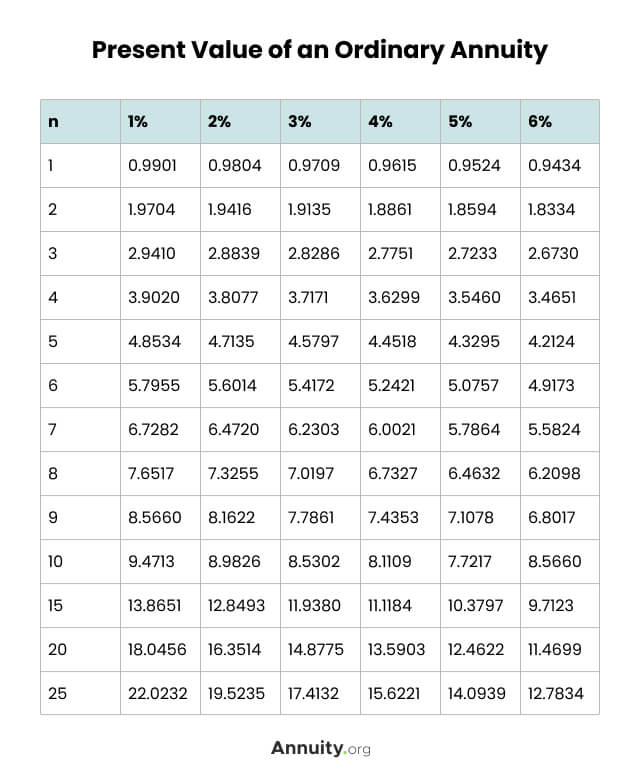

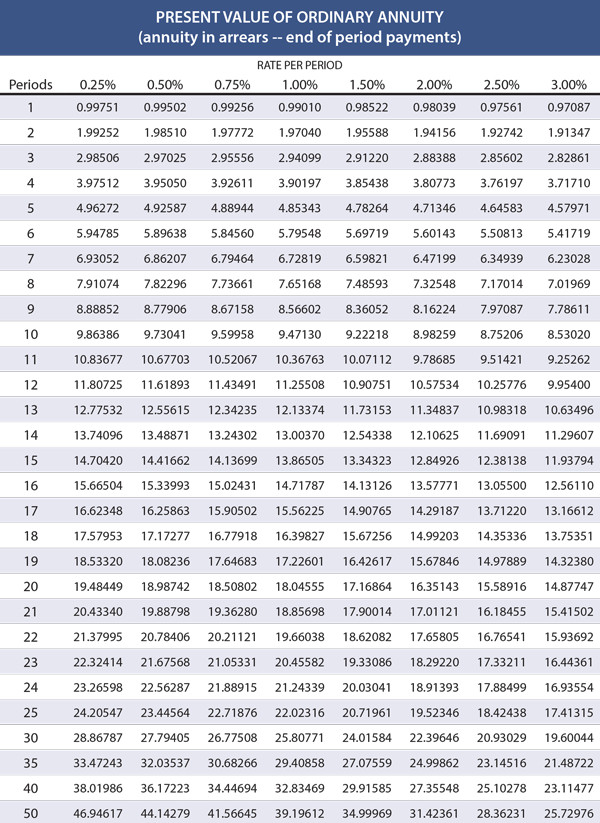

Present Value Of Ordinary Annuity Chart

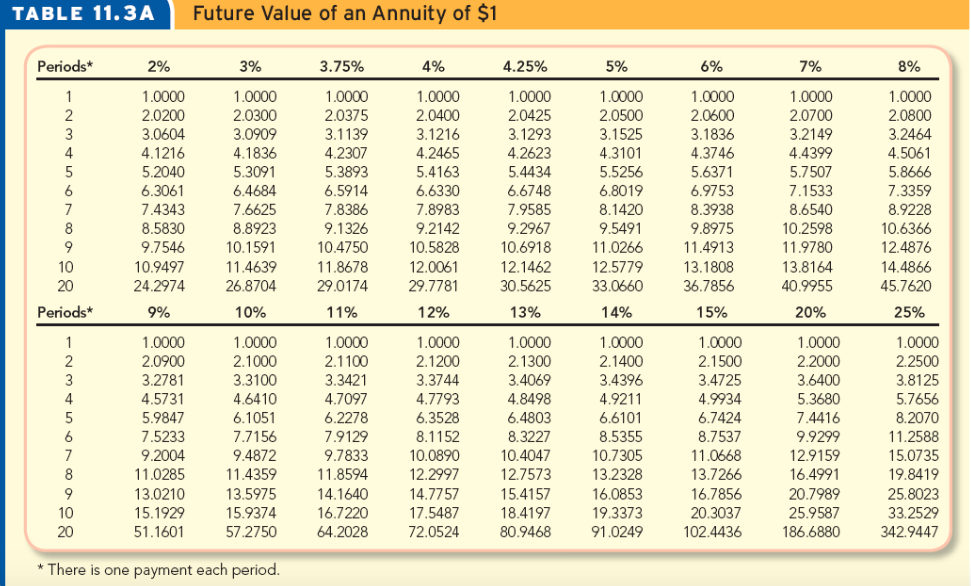

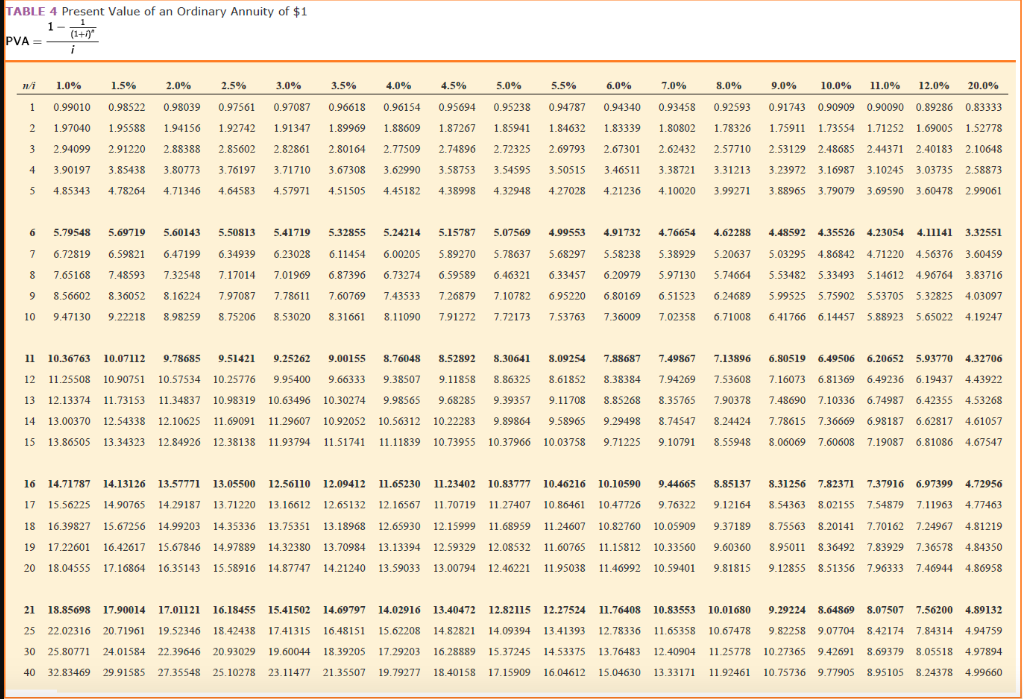

Present Value Of Ordinary Annuity Chart - Web an annuity table is used to determine the present value of an annuity. Web the present value of annuity calculator is a handy tool that helps you to find the value of a series of equal future cash flows over a given time. The first column ( n) refers to the number of recurring identical payments (or periods) in an annuity. Present value of an annuity refers to how much money must be invested today in order to guarantee the payout you want. Web accountants use present value calculations of an ordinary annuity in a number of applications. Web our explanation of present value of an ordinary annuity uses the appropriate present value factors for discounting a stream of equal cash amounts occurring at equal time intervals. Web present value factor for an ordinary annuity (interest rate = r, number of periods = n) n \ r 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% By finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. Click here for more accurate pvaf calculations. By plugging in the values and solving the formula, you can determine the amount you’d need to invest today to receive the. Your company provides a service in december 2023 and agrees to be paid in three installments of $100 each. Web the present value of annuity calculator applies a time value of money formula used for measuring the current value of a stream of equal payments at the end of future periods. Web the present value of annuity calculator is a. Web present value factor for an ordinary annuity (interest rate = r, number of periods = n) n \ r 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% Pmt is the dollar amount of each payment. Web an annuity table is used to determine the present value of an annuity. Web. They provide the value now of 1 received at the end of each period for n periods at a discount rate of i%. Present value of annuity (pv) = σ a ÷ (1 + r) ^ t. Pmt is the dollar amount of each payment. Web you can view a present value of an ordinary annuity table by clicking pvoa. Web an annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. Your company provides a service in december 2023 and agrees to be paid in three installments of $100 each. An important feature is the use of loan amortization schedules in order. By plugging in the values and solving the formula, you can determine the amount you’d need to invest today to receive the. By finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. Web present value factor for an ordinary annuity (interest rate = r, number. Click here to create a bespoke pvaf table. Click here to see our how to use a present value of an ordinary annuity table (pvaf table) youtube video. Calculating the future value of an ordinary annuity. Web accountants use present value calculations of an ordinary annuity in a number of applications. Web an annuity table, often referred to as a. R is the discount or interest rate. Web you can calculate the present or future value for an ordinary annuity or an annuity due using the following formulas. Web the present value interest factor of an annuity is a factor that can be used to calculate the present value of a series of annuities when it is multiplied by the. By finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. Web the purpose of the present value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. Calculating the future value of an ordinary annuity. By. It contains a factor for the payments over which a series of equal payments are expected. Future value (fv) is a. Web present value annuity factors (pvaf) table. Create a printable compound interest table for the present value of an ordinary annuity or present value of an annuity due for payments of $1. N is the number of periods in. Click here to create a bespoke pvaf table. An important feature is the use of loan amortization schedules in order to prove the answers for many examples. Web what is the present value of an annuity? Web the present value interest factor of an annuity is a factor that can be used to calculate the present value of a series. Click here to create a bespoke pvaf table. In other words, with this annuity calculator, you can compute the present value of a series of periodic payments to be received at some point in the future. Web if you don’t understand the future value of your present investment in an annuity, you’ll have trouble getting a clear picture of your net worth, which is key to understanding your overall. This is also called discounting. N is the number of periods in which payments will be made. Web the formula for calculating the present value of an ordinary annuity is: An important feature is the use of loan amortization schedules in order to prove the answers for many examples. Your company provides a service in december 2023 and agrees to be paid in three installments of $100 each. Present value of an annuity refers to how much money must be invested today in order to guarantee the payout you want. Web our explanation of present value of an ordinary annuity uses the appropriate present value factors for discounting a stream of equal cash amounts occurring at equal time intervals. Web calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. Web calculate the present value interest factor of an annuity (pvifa) and create a table of pvifa values. Click here to see our how to use a present value of an ordinary annuity table (pvaf table) youtube video. Web the purpose of the present value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. By finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. Pmt is the dollar amount of each payment.

What Is an Annuity Table and How Do You Use One?

What is an Annuity? Present Value Formula + Calculator

Present Value of Ordinary Annuity

Present Value Of Ordinary Annuity Table 60 Periods Bruin Blog

How To Use Present Value Of Ordinary Annuity Table Bruin Blog

Present Value Of Ordinary Annuity Table 60 Periods Bruin Blog

Present Value Of Annuity Table change comin

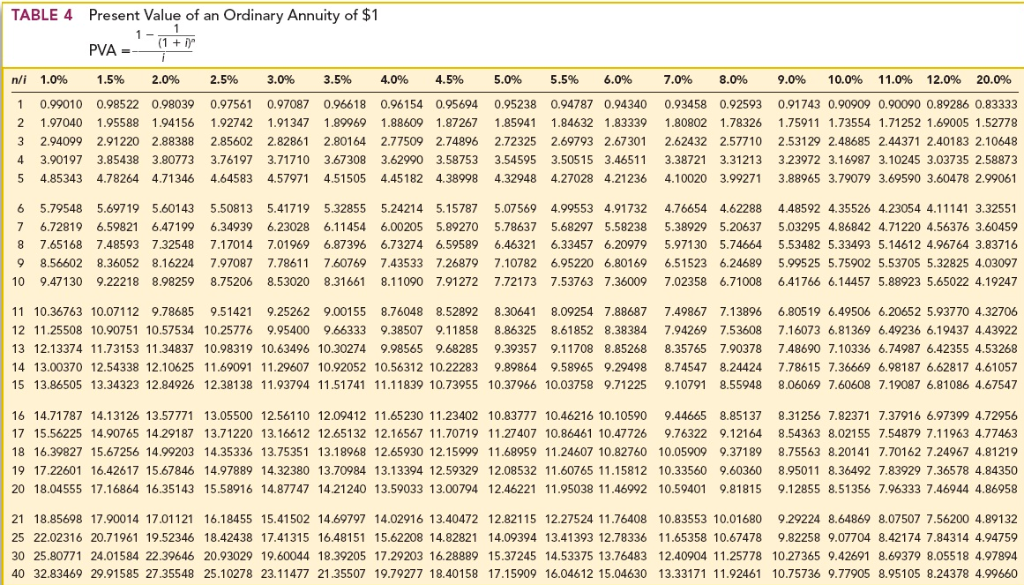

TABLE 4 Present Value of an Ordinary Annuity of 1

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

Calculating Present and Future Value of Annuities

Present Value of Ordinary Annuity Table

Web An Annuity Table Is Used To Determine The Present Value Of An Annuity.

Present Value Of Annuity (Pv) = Σ A ÷ (1 + R) ^ T.

Web An Annuity Table, Often Referred To As A “Present Value Table,” Is A Financial Tool That Simplifies The Process Of Calculating The Present Value Of An Ordinary Annuity.

Web Accountants Use Present Value Calculations Of An Ordinary Annuity In A Number Of Applications.

Related Post: