Printable 2290 Form

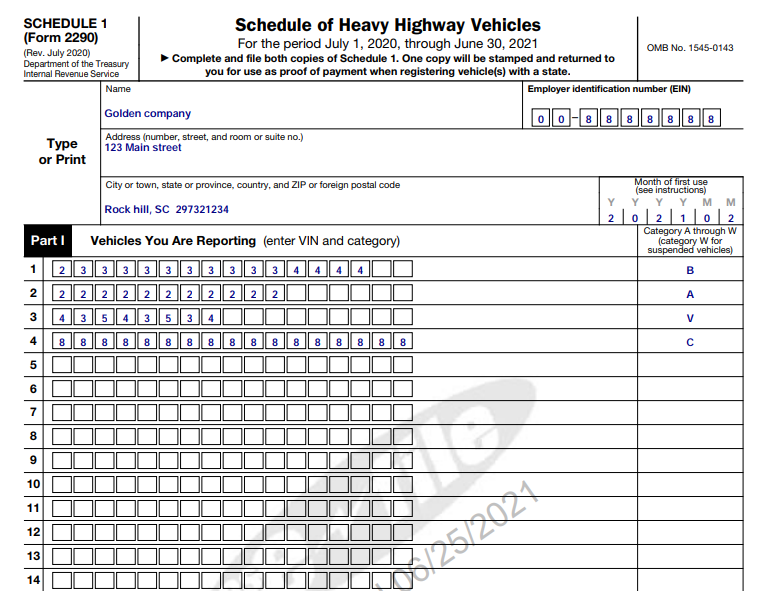

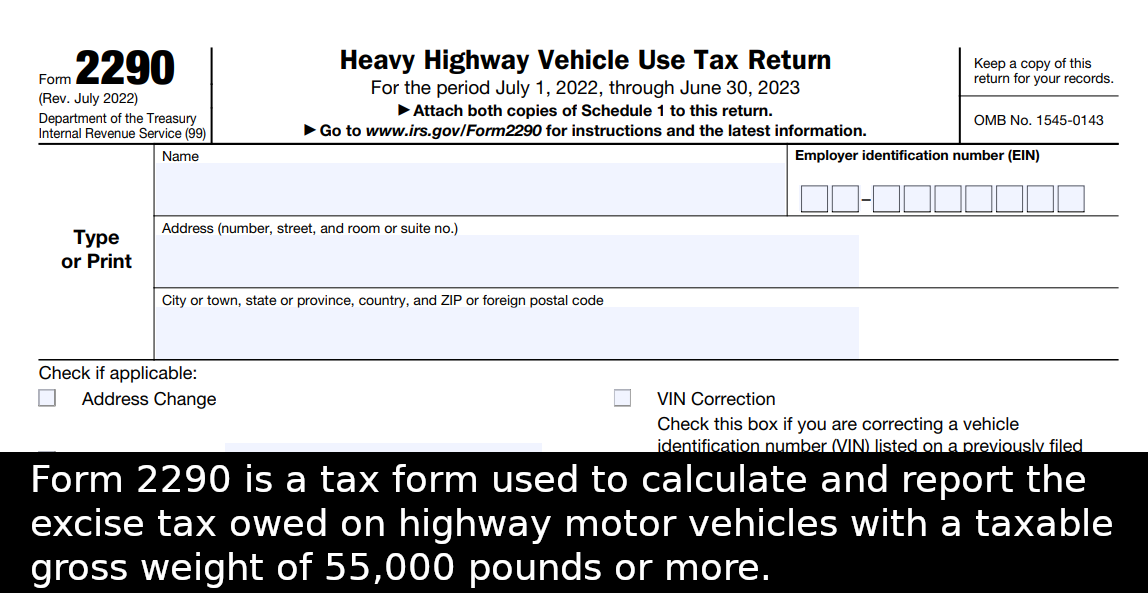

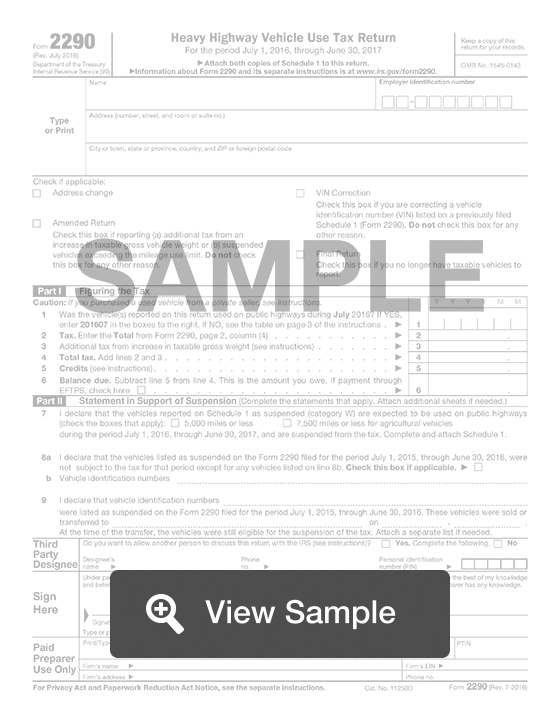

Printable 2290 Form - July 2022) department of the treasury. John uses a taxable vehicle on a public highway by driving it home from the dealership on july 2, 2023, after purchasing it. Stamped schedule 1file any year return!experienced teamform 2290 asap Web form 2290 is used to: Pay heavy vehicle use taxes (hvut) for the vehicles with a taxable gross weight of 55,000 lbs or more. The form 2290 is used to report and pay the hvut for vehicles that have a taxable gross weight of 55,000 pounds or more and operate on. The vehicle is required to be registered in. The tax rates are based. All new and existing 2290online.com. Web form 2290 is used to report and pay the hvut for vehicles operating on public highways with a gross weight of 55,000 pounds or more. Free tax calculationfree email supportfree registrationfree vin correction Web printable form 2290. Schedule of heavy highway vehicles. Pay heavy vehicle use taxes (hvut) for the vehicles with a taxable gross weight of 55,000 lbs or more. Web your 2290 form must be filed the month after a taxable vehicle is first used on public highways during the current period. Web what information is required to get the printable 2290 form? Web who must file form 2290? Web what is the form 2290? Free tax calculationfree email supportfree registrationfree vin correction A useful guide to help you fill out. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. The current period begins july 1 and ends june 30. The form 2290 is a tax return that must be filed by anyone who owns or operates a heavy highway motor vehicle with a taxable. A trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Web steps to file form 2290. The vehicle is required to be registered in. File with 2290online in minutes with these easy steps. Schedule of heavy highway vehicles. Web steps to file form 2290. All new and existing 2290online.com. A trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Web form 2290 is used to: Web what information is required to get the printable 2290 form? July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Free tax calculationfree email supportfree registrationfree vin correction First used month (fum), vehicle. The form 2290 is a tax return that must be filed by anyone who owns or operates a heavy highway motor vehicle. File with 2290online in minutes with these easy steps. Stamped schedule 1file any year return!experienced teamform 2290 asap A trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more. First used month (fum), vehicle. Web irs tax form 2290 is a federal form that. Web irs tax form 2290 is a federal form that must be filed by anyone with heavy highway vehicles weighing 55,000 lbs or more registered in their name. Web form 2290 is used to: Click any of the irs 2290 form links below to download, save, view, and print the file for the corresponding year. July 2020) departrnent of the. Report suspended vehicles that are going to be. File with 2290online in minutes with these easy steps. First used month (fum), vehicle. The tax rates are based. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web irs tax form 2290 is a federal form that must be filed by anyone with heavy highway vehicles weighing 55,000 lbs or more registered in their name. Web printable form 2290. Web what is the form 2290? Pay heavy vehicle use taxes (hvut) for the vehicles with a taxable gross weight of 55,000 lbs or more. Web who must. The current period begins july 1 and ends june 30. Web printable form 2290. A trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Stamped schedule 1file any year return!experienced teamform 2290 asap The form 2290 is used to report and pay the hvut for vehicles that have a taxable gross weight of 55,000 pounds or more and operate on. Ez2290 | may 31, 2022 | form 2290 | no comments. Report suspended vehicles that are going to be. First used month (fum), vehicle. The tax rates are based. John uses a taxable vehicle on a public highway by driving it home from the dealership on july 2, 2023, after purchasing it. Web steps to file form 2290. Web form 2290 is used to report and pay the hvut for vehicles operating on public highways with a gross weight of 55,000 pounds or more. Web what information is required to get the printable 2290 form? The form 2290 is a tax return that must be filed by anyone who owns or operates a heavy highway motor vehicle with a taxable gross weight of 55,000. Pay heavy vehicle use taxes (hvut) for the vehicles with a taxable gross weight of 55,000 lbs or more. Web who must file form 2290?

Understanding Form 2290 StepbyStep Instructions for 20232024

IRS Form 2290 Printable for 202324 Download 2290 for 14.90

IRS 2290 2018 Fill and Sign Printable Template Online US Legal Forms

IRS Form 2290 Printable (2022) 2290 Tax Form, Online Instructions

Irs Form 2290 Printable Printable Forms Free Online

Free Printable 2290 Form Printable Forms Free Online

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Form 2290 2023 Printable Forms Free Online

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

All New And Existing 2290Online.com.

The Vehicle Is Required To Be Registered In.

Web Your 2290 Form Must Be Filed The Month After A Taxable Vehicle Is First Used On Public Highways During The Current Period.

2290Online.com Log In And Sign Up Instructions.

Related Post: