Printable 1096

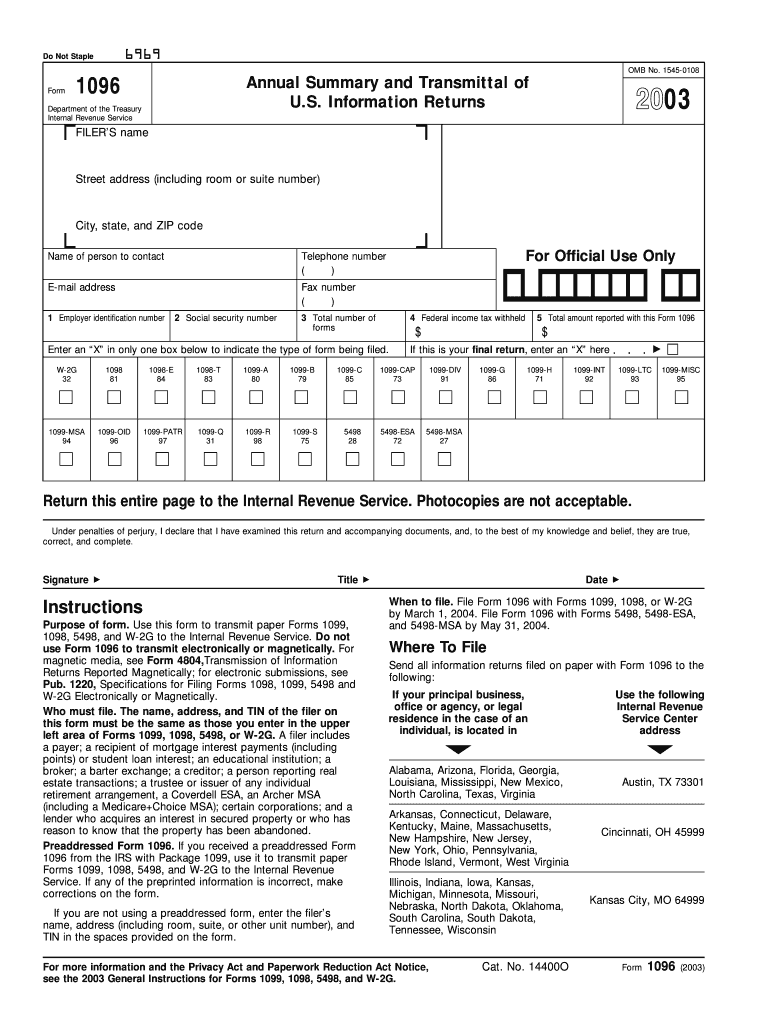

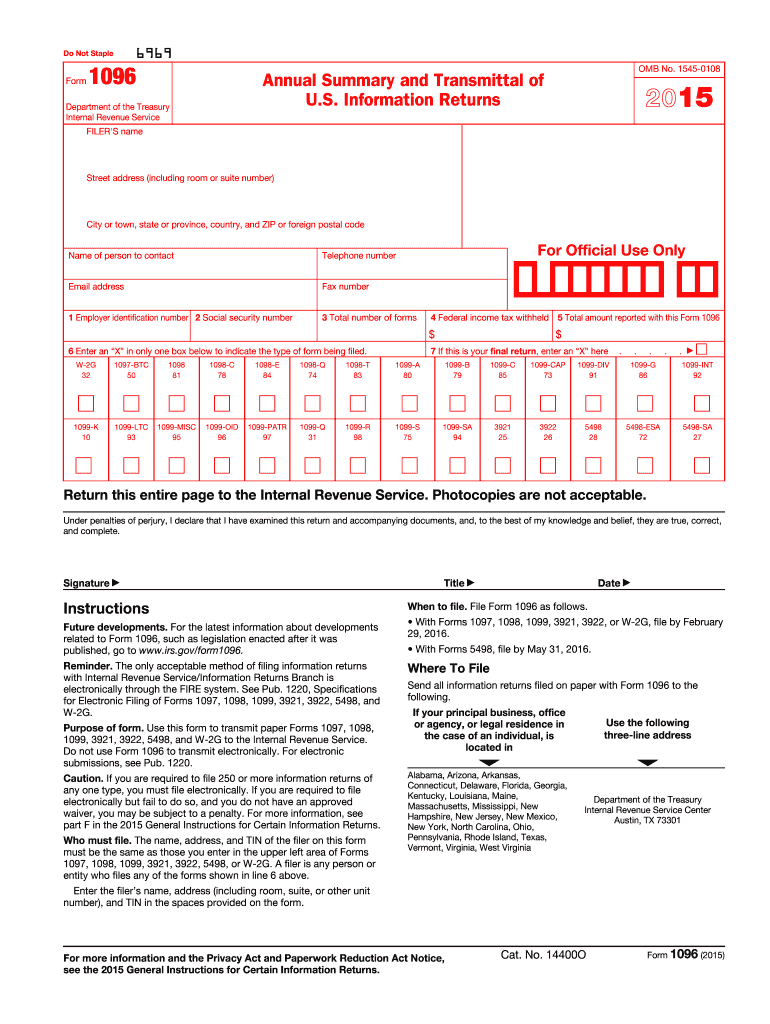

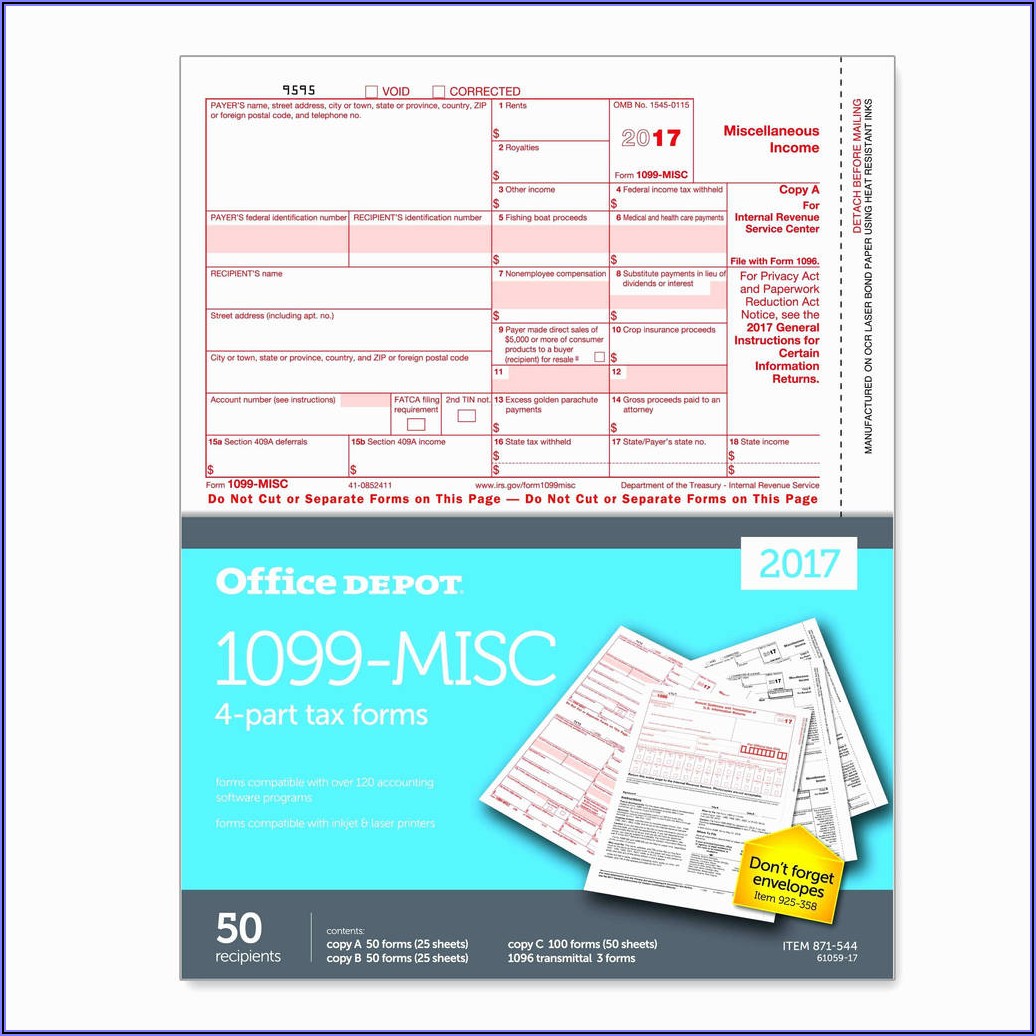

Printable 1096 - It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. You can print your form 1096 after going through the manual process of printing and filing of 1099. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. January 21, 2019 05:30 pm. Information returns, including recent updates, related forms and instructions on how to file. Web information about form 1096, annual summary and transmittal of u.s. It appears you don't have a pdf plugin for this browser. Web form 1096 is used when you're submitting paper 1099 forms to the irs. Web we last updated the annual summary and transmittal of u.s. Web updated november 06, 2023. This document summarizes information for certain informational returns that apply to small business owners: It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Choose the scenario that fits your situation. Form 1096 is only necessary if you are submitting paper forms, not if. Select view 1099 to view a pdf copy. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Annual summary and transmittal of u.s. Information returns in january 2024, so this is the latest. January 21, 2019 05:30 pm. Print your 1099s or 1096. Web form 1096 is used when you're submitting paper 1099 forms to the irs. More about the federal form 1096. To ensure irs compliance, these printouts are watermarked and not suitable for filing to the irs or ssa. Web we last updated the annual summary and transmittal of u.s. Enter all information correctly for the tax year. Select view 1099 to view a pdf copy. Let me show you how to prepare and print it. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Annual summary and transmittal of u.s. Go to expenses, then vendors. Web information about form 1096, annual summary and transmittal of u.s. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. January 21, 2019 05:30 pm. This guide aims to demystify form 1096, making it accessible and understandable for anyone who needs to file it. Web information about form 1096, annual summary and transmittal of u.s. We last updated federal form 1096 in january 2024 from the federal internal revenue service. Information returns, including recent updates, related forms and instructions on how to file. Irs 1099. Web information about form 1096, annual summary and transmittal of u.s. Web updated november 06, 2023. Choose the scenario that fits your situation. Efilers, select “print onto a blank sheet” to create electronic or hard copies for your records. February 2021) department of the treasury internal revenue service. It appears you don't have a pdf plugin for this browser. Web updated november 06, 2023. Choose the scenario that fits your situation. Go to expenses, then vendors. Web we last updated the annual summary and transmittal of u.s. Web we last updated the annual summary and transmittal of u.s. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Print your 1099s or 1096. Print your 1099 and 1096 forms. You can print other federal. Let me show you how to prepare and print it. Enter all information correctly for the tax year. You can print other federal tax forms here. Select view 1099 to view a pdf copy. Annual summary and transmittal of u.s. Print your 1099s or 1096. Print your 1099 and 1096 forms. Go to taxes then select 1099 filings. Information returns,” is a summary document used when filing certain irs information returns by mail. Information returns, including recent updates, related forms and instructions on how to file. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Go to expenses, then vendors. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Information returns in january 2024, so this is the latest version of form 1096, fully updated for tax year 2023. You can print other federal tax forms here. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. This document summarizes information for certain informational returns that apply to small business owners: Web information about form 1096, annual summary and transmittal of u.s. Web updated november 06, 2023. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form.

Fillable Online 21 Printable 1096 Form Templates Fillable Samples in

Printable 1096 Form 2021 Customize and Print

1096 Tax Form for Dot Matrix Printers, Fiscal Year 2022, TwoPart

Form 1096 Printable Fill Out and Sign Printable PDF Template signNow

1096 Form Fill Out and Sign Printable PDF Template airSlate SignNow

1096 Form 2021

Printable 1096 Form

Download Form 1096 Template retaillinoa

Printable 1096 Form 2021 Customize and Print

Printable Form 1096 Jxuvissoh V Qm

Enter All Information Correctly For The Tax Year.

More About The Federal Form 1096.

Select View 1099 To View A Pdf Copy.

It Serves As An Accompanying Cover Sheet That Provides The Irs With A Quick Overview Of The Information Returns You’re Submitting.

Related Post: