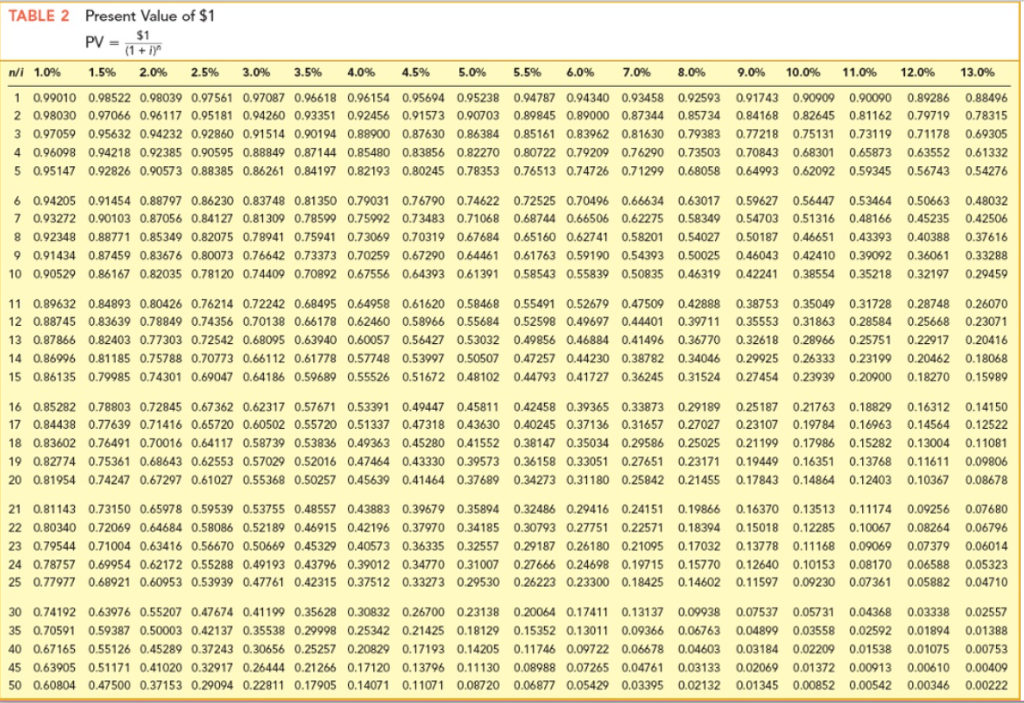

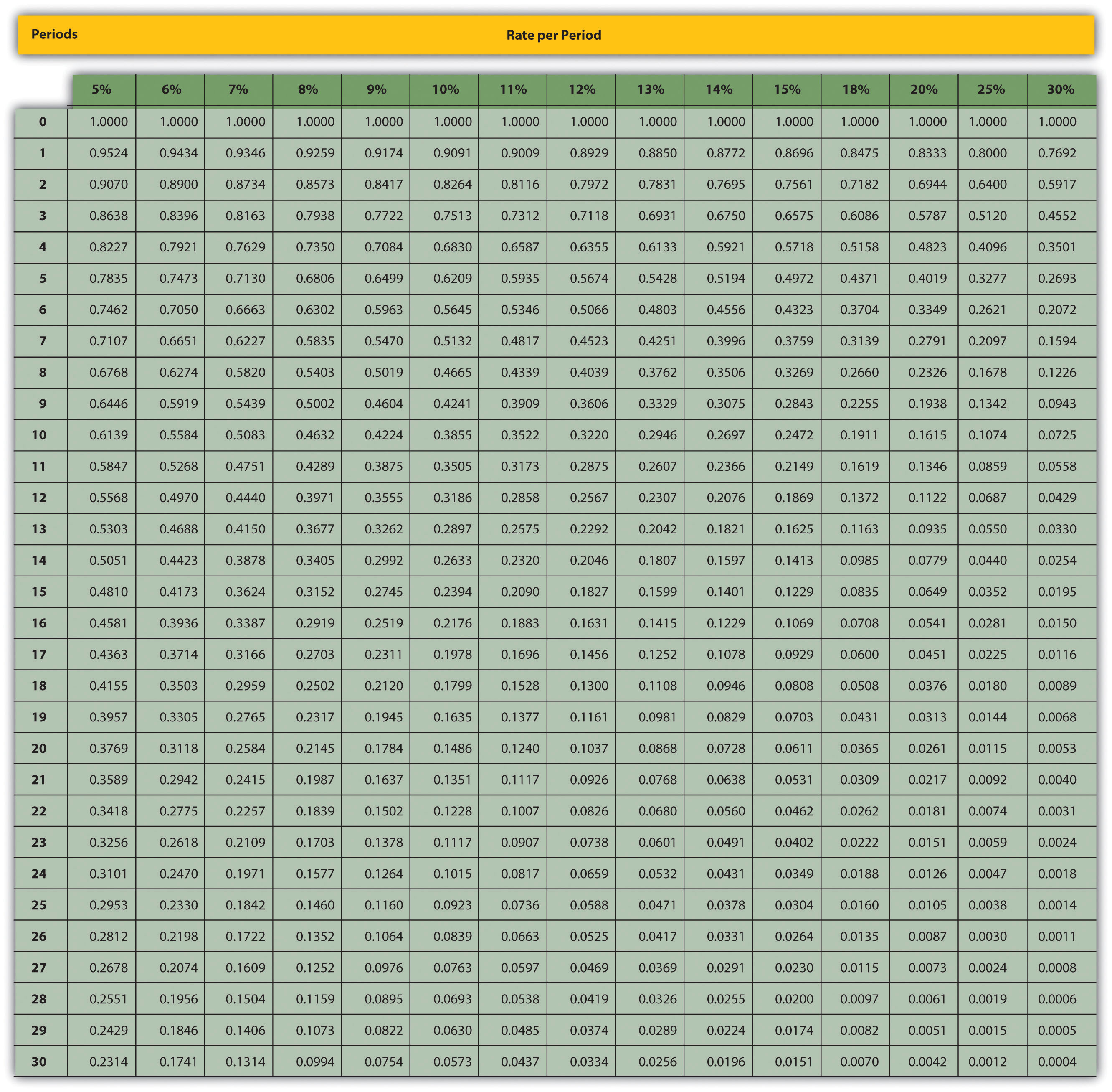

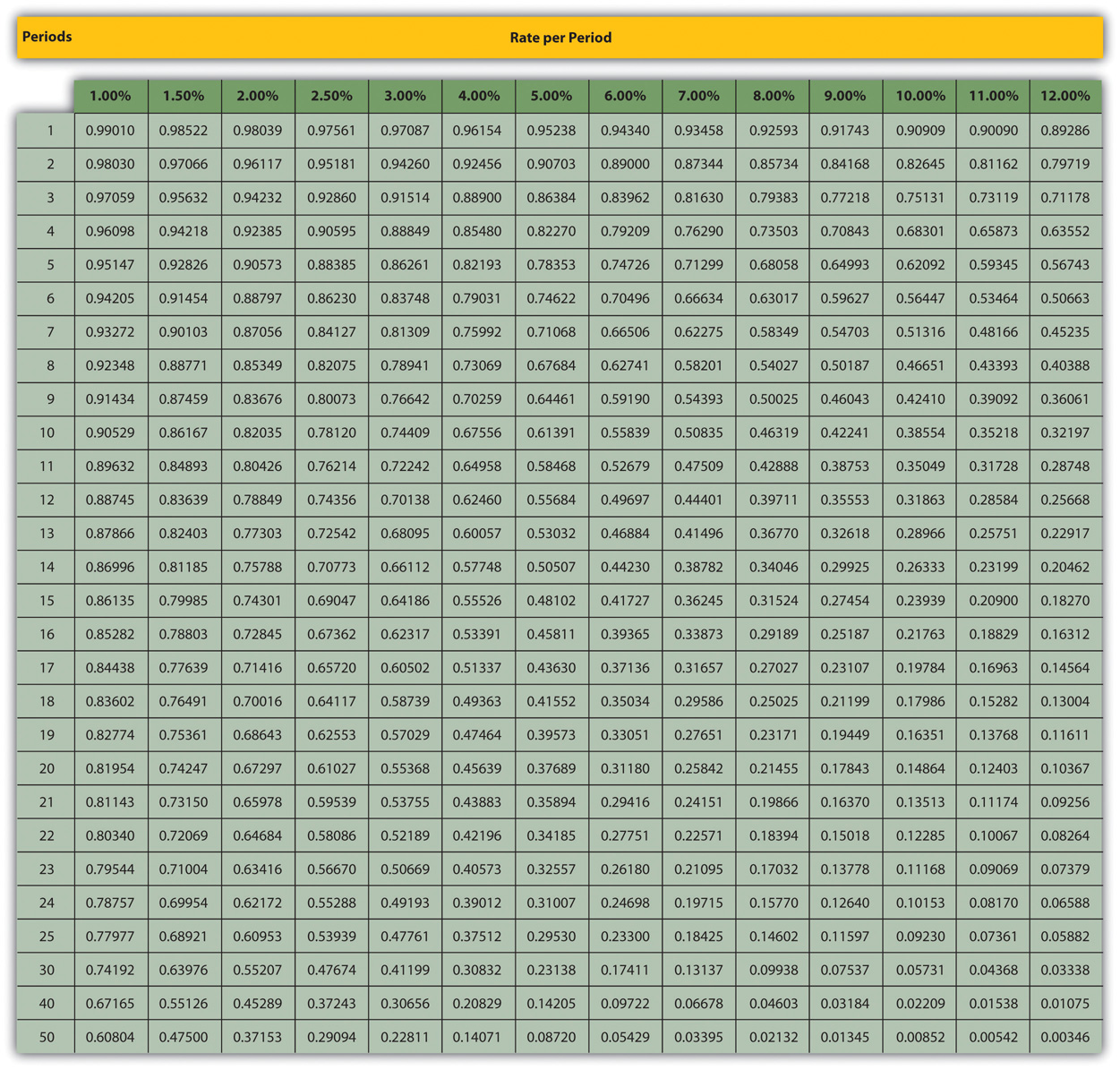

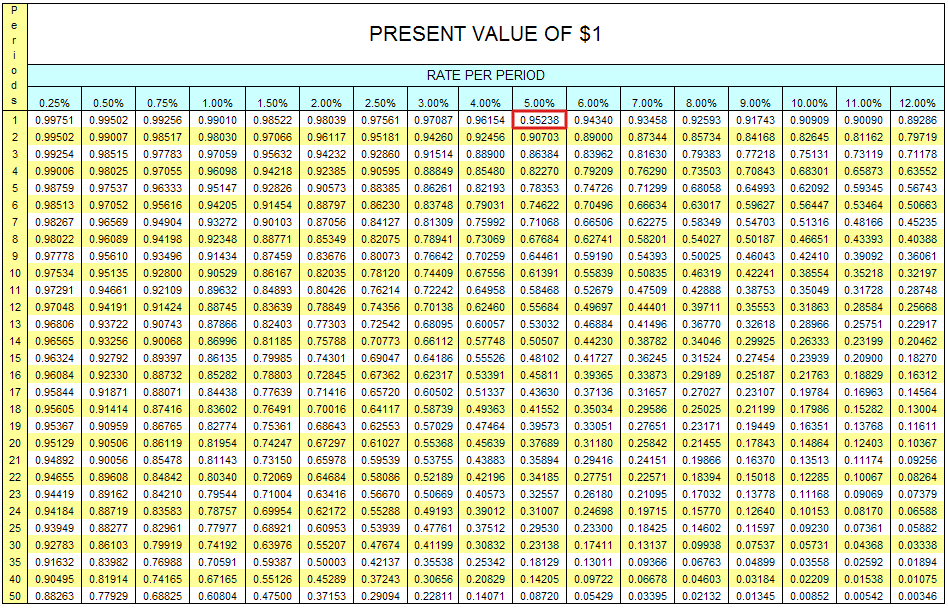

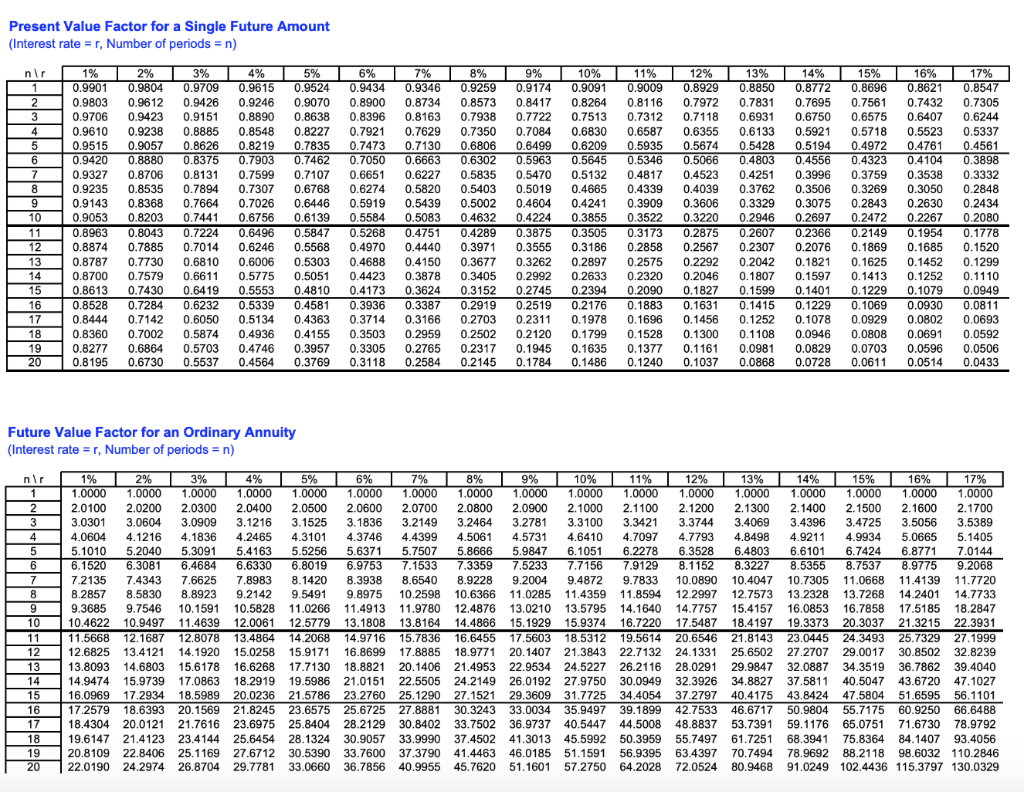

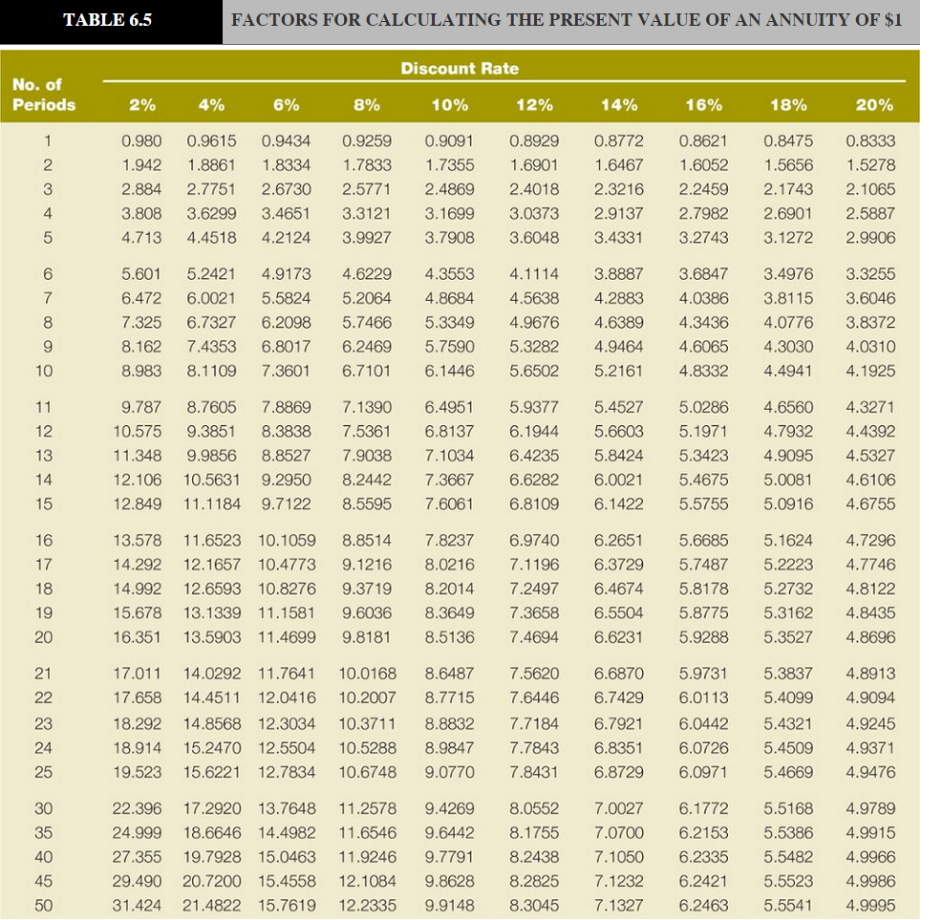

Present Value Chart

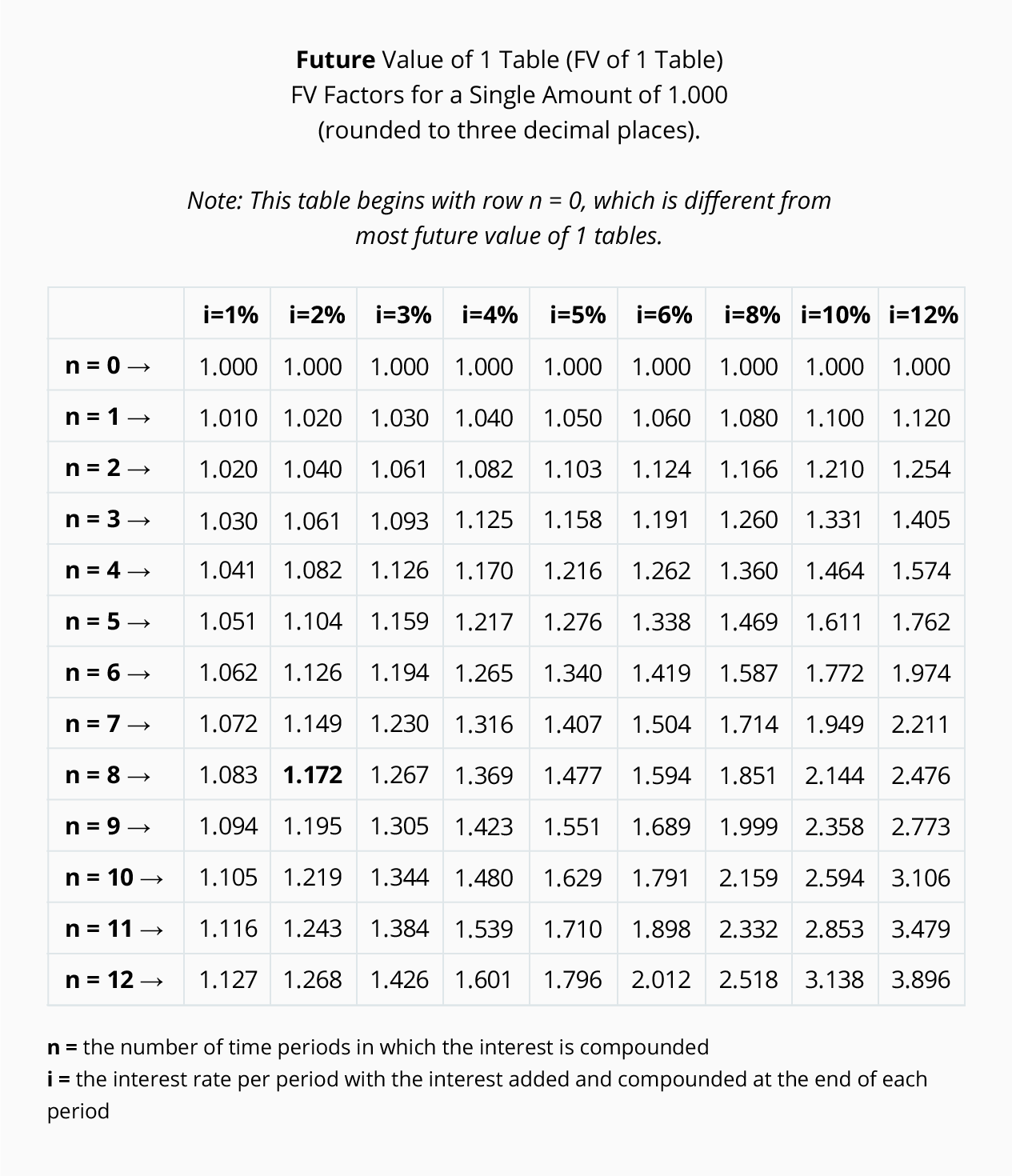

Present Value Chart - They provide the value now of 1 received at the end of period n at a discount rate of i%. A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value. Web present value tables formula: Now let us extend this idea further into the future. P v = f v ( 1 + i) n ⇒ p v = $ 1 ( 1 + i) n. This helps decide which option is better: Getting money now or later. We say the present value of $1,100 next year is $1,000. Web the present value is how much money would be required now to produce those future payments. To calculate npv, you need to estimate the timing and. We say the present value of $1,100 next year is $1,000. Web present value (pv) is today’s value of money you expect from future income and is calculated as the sum of future investment returns discounted at a specified level of rate of return expectation. This helps decide which option is better: Pv = 1 / (1 + i)n n. Web free net present value calculator helps you to compute current investment amounts required to achieve future goals. You can view a present value of an ordinary annuity table by clicking pvoa table. Pv = fv x 1 / (1 + i)n. Present value helps compare money received today to money received in the future. Web the present value is. The pv formula discounts the future value of an asset to what it would be worth today. Calculating present value involves looking at an implied annual rate of return (whether that’s inflation or. Getting money now or later. P v = f v ( 1 + i) n ⇒ p v = $ 1 ( 1 + i) n. This. A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value. Where pv is the present value, fv is the future value = $1, i is the interest rate in decimal form and n is the period number. It's an improvised version and an. Web using the pvoa table. It is used to calculate the future value of any single amount. Web pvif calculator to create a printable present value of $1 table. To find present value, we discount future money using a discount rate (like 5%). Present value helps compare money received today to money received in the future. Web present value calculator is a tool that helps you estimate the current value of a stream of cash flows or a future payment if you know their rate of return. Examples include the calculation of capital expenditure or depreciation. Pv = fv / (1 + i) n. Web what is a present value of 1 table? Web future value. A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. In other words, it computes the amount of money that must be invested today to equal the payment or amount of cash received on a future date. It helps individuals and businesses make informed decisions by. Now let us extend this idea further into the future. Web present value (pv) is the current value of a future sum of money or stream of cash flows given a specified rate of return. Examples include the calculation of capital expenditure or depreciation. They provide the value now of 1 received at the end of period n at a. Web free net present value calculator helps you to compute current investment amounts required to achieve future goals. The pv formula discounts the future value of an asset to what it would be worth today. If you don’t have access to an electronic financial calculator or software, an easy way to calculate present value amounts is to use present value. Web present value (pv) is the current value of a future sum of money or stream of cash flow given a specified rate of return. The present value formula is: It is used to calculate the future value of any single amount. P v = f v ( 1 + i) n ⇒ p v = $ 1 ( 1. This concept is used in the valuation of stocks, bond pricing, financial modeling, and analysis of various investment options. Last updated february 14, 2024. If you don’t have access to an electronic financial calculator or software, an easy way to calculate present value amounts is to use present value tables. In other words, it computes the amount of money that must be invested today to equal the payment or amount of cash received on a future date. Web the video explains the concept of present value in finance. The present value formula is: Web present and future value tables this table shows the future value of $1 at various interest rates ( i) and time periods ( n). Web net present value (npv) is used to calculate the current value of a future stream of payments from a company, project, or investment. This can be re written as: Web using the pvoa table. Web present value calculator is a tool that helps you estimate the current value of a stream of cash flows or a future payment if you know their rate of return. Web the present value is how much money would be required now to produce those future payments. It's an improvised version and an alternative to traditional future value calculator to determine the future sum of money based on the range of interest percentage and time period variations. Web present value (pv) is today’s value of money you expect from future income and is calculated as the sum of future investment returns discounted at a specified level of rate of return expectation. Where pv is the present value, fv is the future value = $1, i is the interest rate in decimal form and n is the period number. They provide the value now of 1 received at the end of period n at a discount rate of i%.Present Value Tables PDF

Present Value Of Annuity Table Up To 50 HEWQB

Solved TABLE 2 Present Value of 1 1 n/i 1.0 1.5 2.0

Appendix Present Value Tables

45+ Present Value Annuity Factor Table Pdf PNG Cory J. Falls

Present Value Interest Factor Annuity Table Pdf Bruin Blog

What is a Present Value Table? Definition Meaning Example

Present Value Of Annuity Table Up To 50 HEWQB

Solved The present value of 30,000 to be received in 5

Present Value Table.pdf Present Value Personal Finance

Because We Could Turn $1,000 Into $1,100 (If We Could Earn 10% Interest).

The Pv Formula Discounts The Future Value Of An Asset To What It Would Be Worth Today.

Web Free Net Present Value Calculator Helps You To Compute Current Investment Amounts Required To Achieve Future Goals.

Table 1 Future Value Of $1 Fv = $1 (1 + I ) N N / I

Related Post: