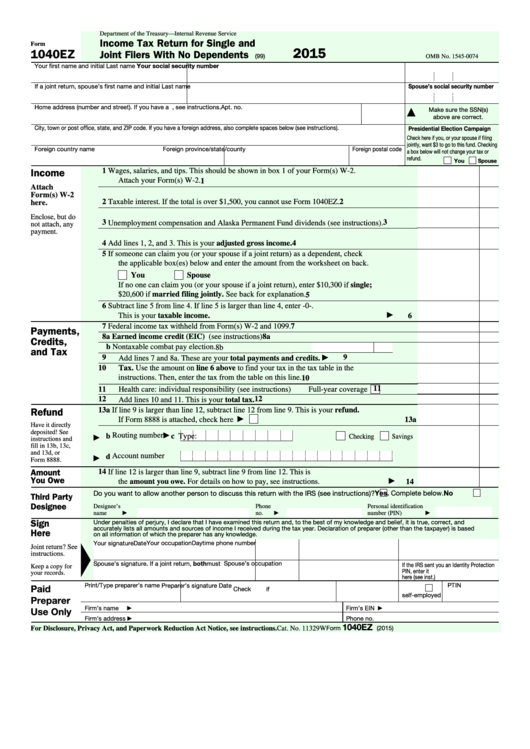

Printable 1040 Ez Form

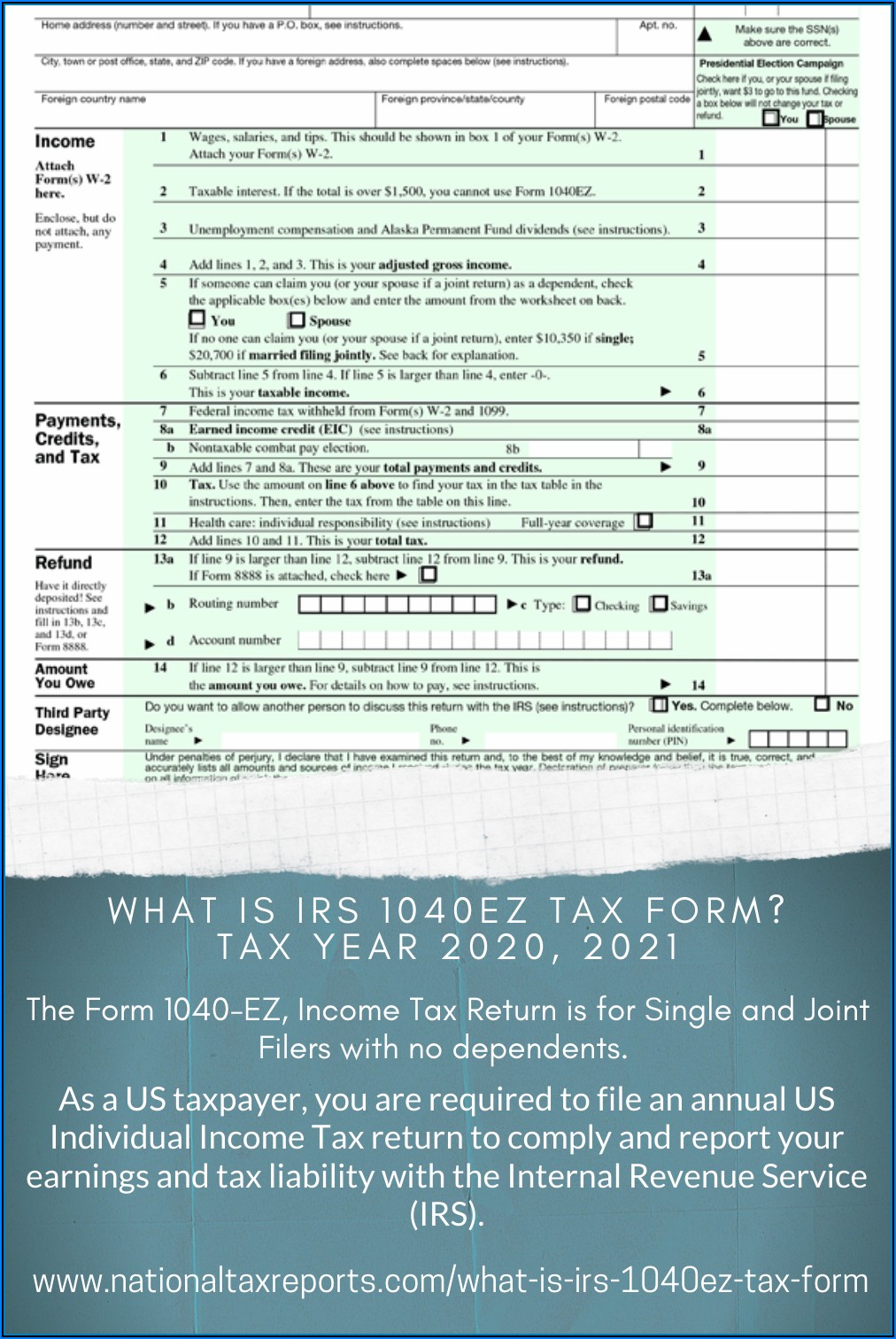

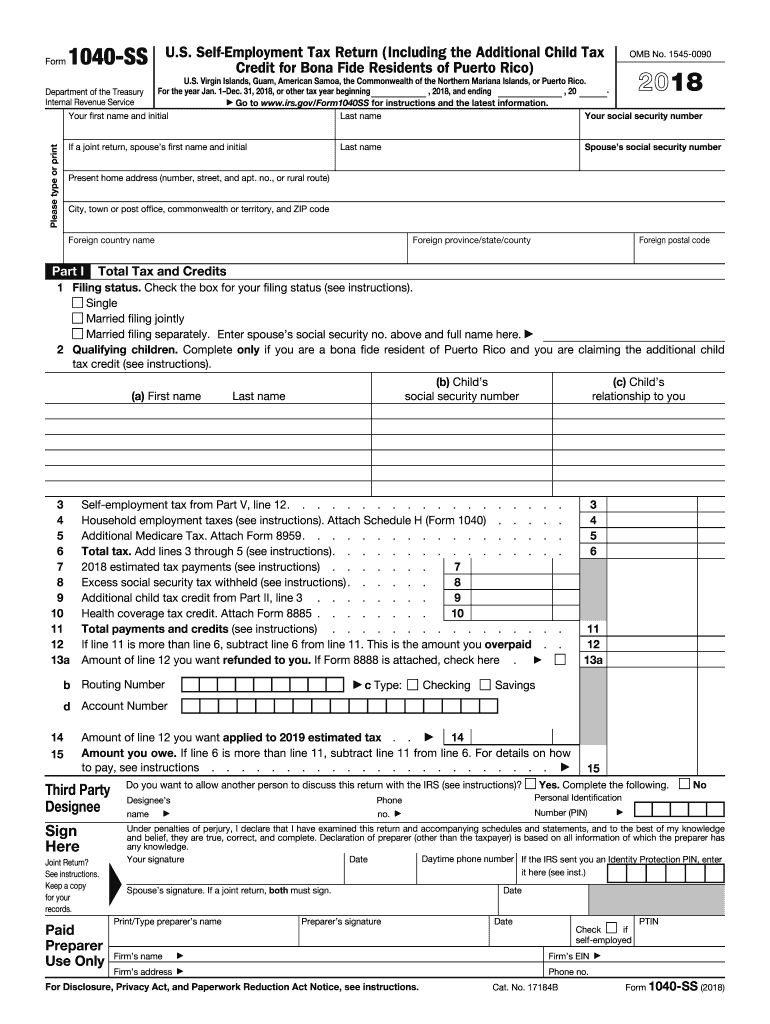

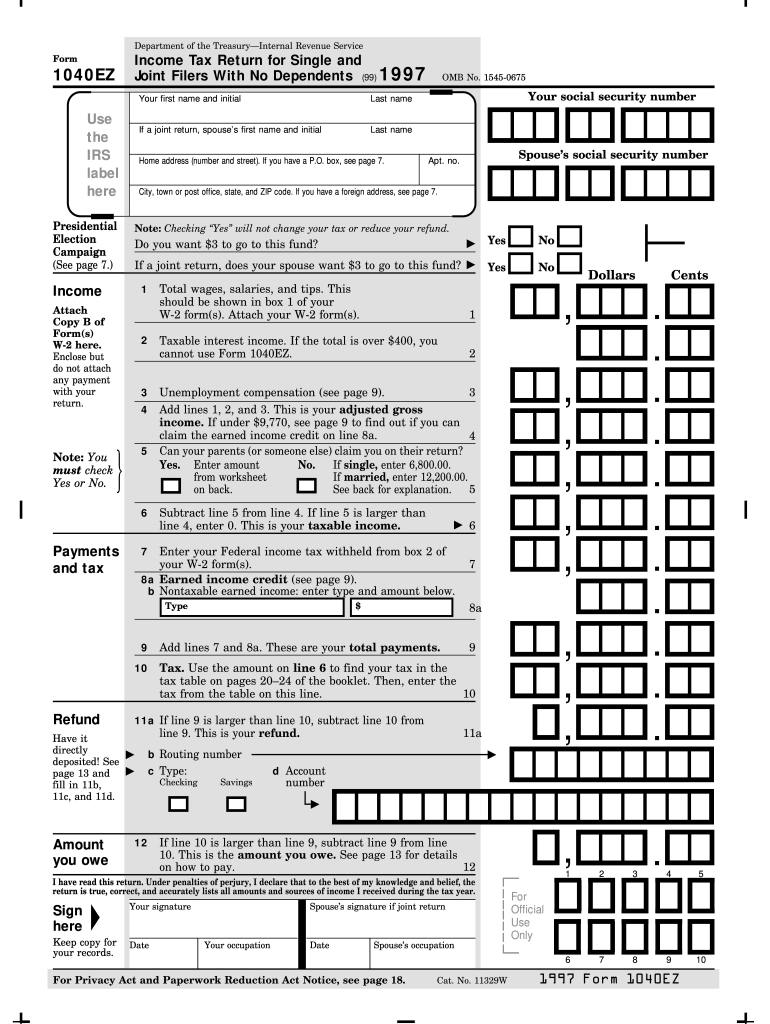

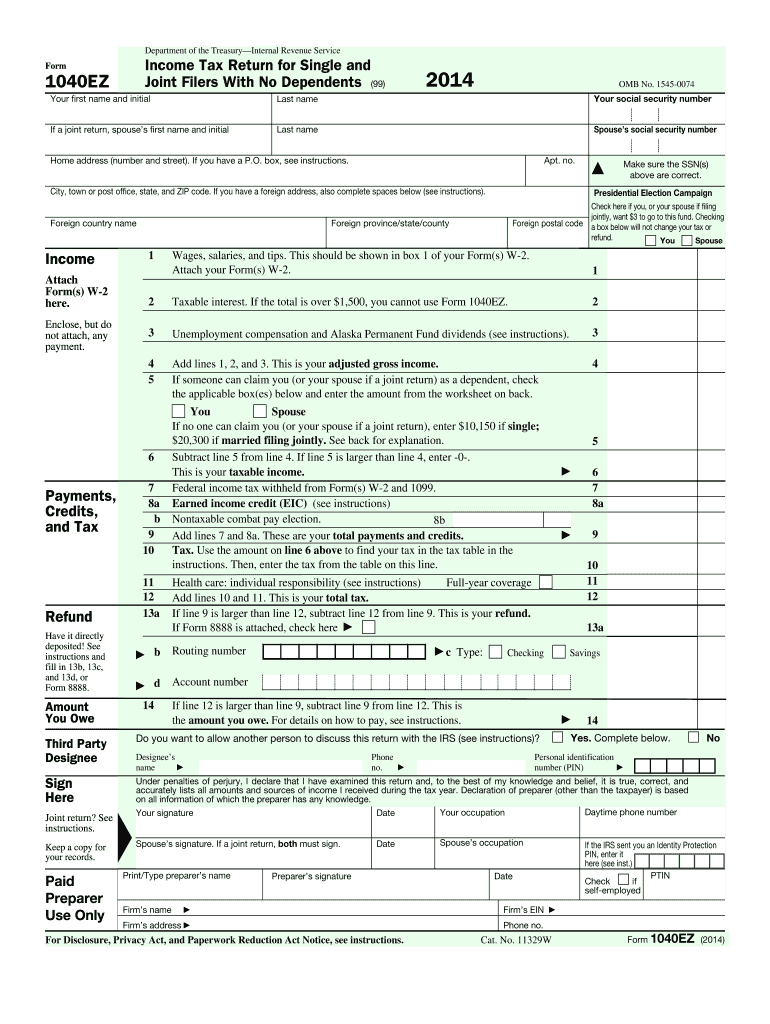

Printable 1040 Ez Form - Your taxable income, including your spouse’s income if you’re filing jointly, must be less than $100,000. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. For tax years beginning 2018 , the 1040a and ez. This is why the irs allows some taxpayers to. If you’ve ever filed a federal income tax return, chances are you used irs form 1040. Web to qualify for the 1040ez, taxpayers needed to meet certain conditions, such as taxable income less than $100,000, filing status of single or married filing jointly, no. Us individual income tax return. Web line 11 if you filed a form 1040; Web form 1040 (2019) b add schedule 2, line 3, and line 12a and enter the total. Web new 1040 form for older adults. Office, state, and zip code. Individual tax return form 1040 instructions; Irs use only—do not write or staple in this. 13a child tax credit or credit for other dependents. Request for taxpayer identification number (tin) and certification. Web the 1040ez has a cap: If you’ve ever filed a federal income tax return, chances are you used irs form 1040. 13a child tax credit or credit for other dependents. Request for taxpayer identification number (tin) and certification. Web line 11 if you filed a form 1040; Us individual income tax return. This form is for income earned in tax year 2023, with tax returns due in april. Web line 11 if you filed a form 1040; The irs has released a new tax filing form for people 65 and older. The 1040ez is a simplified form used by the irs for income taxpayers that do not. Annual income tax return filed by citizens or residents of the united states. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. For tax years beginning 2018 , the 1040a and ez. Web form 1040ez was a simplified version of the standard 1040 form that most americans use to file their taxes.. Before recent tax reforms, you could file with form 1040ez if: Individual tax return form 1040 instructions; This is why the irs allows some taxpayers to. Web to qualify for the 1040ez, taxpayers needed to meet certain conditions, such as taxable income less than $100,000, filing status of single or married filing jointly, no. Web follow these five steps to. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Web line 11 if you filed a form 1040; Web form 1040 (2019) b add schedule 2, line 3, and line 12a and enter the total. Your agi is calculated before you take. Your filing status was single or married filing jointly. Web form 1040ez was a simplified version of the standard 1040 form that most americans use to file their taxes. Before recent tax reforms, you could file with form 1040ez if: Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Before recent tax reforms, you could file with form 1040ez if: Office, state, and zip code. Your taxable income, including your spouse’s income if you’re filing jointly, must be less than $100,000. Individual. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Before recent tax reforms, you could file with form 1040ez if: Your filing status was single or married filing jointly. Request for transcript of tax return. Your agi is calculated before you. Web line 11 if you filed a form 1040; 13a child tax credit or credit for other dependents. Office, state, and zip code. For tax years beginning 2018 , the 1040a and ez. This form is for income earned in tax year 2023, with tax returns due in april. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Web check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more. Web form 1040 (2019) b add schedule 2, line 3, and line 12a and enter the total. Web follow these five steps to fill out irs form 1040 for the 2022 tax year. Web the 1040ez has a cap: Web new 1040 form for older adults. 13a child tax credit or credit for other dependents. If you’ve ever filed a federal income tax return, chances are you used irs form 1040. The irs has released a new tax filing form for people 65 and older. Annual income tax return filed by citizens or residents of the united states. B add schedule 3, line 7, and line 13a. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Your filing status was single or married filing jointly. Request for transcript of tax return. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web what is form 1040ez?

Printable Form 1040Ez

Irs 1040 Form Example 1040 Ez Nr Form Example 1040 Form Printable

Printable Irs Form 5564 Printable Forms Free Online

1997 1040 Ez Form 1997 Fill and Sign Printable Template Online US

Printable Tax Form 1040ez Printable Form, Templates and Letter

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill and Sign Printable

Fillable Form 1040ez Tax Return For Single And Joint Filers

1040ez State Form Printable Printable Forms Free Online

Irs Gov Printable Tax Forms 880

1040ez State Form Printable Printable Forms Free Online

Individual Tax Return Form 1040 Instructions;

Office, State, And Zip Code.

Before Recent Tax Reforms, You Could File With Form 1040Ez If:

It Was For People With Relatively Simple Tax Situations,.

Related Post: