounts. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner.

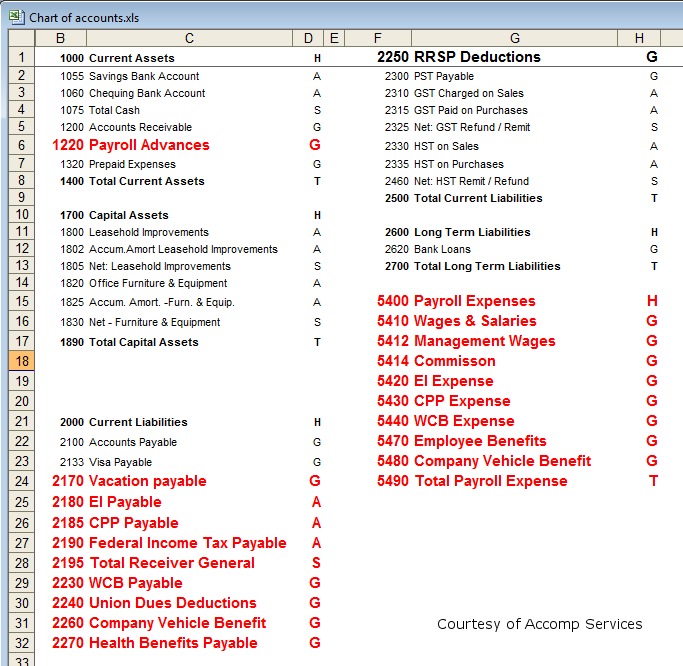

Chart Of Accounts Payroll

ChartofAccountsTemplate.xlsx Payroll Tax Expense

Small Business Payroll Software Simply Accounting Tutorial

Chart Of Accounts For Payroll

Sample chart of accounts quickbooks

Chart Of Accounts For Payroll In Quickbooks

Free Payroll Templates Tips & What To Include

Sample Chart Of Accounts Excel

Chart of Accounts Payroll Tax Taxes

The Chart of Accounts List Builds Your QuickBooks Online Company

To Automate The Entire Process, You Can.

Web What Is The Chart Of Accounts?

For Small Business Owners Who Don’t Want To.

It Provides A Logical Structure To Make It Easy To Record Information And To Add Or Remove Accounts.

Related Post: